Budgets Aren’t Balance Sheets! and other Basic (USA)Facts about Billionaires’ Philanthropic Behaviors, Such as of 2014-retired Microsoft CEO Steven Ballmer + His Wife Connie [Aug. 4, 2018]

I started to weave some of this information into a different post, anticipating writing further on it.

However, after about a days’ hunt for two (STILL not found yet) EIN#s connected with the famous philanthropists mentioned in the title, and after reading the tax returns / shabby filing habits of one of the no doubt much smaller ones also associated (referring to the Los Angeles Clippers Foundation — Steven Ballmer also owns the Los Angeles Clippers), I felt it better to sequester this topic onto its own post.

Too bad, because, understood better, it adds weight to the original argument — most headlines involved nonprofits at SOME level, and we’d be better off as a whole, when they come up, to look them up!

Anyhow: My post title:

Budgets Aren’t Balance Sheets! and other Basic (USA)Facts about Billionaires’ Philanthropic Behaviors, Such as of 2014-retired Microsoft CEO Steven Ballmer + His Wife Connie [July, 2018] (short-link ends “-982”). Started mid-July, published Aug. 4, 2018, at about 9,000 words (tags added later). It comes from the middle of Two Plaintiffs’ Counsel Nonprofits for Class Action Lawsuit (℅ Center for Investigative Reporting article) (Short-link ends “-95X,” published 7/31/2018).

CLICK IMAGE TO READ! Good Ventures (Public, ℅ SVCF) Form 990, FY2016 Sched L acknowledging ICONIQ Capital’s “Interested Person” status through 35% owner, Divesh Makan (viewed 8/4/2018)

The post title could also reference, and I do include for comparison, two other philanthropic couples, both with close ties to Facebook and a multi-billion-dollar Silicon Valley Community Foundation (“SVCF”) formed by merger to reach $1 billion assets only in 2006.

Besides Zuckerberg’s apparent direct involvement in (funding) SVCF and with Iconiq Capital’s Divesh Makan (discussed below) from before Facebook went public, these two couples also headed two of SVCF’s many “related tax-exempt organizations” formed since 2006 (samples below). However, the Chan-Zuckerberg related organization dissolved itself in 2016 into multiple other “CZI” branded LLCs (Delaware entities) while more “CZI” branded nonprofits were then started up (again, shown below).

CLICK IMAGE TO READ! Good Ventures (Public, ℅ SVCF) Form 990, FY2016 Sched O showing entwined relationships (viewed 8/4/2018)

So husband-and wife couples Priscilla Chan & Mark Zuckerberg (Startup: Education + the more recent Chan Zuckerberg Initiative) and Dustin Moskovitz & Cari Tuna, have overlapping mutual foundation interests. Zuckerberg and Moskovitz were Facebook co-founders, and one major mutual foundation in common is the Silicon Valley Community Foundation in Santa Clara County, (SF Bay Area) California.

Moskovitz & Tuna’s variety of “Good Ventures” entities (one public (<==EIN#452757586, 2016 tax return), one private (<==EIN#461008520, 2015 tax return) foundation and an LLC) collectively report (2016) over $1B Assets (the LLC’s assets are unknown; LLCs don’t have to reveal their financials to the public). (Next 3-image gallery shows: 1) Total combined gross Assets from these two “Good Ventures” foundations (along with some others) in table form, and 2), 3) self-disclosure on multiple entities from the organization’s website.

GoodVentures.com the website was (still is, generally) initially confusing until I looked up the referenced organizations financials. That website doesn’t overtly feature “SVCF” but instead “GiveWell” and “Open Philanthropy Project,” which (like Startup: Education — and Good Ventures) seems to keep changing its format and, correspondingly, its reporting requirements, using one sound-byte (or trademark) for multiple organizations. GiveWell it also turns out is a trade name (‘dba’) not an entity name.

-

- GOOD VENTURES (Form 990Finder Search results = 12, (two w composite Assets almost 1 Billion by Moskovitz|Cari Tuna combo) ~~Searched 8/4/2018

The public “Good Ventures” foundation (℅ SVCF) has only 3 officers: Cari Tuna, Dustin Moskovitz, and Divesh Makan, and the (highly paid) board / officers of related SVCF (as of tax return 2016).

There are investment managers in common among these various foundations and LLCs (ICONIQ Capital, Apercen Partners, Square Seven Management**) showing up: as “℅” on the addresses; as well-paid independent subcontractors (Form 990 Pt. VIIB); and/or as “(Form 990 Sched L) Interested-Person Transactions,” or (as in Good Ventures example imaged above) as might be reported on a tax return under Schedule O, “Supplemental Information”). … For the LLCs, searchable in California at BusinessSearch.sos.ca.gov, they show up as either listed “managers” and/or at the same street address + Suite#s entity addresses.

(**Square Seven Management LLC it says is managed by Iconiq Capital LLC, a Delaware Entity)

These networked billionaires work through networked foundations and similarly named LLCs to: move the money, pool the assets, and use common investment managers often, who invest alongside them and are paid fees and percentages of “AUM,” assets under management (presumably).

Who knows, perhaps that’s what ‘APERCEN” in “Apercen Partners” refers to – “A percen(t).” (Just kidding…)

Investopedia 2/28/2016 article (Mark P. Cussen), “Are AUM Fees a Thing of the Past?” (Click image to enlarge or click through for article).

Search “AUM fees” for several results. Here’s an interesting and quick-read one from March 28, 2018: “Why AUM-Based Fees Don’t Meet Fiduciary Standards” by Bert Whitehead of “Cambridge, Connection, Inc. “Advisor Perspectives.” Another from Guideline.com (What is an AUM Fee?), and from Investopedia that they may be going out of fashion: Are AUM Fees a Thing of the Past? by By Mark P. Cussen, CFP®, CMFC, AFC | February 12, 2016. Notice these are all written by financial advisors of one kind or another, see all the initials after that last author (and nearby image)

The networked billionaires then advertise their own work on websites which post, typically, no identification (or minimal and not the most recent by far) of tax returns for specific foundations, or evidence of any LLC filings, or audited financial statements. Where would those audited financial statements be found? While sometimes the California OAG may post audited financial reports under individual foundation’s “Details” page, for these (I’m reporting on herein) it doesn’t seem to.

The spider-like nature (multiple related organizations, with separate identities but apparently common SVCF management) and behavior of SVCF blurs the IRS’ definition (when movement of money is shown) of “supporting organization” (the “support” seems to be going in the opposite direction) and the concept of actual independent entities, when the independent entities simply delegate administration and management to the controlling one (here, SVCF), paying its board and/or employees handsomely for the fees, and retaining (both supporting and supported, i.e. SVCF, organizations) most assets while granting out (for several of these SVCF-managed related organizations) millions of dollars more in a given year than is taken in — some “budget” — knowing that their rich benefactors will either cough up some more, or close it down as part of an obviously pre-determined exit strategy.

Overall it seems to be more about the investments held by and funds moving between multiple nonprofits under common management (including some of the boards) than about the advertised projects. Another reason I say, watch the Balance Sheets as much as if not more than the Budget.

Also complicating comparisons among multiple entities, even of public with private ones under common management or ownership:

Differences between public (990s) and private (990PF) filings (unofficial, deduced just through observation)…making cross-comparisons from the same wealth source harder for the average person, although the purpose of by law (Internal Revenue Code) making them public at all, one would think, is for the average person, “the public,” — not just potential donors — to understand how entities with tax-exempt privilege are in fact operating and what they are doing with that privileged status.

My comments refer to IRS Forms 990 since substantial revisions in 2008 only. I have spent more time looking at the more recent forms, although I often do go back before 2008 for specific entities.

- PUBLIC 990-filing foundations have to categorize types of investments on their balance sheets (Part X, since the IRS Form 2008ff) and provide more detail on Schedule “D” to Part X for any amounts for Other Investments or “Other Assets,” but do not have to name which exact corporate/public-traded or other investments are held.

