Posts Tagged ‘Philanthropic Behavior of Billionaires’

Three Tax-exempt Cummings Entities (Inc. 1994 and 2004 (co-located) in Reno, NV, and 2014 in Phoenix, AZ) and Their Family-Controlled Personal Agenda: Taking Former Arizona State U’s ‘DBH’ Accreditation International, Con’td. (#2 in a Pipeline, Publ. Dec. 16, 2019).

CGI-BHS (or “CummingsInstitute.com” ‘History’ page, shows Husband, Wife, Daughter; this is Nicholas A. Cummings only. More below on this post… (SShot 2019-12-16)

While the three Cummings Foundations (or “tax-exempt Cummings entities”) do not connect directly to AzBio roadmap I’ve been blogging recently, they are, generally, in the same business of which healthcare is a large part, and one of them, as it happens for this post series, also active in Arizona. Two are in Nevada: See map of western United States.

Also, family court concerned parents and domestic violence survivors, protective parents and others concerned about child abuse (including sexual abuse of children, treatment for which comes up here), keep in mind that the influential NCJFCJ* is located at the University of Nebraska-Reno, a longstanding chapter of AFCC** (providing more work for psychologists etc. via family court systems) is in Arizona. (New Here? If so, know that: *stands for “National Council of Juvenile and Family Court Judges, Inc.” a key nonprofit in the family court biosphere…**stands for” Association of Family and Conciliation Courts, Inc.“).

I had to flee California a year ago (had been trying to leave for years) and in doing so, one fine, Sunday, late-summer evening, I drove first to (and after a quick overnight, through) Reno, which is just a very few hours (if that) away from the San Francisco Bay Area, also a known location for AFCC influence. Dr. Cummings, above, seems to have practiced in the SF Area for many years also.

The AFCC and the field’s (and family court systems’) tendency is to view and discuss criminal behavior as the perpetrator’s treatable, manageable, maybe even preventable psychological or psychotherapeutic issues. This approach also involves treatment of (and gaining access to) victims of the same perpetrators– in fact, the more treatment all round for everyone, the better, it seems. So much of public policy deals with this kind of population management and behavioral health/modification interests… an enduring line of work supported by public resources.

Co-locating/integrating mental healthcare (referrals and interventions) at the medical level likely works great as a career curve for those providing the mental/behavioral health interventions, as professionals in specific “psych-related” fields. I’m not so sure how it works well for the funding public, or patients funneled through the various centralized, coordinated, systems of care, either as effectively reducing crime and violence, OR economically.

Again, look at your maps for California, Arizona, and Nevada…

The AFCC-collaborating NCJFCJ has been located for decades at the University of Nevada-Reno which, despite being in a different state, is still near the UK CAFCASS-collaborating AFCC strongholds in San Francisco (although origins and strong connections still exist in Los Angeles), and as I’ve been saying recently, the attempts to regionalize and market Arizona internationally as a great pharmaceutical and behavioral health entrepreneurial hub, even down to upgrading the airports. [“CAFCASS” Children and Family Court Advisory Support and Services, est. about 2000] That’s one reason examining the filing habits of the financial backers is so important.(While it’s still there..) see my Twitter account profile (home page) for a long, pinned Tweet (thread) showing this, both in descriptions with links and some of the attached media, naming also how domestic violence specialists with the health (vs. criminality) focused professionals such as Jeffrey L. Edleson (with strong ties to both University of Minnesota and the University of California-Berkeley (both, Schools of Social Work), and is now working separately on Hague-related international (parental abduction) issues in the same field. {{Paras. edited to correct a misplaced phrase and give definition of the acronym CAFCASS and directions to why I connect the three bodies (CAFCASS is not a private organization; AFCC and NCJFCJ are, but membership features (espec. the latter) judges and other civil servants)Different “rules of engagement” apply for government entities vs. private corporations, nonprofit or otherwise, which is the point, and those private corporations’ leverage when they overlap in membership with civil (gov’t) employees in positions of high authority. This leverage being exercised through private memberships can also be operated, where it suits the groups’ purposes, privately — away from the prying eyes of the (paying) public. //LGH Dec. 19, 2019 edit.

Other major themes are regionalization, nationalization, and internationalization, of course (as ever) coordination of services to integrate cross-sector while maintaining close access to U.S. federal grants to states from HHS and its many parts.

What Cummings (the family line) may lack in billionaire wealth like some others in the USA, they seem to (primarily he seems to, his (sic) women’s voices and another male Cummings (son? former son-in-law? “Andrew” rarely seen on-line in their own words) more than make up for in aggressive self-promotion, branding, storytelling (rarely matches the withheld financials), spin, and marketing.

Historically he is also well aware of the power of degree-granting independent nonprofits, having started up, it says, some of the earlier independent professional schools of psychology in California in the late 1960s, at a time when the field was just “coming into its own…”

Overall, this drill-down is long overdue.

Post Title: Three Tax-exempt Cummings Entities (Inc. 1994 and 2004 (co-located) in Reno, NV, and 2014 in Phoenix, AZ) and Their Family-Controlled Personal Agenda: Taking Former Arizona State U’s ‘DBH’ Accreditation International, Con’td. (#2 in a Pipeline, Publ. Dec. 16, 2019). (Short-link ending “-bLg,” about 12,000 15,000 words, some overlap with prior post. Last update/tags added and I discussed (multi-screenprints posted) also on Twitter, Dec. 18, concerned about subcontractor “Benevity” and related chameleon-like corporate filings in California, Florida, and run it seems from Canada).

This post adds drill-downs on these entities and looks at the organizations’ self-descriptions in contrast with tax and state-level filings). It also profiles two other involved people (besides quoting the self-profiling of namesake Nicholas A. Cummings in the process of quoting websites). For further follow-up, I’d recommend (someone else!) further follow-up, among other things (such as “Sun Corridor, Inc. entities and developments), on the Columbus, Ohio’s American Endowment Foundation’s free-wheeling “DAF” model and the Tobin Family behind them. Tags coming soon. Post may be partitioned after publication; it certainly needs it, but for now, I want it published…It’s possible or probable that a Cummings may be handling one of the donor-advised funds there (in Ohio) as it shows as a major contributor to one of the entities in Nevada… //LGH

This post exists to supplement my #2 post in the Arizona Pipeline, now published, accessible at:

Wm. O’Donohue, UN-Reno PsychProfessor 20yrs or so (or Wm. T. O’Donohue) (from faculty page, viewed Dec 16, 2019)

In the process, besides the family named, I also ran across and briefly profiled an early CEO of one of the entities (which showed up on its tax return), when his name also came up as frequent co-author on an earlier (2008) find (two nearby images): William O’Donohue, sometimes “William T. O’Donohue,” a professor of psychology at University of Nevada-Reno.

He directs a “Victims of Crime & Integrated Healthcare Research Lab” there, and part of his vita (only current to Jan. 2010 available at university faculty page) shows one professorship sponsored by or named after Cummings (image top left on this post), with whom he has also authored several (papers, books chapters, etc.).

(Chair of California’s First-5 Commission since 2013; see under CCFC.ca.gov (California Children & Families Commission is also called “First-5” and has a statewide as well as (58?) county commissions; parallel to this there are similarly named and connected private non-profits. Together, they push certain types of programming using Tobacco Tax Revenues obtained through a (passed 1998?) Prop. 10 Californians voted through. I’ve blogged it and how it intersects with “family court matters” under posts with the title “Tobacco.” (Health Systems Flush with Cash, etc.)

Later, mostly because Nicholas Cummings continually references his own background at Kaiser Permanente as either “Chief Psychologist” or “Head of Mental Health” (1959-1979), and Kaiser is so closely associated with promotion of universal healthcare in the USA (“Obamacare,” etc.) — while Cummings’ main business model (“BioDyne”) is pushing to locate psychologists alongside doctors as beneficiaries of that funding stream — I also looked at the former head of Kaiser Permanente in California, George Halvorson, who since 2013 has been appointed Chair of California’s First 5 Commission, and whose bio blurb there cites to a strange nonprofit which bears his name legally, but not as divulged on the website — anywhere — while it’s clearly promoting NINE of his books (and no one else’s books)…

Below, I’ve linked to and summarized foundation data for CFBH and its related or main contributing businesses: another, earlier Cummings Foundation (“N&DCF,” as mentioned on the website) in Reno, Nevada, and somewhere between those two, taking contributions from at least three businesses (an LP, an LLC, and an “Inc.”) all labeled NDC, and (largest amounts at least in one year I viewed) a two-plus-billion-dollar-assets entity, American Endowment Foundation (“AEF”) based in Ohio, as mentioned in at least the first version of post title. Partway through this post I also ran across the “CGI-BHS” which accounts for the post title’s listed years: about one every ten years it seems…

Pardon the long sentence in the next paragraph. The subject is the longest part. The predicate is the main point: Why have we as a nation tolerated putting tax-exempt foundations, private and/or so-called “Community,” effectively on steroids, incentivizing development of bad accounting practices within the sector; that is, we have, being ourselves taxed almost every time we “twitch,” justified as supporting government services for our own welfare and paying off long-term (forward-projected) pension liabilities across-the-board, continued to tolerate (by ignoring, or failing to report as they exist: comprising an identifiable sector) private interests spreading roots (fiscally) and continuing to develop business relationships involving public institutions underground in such a way that most of the public, who reside mostly above-ground fiscally as employees (through tax-withholding, fees-based public services such as access to the courts, or receiving food to eat when work is not available) just cannot, realistically, see each new round of the same types of entrapment coming?

That was a very long sentence too, introducing this one:

Having just a few foundations, backed by wealth from prior corporate profits in the pharma-medical-mental-healthcare, transportation, and internet/info/communications infrastructures (themselves all closely connected) plotting together to control the economy of an entire state as a regional hub — marketing THEIR private roadmap internationally through additional multi-partner entities (like Arizona’s “Sun Corridor, Inc.”), often with overlapping leadership, and at least one of them (sector: USA’s burgeoning Mental Health Archipelago) taking major funding from an out-of-state, out-of-region, tax-exempt foundation featuring Donor Advised Funds (“DAF”) administrative services — specializing as a “concierge service” to financial advisors themselves managing clients’ donor advised funds) seems like putting the inherent obfuscation of the DAF (let alone tax-exempt) sector on steroids.

SUN CORRIDOR searched at Arizona Corporation Commission, came up with several entities; one Sun Corridor, Inc. (reg. 2008 for-profit, line of work “business consulting”) was administratively dissolved for non-filing as of 2014. Somehow (I still don’t see “how..”) a pre-existing (2005ff) identically named — but NOT for profit “Sun Corridor, Inc.” formed in 2005 (in a different county) is still active. Sun Corridor Subsidiary, Inc. (also non-profit) still exists active; Sun Corridor Metropolitan Planning Organization, Inc., NONProfit, still exists. And lastly, applied for in July 2015 only, the trade name “Sun Corridor” was applied for by Sun Corridor, Inc. — hopefully the legitimate (nonprofit) not the administratively dissolved one. I’ve pasted here as active links and in table format; links may or may not remain active. If not, repeat the search at the link given below under mini-section FOUR HELPFUL LINKS to VALIDATE OR FACT-CHECK THIS POST

| Entity ID | Entity Name | Entity Type | Entity County | Agent Name | Agent Type | Entity Status |

|---|---|---|---|---|---|---|

| S627242 | SUN CORRIDOR {appl. July 2015} | Trade Name | Active | |||

| 18813950 | SUN CORRIDOR METROPOLITAN PLANNING ORGANIZATION {8/20/2014} | Domestic Nonprofit Corporation | Pinal | IRENE HIGGS | Statutory Agent | Active |

| 20109206 | SUN CORRIDOR SUBSIDIARY, INC. {6/8/2015|Bus. Type: Business League} | Domestic Nonprofit Corporation | Pima | ROCKWELL AGENCY LLC | Statutory Agent | Active |

| 11804156 | SUN CORRIDOR, INC. {2005} | Domestic Nonprofit Corporation | Pima | LAWRENCE M HECKER | Statutory Agent | Active |

| 14963961 | SUN CORRIDOR, INC. {2008/Adm Dissolved for non-filing by 2014} | Domestic For-Profit (Business) Corporation | Maricopa | KEVIN PASCHKE | Statutory Agent | Inactive |

Statutory Agent Rockwell Agency LLC (L19182049) was formed only April, 2014, its agent Lawrence M. Hecker and some other principals including one added 2015, T. William Pew, entity address in Tucson). (See the link provided or repeat the search if needed).

It really is JUST A FEW FOUNDATIONS, but COORDINATING ACTIVITIES

WHILE FAILING TO “TELL-ALL” ON WEBSITES

& WITHHOLDING SUFFICIENT AUDITED FINANCIAL STATEMENTS FOR FAIR ANALYSIS.

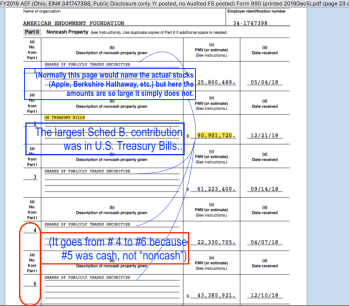

Total results: (here, just 1). Search Again. (American Endowmt Fndtn, EIN# 341747398, YEDec, FY2017 Only)

(The last three years’ returns shown in a table much further down on this post).

| ORGANIZATION NAME | ST | YR | FORM | PP | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| American Endowment Foundation | OH | 2017 | 990 | 2085 | $2,001,944,686 | 34-1747398 |

Started only in 1993, this Columbus, Ohio-based “AEF” says it’s now approaching $3 billion assets. Its latest tax return gives just a whiff of the size (but not rate of expansion; a three years-worth table is further down in this post). Also involved in this same AzBio roadmap is another Ohio-based, well-known entity, ‘Battelle Memorial.”

Like the Cummings Foundations, my background reading on the AEF (only discovered within the past month) shows many family relationships among the own board; a key indicator of purpose may be found in the background of Thomas J. Tobin (briefly touched on here in context of the tax returns).

Other than I was personally busy and writing on other urgent topics, I am now wondering how it is I failed to look up the EINs of the Nicholas and Dorothy Cummings Foundation (est. 1994 in Nevada) and Cummings Foundation for Behavioral Health (est. 2004 in Nevada) and keep monitoring them year by year after I first noticed the founder(s)’ stated goals and behaviors OVER SEVEN YEARS ago (in 2012). Early 2012 puts awareness of this connection to the ‘Battered Mothers Custody Conference’ regular and vocal presenters (at least one in psychology, another in law) early on in the course of this blog.

Debts and liabilities relating to some real estate among the Cummings-controlled entities, which are housed or held in at least three other entities which aren’t labeled non-profit (shown below).

FOUR HELPFUL LINKS to VALIDATE OR FACT-CHECK THIS POST:

1), 2) These two links may prove handy in follow-up or following (fact-checking) this post. Nevada Business Entity Search: https://esos.nv.gov/EntitySearch/OnlineEntitySearch, branded “Silver Flume,” and the Arizona Corporation Commission’s version of a similar but (as ever) not identical search interface, at: https://ecorp.azcc.gov/EntitySearch/Index.

3) Other than specific organizations’ own websites, I also, as usual, did many searches at Candid.org (new branding of Foundation Center after purchasing “Guidestar.org”), exact url: https://candid.org/research-and-verify-nonprofits/990-finder. You’ll find this often in my posts when showing tax return tables with this phrase, which Candid.org generates: “Total Results: [number] Search Again.

4) Another website I use often to locate an EIN# where organizations are being especially vague, coy, or otherwise secretive about their own — and sometimes to locate a tax return more current than what Candid.org can (or does) produce, which returns are (as I understand it) obtained from the IRS anyway: http://apps.irs.gov/app/eos

Post-specific: Later on in the post I looked for Psychology Licensing Boards in both Nevada and Arizona. Nevada’s seems functional; Arizona’s does not.

The general theme of my current posts is Arizona, specifically “AzBIO” and behavioral health ecosystem build-ups (this century, and the last decade of the 1900s).

I already showed an AFCC connection to a University of Arizona’s “School of Mind, Brain and Behavior” (through Connie J.A. Beck expounding upon mandatory mediation with IPV (Intimate Partner Violence) involvement), and previewed other major foundations behind turning at least Southern Arizona into a regional BioScience economic hub.

There’s open admission that this has been coordinated in large part by the Flinn Foundation in association with Battelle Memorial out of Columbus, Ohio.

Flinn Foundation has no problem publicizing its roadmaps, and progress towards the private collective goals targeting an entire state ecosystem, whether by state, by year and quarter, or part of Arizona (Southern, Northern), or by metropolitan area.

What it does, obviously, have a problem with is posting any of its own financials ANYwhere on the website https://flinn.org/bioscience/

-

- Flinn.org|bioscience (Roadmap Progress (showing “Key Data 2003-2011”) & Colorful Quarterly Updates) ~ 2019Dec07 Sat PST

Having seen this BioScience / Behavioral Health (related) sponsored drive for the State of Arizona, I then felt it necessary to include and remind us of the role of the Cummingses (elder: Nicholas A. and Dorothy) and dedicated daughter (Janet L.), (and (relationship?) an Andrew Cummings in Greenwich, CT, not usually mentioned on the websites but showing in the tax returns).

Nicholas A., throughout seems well aware of (and typically found citing to) his prior leverage as former President of the APA (American Psychological Association) and for twenty years (1959-1979) Kaiser Permanente HMO (“Health Maintenance Organization”) or its predecessor, as Chief of Mental Health, following the famous LSD-dispensing Timothy Leary.