- Public foundations also in their grantmaking are to supply EIN#s for grantees

- Public foundations by IRS form have to segregate domestic and foreign grants on different schedules (Schedule I, Schedule F)

- PRIVATE 990PF-filing foundations — remember, Good Ventures has one of each both formed about 2012 it says — do list how many shares of exactly which investments, and grouped by type, but do not (as I understand it/I may be wrong about that) have to categorize them on the tax return’s balance sheet statements as to type.

- PRIVATE (990PF-filing foundations) in listing their grants do not have to separate domestic (USA) and foreign (non-USA) grants — and some of these are granting out millions with very long lists. They also are not required to provide EIN#s for any grantee, making fact-checking or follow-up harder; especially when grantees can and do tend to change their names, or if the name & address recorded on the 990PF do not match reality.

- The PROBLEM: Together, this makes obtaining an overall view on any single enterprises’ (or individuals’) financial impact on specific projects. The information is dispersed, and it’s recorded in different reporting formats even when the money may be coming from the same source (i.e., same extraordinary personal wealth).

- Movement / re-branding of business entities over time:

- The project & organization “Open Philanthropy” at “GiveWell” (to which GoodVentures and others have been contributing) then morphed into “Open Philanthropy” (so far, I’ve located three types of entities: LLC, 501©3 — barely funded — and 501©4 — startup funding about $55M!!). Some details below, see also list of “tags” for this post which name several of the entities.

- GiveWell and Open Philanthropy bring up two more names (both young(ish) men, not a “couple”), Holden Karnofsky & Elie Hassenfeld, as well as the hedge fund investment management firm (Bridgewater Associates) where they met and came from. More on this below the next aqua-highlit paragraph and “Open Philanthropy Action Fund” tax return table.

- Not shown this post, but I’ve looked at several (at least five) of the largest donors GiveWell has been recommending and looked up their tax returns since this post was published Aug. 4, 2018. I also did a chrono review of GiveWell (“The Clear Fund’s) tax returns as far back as 990finder provides. I wouldn’t give any of them a “C+” on transparency or reporting, and some (Imperial College Foundation, Atlanta GA) an “F” (just moving money to a well-endowed UK London,UK college).

- Among the grantees, Harvard grads are “everywhere,” particularly at Evidence Action, which has a well-stated relationship with GiveWell as a sponsor, also with organization’s I’d run across and blogged separately associated with behavioral modification studies on the poor in developing countries. J-PAL and IPA (Innovations for Poverty Action). Search Alix Petersen Zwane for more insight.

- Around 2011/2012, Cari Tuna shows up on the Board and GiveWell’s entity address goes cross-country (NY to SF), and funds start pouring in.

- As I have said several times, “Harvard/Bain/Bridgespan” investment model in action.

- Startup Education (of SVCF) morphed into Chan Zuckerberg (or “CZI”) initiatives, and so forth. Several details (in image gallery format and described) below. See also list of “tags” for this post which name several of them.

Meanwhile the GiveWell (“Clear Fund”) Tax returns showing a “related organization” show instead, a 501©3 of different EIN# entirely…

| ORGANIZATION NAME | ST | YR | FORM | PP | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| OPEN PHILANTHROPY ACTION FUND | CA | 2016 | 990O | 31 | $50,594,597.00 | 81-2644663 |

The Time a Hedge Funder Quit His Job and Then Raised $60 Million for Charity (3-26-2015, by Nico Pitney in Huffington Post under “Good News.)

“GiveWell” is a dba of “The Clear Fund” which was established out of a group of Connecticut hedge-funders looking at what next to do with their time and excess money (Huffington Post 2015 article; The Clear Fund’s tax return says it was established only in 2007 (<==that tax return), and it’s a NY legal domicile — right before that global recession…remember??):

LinkedIn for Ellie Hassenfeld of “GiveWell”

(And, as to Mr. Hassenfeld, (<==LinkedIn), only 33 years old in 2015 (per HuffPost article; see nearby image), how does a BA in Religion (2004) from Columbia University lead to three “lucrative” years (2004-2007) as Investment Associate at Bridewater Associates, or did something else lead there?

| ORGANIZATION NAME | ST | YR | FORM | PP | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| Clear Fund | CA | 2016 | 990 | 55 | $13,708,185.00 | 20-8625442 |

| Clear Fund – GiveWell | CA | 2015 | 990 | 42 | $12,449,684.00 | 20-8625442 |

| Clear Fund | CA | 2014 | 990 | 35 | $8,233,496.00 | 20-8625442 |

Click here to read this 2007 NYT Article on Karnofsky and Hassenfeld who, the closing paragraph says, met at Bridgewater Associates.

From the tax returns I was reading, it’s clear that (among others) Moskovitz & Tuna’s “Good Ventures Foundation” certainly donates to Give Well (several grants totaling $1.25M in FY 2015 as I recall, before my eyes started crossing among the tri-partite (typically) various named foundations here…)

Pursuing Self-Interest in Harmony with the Laws of the Universe and Contributing to Evolution is Universally Rewarded” (a.k.a.) “The Billion-Dollar Aphorisms of Ray Dalio, Who Built the World’s Largest Hedge Fund by Running It Like a Cult” (4/10/2011 in New York Magazine)

(Click to enlarge! then proceed to nearby link for the entertaining and informative article on Bridgewater Associates.)

…In 2006, Bridgewater’s computers began to indicate that the American economy seemed to be heading for what Dalio calls a “D-process,” a sort of national bankruptcy proceeding in which debt-service payments rise relative to incomes until, under the threat of default, the government is forced to print tons of money and buy up long-term assets. The firm’s traders piled into investments that would be most affected, including, at various times, U.S. Treasury bonds, gold, and the yen. They also studied Japan’s “lost decade” and the Latin American debt crisis of the eighties and used what they learned to program red flags into Bridgewater’s trading system. In the spring of 2008, one of these flags, a risk metric for credit-default spreads, prompted Bridgewater to pull its entire positions in several banks—including Lehman Brothers and Bear Stearns—the week before Bear Stearns imploded. In the years since, seeing the crisis coming has become the hedge-fund version of having been at Woodstock, but Dalio and his team actually did it.

Throughout 2010, the D-process continued to unfold. By the end of the year, 80 percent of Bridgewater’s bets were in the black, and even critics who’d mocked Dalio’s eccentricities had to acknowledge his brilliance as an investor..

And, further on, his hiring preferences:

…Getting a job at Bridgewater isn’t easy. Applicants are given Myers-Briggs tests (“Not a lot of F-types there,” says one former employee) and some are asked to conduct mock debates with other candidates for the same job. One ex-candidate, who was not offered a position, summarizes Bridgewater’s group interview process as “John, what are Bob’s flaws? Bob, what are John’s flaws?”

Most hedge funds hire primarily more-experienced investors, but Dalio is said to prefer recent undergrads from schools like Princeton and Dartmouth, who may not know how to price rate swaps but bring other advantages. “Young people are more malleable,” says one employee. “If you take someone who’s led a thousand-person group at a bank and bring them to a place where they can be challenged by their 28-year-old analyst, it’s not going to be easy for them.” Even with those measures in place, Bridgewater life proves just too bizarre for a lot of recruits. Thirty percent of new employees are said to quit or get fired within two years.

For the employees who remain, the payoffs can be sizable: generous (though not industry-leading) pay and a full slate of perks, including quarterly blowouts at which Dalio has been known to take a direct role in the revelry. (“He’s a bit of a frat boy,” says a former employee who recalled hoisting tequila shots with him.)

Anyhow: My post title again:

Budgets Aren’t Balance Sheets! and other Basic (USA)Facts about Billionaires’ Philanthropic Behaviors, Such as of 2014-retired Microsoft CEO Steven Ballmer + His Wife Connie [July, 2018] (short-link ends “-982”). It comes from the middle of Two Plaintiffs’ Counsel Nonprofits for Class Action Lawsuit (℅ Center for Investigative Reporting article) (Short-link ends “-95X,” published 7/31/2018).

Budgets aren’t Balance Sheets! whether referring to things large or things small. Balance Sheets not Budgets are the cumulative “bottom line” for any entity and are, as most independently audited financial statements show by putting them FIRST, actually more important (though nothing is simply UNimportant) than the Activities (Revs, Expenses) statements.