For example in one of the three featured Cummings-named non-profits on this post (more details below), despite how small, recent, and specifically tailored to his own business model it is, the “history” page casually calls it a “university” and cites its inspiration from a meeting of Silicon Valley Tech entrepreneurs who dropped out of college — because they knew more than their teachers — and “revolutionized society.” The text then goes on, citing his own credits, to state his plan to revolutionize the healthcare sector…. Talk about “grandiose” — while casually deficient in basic state-level compliances, sloppy in providing specifics on the descriptive websites, and tax returns in poor format, once a person can locate them (off-site):

Our History (url: https://cummingsinstitute.com/history/)**

Founded in 2015, the Cummings Graduate Institute for Behavioral Health Studies is one of a handful of universities worldwide that grant the distinguished Doctor of Behavioral Health (DBH) degree,*** and is the only university that exclusively focuses on the growing field of integrated healthcare. CGI credits its origins to the work of Nicholas Cummings, Ph.D, Sc.D (1924 — ), an American psychologist, author, and former president of the American Psychology Association (1979)….

[all emphases mine, quote continued below]

**The word “graduate” not included in web domain name; it could’ve been — why not? the word “institute” without further definition is just about meaningless).

***This’d be a great place to list or link to ANY others in the handful to support such a statement, but it seems the sentiment was why bother? It just keeps on talking…. and assumes the reader is content to be a passive consumer of the storytelling. Where’s any respect for the intended readers?

Grouping this degree-granting nonprofit set up only a few years ago the designation “university” seems to be grasping at importance: Typically university websites at least in the USA as we commonly understand them carry the suffix “_____.edu” whether public or private, and the term “university” hasn’t yet been fully degraded to “anyone who can pull a nonprofit together and get accreditation for granting a few degrees…”

Who and What this nonprofit (and family line) is may be better viewed by looking closer at the various financial (tax) and corporate filings it doesn’t care to post in between the news on its achievements.

Actually — see nearby image or its website — having just in June and September 2019 obtained certain kinds of accreditation, it announces the launch of a “CGI.EDU” website in January 2020. (The full legal name is CGI in Behavioral Health Studies” which’d be a more honest representation of what it’s doing; retaining the reference to “Cummings” and losing the references (BHS) to what it’s actually promoting).

The text then launches a recitation of his brilliant innovation, and eventually only in passing and never separately from HIS accomplishments mentions his own daughter, Dr. Janet L. Cummings.

Janet L.’s voice is not expressed here as in any way distinct from his, nor anything she did separately from him, although it’s likely she’ll be outliving both him and his wife Dorothy M. Cummings, not mentioned either, here, as actually DOING anything. Janet L. will be with other leadership (few outside Cummings on the various entities show up — you’ll see, below) “carrying the torch” on this enterprise. It doesn’t specifically mention a father/daughter relationship and I don’t know whether Dr. & Mrs. Dorothy Cummings is Janet’s (or Andrew’s) biological mother, stepmother, or not. It could be found out, I just do not know presently. Judging by the photo, she resembles Nick Cummings and looks a whole lot younger. Was that a graduation photo?

(Nevada Board of Psychologist Licensure look-ups: Janet L. (“..rID1064”) has a 1992 Psy.D. from Wright State University, but is not active in Nevada because “Registration status: Closed. Incomplete Application.” Psychboard.Az.Gov searches Behavioral Analysts and Psychologists separately. I couldn’t get the search to load currently, but before doing so, a pop-up message warns it directs away from a government site to a non-government site. Therefore, the process of looking to a government site (and the licensing board at Arizona) seems to simply direct away from it; disclaimers beyond that warning are not mentioned in the pop-up.

Our History (url: https://cummingsinstitute.com/history/), cont’d.

… In the early days of the technical revolution, Dr. Nick Cummings was invited as the CEO of American Biodyne to attend a luncheon*** where he would meet innovators and entrepreneurs of Silicon Valley, including Bill Gates and Steve Jobs. Dr. Cummings was inspired by the brilliance of these entrepreneurs, and was struck by a similarity he noticed among the group: a particularly high college dropout rate. The tech giants of Silicon Valley had either enrolled in college and quickly dropped out after learning they knew far more than any of the faculty, or never enrolled at all; choosing instead to spend all of their time inventing the new technologies that would absolutely revolutionize our lives. Dr. Cummings realized that what healthcare needed was a similar revolution, and he saw an opportunity to teach behavioral health providers to disrupt the ineffective, fragmented healthcare system from within. There was only one problem: no university existed that was out-of-the-box enough to create both the curriculum and the environment that would stimulate the kind of innovation that healthcare needed. The choice was clear.

In some world views, anything “fragmented” is bad or regrettable, although the purpose here is to “fragment” (disrupt) from within to shift the paradigm for the “entrepreneurial” among the behavioral health practitioners (and psychologists)… [I noticed the State of Arizona has separate licensing links and presumably requirements for behavioral health analysts and psychologists.]]

In 2014, Dr. Cummings along with his daughter, Janet L. Cummings, Psy.D, created## the Cummings Graduate Institute for Behavioral Health Studies to fill the educational gaps for innovative and entrepreneurial healthcare professionals wishing to disrupt healthcare from within or for those looking to launch new ventures. Drs. Cummings designed the DBH program at CGI to address three critical needs behavioral health providers would need to be successful in this aim: medical literacy, efficient and effective delivery of behavioral health interventions in medical settings, and entrepreneurship and innovation in the healthcare marketplace.

[all emphases mine, end of this quote]

## “CREATED…”: The word “created” is generic, however, the links I gave above to Nevada and Arizona business entity search sites lead to documentation of who actually ‘created’ as in ‘incorporated,’ and Nick C’s name isn’t on the filing paperwork. As I recall from recent lookups (but, you have the links)…hers and one non-family member’s, Brett Sabatini, is.

*** “A LUNCHEON…”: Conveniently vague and no context given: approximate year (even decade), geography (which state), ANY name of “luncheon” other than “a luncheon” and how many other innovators were involved, or special invitees. Was this within a conference, at a pay-per-plate fundraiser, or what? We all know luncheons can be “tete-a-tete” (intimate, small) or parts of any hotel- or resort-based conference with up to a thousand or so attendees. With no other info, the statement is basically just boasting.

The carelessness of the text so few internal links or footnotes to validate any claim, and such vague language as to make fact-checking most claims tricky, assumes a storytelling, “take our story on faith” approach. Though no Ph.D., I never put out posts with so few links and so little supporting evidence. Even children listening to stories — which readers shouldn’t be treated as — should get to ask questions. Yet the dynamic here is, DON’T ask questions, and avoid direct connectings to anything which might show the fiscal, corporate, or anything more than the most basic summary of who they (the Cummings entities mentioned) are and what they are doing.

From another part of the site, a sense of how many degrees granted so far: As of Sept. 2019, only TEN:

As of September 2019, CGI has graduated ten Doctors of Behavioral Health who are located across the United States practicing in a variety of capacities including healthcare leadership, private practice, and university education.

cummingsinstitute.com/contact-us/ (Viewed Dec 6, 2019. History page says the CGI was started in 2015, a spinoff from a DBH program (but privately controlled) at Arizona State Univ.; Nicholas Cummings (bottom left) was born 1924 so would be about 95 yrs old now…

When and by whom were its various accreditations granted? (Stated on-site HERE)

AZ-SARA (State Authority Reciprocity Agreements with other states, which then apparently lets it be a member of the National Council (“NC”)-SARA: Sept., 2019.

DEAC ( a Washington, D.C., nonprofit referring to post-secondary education) — only June, 2019.

A large banner announces that its “CGI.EDU” website will launch in January 2020 despite having only granted ten graduate degrees so far, total. (It seems that an undated (and no-names) photo I show again below, may show the first three, or possibly four. They may be staff, but they’re wearing robes, and three of the (standing) four, caps…

TWO EXISTING BLOG MEDIA LIBRARY PDFs (2013, 2008) LEAD TO MORE VITAL INFO:

The next two pdf links come from this blog’s existing “Media Library” and were not created from scratch during my current investigations (look-ups) for this post.

I include the first (May, 2013), because it reflects Cummings stating his own qualifications for legal expert witness-type purposes in a specific civil case; I include the second, (2008 and a J Contemporary Psychotherapy article), a short piece ‘…Our Inadvertent Vow of Poverty..‘ because it reflects intention to build the financial resources for the field. It’s well-written. Of course it also ignores entires fields of basics on the family court system and how the Dept. of Health and Human Services runs specific legislated funding streams to impact outcomes in family courts, although those courts are under state, not federal jurisdiction. The desired impact includes increased “noncustodial” (primarily fathers’) time and settling differences out of court, i.e., steering litigants away from normal civil or criminal courts where specific rights and procedures exist, or that overall,** this family court system is having a “field day” providing revenues for those in the fields of psychology, psychotherapy, etc. It also shows two co-authors (daughter Janet and William O’Donohue). [[**Sentence in this color added post-publication 12/17.]]

On researching tax returns for this post, I’d noticed that William O’Donohue also shows up as a CEO on one of the Cummings foundations. Presumably he is or was a colleague and/or business partner of like mind on the enterprise/s, the footnote shows he was (and seemingly still is) a professor in the University of Nevada-Reno Psychology Department with a specialty interest in treating children adults who have been sexually abused, and has been supported (per a vita with footer stating only “January, 2010” posted on his U-Nevada Reno, faculty page now, Dec., 2019, and that he’d had significant, ongoing grants supports from the NIJ, since degrees obtained (up through PhD) in psychology in the 1980s, and one, in “Philosophy of Science” in mid-1990s.

(The link’s label is mine; it’s a short read, makes 30 statements in as many numbered paragraphs, and the case –in Hudson County, NJ, with defendants in California — possibly deals with the issue of characterization of sexual re-orientation therapy as legitimate (vs. “de facto” unethical) where those engaging in it are fully-informed. My main interest here, however, are his stated credentials. Why, as late as 2013, no supporting links or footnotes are included to his claims (such as might be find in any article in, for example, a law review) I do not know. It was a random internet find. But, Please read!)

Looking for who was on (as it claimed to have been on) President Kennedy’s Mental Health Task Force (no year mentioned on the Certificate above), I found this page at the JFKLibrary.org which, being a brief summary, doesn’t name those on the Taskforce, but does describe how many (27) when they met with him at the White House (Oct. 18, 1961) and the context of constituting it (as supported by his sister Eunice Shriver Kennedy and in light of “Mental Retardation” (now, “intellectual disabilities,”) being an issue directly affecting the Kennedy family — his own sister, Rosemary, less than two years younger than himself). This links to CarterCenter.org (associated with Emory University in Atlanta), “Mental Health TaskForce“, but reflects a 501©3 and doesn’t readily lead to identification of who was on the Carter Task Force while he was in Office.

References from this (I took some screenprints of a word-search) show lots of Cummings quoting Cummings over a period ranging from 1968 – the 2000s. Just one sample (References are of course alpha by last name). I encourage you to read this pdf (it’s not that long either).

ALSO AT THE UNIVERSITY of NEVADA-RENO is, with similar fields of concern, the National Council of Family and Juvenile Court Justices.

Re-reading this five years later (my pdf is dated 2014) I see that Wm. O’Donohue is listed there (and still) as a Professor of Psychology a University of Nevada-Reno, with an interesting specialty focus (integrated healthcare isn’t primary) and directing a ‘Victims of Crime & Integrated Care Research Lab” with, apparently (by pronoun usage, not all photos are clear and photos are not definitive anyway) four female assistants (who hold 3 M.A.’s and a single B.S. — in Psychology from Portland State University, last name “Cummings” — and a lone male, with a B.A. — or is it ” B.S.”? (Label says one thing, contents the other, on the brief description available on this lab’s website), from University of Utah.

(Link in nearby text, my post short-link ending “-bLg” publ. Dec. 15, 2019) Caroline S. Cummings, B.S. of Victims of Crime & Integrated Healthcare Lab at University of Nevada-Reno, directed by Nicholas A. & Janet L. Cummings frequent co-author (and psychologist/professor, William O’Donohue. I have no idea whether or not she is related, but did notice.

O’Donohue’s vita is presented in doc, not pdf format; hard to open at first.

Wm T. O’Donohue, WTO VITA ‘updated Jan 2010’ (Accessed from UNR website 2019Dec14, context post -bLg, Cummings associate) (39pp printed Doc to pdf, ca 4.5pp of this Educatn thru NIJ Grants, the rest, publicatns)

Wm T. O’Donohue, WTO VITA ‘updated Jan 2010’ (Accessed from UNR website 2019Dec14, context post -bLg, Cummings associate) (39pp printed Doc to pdf, ca 4.5pp of this Educatn thru NIJ Grants, the rest, publicatns)

No products (publications proceeding from the lab, i.e., what does it do? are even listed. Some of individual participants’ publications are, but not as associated with the lab. He has a Wikipedia, all websites I’ve seen so far show the same headshot only photograph (with blank (solid-color, no context) and I found a single post (at least pertaining to him), seems inactive, called “http://williamodonohuephd.com“), one of just three external links on the Wiki page.

SEPARATELY, his LinkedIn (#8606726),judging by education profile, it’s the same person) shows a Nevada LLC active since 2011, “OneCare Health Solutions, LLC” Judging by the “Silver Plume” Nevada registration this was NV20101695484, Formed 9/10/2010 and “Annual Report Due” 9/30/2015; apparently not provided as it remains (despite the LinkedIn’s characterization) “status revoked.” The only other manager listed was an “Ed Edghill” in West Chester, Pennsylvania. I’m not a private investigator and chose not to go further looking to validate who is or isn’t this Ed Edghill (there are several by this last name listed in Sanger, California: may be entirely unrelated, or not, I DNK).

O’Donohue At Sage Publications: (link to “author’s Website” from SAGE is, however, broken):

“William T. O’Donohue is a licensed clinical psychologist, professor of psychology and adjunct professor in the Department of Philosophy at University of Nevada, Reno, and a faculty member of the National Judicial College. He is widely recognized in the field for his proposed innovations in mental health service delivery, in treatment design and evaluation, and in knowledge of empirically supported cognitive behavioral therapies. He is a member of the Association for the Advancement for Behavior Therapy and served on the Board of Directors of this organization. Dr. O’Donohue has published over 50 books and 150 articles in scholarly journals and book chapters. For the past 14 years, he has been director of a free clinic that treats children who have been sexually abused and adults who have been sexually assaulted.”

(FURTHER LOOKUPS on my CELL PHONE SHOW BOOKS PUBLISHED BY SAGE and SAGE PUBLICATION’s AUTHOR SUMMARY. For Further Exploration).

Nicholas Cummings’ background is in both: psychology and psychoanalysis. His enthusiasm for psychology seems directly related to awareness that most people can’t afford psychoanalysis, so they’re not reaching enough of the total human population who might become clients or, his preferred term, “patients.” Key to reaching more is getting the profession (of psychology) mainstreamed directly with primary healthcare, a.k.a., that which public funds will back on the premise that more prevention (“Brief Intermittent Psychotherapy throughout a lifetime”) earlier saves costs later.

“Incidentally” this also helps preserve his chosen profession. Kaiser Permanente HMO and its (many) associated nonprofits, including foundations, especially in California but not limited to it, have also been closely engaged this century in pushing for universal healthcare (“Affordable Care Act” 2010, aka informally as “Obamacare.”).

http://www.ccfc.ca.gov/about/organization.html#members, he chairs First5 California, appointed in 2013. Click on name to read bio blurb, which references his prior background (and maintains connections still) to Minnesota. This is the full quote:

George Halvorson was appointed by Governor Jerry Brown to chair the First 5 California Children and Families Commission in May 2013. He also is the chair and chief executive officer (CEO) of the Institute for InterGroup Understanding.*** In this role, Halvorson is focused on putting processes, teaching materials, and learning programs and approaches in place to help people deal with issues of racism, discrimination, intergroup anger, and intergroup conflict. He currently is authoring three new books that will serve as the core teaching curriculum for the Institute.

Prior to taking on his new roles focusing on children and intergroup conflict, Halvorson served for more than 11 years as the chair and CEO of Kaiser Permanente, retiring from that position at the end of 2013. Prior to his tenure at Kaiser, he was the president and CEO for Health Partners in Minnesota, serving in that position for 17 years.

Earlier in his career, Halvorson started health plans in Uganda and Jamaica, and helped start health plans in Chile, Spain, and Nigeria – most of which continue to operate. He has advised governments in Great Britain, Ireland, Germany, Saudi Arabia, New Zealand, the Netherlands, and Russia on health care issues and has been featured as an educator for national health ministries at the European Union Health Summit in Brussels.

“Peace Thoughts, Truth and Honesty,” of course… except in business dealings, judging by quick fact-checks on this entity….See footnote below. (Posted Dec. 16, 2019, short-link ending “-bLg”)

***This sounds like the name of a nonprofit of uncertain legal domicile (not shown here; we’re supposed to just “know” — or be impressed?). I looked for it years ago, DNR results…

<~~There is a website; it is in Sausalito, CA (a quaint niche/tourist? town known for its harbor and many houseboats, just north of San Francisco’s Golden Gate Bridge) and seems to be well-geared to sell Halvorson’s (nine, pictured) books and push First 5, Conflict Resolution, and how to “trigger” a sense of group, that is, an “us” versus a “them” mentality, etc. … Nice bold graphics (black on white), just no financials: www.intergroupinstitute.org/about. Very “California”…Look at the “books” page and a few of the blog titles…. I have a KAISER | FIRST5 | George Halvorson Footnote; more FnAQs* on this Intergroup Understanding Institute on that footnote. *FrequentlyNOT-AskedQuestions, like “what’s your EIN# and why haven’t you been filing appropriately according to state laws, year after year?”