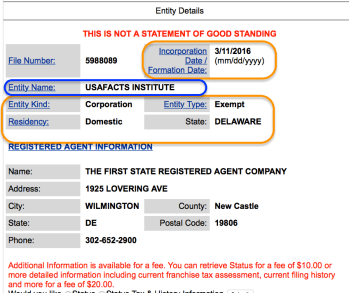

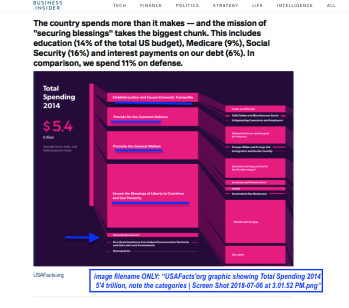

In this post you’ll hear about a billionaire philanthropist whose giving organization is frequently called “The Ballmer Group” and about The Ballmer Group (or, the billionaire’s) recent (2016, 2017) project “USAFacts.org” as coming from “USAFacts Institute.” Neither entity posts its own financials on the website; neither are the financials easy to find on any other public source — whether Washington State, Delaware, or even [for USAFacts Institute, the only nonprofit of the two) on the IRS exempt organization select check database.

Separately, you’ll also be reminded** about the Silicon Valley Community Foundation (“SVCF”) and its about 16 “Related [also tax-exempt] Organizations” One return by one of the related organizations even showed 17.

While these (so far as the nonprofit I looked most closely at) are posting tax returns, it’d just about take specialized software to extract the piecework reporting from the Forms 990 for 17 nonprofits and put them in a visual, coherent flowchart diagram or format — interactive to handle name changes, and periodic dissolutions. While that difficulty extracting information from multiple IRS tax returns (multiple (a) over several years each, and (b) multiple when there are many “related” tax-exempt organizations) is typical of nonprofits, some people seem to exploit the capacity more than others… What I’ve shown below is just a sample…

On the second image below I marked three of the SVCF-related organizations: <>The Real Estate Trust (accepts donations of real estate for the SVCF), the Skoll Fund — Jeffrey Skoll, historically associated with eBay (Pierre Omidyar / cf. Omidyar Networks) is a Canadian billionaire active in many arenas, including UK (Oxford University’s SAID School of Business | Skoll Centre for Social Entrepreneurship) and with US Federal government partnering with SoulPancake LLCs to promote fatherhood, as I tweeted (@LetUsGetHonest) or possibly also blogged) not long ago. Participant Media (owned by Jeffrey Skoll Group) purchased Soul Pancake, etc.. — and <>Good Ventures by the co-founder of Facebook (Dustin Moskovitz) and his wife Cari Tuna, it says a former Wall Street Journal Reporter. See also Good Ventures’ “Governance” link, which lists several SVCF officials, and a (co-founder of) ICONIQ Capital, and see also “Approach to Grantmaking Practices.” The website doesn’t post its financials either, and while it’s technically a related organization of SVCF as an entity, it talks about its close partnerships with two others, “Open Philanthropy” and “GiveWell.”

On the second image below I marked three of the SVCF-related organizations: <>The Real Estate Trust (accepts donations of real estate for the SVCF), the Skoll Fund — Jeffrey Skoll, historically associated with eBay (Pierre Omidyar / cf. Omidyar Networks) is a Canadian billionaire active in many arenas, including UK (Oxford University’s SAID School of Business | Skoll Centre for Social Entrepreneurship) and with US Federal government partnering with SoulPancake LLCs to promote fatherhood, as I tweeted (@LetUsGetHonest) or possibly also blogged) not long ago. Participant Media (owned by Jeffrey Skoll Group) purchased Soul Pancake, etc.. — and <>Good Ventures by the co-founder of Facebook (Dustin Moskovitz) and his wife Cari Tuna, it says a former Wall Street Journal Reporter. See also Good Ventures’ “Governance” link, which lists several SVCF officials, and a (co-founder of) ICONIQ Capital, and see also “Approach to Grantmaking Practices.” The website doesn’t post its financials either, and while it’s technically a related organization of SVCF as an entity, it talks about its close partnerships with two others, “Open Philanthropy” and “GiveWell.”…and some of the behaviors of just one of its (“Schedule-R Part II”) related organization with an independently voting board of just three (Mark Zuckerberg of Facebook, President), behaviors both as a grant-maker, and as eventually dissolved (despite $34M recorded deficit spending its final year, 2016) into chameleon LLCs with common connections. (Can you say “Facebook” “ICONIQ” and “Social Venture Capitalism for Hire“?).

The new, improved CZI website says it’s a “new kind of philanthropic organization” (It appears to be an LLC) and mentions a 2017-formed “CZI Community Fund” which has already picked 41 organizations to help… an inset gives the announcement just the other day: July 31, 2018: (image #1 of 4, top right corner).

-

- Image #1 of 4: CZI ChanZuckerberg’com home page + Community Fund page (4 images)~~Viewed 2018Aug02..

-

- Image #2 of 4: CZI ChanZuckerberg’com home page + Community Fund page (4 images)~~Viewed 2018Aug02..

-

- Image #4 of 4: CZI ChanZuckerberg’com home page + Community Fund page (4 images)~~Viewed 2018Aug02 @ 5.01.17 PM (Fine print on footer shows trademark info)

www.chanzuckerberg.com/about “WHO WE ARE”

The Chan Zuckerberg Initiative, founded by Mark Zuckerberg and Priscilla Chan in December 2015, is a new kind of philanthropic organization…

Really? It’s a Delaware LLC registered in California. Nothing too new about that..

…that brings together world-class engineering, grant-making, impact investing, policy, and advocacy work. Our initial areas of focus include supporting science through basic biomedical research and education through personalized learning. We are also exploring other issues tied to the promotion of equal opportunity including access to affordable housing and criminal justice reform.

We look for bold ideas — regardless of structure and stage — and help them scale by pairing world-class engineers with subject matter experts to build tools that accelerate the pace of social progress. We make long-term investments** because important breakthroughs often take decades, or even centuries.

**…While going through serial name-changes in multiple LLCs of similar names, indicating something of a short-term attention span (??)… [[Do the searches (and look up details) at BusinessSearch.SOS.CA.Gov (pick LLC search, then Corporations Search)…]]

We engage directly in the communities we serve because no one understands our society’s challenges like those who live them every day.*** These partners help us identify problems and opportunities, learn fast, and iterate toward our goals for the next century. We strive to be lifelong learners who work collaboratively across functions in service of our mission.

In Silicon Valley Community Foundation, it seems that the couple is hanging out with billionaires moving millions through foundations to foundations… not exactly “local” in scope. The “those who live them [“society’s challenges”] every day” in any (Silicon Valley OR San Francisco Bay Area) communities run the gamut from billionaires to “low-income families” to the homeless. The phrase indicates empathy and concern for the challenged.

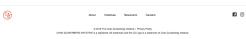

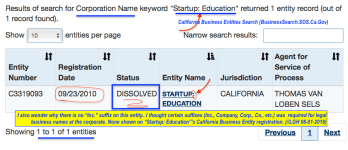

The filing records of both Startup Education, the SVCF (which controls it), and the name-changing CZI LLCs tells another story…

**”Reminded” not thoroughly shown because it’d take more than one post to show how the dissolved SVCF-related “Startup: Education” foundation (and I just picked ONE), legal domicile: California, has since then,*** having run into significant, multi-million-dollar deficits itself (according to the 990s) dissolved itself while — meanwhile, I should say — Mark Zuckerberg & friends set up a variety of “Chan Zuckerberg” or “CZI” Delaware LLCS, registering them (properly) in California as “foreign“ — having changed their names several times, and shifted the operations, so to speak, of

(1) a Chan-Zuckerberg dominated “related [nonprofit supporting] organization (Startup: Education) to Silicon Valley Community Foundation (which, in effect, let SVCF manage the investments, and reimbursed it handsomely for doing so) which must show the public its tax returns and register as a charity in California, to

(2) a Delaware LLC registered in California as “foreign” entity and which, being an LLC does not have to show the public its tax returns (although it must file them, for sure). In the process, coming more out in the open about the branding by its owners than does the generic name “Startup: Education”

***While Startup: Education existed September 2010 – January 2017 only it moved millions of dollars in grants, among other places across the continent to two foundations in New Jersey, one of which, with a NJ State Senator (previously Mayor of Newark) on board also dissolved in 2016). Jen Holleran, Harvard Graduate School of Education ’95 (<==read this 2011 article how Zuckerberg, also Harvard, picked her for Startup: Education; and her prior work at (another grantee) “New Leaders for New Schools” (that link in that article already extinct with no redirect)) is now staff at the Chan-Zuckerberg Initiative was as I recall (before my eyes started to cross looking them all up) also on board of the NJ target grantee…While it existed… The other foundation to which it moved millions was already fairly “flush” (incorporated in 1955) the Community Foundation of New Jersey.