I’d be interested to know his academic background and how he got into all this before working to promote and administer “universal healthcare” in the US in (at least) two different states, prior to now working to (so says the CCFC website) regionalize pre-school and early care, including for reimbursement rates, to better socialize (reduce inequities based on household income) the care and rearing of VERY young kids, starting at (if not before) birth…

Halvorson has authored eight health care-related books, including Strong Medicine; Epidemic of Care; Building Health Co-ops in Uganda; and Ending Racial, Ethnic, and Cultural Disparities in Health Care. He has also written four books on instinctive intergroup behavior and one book, Three Key Years, that deals with brain development and emotional needs for very young children. Additionally, he has served on more than 30 boards and commissions, and has chaired more than a dozen – including the American Association of Health Plans; the International Federation of Health Plans; the Partners for Quality Care Board; the Health Governors for the World Economic Forum in Davros, Switzerland; and the Health Plans Committee for the Board of the American Diabetes Association.

He and his wife, Lorie, have five sons, two daughters-in-law, and five grandchildren. While they reside in the San Francisco area, they continue to have strong ties in Minnesota

More at Footnote: Universal Healthcare | Kaiser Permanente | First 5 California and George Halvorson

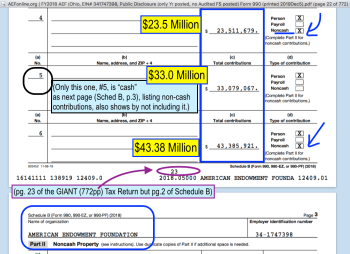

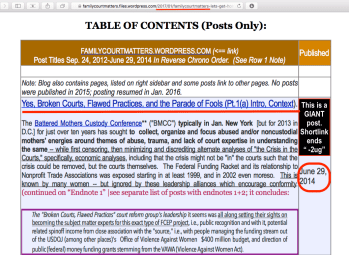

The next two images, from either my Table of Contents 2012-2016, or from one of the posts shown on it, voice just some of my prior concerns I already raised about this particular family’s role which also intersects with my “Stunning Validation by Jeffrey Moussaieff Masson” post which got me looking at the history of psychology (professionalized or otherwise) and psychoanalysis (a.k.a. “Freud et al.”) more closely than awareness of AFCC’s typical membership categories already had.

These just two images are fine-print/colorful (annotated or background) and intended to supplement, not replace, the information on this post, best after reading the rest of it:

Find FamilyCourtMatters.org prior, related posts: two-image gallery. Find by dates or from within sticky post “Table of Contents 2017” either as pdfs (with active title links: best) or from that page linking to direct displays of those TOC’s as separate posts. Next quote (from my “Table of Contents 2017 continues themes from 2016…” contains a link to a pdf containing the images shown just below, but explains that’s a 37-pager. (Second click on blank page icon probably required to open).

PDF #3: Table of Contents, June 29, 2014 reverse chrono to Sept. 24, 2012 (37 pages, about 140 posts), … (pdf format, showing in 8X11 page installments). This being so much longer, has different sections. . . The table of contents (therein) is on pp. 4-20. FYI. The front and end matter contain narrative (blog) substance, not just “navigation” instructions. …

[No posts published from June 29, 2014 – January 22, 2016.] {{i.e., last half of 2014 throughout all 2015, I did publish before Sept. 24, 2012, but have no manually created “Table of Contents” for them; see “Archives.”}}

The post containing the same (long: 140 posts) list of TOC, June 29, 2014…to Sept. 24, 2012 (all titles with active links, shortlink ends “-2rW”) is here, but I recommend viewing it as pdf with 8-11 display from the above link. A post containing links (pdf & post) to this, and to TOC 2016 and 2017 is here (short-link ends ‘5qZ’). That post is complicated, so the next mini-section in this background-color (inside black bordered box) summarizes….

There are hundreds of posts (my admin dashboard shows 839 posts as of mid-December 2019). They are also points of reference for key topics within this field from a consumer’s AND investigator’s (tracking the nonprofits and how they hook up with federal grants, as by now you know) and domestic violence/family court survivor (mother)’s point of view, trying to keep it objective but not ‘dispassionate’ where there are such huge accountability loopholes throughout.

QUICK REVIEW: HOW TO ACCESS FAMILYCOURTMATTERS TOC POSTS.

This MINI-Section, except label and last three links, covers access to MOST of this blog’s titles one way or another! I took the time to review because the titles themselves are like a table of contents to under-reported topics within this field which shed major light on the ones typically being publicized in MSM or by specialty (niche) advocacy groups.

It contains descriptive text, title with link from the top of my Comprehensive (Sept. 2014 – Sep. 21, 2017) TOC post.

Below, in this background-color, I added links to three posts finishing the list for 2017 (Oct, Nov & Dec). For 2018 and 2019, see other Sticky Posts near the top of the blog or (probably quickest route) links provided on blog right sidebar widget.

This (next) post** presents three different ways to view three different time spans’s tables of contents…. This post pulls it all together and puts links in one place to older tables of contents direct from here (in 8X11) or directly on their original posts…

It’s actually current through Oct. 8, 2017. The pdfs take so long to make, I hadn’t updated them… Therefore posts for Oct, Nov, and Dec. 2017 are presented in separate posts, all marked “Sticky” within the top dozen links, so easy to find, and I’m posting them also right below here:

- Seven Posts from December, 2017 (Informal TOC Update @ March 14, 2018) (short-link ends ‘-8MD’).(About 7,000 words).

- Eight Posts from November, 2017 (Informal TOC Update@ March 9, 2018) (short-link ends “-8KE”). about 10,000 words

- Eight Posts Published in October, 2017 (Informal TOC Update) @ March 6, 2018. (short-link ends “-8Kh”). About 3,150 words.

(In grabbing those titles to paste in here, I added the short-links to the actual post titles for all three for future, easier reference//LGH Dec. 15, 2019).

-

- re CUMMINGS FNDTN new post | Two images from my oldest TOC show related post (dates) |SShot 2019Dec07 Sat @3.43.25 PM

-

- re CUMMINGS FNDTN new post | Two images from my oldest TOC show related post (dates) |SShot 2019Dec07 Sat @3.41.44 PM

The “Giant post ending “-2ug” (June 29, 2014, first TOC image above, left) I’m thinking about how to re-write with graphics, cutting it down to flow-chart size with a basic “legend.” Don’t hold your breath, but it’s on my “to-do” list being such a key point for this blog. It was also my last post before taking a (basically, forced) one-and-a-half year break posting here, to protect my own housing options from specific family-oriented obstacles to the same (forum: probate court, topic: trusts). Most of the organizations listed on it haven’t gone away yet, or changed behaviors. It’s still basic information…

Compared to Flinn.org:

When it comes to the various Cummings Foundations, ALL their Board of Directors or Foundation Managers represent far fewer individuals (at least one of them in his mid-90s by now), which makes me wonder how old is the one daughter involved (Dr. Janet L. Cummings), and probably (even taken as a whole with other related for-profit entities, i.e., some holding real estate) far fewer resources. All three websites are even less interested than “Flinn.org” in revealing their EIN#s or financials, while posting glowing descriptions of their own disruptive innovations (links below, see for yourself). So I decided to take a closer look.

Having now taken that closer look, I can see why they might not want people to get a closer examination* of the books! (*..of even tax returns up through Dec. 2017: I don’t have; websites do not volunteer any audited financial statements so far…)

My prior attempted titles for this post reflect its complexity as I progressively uncovered one red flag connection or omission after another. Included here for extra preview:

4th attempt, variation on the 3rd: Three Tax-exempt Cummings Entities (Inc. 1994 and 2004 (co-located) in Reno, NV, and 2014 in Phoenix, AZ) and Their Family-Controlled Personal Agenda: Taking Former Arizona State U’s ‘DBH’ Accreditation International, Con’td. (Publ. soon after Dec. 9, 2019). (short-link ends “-bLg”)

First title attempt/this Post is (however titled, it’ll be available when published at this link): Cummings Fndtn for Behavioral Health (EIN# 300163951, NV), Major Contributor American Endowmt Fndtn (OH) and a few others co-located with CBFH, per its 990PF Roadmaps (Publ. Dec. 5?, 2019) (shortlink ends “-bLg” started Dec. 4, 2019)

THIS POST exists to link to for further drill-down (supporting information) linked to my #2 post in the Arizona Pipeline, now published and accessible at:

There seems to be sharing of debts and liabilities relating to some real estate among the Cummings-controlled entities.