THINK ABOUT IT: WHY DO THIS? TO RESCUE PUBLIC SCHOOLS ACROSS THE CONTINENT? TO SET AN EXAMPLE OF WELL-MANAGED BUDGETING (by cost-overruns before dissolving a nonprofit of, say, 50% through hard-to-track donations, also across the continent)? Not likely…

The Startup: Education “We’ve moved” website implies that there’s ONE “CZI” when in fact, there are several, including the one most logically related (if names are an indication) to the nonprofit in fact also cancelled itself; leaving two more active ones, and a third one (if you follow the details), CZI Holdings LLC.

Apparently in this social class (at this level of wealth), forming and dissolving over time multiple LLCS and 501©3s with serial name-changes in just a few short years is something like sneezing — a natural response; just part of life.

(See next six-image gallery. The names reflected at any point are the most recent ones. What’s not shown — but details do — how many name-changes some of the LLCs had, and (what’s more) the name-changes (for CZI Holdings) of the “Management” LLC listed. The name “Chan-Zuckerberg Initiative” was held by more than one entity over time, too..

I took some notes. Rather than more images, here’s a short summary (no pretense to be complete) of the three Chan-Zuckerberg LLCs (I’ll use “C-Z” for written out and “CZI” for as shown in the company name) below + what’s now called “CZI Holdings…” Note: the summary doesn’t include any “manager” LLCs which also show up, often, in common, on their filings:

“C-Z” (full-name written out) & a CZI LLCs were formed 2014, 2015, 2016, and 2017. (Meanwhile with Startup: Education self-dissolving in 2016, some 501©s nonprofits, were then dissolved and at least two new ones formed in 2016 and 2017; I showed some in a separate image gallery below in this trust.):

#1 LLC Entity Number 201422710006 (now status “Cancelled” as image gallery #1 shows just below) The “Entity” # is left column on Secretary of State Business Search (first-level results); see below. I may not have presence or absence of any commas in the name verbatim. Dates are either those on the filing or those stamped on the filing; the purpose here is a general idea, and the exact sequence for each LLC, of name-changes:

- 8/12/2014 Began as “Startup: Education Investments LLC” (with the corresponding 501© having started in 2010 ℅ SVCF);

- 10/30/2015 Amended to “Zuckerberg Education Investments LLC”

- Manager is Square Seven Mgmt LLC (394 Pacific Ave 2nd Fl, SF 94111)

- 11/20/2015 Amended to “Zuckerberg Education Ventures LLC”

- 06/21/2016 Amended to Chan-Zuckerberg Education Initiative

- 03/17/2017 Cancelled.

{{Continued below the image gallery so you can look at the filings}}

#2 LLC Entity 20160210175, Chan-Zuckerberg Initiative, LLC, Now status “ACTIVE”:

- Formed 01/15/2016 (SOS-stamped, 12/18/2015 on the form) at same addr as Square Seven Mgmt LLC, above) called CZI Services, LLC

- (I know from Startup Education 2016 filing that CZI Services, LLC paid just over $1M for the “intellectual property rights” of the dissolving (within a few months) 501©3…and because of this filing that an EIN# 820734145 exists, but it won’t be filing a Form 990 anytime soon (because it’s not a nonprofit!)…

- Managed by “CZI HOLDINGS, LLC (see image 2 of above gallery)

- Type of business (called “Asset Management.” That is, Entity 20160210175 is in the business of “Asset Management.”)

- 08/02/2016 Name Amended to Chan Zuckerberg Initiative, LLC – its current name.

#3 LLC Entity 201706010109, now “Chan Zuckerberg Education, LLC, Now status “ACTIVE”

- 02/28/17 formed as Chan Zuckerbeg Education, LLC

- Managed by Chan Zuckerberg Initiative LLC; Type of business is “Asset Management”

- 07/28/2017 same name.

#4 LLC# 201533910075 CZI Holdings LLC (was originally, being a different entity, Chan Zuckerberg Initiative LLC!), Now status “Active”:

- 12/01/2015 formed as Chan Zuckerberg Initiative, LLC

- 08/02/2016 name changed to CZI Holdings

- Managed by Mark Zuckerberg,Type of business (called “Asset Management.”

- Address 314 Lytton Ave, Palo Alto, CA. (see nearby annotated image):

- Attached Delaware filing shows Priscilla Chan as only Member/Manager.

In 2015, the IRS form omits the colon (“:”) in the entity’s name, but in 2016 you can see it. Reminds me of “Connected: The California Center for Career and College” (or similar name; previously blogged herein, I think in late 2016). Not shown here, the 2016 IRS form puts it back in; 2016 being the last full year of its existence…

The wildly see-sawing balances (look under “schedule” at this pdf from the California OAG’s Registry of Charitable Trusts: )

Startup|Education (EIN#273533876, CalEntity#3319093, Chan-Zuck+SVCF(existed Sep2010-Jan2017, wildly see-sawing contribs, sold intellectual Property to CZI Services, assets (lease contrac..(2nd click on blank page icon to view may be required | multi-page document).

any given year of “Startup: Education” shows it’s just a way-station on the highway to a larger agenda communally shared by those already in power in attempts to convince others, or perhaps themselves, how much they care about the unfortunate and outcast in society..

Back to the Steven & Connie Ballmer projects:

USAFacts Institute apparently hasn’t even produced a “Form 990-N” (if, say, its initial year was revenues under $50K) yet, which would, by having done so, reveal an EIN#. Yet, you’ll see below it’s already partnering with University of Pennsylvania, Wharton School of Business (on the PWBM — Penn Wharton Budget Model — a sophisticated computer-generated modeling based on several inputs), Lynchburg College (which I haven’t looked up yet) and a center at Stanford University in MY current location, generally speaking (Northern California).

Also whether referring to things governmental OR in the private sector — including that essential part of any billionaire’s private for-profit enterprise (for Microsoft, it seems to apply, as it would also for Apple…), the tax-reduction, sometimes called tax-exempt or “nonprofit” sector — individual entities (whether private or public) have balance sheets and, let’s HOPE, budgets. But the Balance Sheet, not the “Budget” is the real bottom line. That’s true for the United States of America, too.

However, when it comes to common ownership at the larger levels (say, federal government, or individual billionaires, millionaires, or their foundations), the measurement of total controlled assets — obviously something going to be in ongoing flux over time — would have to cross more than one single incorporated (if private) or, I guess “authorized” (if public) entity.

If this is just “verbiage” to you and you want to understand what I’m referring to, then kindly look for (most of my posts have links, or find your own!) ANY Form 990 filing from 2008 or further and read its Page 1, Part I, Summary. SOME will have also Schedule R (related) organizations, or Schedule L (Transactions with Interested Persons — which includes “entities,” that is, not just flesh-and-blood “persons.”).

Why would this be any less true, then, with the U.S. Government or smaller parts of it? Or State, or any other forms in which government comes?

What (how large, how much) are the collective revenue-producing assets which can:

- be invested for revenue (interest & dividends) even if held in trust for others?

- be invested for revenue (interest & dividends) even if held for government operations?

- be sold off for revenue, at a profit (or a loss)

- be themselves government enterprises [“proprietary funds” in CAFR terms] and charge “admission,” fees for services or access, etc.