Viewing only the total Form 990-reported assets (once each EIN#s has been looked up and verified) and the (Cummings-controlled) entities’ websites’ brief summaries give only a fraction of the picture and as such are mis-leading.

The 1993-founded AEF (in Columbus, Ohio) being the major contributor a certain year, I looked it up and found what looks like a new species of “community foundation” retaining some of the (in my opinion) worst characteristics of Donor-Advised-Fund tax-exempt foundations while losing even a pretense of the “local” part expressing concern for the region in which it’s geographically or legally domiciled. In fact it advertises how its donor-advised funds can be used to contribute to individuals favorite community foundations, with their donor-advised funds, too. Its stated tax-exempt purpose, in all caps, is, in just seven words:

“To Expand the Capacity of American Philanthropy.”

(FY2017 (YE Dec) Form 990, Pg. 1, Part I, Summary, Line 1)

Part VIIB (sole independent contractor paid anything over $100K) was a Gift Admin/Software provider from Canada — which was paid $2.4M for its services. 2017 (Part VIII Line 1 Revenues were about $684M) and its Investment Income about $41M). The software provider was called Benevity, Inc., 1812 4th St. SW, # 300, Calgary, Alberta, Canada. I could say a lot more here (after looking it up), “I get it,” but this post is already too long!

After about 20 minutes of lookups, quick summary: This part on “BENEVITY” qualifies as an “aside” but is included because the 1993ff “AEF” here chose to use it for a subcontractor in 2017, which gives at least some idea where its (AEF’s) “head” is at…

Benevity, Inc. (that $2.4M paid FY2017 subcontractor helping AEF, above) has a “contact us” page showing three offices in Canada (not at the address shown in the FY2017 return above, which address was interesting in its own right (building owned by W. Chan Investments, Ltd., at least in 2018 and with 11 spaces still for lease) in Calgary, Victoria, and Toronto + one in the UK (Cirencester/Gloucestershire), and two in the USA: one in San Mateo, California, and one in Clearwater, Florida. They focus on employer giving, contributions managed in 17 languages, one of the first “Certified B” corporations in Canada.

The address in San Mateo, California (get this: a “Burt Cummings” was involved) is a $1.8M home sold (recently); the “Benevity” in California existed for less than a month in 2018, apparently for the purpose of merging into Versaic, Inc., a California Corporation of which two versions exist, one with multiple strange filings (several “Restatements,” an agent Resigned in 2006, name change from “SponsorWise” (Up til then) to “Versaic, Inc.” a California Stock Corporation in 2011 (what happened during those 5 years, then?), and within one month (actually a half-month) after Benevity Mergersub, Inc. (existed for a only few weeks in March, 2018 as a California Stock Corporation) it merged into Versaic, Inc. (Calif. Corporation), Versaic, Inc. (California) then merged into Versaic, Inc. a Delaware Corporation, address, ℅ Benevity International, Inc. in Calgary–and that’s just looking into ONE of the two USA addresses of Benevity, Inc. in Calgary, Canada.

See “Footnote: Benevity, I mean Versaic, Inc., I mean American Online Giving Foundation,** in Canada, The UK, California — I mean, Delaware, and Florida — (from the State of Georgia), I mean… (ad infinitum)…” for my brief follow-up for this insanity, a.k.a. “business model” (which reminds me of the “JustGive” going “JustGiving” I blogged in much detail several years ago — same general idea. Start in the USA, featuring on-line transactions, move out of the country… I’ll add a Footer, but I need to talk to someone else (who, not sure yet!) about this… Oh yes — and the Florida Address AOGF shows legal domicile Georgia. Get the general idea? ! ! !

**I’m not saying AOGF is “Benevity,” although tax returns show it’s paying Benevity as a Part VIIB Subcontractor for administrative services, and although Bryan de Lottinville is President of AOGF## and leader of Benevity… In fact AOGF in 2015 showed only 3 board of directors and ZERO employees (it being “online giving” while claiming $127M of contributions most of which it gave away — but provides no Schedule I listing of. Now, I wouldn’t like to be responsible to itemize over $100M of micro-donations (or large ones) on a Form 990 Schedule I, but that IS the IRS requirement (unless “micro” somehow avoids compliance). This money could easily also be going to “domestic” (USA) governments as happens under AEF, above, which chose Benevity.

((AOGF is EIN#810739440; FY2016 viewed; table of last three Form 990s is in the footnote) (AOGF legal domicile FL, has had two addresses in Florida already, the second of which shows up as one of just two “USA” offices of Benevity — same street address) and files in many different states within the USA)

[Dec. 17, 2019 added comments]:

This should be blogged. I’m just spreading some breadcrumbs here and in the footnote below after another day (Dec. 17) looking at this, I have a better understanding of “standard operating procedures…” There are many accountability problems. I’d also like to point out that, while registered in Georgia (why Georgia), the word “American” could refer to all of North America, not just the USA — and again, Benevity.com IS a Canadian, not US, organization. Market niche is “world’s largest employers…” and they’re moving that money FAST while failing to provide full, and visually readable, records of it for the public, esp. in the USA…

For AEF to be mixed up (utilizing) AOGF and promoting the Cummings (as just one of millions of dollars of donations in a certain year, but still the bulk of the Cummings’ entity’s contributions for that year) reflects negatively on AEF. I also note that one of the Cummings entities below seems to be adopting the similar model — citing $40M of assets in the form of “pledges.” The whole situation needs a real “plumbline” of accountability which I don’t see it’s likely to get anytime soon.

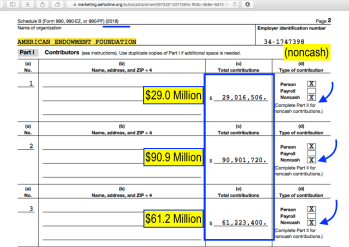

For FY2018, AEF also turned out to have MAJOR “Schedule B” contributors, contributing millions of dollars, EACH and OVERALL, of noncash (i.e., public-traded securities, it seems), which the entity then can sell at a loss, as often happens on tax-exempt community or other large foundations. Sometimes they seem to be in effect dumping grounds for non-producing assets while contributors (donors) get nice federal income and/or excise (state-)** tax-reduction, the entity continues to function (often by taking more grants) (**I’m not a tax professional… for the finer points, ask one!)

-

- AEF FY2018 SchedB, p.3 showing 5 out of 6 contribs were (unspecified) ‘public traded securities’ Noncash (#5 was cash)

Add the six amounts shown on images 1 & 2 above to show about $279.4 Million (out of total contributions that year shown on page 1, over $1 billion) were “Schedule B,” i.e., larger. One wonders who the owners were. Because AEF describes itself as “concierge donor-advised funds-service, targets services especially towards other financial advisors, I’m wondering who would have that kind of money to donate in a single year to this Ohio nonprofit, and why one of them decided that $90 of US Treasury Bonds should be donated. Interesting situation …

Grant-making, as I’ve reiterated recently and even copied screenshots of my recent post to Twitter to say it again, is not necessarily the primary purpose here.

I also give both Cummings Foundations a failing grade for [A] seeking to exploit and target access to public healthcare funds (a massive enterprise field) while, [B] disrespectfully to the public who’ll pay for this, failing to even divulge their own EIN#s, let alone financials for any year.

The respective foundation assets as of FY2017 are shown: $40.9M (CFBH, files 990PF so founding year NS on face page), $27.2K (N&DCF CFBH, files 990PF so founding year NS on face page)) (co-located), and $2.0B (AEF in Ohio). (AEF’s website now claims $3 billion).

and nonprofit “CGI-BHS” (My acronym for Cummings Graduate Institute for Behavioral Health Studies” (granting DBH’s on-line), which files Forms 990, starting only in FY2015. Total Gross Assets (2017) $306K. This one’s not self-supporting, or even close to it…

Written by Let's Get Honest|She Looks It Up

December 16, 2019 at 7:33 PM

Posted in 1996 TANF PRWORA (cat. added 11/2011)

Tagged with 'Sun Corridor' entities in Arizona, 'This Post Has Many Tax Return Tables!', AEFonline.org - American Endowment Fndtn (DAFs on steroids), Andrew Cummings in CT and/or NY (cf Nicholas A.), AOGF-American Online Giving Fndtn (EIN#81-0739440) + Benevity's Bryan de Lottinville, Behavioral Health Economy-Private Interests who want Arizona to be a Hub, Benevity.com (Canadian administrator of global giving software also running USA nonprofits like AOGF (American Online Giving Foundation) ("onlinegivingfoundation.org' 2015ff - Georgia Legal Domicile), Biodyne business model, Bryan de Lottinville, Cummings Foundations, DAF - Donor Advised Funds = Organization-Controlled, Dorothy M. Cummings (Mrs. Nicholas A.), George Halvorson (2013ff California First 5 Commission Chair), George Halvorson's SausalitoCA Nonprofit (CCFC.Ca.Gov bio-blurb mislabels), Janet L. Cummings PsyD, Nicholas A. Cummings (see also my tags 'Nicholas J. Cummings' which is an error), obfuscation, Philanthropic Behavior of Billionaires, Philanthropic Obfuscation (on websites &/or Forms 990 presentation), Stretching the Definition of "University", University Centers and their Namesakes/Donors, When Reading Forms 990 Notice the Subcontractors too

Three Footnotes to About 2,500 Words on Why I Still Bother (to Blog). (#2 of 2,June 29, 2019)

Three Footnotes to About 2,500 Words on Why I Still Bother (to Blog). (#2 of 2,June 29, 2019) (short-link ends “-ad3” | just under over 2,000 words). Two Posts published in a row only to segregate the footnotes from post In About 2,500 Words,** Why I Still Bother… (short-link ends “-ac4″/ #1 of 2) which really should be read first. It’s more important and has more content.