HOW MUCH ACCUMULATION — while continuing to bill and hold the public responsible to fund all debt, current, and (projected forward indefinitely) FUTURE — IS ACCEPTABLE?

Why shouldn’t there be less stockpiling of assets and tax + fees burdens on the public?

At what point did (if it yet has) total effective control of things needed for life and survival (ONE of which is forms of communication for social organization; another transportation, another food, another production of energy for the aforesaid and other purposes), another certain housing, disposal of waste, protection from contagious diseases, or stripping of the environment beyond what could sustain food for life?) get handed over to a government advised or steered by coordinated nonprofit organizations headed by multi-billionaires?

Did I yet mention “EDUCATION” including educating the public, especially the young, to NOT think about balance sheets when they are lectured about Budget Deficits — and to believe that the word “charity” as applied to billion-dollar-assets-controlling (but often their own accounting, simply “out of control”) entities when they — in exchange for a tax benefit and retained control of wealth and closer relationships with those who have the MOST to give and would benefit the MOST from tax-exempt donations — give away, say, the about 5% of any SINGLE entity’s non-charitable use assets (as expressed in a Form 990PF) in exchange for reduced excise taxes?

Yes, my post titles tend towards sarcasm, and length. It should also be included, however, that the behavior of those reporting on the giving of, say, “The Ballmer Group” also have certain behaviors, like omitting ANYTHING which might link an actual business name to a legal domicile and from there (in this case) to even one specific tax return that we, the public (affected by its premium quality — tax-exemption!) can read, IF this “The Ballmer Group” organized to give is indeed the nonprofit it claims to be.**

- ** Keep reading. This post clarifies that it’s not, which doesn’t prevent news media and even philanthropic media (who should know better if anyone would) from describing it as though it was. Only a closer reading of at least Ballmer Group’s own web-page shows that, technically, it’s not claiming to be what it’s not. It’s just not openly explaining what it IS…

- WATCH OUT for this type of circuitous website lacking the important information regarding any group, and the focus instead on their favorite projects and noble purposes.

For example, The Circle of Philanthropy, Business Insider, and those many foundations, organizations, cities, projects etc.** so thankful for the donations might think about the rest of the public and provide that information. They might also helpfully point readers to the fact that a balance sheet is NOT a budget — but perhaps doing so might pull the rug out from the entire burgeoning nonprofit sector itself, and those working in it or (as subcontractors) FOR it. Generally, they don’t.

[**whose representatives are interviewed and quoted, helping compile by-lines for the reporters and reputations or even revenue for their publications, too]

Want a nice example of some reported “independent subcontractors” for a billion-dollar “community” foundation in the news? Before it was in the news as it is now (latest article in late June, 2018) for bullying by top executives, I made a note — and plenty of screenprints — of its tax returns and that it doubled in size with a 2006 merger, just shortly before the 2008 recession triggered by/resulting in[?] massive foreclosures for homeowners…

Silicon Valley Community Foundation EIN#20-5205488 which is so “community” it has offices in New York, a subcontractor for investment management (FY2015) in the Cayman Islands…and another headline-making subcontractor who (FY2016) was paid a minimum of $4.8M for investment management services, “not to mention” nearly $700M investments in “Central America and the Caribbean” (out of its $7 BILLION total gross assets, that is, as of over a year ago, and its been growing fast). It also has (and controls) sixteen “related tax-exempt entities” including one set up specifically to accept and process real estate gifts on behalf of donors and/or recipient nonprofits — or (it suggests) donors might want to set up a fund at SVCF (i.e., donor-advised or similar fund) to be administered on behalf of intended nonprofit recipient, if not SVCF itself directly.

SVCF (EIN#20-5205488) Tax Return FY2015, Form 990, Part VIIB, Independent contractors, mostly for investment management, some for Fund-raising. Only 5 of 19 shown; look at the fees. Note the second highest ($800K paid) is located in the Cayman Islands. (I took this image in 2017. Probably previously posted…/LGH)

So I guess you could say, most of us are not just affected, but also entrenched, ensnared, or ensconced into this way of doing business with our own government. It’s become so normal — but it’s abnormal in ever-increasing ways, I believe. One of the first things lost is representation before government (important in any contract of CONSENT by those governed to those using force and raising funds to govern).

WHY: If the money WE are billed for cannot be traced once lost in the nonprofit sector, then WE cannot hold those in control of at least the governmental entities accountable.

It seems WE were not intended, really, to ever have that ability as exercised through government entities — which was the (commonly conceived and alleged) intention of U.S. Constitution, and the State Legislatures too.

Effective leverage was lost right along with the taxed / tax-exemption divide. The tax-exempt sector, generally, already knows this. Most people, generally, don’t. A whole lot of massage / conditioning / PR is necessary to perpetuate that status (basic ignorance of operating principles), it seems to me — and I’ve been studying and exploring this diligently, individually, for nine years now.

More on Silicon Valley Community Foundation, EIN#20-5205488, 2006ff…

This is an extended section, so I’ll mark its ending with similar color heading and the character string “~|~” Remember the post title (Balance Sheets vs. Budgets) and that it’ll be getting down to the Ballmers and (FYI) its recent nonprofit “USAFacts Institute” featuring US Gov’t Budgets (not balances) while failing to post its own. A closer look at SVCF may explain how different they can be and that the real point of such platforms may be less “charity” than investment clubs..!

Look HERE*** (<==complete FY2016 Form 990) for the corresponding Part VIIB for the following year, and noticed the amount to Iconiq has doubled, as well as another “ICONIQ” fund being on the list of the top (this year, only) 9 contractors.

(The next fine-print section simply describes the above image gallery, and a bit more viewable through just its FY2016 returns..

***(Or at the above “image gallery” for Part VIIB, and other selected, some annotated images all except (obviously) the first one(showing total gross assets, notice the growth, 2014-2016), parts of SVCF’s Form 990 for FY2016 only. Besides Pt VIIB, it shows Sched F (activities outside the US) as a total of over $700M, and (from those details) that over those, over $700M (two line items) are in the form of “investments, although several million are also in the form of grants to “organizations like 501©3s consistent with (the foundation’s) purposes.

Of the over $700M in the form of Investments (Year 2016 only), $695M are from the region “Central America and the Caribbean,” i.e., which would include the Cayman Islands.

An excerpt from Sched D Pt. VIII (see image gallery, above this descriptive section) “Other Securities” purpose is to detail a specific line on Part X, “Balance Sheet” (Statement of Balances, i.e., Assets, Liabilities, Net — matching the “bottom line” on Pt I Summary of the Form 990.) You can easily see that over $700M is in “HEDGE FUNDS.” That’s significantly higher than even for FY2015 (I believe it was about $113M, but see FY2015 tax return to check). While total organization assets (gross) are as is shown, $7B, still Investments – Other Securities of over $1B is “a sizeable chunk” and of these, let’s call it about 70% are in Hedge funds — roughly corresponding to how many overseas investments exist, mostly in Central America and the Caribbean. Notice what the non-hedge fund other assets are in also (including Private Equity, Real Estate, Commodities..)

SVCF FY2016, Sched F (explains monitoring of the part of “Activities” which are grants, BUT, that’s a minimal amount compared to “Investments”)

SVCF FY2016, Sched F (notice the description column reads “Investments,” and those amounts. Compare to total Sched. F activities (image gallery). Major non-USA activity seems to be INVESTMTS and you can see, in which region)

…So much for the “COMMUNITY” in community foundation. It’s more like a private investment platform, and income source for ICONIQ and others, for the wealthy. Like some of the individuals reflected in the “related organizations” and the corresponding “Transactions with Interested Persons” shown, again, on just this single year’s tax return…

The Spider of Silicon Valley… (from Forbes, 12-15-2014, about Iconiq Capital + Divesh Makan)

ICONIQ [Capital?], “Investment Management” (which got over $2M from Silicon Valley Community Foundation, Form 990 Part VIIB, image above) has its own fascinating history and plenty of coverage. Though not the most recent news, Forbes’ “The Spider of Silicon Valley: Inside ‘Zuck & Friends’ Secret Billionaire Fund“ Dec 15, 2014, featuring an Iconiq co-founder Divesh Makan, who formed the “Family Office/Venture Capital” firm as a walkout from Morgan Stanley, before which he was at Goldman Sachs (with degree in electrical engineering from South Africa and an MBA from Wharton) explains it at length better than I could in a short summary,

…other than to remember part of the early start was with pre-IPO Facebook, Mark Zuckerberg, Sheryl Sandberg. Their fund gives “non-tech titans” and non-Silicon Valley (billionaires) access to invest alongside Zuckerberg et al., including in startups. See the Forbes graphic with concentric circles.. And very nice fees attached…

…Like other wealth managers, Iconiq charges percentage-of-assets fees: up to 1.5% on allocations in stocks, bonds and ETFs. But it takes additional performance fees of 20% to 30% on venture fund profits. Not wanting to miss out on the action, Iconiq itself co-invests with its clients on the deals they arrange.