These footnotes are named, not numbered; each has its own text box and background color.

Footnote: Taxation + Tax-Exempt Sector: “Not quite the level-playing field facilitator…”

The private, tax-exempt sector can’t even be seen as a whole without significant and ongoing attempts to follow tax returns (audited financial statements, often in rare supply, are also necessary). Unfortunately (?–is it really fortune/happenstance, or coincidental?), structure and access to databases of IRS tax returns are designed, organized, and controlled by the same tax-exempt sector (increasingly, merging into each other, as “Foundation Center” recently did by acquiring “Guidestar” and now labeling it “Candid”) Or, The Urban Institute did by re-structuring its previous data base “NCCS” (National Center for Charitable Statistics), which I just revisited after having noted a year or so back that it’d been shut down; readers were directed to just a few alternate providers). IRS.gov holds much, but doesn’t upload several years worth of returns, and not all organizations that file or once filed are searchable on its Exempt Organization Search list.

Read the rest of this entry »

Written by Let's Get Honest|She Looks It Up

June 29, 2019 at 7:28 PM

Posted in 1996 TANF PRWORA (cat. added 11/2011)

Tagged with "Drill-Down" "#DoTheDrillDown" geological pt of reference, Footnotes to Post 'In About 2500 Words' (June 29 2019), Habits of the Wealthy, Intergenerational transmission of wealth, Philanthropic Behavior of Billionaires, Public/Private Partnerships (as the Food Chain), tax exemption, Taxation vs Tax-Exemption, The Clapham Group | Mark Rodgers (AES-Alliance for Early Success | Board of Directors, Wealth poured into tax-exempt foundations to influence public policy, Why I Still Bother to Blog

In About 2,500 Words,** Why I Still Bother… [Published June 29, 2019/#1 of 2]

In About 2,500 Words,** Why I Still Bother… [Published June 29, 2019/#1 of 2] (short-link ends “-ac4”).

**Post title originally: “In About 1,000 Words…” I had to adjust the title several times but quit, cold-turkey, before 3,000 words.

Then I <>added two image galleries with captions and connecting text and three or four more individual images ….<>expanded one of the early “**” references while copyediting for grammar, then footnoted it… <> added to the very bottom a bio blurb from one of the added image captions for a Mark Rodgers, of The Clapham Group (Charlottesville, Virginia), on the Alliance for Early Success‘s (“AES” in Kansas but legal domicile Nebraska) Board of Directors, which information is fascinating, I’m currently writing on because its a classic example of why we all need better language and to establish the habit of identifying, digging up the financials, and comparing them to the public relations material, even when it shows up at Harvard University (https://developingchild.harvard.edu), or backed by people (with heirs) listed in Forbes if not THE richest in a state, others in the same class.

Please see after this, Footnote “Clarification“ at the bottom of this post, (Three Footnotes to About 2,500 Words on Why I Still Bother (to Blog). (#2 of 2,June 29, 2019) (short-link ends “-ad3″| published the same day).

Here, it does and there are already major discrepancies surfacing. It’s also interesting in its own right.

I have to bite my tongue even now to not add to that information, knowing as much as I’ve just discovered within the past week (but had made mental notes of as far back as September 2016)…

It did only take about 2,500 words to state my case. The rest is “for example” and some examples, details behind the declaration.

Details matter. They reveal who’s involved in which roles in any mass social transformation targeting public institutions (i.e., source of ongoing revenues). Discernible practices discourage fair and open debate before any side has enough backing on questionable methods, or even purposes.

Privately networked, cross-jurisdictional collaborations and layered tax-exempt entities obscure full awareness of how few are at the top. Like any pyramid (marketing) scheme: highly networked, compartmentalized by cause at the lower levels.

… Still under 6,000 words (or so) …

Why I still bother to blog: Not just for fun!

I write to communicate what I see in fields whose established leadership do see, but have chosen not to say — including in fields developed essentially within the last two decades or so.

I write for those who like me, should’ve had better validation over two decades ago of things which just didn’t smell right in and around the family courts, on-line complaints and media exposes of the family courts. Those things that weren’t and still aren’t right, if you, like me, have smelled but (unlike me) haven’t yet found the source, know that the “what’s not right” can be seen and identified in objective terms — but not the cause-based rhetoric we are all being fed, constantly. So there’s a matter of functional vocabulary leading to expression in forms of what is seen — and from there, what to do about it, and only from there, how.

It starts with understanding there’s an existing taxonomy, the scaffolding of any operational support for ANY cause, to be considered. IS IT PUBLIC or IS IT PRIVATE — IS IT AN ENTITY or IS IT A PROGRAM POSING AS AN ENTITY shows WHERE IT TIES INTO THE ECONOMY. For collaborations and coordinated programming or any cause, the whole still has parts, and these parts still should be identified.

I also write to show how suppression of functional vocabulary is commonplace, cannot be accidental, it’s nearly universal, and the intent is subjugation of an entire population (and engaging them in keeping others down). In this language and vocabulary are a technology… key tools… leverage. The antidote is self-education. It takes some time and practice, but it’s achievable. One challenge will be time when people’s time is spent fighting to survive economically.

Basic literacy on how we are governed must be in economic terms, and must deal with concepts on submission to taxation in exchange for accountability for use of those tax receipts. Not just trust in leadership, and not just rebellion without understanding how to govern ourselves. (The intended level of dissonance with reality seems to parallel with a historic intent for South Africa: “Hewers of Wood and Drawers of Water”). That’s not the ideal society or a “just and sustainable world” when applied globally.

I write so women (mothers, in particular) might have a choice not just between forms of exploitation or abusing others (& becoming an abuser because it seems safer) or having been driven out of one field, need to make “family court reform” the new one — but walking in without a perspective on the usual guides to “family court reform.”

If what I’m saying is: untrue — challenge it; true, but irrelevant — show me how*; If it’s true and relevant — deal with it, which will require making hard choices.

I know that challenging, or proving irrelevance, or dealing with this material would be itself challenging — because you’d have to consider enough of the material to debate it, and then figure out ways to dismiss it.

It seems to me that too many “thought-leaders” have not accepted that the easy route — dismissal, silence, censoring the discussion, encouraging dependency of followers; let them run interference — won’t work forever.

Read the rest of this entry »

Written by Let's Get Honest|She Looks It Up

June 29, 2019 at 7:26 PM

Posted in 1996 TANF PRWORA (cat. added 11/2011)

Tagged with "If we want a better system...We'd better recognize + scrutinize the tax-exempt sector and find a better more accurate term than "Philanthropy" to describe and discuss it.", "What's LOVE [or public benefit] got to do with it?" (This system), "What's Really Going On Here?", Billionaire tax-exempts (2015) list (Harvard Yale Stanford Princeton -- B&M Gates -- Credit Unions - Health Care Administrators - etc), Family Courts Problem-Solve SOMETHING by reframing the criminal as low-level disputes -- not that WHAT is clear...., Foundation Center Inc (990finder database) Entity Name Royal Screwups (cont'd.), Guidestar USA Inc (formerly Philanthropic Research Inc) 1995ff in WmsburgVA (DE corp), Have you read your local CAFR yet? If not why not?!, Let's Get Honest blog, Philanthropic Behavior of Billionaires, Survival in any landscape demands a minimum comprehension of meaning ... requires a set of symbols (language) from OUTside it ... to express (even if only to onesself) the essentials" (LGH 2012), Taxation vs Tax-Exemption, Wealth poured into tax-exempt foundations to influence public policy, Why This Blog?, Why Understanding Tax-Exempt Sector is not Optional in pursuit of Justice + representative government

Budgets Aren’t Balance Sheets! and other Basic (USA)Facts about Billionaires’ Philanthropic Behaviors, Such as of 2014-retired Microsoft CEO Steven Ballmer + His Wife Connie [Aug. 4, 2018]

I started to weave some of this information into a different post, anticipating writing further on it.