Makan shuns publicity and goes as far as to require clients to sign nondisclosure agreements. Though Iconiq refused comment, FORBES’ investigation was stitched together from dozens of interviews with those in and around the firm. Many requested anonymity, fearing they would be shut out of Makan’s club.

Forbes, Dec. 15, 2014 “The Spider of Silicon Valley..”

Silicon Valley Community Foundation formed in 2006 through a merger of two other community foundations, quickly acquiring a billion dollar investment platform, I noticed (DNR exact context or why, probably through a grantee I was studying) over a year ago, particularly with the high fees and salary paid to acquire their CEO Emmett Carson. SVCF is now (2017-2018) being featured, negatively, in “The Chronicle of Philanthropy” for its catering to billionaire/millionaire investors through Donor Advised Funds as much as to anything local. The story series is “Turmoil at Silicon Valley Foundation” and recently both Carson, not solely for his own behavior so much as for tolerating the toxic and oppressive and it seems even sexual harassment-involved behavior of (nonetheless fantastic fundraiser), Mari Ellen Loijens. (“A Star Performer Created ‘a Toxic Culture’ at the Silicon Valley Community Foundation, say Insiders‘” 4-18-2018).

Silicon Valley Community Foundation formed in 2006 through a merger of two other community foundations, quickly acquiring a billion dollar investment platform, I noticed (DNR exact context or why, probably through a grantee I was studying) over a year ago, particularly with the high fees and salary paid to acquire their CEO Emmett Carson. SVCF is now (2017-2018) being featured, negatively, in “The Chronicle of Philanthropy” for its catering to billionaire/millionaire investors through Donor Advised Funds as much as to anything local. The story series is “Turmoil at Silicon Valley Foundation” and recently both Carson, not solely for his own behavior so much as for tolerating the toxic and oppressive and it seems even sexual harassment-involved behavior of (nonetheless fantastic fundraiser), Mari Ellen Loijens. (“A Star Performer Created ‘a Toxic Culture’ at the Silicon Valley Community Foundation, say Insiders‘” 4-18-2018).

Mari Ellen Loijens (now about 48) is on the board of a community foundation (“housed at” SVCF) it says, run by Facebook Co-Founder Dustin Moskovitz + his wife Cari Tuna. That gets interesting when one considers the SVCF subcontractor Iconiq also heavily involved over time with Facebook’s Zuckerberg & Sheryl Sandberg. And that one of Iconiq Capital’s founders (Divesh Makan) was backing Zuckerberg in Facebook before its first IPO (Initial Public Offering).

Mari Ellen Loijens (now about 48) is on the board of a community foundation (“housed at” SVCF) it says, run by Facebook Co-Founder Dustin Moskovitz + his wife Cari Tuna. That gets interesting when one considers the SVCF subcontractor Iconiq also heavily involved over time with Facebook’s Zuckerberg & Sheryl Sandberg. And that one of Iconiq Capital’s founders (Divesh Makan) was backing Zuckerberg in Facebook before its first IPO (Initial Public Offering).

…Loijens, whose title is chief business, development, and brand officer, now oversees about 40 people in the foundation’s departments of corporate responsibility, strategic partnerships, marketing and communications, and development, her longtime specialty. She sits on the boards of several grant-making organizations housed at the community foundation,** including one led by Cari Tuna and her husband, Facebook co-founder Dustin Moskovitz.

A graduate of Mount Holyoke College and the former president of the Junior League of San Jose, Loijens, who is married, moves easily among the Bay Area wealthy. She displays her designer clothes, shoes, handbags, and jewelry on an Instagram feed that she describes as “my fun place to play with fashion and other personal passions.” (The feed was just made private.) She’s active, too, in professional associations, sharing her fundraising knowledge with others.

**”Community foundations housed at SVCF” must mean Schedule-R ‘Related Organizations.” Notice this story isn’t with the nuts-and-bolts Form 990 reviews. I guess the main target audience are people already familiar with the forms (either as nonprofit recipients or would-be recipients, or donors and investors eager for some influence and a sense of positive contribution to society, perhaps to ease some consciousness of wealth disparity (??who knows, really!) to go along with their tax-deductible contributions)…The article could’ve easily named which foundation her board is on (which might seem to be an “interested person” potential conflict of interest), but didn’t.

It’s probably “GoodVentures”. See Moskovitz’ Wikipedia for more information. GoodVentures associated with “GiveWell” and “OpenPhilanthropy Project.” No unsolicited grants, solidly Democratic; Moskovitz is youngest self-made billionaire, etc.

(Yes it is: I just checked SVCF tax return FY2016 (over 1,000 pages long) for Schedule-R Tax-exempts related to SVCF (in the process wading past the Sched F activities (over $730M, it seems to be mostly grants) and Sched I (Grants to Domestic Orgs. & Governments) (over $1B) noting the larger/largest ones.

THE largest grant was to “Startup Education Fund ($24M) which is a “related organization.” Guess who’s president of that one? Mark Zuckerberg.

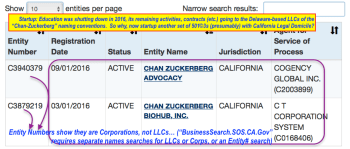

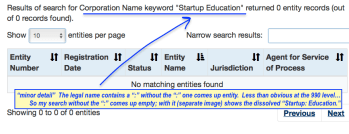

Yet Startup Education, Inc. simply farms out its management to and characterizes itself as a “supporting organization” of the larger “SVCF.” It pays SVCF both as an independent subcontractor (a few hundred thousand dollars) and reimburses it for millions (one year, $4M, another $16M) reported under “Transactions with Related Organizations (part of Schedule R). Its unusual profile at “Form990finder” searching by EIN# (notice th “fake name” search results — i.e., as you can see, a name search for “Startup Education” straight at Form990finder without the EIN# wouldn’t have located it, but if one searched just half the two-word entity name, it might have come up — along with any other nonprofit with the word “startup” in its name:

Startup Education Inc (EIN#273533876, Sched-R related to Silicon Valley Community Fund, “SVCF”) (Foundation Center (which provides 990finder) mis-labeling it as “Startup Experiatice“), formed 2011, shows $59M assets one year, “0” the next (and details, that it’s been overspending by millions last two years, without so far terminating itself…

I was right about “GoodVentures” being the one housed here, and (what’s more) it was the largest ($59M) donor TO SVCF listed on Schedule L. Extra and unusual efforts were made adding obstacles to connecting the information given to EIN#s to the form it was given on. To see this, go towards the very end of the document and read Schedules R, including their “Additional Schedules.”

The rest of that story not for this post, however, I’ve warned people concerned with subject matter of this blog (individually, off-post, as well as featuring certain community foundations periodically in blogging) that the word “community” and local geographic ties to such a foundation (typically, can easily become quite large) doesn’t mean its investments are. Activities, grants, maybe — but investments? not necessarily.

I’ve also posted on “Donor Advised Funds” (DAFs) where the facilitator doesn’t take responsibility to ensure that they are going to legitimate sources, but acts as a “neutral” facilitator. Just one image from SVCF, also for FY2015, shows a Schedule D and the extent of holdings, grants, and end-of-year (aggregate) balance in (column 1) 1,203 Donor-Advised Funds and (column 2) 703 Other funds and accounts (comparable amounts for FY2016 shown in an image gallery I added above..)

SVCF Sched D (see surrounding text re: Donor Advised Funds), notice the green annotation… end of year amounts…

SVCF (here, for Year 2013, not 2015) Sched A. Notice the growth in contributions over just the last 5 yrs., from $110M to over $1B…

SVCF Initial Tax Return after 2006 merger showing EIN#s and assets transferred from two predecessor Community Foundations (with their EIN#s) to create a startup $1.1B of funding available for investments (and some, grants, and of course investment management fees, salaries, etc.). TWO YEARS LATER (2008) local & national homeowners would start losing their housing due to foreclosures. The same year (2006), US Dept. of HHS began distributing $150M/annually under #CFDA93086 for “Healthy Marriage/Responsible Fatherhood” (to various grantees mostly nonprofits, but some of the largest grants to for-profits such as Public Strategies, Inc. (in OK, for PR campaigns) or “I C F Inc.” (for running website clearinghouses, etc.) — in an effort to “reduce poverty” and dependence on welfare through encouraging fathers to get move involved with their children and pay better child support..Some #CFDA93086 grantees were also state or local governments or departments within them (See TAGGS.HHS.gov for more details)..

{SVCF related statement for 2006; it received $500,000 contribution that year, as well as the transferred assets totaling over $1B. News coverage says its size grew 800% over (see Chronicle of Philanthropy “Turmoil” series, 4-18-2018 article on Loijens’ resigning) to over $13Billion assets in 2016..}

~|~ (This ends Silicon Valley Community Foundation section…) ~|~

This helps people conceal their collective interests through a variety of vehicles which, if then coordinated to specific projects, and wield “stealth” influence (talking over local government and public projects) over residents actually living in the area, and supporting the salaries of people elected to represent THEM — not necessarily every wealthy investor who takes an interest in the community…

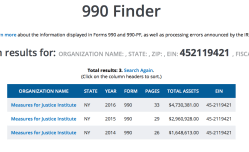

Meanwhile, another group has formed to “Measure” for “Justice” but only measuring the criminal sector (that’s how I became aware of the elusive “Ballmer Group.”). Anyone dealing with the criminal sector ought to also take into account the natural “drainage” FROM the criminal sector into the family courts — but are the sponsored social entrepreneurs, generation (“next,” I guess) about to consult the commoners? Apparently not…

I had to park this information here in order to complete a much earlier post that has stayed in “draft” mode while:

- I was focusing and more active on Twitter for a season and,

- During an increasingly disturbing (and still unsolved) personal crisis involving housing, which seems (in my situation) to be cyclical every few years — usually right after some party is confronted on serious boundary violations or illegal behavior compromising my safety and rights.

So reading about missing accounts for billionaires and those oh-so-pleased to get the gifts, while housing in this area has become unaffordable, and the churning of professional and qualified workers after, say, a decade in the family courts (sometimes — and for me it was — after a decade of family (domestic) violence)…is resulting in displaced populations, some of them homeless … doesn’t help inspire respect, hope, or vision for HOW to out-run the abuse and expect any form of sustainable future.

Building ANYTHING, including revenue or income streams sufficient individually to maintain even just housing and a few basics, faster than it can be disrupted or co-opted, requires principles on which to build and energy to do it with. How’s that work when masses of population are dissociative about how government accounts for its operations and works — but when discontent, can be rallied around causes, not basic economic and (at least as practiced) accounting — giving the public an account — realities?

How much of this has to do with abusive MIS-management of people, not just resources?

I don’t know how to (at least without chemicals: and chemicals are not my style!) become UNaware of the scope of imbalance and dishonesty with which our culture is saturated, even as I do appreciate the positive and creative aspects of life (i.e., arts, architecture, music, technology bringing performances and inspiration to many, dance (I’m watching Jennifer Lopez’ “World of Dance” as much as possible)… and so forth. So, I will continue writing about it as much as I can as long as I can. At least “for the record.”

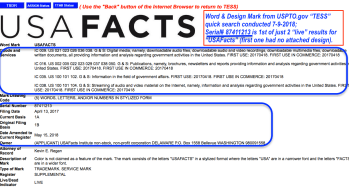

What type of “entity” and located where? Does it have an EIN# recorded by the IRS; what legal domicile? When was it started (Wikipedia footnotes on “USAFacts.org” told me more than this website did, readily!)

USPTO.gov (US Trademarks search under “TESS”) showed the trademark was registered right before tax-time (or, at least April 15, 2017) to a Delaware Entity with a Washington State (PO Box 1558, Bellevue, WA — see also Ballmer Group) address. Washington State Corporations & Charities search now requires user account? (I declined this time) it seems, while Delaware gives basic (not much, but some) information for free and then charges for much of anything else. Delaware Entity was formed 3/11/2016 (next image) and then two trademarks (one, with design attached) about a year later (2nd -4th images with a lot of fine print, look for “Owner”):

(Found again subsequently: https://ccfs.sos.wa.gov/#/AdvancedSearch does not require creating a “user” account and password)…

Image (screen snapshots I took from websites) gallery from “Measures For Justice, Inc” “Ballmer Group” and “USAFacts.org” are showing typical coordinated and mutual or sequential foundation backing of specific nonprofits with specific favored projects and maintaining post-funding board control of the project in exchange, in part, for membership on the board of directors and control of the same. USAFacts.org seems to be the most recent of these. Mentioned here as a point of reference and because, in an ideal world, I would go ahead and blog (or someone else might be inspired to, from a consumer/taxpayer, not involved backer, point of view!)

I call it Harvard/Bain/Bridgespan model in this blog, also copied by McKinsey (global consulting organization) who in copying it, did so at a larger scale (searchable on this blog.

I didn’t however, get to that understanding on Measures for Justice, Inc. before first locating the geographic domicile (NY), going to CharitiesNYS.com to locate its EIN# and read its (NY provides these) charitable registrations and annual filings, including a website or two. I also in a general search ran across initial biography of its Executive Director Amy Bach, showing her (essentially Ivy League) academic background and how first Echoing Green, then the Draper Richards Kaplan (“DRK” Foundation (among others) chose to back her. By this time I’d already seen the early (US) DOJ grant helped, and in a more recent return, essentially paid her $138K salary (the only paid officer) at Measures for Justice.

A further straightforward Google search of “Ballmer Group” gives more timelines and names more collaborating foundations (Edna McConnell Clark, Annie E. Casey, Robert Wood Johnson) and was part of (closing statement, next article) “StriveTogether…Cradle to Career Network” and add some timelines. There are several articles; but here’s one dated Feb. 28, 2017 from Inside Philanthropy: “A Rising Force: Where is Ballmer Group’s Money Starting to Flow?” by Alyssa Ochs and David Callahan. Ballmer Group has also hired (Feb. 2017) as its executive director Nina Revoyr from (Los Angeles-based) The Children’s Institute, which I already know as having plural entities and being on the HMRF (Healthy Marriage /{&ESPECIALLY} Responsible Fatherhood) HHS grants stream.

And I wouldn’t have thought much about or particularly noticed Measures for Justice on Twitter, Ballmer Group or USAFacts.org if I hadn’t previously over some years and as related to this blog’s primary subject matter, noticed “MforJ’s” new “partner” the National Center for State Courts (NCSC) — “Trusted Leadership. Proven Solutions. Better Courts” — and its various Associations, Partners, assistance of “AFCC” and summits, roundtables, and trainings on how to handle, of course, “domestic violence.” .. as well as its leadership participating in “Governance the Final Frontier” Executive Leadership Conferences in association with Harvard:

Just a sample of NCSC (here, post-Thanksgiving 2010, with “COSCA”) collaborations affecting “responses to Domestic Violence”); previously posted I see Oct. 20, 2017 in a different context.

Notice NCSC Motto at top: Trusted Leadership. Proven Solutions. Better Courts. Representing a “Harvard Executive Session” as linked to on NCSC. Previously blogged on FamilyCourtMatters.org.< Click image to enlarge if needed, and here for the source url (a video is also included)

By March? 1983, shown here “Vol. 2 Number 1” NCSC was “Secretariat” and provided administrative resources (incl. handling of finances as I understand it) for AFCC.** Image from 1983 AFCC newsletter and at that point (see banner) “An international association of judges, counselors, mediators and lawyers.” **Not shown on that image. See blog sidebar for the full issue which does reference NCSC assistance as Secretariat. It’s unclear to me whether this assistance lasted longer than a year or for how long, however it was valid for 1983.

An “Executive Session” here seems to be like a class or cohort going through a certain training together. Notice Mary McQueen, President of NCSC is on there — and who else is. (Previously posted herein, Oct. 22, 2017, probably under a title including “Governance The Final Frontier”)

NCSC-AFCC input to “Family Courts Resource Guide | NCSC (<==multi-page pdf. A 2nd click on blank page icon to view may be necessary.) … I took this pdf in 2014. Fine print shows advertising for both AFCC and (if one pays attention) a known AFCC activist/loyal member pushing its agenda at UBaltimore School of Law, Barbara Babb (a Center formed around 2000). Fine print also shows advertising of a “D.C. Fathering Court,” but does one see advertising of how federal grants through #PRWORA help fund fathering activities nationwide and establish “fatherhood as a profession” and portions of it as administered through the HHS “OCSE” Office of Child Support Enforcement specifically target state-based courts and their “custody-outcomes” to “increase (father) contact…” and, correspondingly, often reduce child support arrears… No…

AFCC is a nonprofit. NCSC is a nonprofit. Measures for Justice, Inc. is a nonprofit, and it seems that even USAFacts.org (incorporated 2016 in Delaware) is a nonprofit too although I can’t find its EIN# so far. It seems the Ballmer Group MAY be a nonprofit, but I can’t find ITS EIN# either, or its corporate identity, at least in Washington State or in the usual places…

Essentially, the public investment is into “social services” sector — meaning, guess who’s well aware? of the resources available/which can be commandeered from an ongoing taxable population whose housing, education, development, communications, transportation and raw materials access some of the larger corporations (which run larger foundations) already essentially control.

“Measures For Justice” promoted its Tweet (first image) about its new partnership with “National Center on State Courts” (“NCSC”) which I’ve also blogged on herein for its influence on state courts — but from the private sector (it IS a privately controlled nonprofit)…

-

- Measure for Justice website (inc. 2011, entity address in NY, CEO Amy Bach) page showing its Supporting organizations, alphabetically. Notice #1 is Ballmer Group, #2 is the US Department of Justice (under which “BJA” Bureau of Justice Assistance exists).

USAFacts.org + Steve Ballmer, Wharton School at University of Pennsylvania (notice motto or mission statement of Ballmer Group)..

“We believe that the best work in philanthropy happens when multiple sectors — public, private and nonprofit — come together to tackle problems. Everybody brings a different perspective, and sometimes it’s a little painful because we are all so different, but we think that where the power is. Together, we all go further.” ~ ~ Connie Ballmer, Co-Founder

What a mis-statement! “Public, private and nonprofit” are not the primary sectors! There are TWO sectors — public, and private. Under the PRIVATE, there is a nonprofit and a for-profit sector. Connie Ballmer knows this, as does Steve Ballmer, as does every major foundation executive, and comptrollers, etc., of government entities. So who is that “public, private and nonprofit” statement aimed at? Apparently, an ignorant or gullible public to continue having positive feelings towards philanthropy and, in general, billionaires as paternalistically concerned.

Even the term “nonprofit” if properly categorized (as under “private” sector) is still misleading as a look at page 1 of any billion-dollar-assets Form 990 foundation typically shows. Obviously there are plenty of profits to be made from this form of organizations. The difference is, how much they’re taxed!

What’s more, in the “private” sector there are public-traded companies, and in the public sector, some assets are held in private investments. The statement makes no sense except as salesmanship. One part of it, however, is true — blend the public (gov’t) and the private (including the nonprofit subset) sector as the “we” in question (which leaves out the majority of the population — except as they work for one or the other sector, & have something or nothing to invest in either sector) — that’s definitely where the “POWER” (influence, control, ownership of assets and/or debt) is..The nonprofit sector IS within the private sector (even if boards of directors are exclusively, or primarily, civil servants operating otherwise in the PUBLIC sector)… the phrasing is misleading. Private sector gives its accounts to the “Public” sector (that is, to government entities, which can tax it, and track (if tax-exempt OR not)(And with or without employees) its handling of employee wages and withholding. (Below which, navy background):

“We support efforts to improve economic mobility for children and families in the United States who are disproportionately likely to remain in poverty..”

~ ~ ~ ~

Written by Let's Get Honest|She Looks It Up

August 4, 2018 at 2:22 pm

Posted in 1996 TANF PRWORA (cat. added 11/2011)

Tagged with "A Budget =/= a Balance Sheet!", 990s vs 990PFs, Apercen Partners LLC 314 Lytton Ave #200 Palo Alto (CalEntity #200808410140 | Tom van Loben Sels) manages sev'l fndtns, Basic Vocabulary Private v Public sectors (Budget Revs Expenses | Assets Liabilities), Bridgewater Associates (NY) (institutional + pension fund managemt - $125B under mgmt - Hedge Funds - Roger Dalio - Runs it like a Cult - Dodged the 2008 fiasco), BusinessSearch.CA.Gov (a handy resource!), CalEntity#3319093 Started Sep 2010 Dissolved Feb 2017 (Zuckerberg et al | SVCF related org], Cari Tuna + Dustin Moskovitz (Facebook ~ Asana), Chan Zuckerberg Initiative LLC | successor to Startup Education Fund, CZI and Chan Zuckerberg LLCs detailed, EIN#20-5205488 (SVCF'org), Elie Hassenfeld - Holden Karnofsky (Brigewater Associates then GiveWell [dba for The Clear Fund establ 2007], GiveWell is a dba for The Clear Fund, Good Ventures (990-filer)℅ SVCF EIN#452757586 CalEntity# C3393453, Good Ventures Fndtn (990PF 2012ff CA) EIN#461008520, Good Ventures Fndtn (℅ Apercen Partners LLC) EIN#461008520 (990PF-filer) CalEntity #C3504459 (Total Assets $1B FY2016 per Cal OAG Details), Good Ventures ~ GiveWell ~ Open Philanthropy (Project|Action Fund), Harvard/Bain/Bridgespan consulting model "Gen2" (Hassenfeld-Karnofsky's GiveWell], How Well Do You Know Your United States (and its Balance Sheets), Iconiq Capital (Delaware LLC) + Divesh Makan ("The Spider of Silicon Valley" Forbes article), Jen Holleran (Harvard GSE '95 - Yale - Startup:Education + NAATE (dba for RI 501©3 "The Center for Better Schools") & More (Zuckerberg pick in 2011), Mark Zuckerberg + Priscilla Chan, Measures for Justice + NCSC, NCSC - National Center for State Courts (Trusted Leadership. Proven Solutions. Better Courts.), Open Philanthropy Action Fund (EIN#81-2644663, Open Philanthropy Action Fund (EIN#81-2644663=>startup 2016 $55M contributns - 501©4 cf Hassenfeld-Karnofsky GiveWell|The Clear Fund projects), Open Philanthropy Project (501©3 EIN# 801737472 but only 990-N filed for 2016 + 2017 [formerly a Sched-R related org to GiveWell], Open Philanthropy Project LLC (Cal Entity 201530910524 formed Nov 2015], Philanthropic Behavior of Billionaires, Public or Private -- NOT "Public Private or Nonprofit" (Nonprofits are still private!), PWBM Penn-Wharton Budget Model (working w USAFacts), Seven Square Management LLC (CA but manager is ICONIQ Capital), Startup Education (Sched-R to SVCF) ℅ Zuckerberg, Startup: Education (EIN#273533876 CalEntity#3319093 Started Sep 2010 Dissolved Feb 2017 (Zuckerberg et al | SVCF related org], Steve and Connie Ballmer, The Ballmer Group is a dba for two WA-based LLCs, Turmoil at Silicon Valley Community Foundation (Toxic work environment etc) article series, USAFacts.org + USAFacts Institute (Ballmer project)

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Leave a comment