However, after about a days’ hunt for two (STILL not found yet) EIN#s connected with the famous philanthropists mentioned in the title, and after reading the tax returns / shabby filing habits of one of the no doubt much smaller ones also associated (referring to the Los Angeles Clippers Foundation — Steven Ballmer also owns the Los Angeles Clippers), I felt it better to sequester this topic onto its own post.

Too bad, because, understood better, it adds weight to the original argument — most headlines involved nonprofits at SOME level, and we’d be better off as a whole, when they come up, to look them up!

Anyhow: My post title:

Budgets Aren’t Balance Sheets! and other Basic (USA)Facts about Billionaires’ Philanthropic Behaviors, Such as of 2014-retired Microsoft CEO Steven Ballmer + His Wife Connie [July, 2018] (short-link ends “-982”). Started mid-July, published Aug. 4, 2018, at about 9,000 words (tags added later). It comes from the middle of Two Plaintiffs’ Counsel Nonprofits for Class Action Lawsuit (℅ Center for Investigative Reporting article) (Short-link ends “-95X,” published 7/31/2018).

CLICK IMAGE TO READ! Good Ventures (Public, ℅ SVCF) Form 990, FY2016 Sched L acknowledging ICONIQ Capital’s “Interested Person” status through 35% owner, Divesh Makan (viewed 8/4/2018)

The post title could also reference, and I do include for comparison, two other philanthropic couples, both with close ties to Facebook and a multi-billion-dollar Silicon Valley Community Foundation (“SVCF”) formed by merger to reach $1 billion assets only in 2006.

Besides Zuckerberg’s apparent direct involvement in (funding) SVCF and with Iconiq Capital’s Divesh Makan (discussed below) from before Facebook went public, these two couples also headed two of SVCF’s many “related tax-exempt organizations” formed since 2006 (samples below). However, the Chan-Zuckerberg related organization dissolved itself in 2016 into multiple other “CZI” branded LLCs (Delaware entities) while more “CZI” branded nonprofits were then started up (again, shown below).

CLICK IMAGE TO READ! Good Ventures (Public, ℅ SVCF) Form 990, FY2016 Sched O showing entwined relationships (viewed 8/4/2018)

So husband-and wife couples Priscilla Chan & Mark Zuckerberg (Startup: Education + the more recent Chan Zuckerberg Initiative) and Dustin Moskovitz & Cari Tuna, have overlapping mutual foundation interests. Zuckerberg and Moskovitz were Facebook co-founders, and one major mutual foundation in common is the Silicon Valley Community Foundation in Santa Clara County, (SF Bay Area) California.

Moskovitz & Tuna’s variety of “Good Ventures” entities (one public (<==EIN#452757586, 2016 tax return), one private (<==EIN#461008520, 2015 tax return) foundation and an LLC) collectively report (2016) over $1B Assets (the LLC’s assets are unknown; LLCs don’t have to reveal their financials to the public). (Next 3-image gallery shows: 1) Total combined gross Assets from these two “Good Ventures” foundations (along with some others) in table form, and 2), 3) self-disclosure on multiple entities from the organization’s website.

GoodVentures.com the website was (still is, generally) initially confusing until I looked up the referenced organizations financials. That website doesn’t overtly feature “SVCF” but instead “GiveWell” and “Open Philanthropy Project,” which (like Startup: Education — and Good Ventures) seems to keep changing its format and, correspondingly, its reporting requirements, using one sound-byte (or trademark) for multiple organizations. GiveWell it also turns out is a trade name (‘dba’) not an entity name.

-

- GOOD VENTURES (Form 990Finder Search results = 12, (two w composite Assets almost 1 Billion by Moskovitz|Cari Tuna combo) ~~Searched 8/4/2018

The public “Good Ventures” foundation (℅ SVCF) has only 3 officers: Cari Tuna, Dustin Moskovitz, and Divesh Makan, and the (highly paid) board / officers of related SVCF (as of tax return 2016).

There are investment managers in common among these various foundations and LLCs (ICONIQ Capital, Apercen Partners, Square Seven Management**) showing up: as “℅” on the addresses; as well-paid independent subcontractors (Form 990 Pt. VIIB); and/or as “(Form 990 Sched L) Interested-Person Transactions,” or (as in Good Ventures example imaged above) as might be reported on a tax return under Schedule O, “Supplemental Information”). … For the LLCs, searchable in California at BusinessSearch.sos.ca.gov, they show up as either listed “managers” and/or at the same street address + Suite#s entity addresses.

(**Square Seven Management LLC it says is managed by Iconiq Capital LLC, a Delaware Entity)

These networked billionaires work through networked foundations and similarly named LLCs to: move the money, pool the assets, and use common investment managers often, who invest alongside them and are paid fees and percentages of “AUM,” assets under management (presumably).

Who knows, perhaps that’s what ‘APERCEN” in “Apercen Partners” refers to – “A percen(t).” (Just kidding…)

Investopedia 2/28/2016 article (Mark P. Cussen), “Are AUM Fees a Thing of the Past?” (Click image to enlarge or click through for article).

Search “AUM fees” for several results. Here’s an interesting and quick-read one from March 28, 2018: “Why AUM-Based Fees Don’t Meet Fiduciary Standards” by Bert Whitehead of “Cambridge, Connection, Inc. “Advisor Perspectives.” Another from Guideline.com (What is an AUM Fee?), and from Investopedia that they may be going out of fashion: Are AUM Fees a Thing of the Past? by By Mark P. Cussen, CFP®, CMFC, AFC | February 12, 2016. Notice these are all written by financial advisors of one kind or another, see all the initials after that last author (and nearby image)

The networked billionaires then advertise their own work on websites which post, typically, no identification (or minimal and not the most recent by far) of tax returns for specific foundations, or evidence of any LLC filings, or audited financial statements. Where would those audited financial statements be found? While sometimes the California OAG may post audited financial reports under individual foundation’s “Details” page, for these (I’m reporting on herein) it doesn’t seem to.

The spider-like nature (multiple related organizations, with separate identities but apparently common SVCF management) and behavior of SVCF blurs the IRS’ definition (when movement of money is shown) of “supporting organization” (the “support” seems to be going in the opposite direction) and the concept of actual independent entities, when the independent entities simply delegate administration and management to the controlling one (here, SVCF), paying its board and/or employees handsomely for the fees, and retaining (both supporting and supported, i.e. SVCF, organizations) most assets while granting out (for several of these SVCF-managed related organizations) millions of dollars more in a given year than is taken in — some “budget” — knowing that their rich benefactors will either cough up some more, or close it down as part of an obviously pre-determined exit strategy.

Overall it seems to be more about the investments held by and funds moving between multiple nonprofits under common management (including some of the boards) than about the advertised projects. Another reason I say, watch the Balance Sheets as much as if not more than the Budget.

Also complicating comparisons among multiple entities, even of public with private ones under common management or ownership:

Differences between public (990s) and private (990PF) filings (unofficial, deduced just through observation)…making cross-comparisons from the same wealth source harder for the average person, although the purpose of by law (Internal Revenue Code) making them public at all, one would think, is for the average person, “the public,” — not just potential donors — to understand how entities with tax-exempt privilege are in fact operating and what they are doing with that privileged status.

My comments refer to IRS Forms 990 since substantial revisions in 2008 only. I have spent more time looking at the more recent forms, although I often do go back before 2008 for specific entities.

- PUBLIC 990-filing foundations have to categorize types of investments on their balance sheets (Part X, since the IRS Form 2008ff) and provide more detail on Schedule “D” to Part X for any amounts for Other Investments or “Other Assets,” but do not have to name which exact corporate/public-traded or other investments are held.

- Public foundations also in their grantmaking are to supply EIN#s for grantees

- Public foundations by IRS form have to segregate domestic and foreign grants on different schedules (Schedule I, Schedule F)

- PRIVATE 990PF-filing foundations — remember, Good Ventures has one of each both formed about 2012 it says — do list how many shares of exactly which investments, and grouped by type, but do not (as I understand it/I may be wrong about that) have to categorize them on the tax return’s balance sheet statements as to type.

- PRIVATE (990PF-filing foundations) in listing their grants do not have to separate domestic (USA) and foreign (non-USA) grants — and some of these are granting out millions with very long lists. They also are not required to provide EIN#s for any grantee, making fact-checking or follow-up harder; especially when grantees can and do tend to change their names, or if the name & address recorded on the 990PF do not match reality.

- The PROBLEM: Together, this makes obtaining an overall view on any single enterprises’ (or individuals’) financial impact on specific projects. The information is dispersed, and it’s recorded in different reporting formats even when the money may be coming from the same source (i.e., same extraordinary personal wealth).

- Movement / re-branding of business entities over time: