#”…IRS acknowledges” in the title refers to being qualified to accept tax-deductible contributions, explained below, right underneath the tax return tables showing those two different EIN#’s. As this business entity (or is it two entities?) is mostly government-funded anyhow, it’s kind of a moot point. Still, having HHS describe this on its grants database as ONE organization which suddenly (2015) changes its EIN# — and leadership — and type of formation (Private Foundation / Public Charity) — and leadership — and location (without checking “New Address”) is a little disconcerting.

This post sprang (so to speak, actually it was extracted by me and didn’t move on its own) out of one dated May 2, 2016 and which I eventually posted as “Red Herring Alert’s “Conversation with Dakota County Commissioner/HMRF funds,” and about those funds…

Post-publication post update: Based on some of these findings, I added a PAGE (to right sidebar) on May 14, 2016, called HHS Grantees, Just Georgia, Just HMRF (CFDA 93086), May 13, 2016, Report Run. Take a look! Will also be posting to publicize that page later today. The Page displays grants tables; they take long to compile and have a lot to say, I didn’t want this information disappearing beneath a succession of posts, but to be visible on the sidebar. Georgia is “Below the Bible Belt” and “Faith-Based” goes over well, obviously. It also has among the larger Violence-Prevention grantees, a “Criminal Justice Coordinating Council” which I believe bears more looking into.

The Page also demonstrates beyond argument the relative size of HMRF versus “Violence Prevention” grants — and that State agencies are getting both types (!!). While the Page doesn’t discuss this (due to size limits), I also noticed again “University of Georgia Research Foundation” who I’d noticed years earlier running the social science R&D programming, including targeting African-American families, and using “PREP,” i.e., a curriculum developed by professors at the University of Denver and also heavily promoted within the “Oklahoma Marriage Initiative” which, famously around the turn of this century, and under a Catholic Governor (Frank Keating) and religious protestant evangelical high up in the state-level “HHS” responsibility, “Jerry Regier.” In that scenario, a public relations firm received a real helping-hand for managing the resulting “Healthy Marriage Resource Center” (also propped up by HHS grants).

As a sample, obviously “FBO” (“Faith-based Organization,”), I took a look at this organization, as it says below, and could only say,

Oh my goodness, this organization (website “WWW.MTCIGA.ORG” per the 2014 return, …) is “something else…”

This draft began on May 2, 2016. I’ve published three others since, and am currently studying and about to continue posting on some of the Focus on the Family Statewide Policy (501©4) and Family (501©3) organizations. This MTCIGA has shown up to be either part of this circle, or closely associated with it.

That is a large topic. There will be more than one post, I have not finished getting some outstanding questions answered, and may not, but what I do have to show is enough to raise red flags on WHY groups which fill out tax returns in some crazy-ass ways, and then have executive directors forming some of the curricula they are promoting — but said curriculum nonprofit doesn’t stay incorporated — and a number of other simply “funky” behaviors should say, WHERE’s HHS Accountability in all this? Do they give a damn?

- Check out TAGGS.hhs.gov report of “93010” CBAE (Community Based Abstinence Education) Grantees in Georgia; this is one. Any column title can be sorted by clicking on it, active links are also clickable; which for any organization should show what other types of grants they may have gotten. Only 25 results per page show — suggest try different sorts, including the Sum of Awards ($$, rightmost) column to see largest versus smallest amounts. Notice the variety of types of organizations which obtained abstinence education grants. For example, in addition to what would appear to be other FBOs (“Crowned for Victory,” “Metro Atlanta Youth for Christ, Inc.” — looks like several million dollars, etc.) there is a Housing Authority, a Board of Education, a “Wholistic (sic) Stress Control Institute” called a “Research Institution, Foundation and Laboratory” (also drawing funds for Teenage Pregnancy Prevention, Drug-Free Communities, Preventing HIV/SA, etc.)

Wholistic Stress Control Institute (not the topic of this post) I notice in passing and is also “something else” in similar ways…although rather more on the “new age” spirituality than conservative Christian side, Apparently.

[“Wholistic Stress Institute” section marked by light-blue background and “Arial Narrow” font. Below that, more discussion on the “Faith-Based Organization” referenced in post title.]

The name of its Abstinence Education Award: “THE GOAL OF THE 2 HYPE “A” CLUB IS TO TEACH AN ABSTINENCE EDUCATION TO 300 AFRICAN AMERICAN YOUTH (12-18) IN METRO ATLANTA”Basic search for HHS grants from this organization (Not its only stated source of gov’t grants, though) — click here to see it’s about $6.0M, that is, those recorded on TAGGs database which only goes back to 1991 (mostly about 1995) -for an organization formed in 1988. The DUNS identifier is “620828681” if you want to do other searches:

I plunked down this new (to me) section near the top of this post not actually about this group.

YearEnd 2014 – Page 2 (Program Service Accomplishments) for some reason is blacked out.

YearEnd 2013 — brief description provided on page 2 shows that they have confused grants distributed with grants received. And, as Part I (Summary) and Part VIII (Revenues) also show — the majority, in fact nearly all, grants received are government grants. This organization does not provide enough program service revenues to survive off the government dole — and having been founded in 1988, they have not yet, apparently, figured out the difference (despite the IRS form explaining this on Page 1, and Page 2) between money they RECEIVED and money they Re-DISTRIBUTE to others, which was, none. They also failed to identify on details (Pt. III page 3) what would certainly appear (Part VIII, Line 2) as revenues, but DID on Summary, Pt. I, Line 6

They are not redistributing anything to others; their charitable services seems to consist of programmings run, mostly for nothing, but some fees (See Part VIII) are being charged, as “Program Service Revenues” it says. However in Year End 2011, this amount was $103K — but not shown on Part III at all)…

From “Wholistic Stress Institute,” Fiscal Yr. 2012 Form 990 (middle row above), Page 2, Part III:

4a (Code: )(Expenses $ 934, 565. including grants of $ 934, 565. )(Revenue $ 0. )

TO INCREASE PERSONAL RESOURCES FOR COPING WITH STRESS THROUGH TRAINING PROGRAMS, CONSULTATION ; EDUCATION AND A VARITY OF MULTI-PURPOSE HUMAN SERVICES EDUCATION.

There are no grants distributed. There were, however, some (minimal, but some) Program service revenues, which are not showing up here (compare to Part VIII). The grants shown, that year, were a total of $944K, and are organization revenues, not organization expenses.

That yellow quote above is a transcription, verbatim of the only description in this section of “Program Service Accomplishments.”

It obviously is not a description of what they did that year, but of a mission statement. It also, notably — has obvious errors in: spelling (“varity”), grammar/usage [“a varity of …education.” The word “variety” followed by “of” should refer to a plural, not singular noun. What they probably mean — and what the website makes it clear they are offering –is classes. Plural.], and punctuation [in a list of only four items, they begin with a comma, then add a semi-colon preceded by a space. Commas would do just fine there]. The single paragraph as a short description lacks any identifiable detail traceable to the organization (such as names of classes offered — this would be the typical place to list them on a tax return]. It’s a failure to name things, i.e., in labeling.

Note: the same errors-filled description (punctuated and spelled exactly the same) is showing more than one tax return, with only the numbers plugged in for “(Expenses $nnn….including grants of ($ identical amount))” on top of it. FYI, the tax preparer is Otis H. Plunkett (or, O.H. Plunkettt & Co. P.A.) in Atlanta. I even checked FYear 2008. The page 2 paragraph is identical. Here, the government grants were even higher ($1.4M), but the Revenues – Expenses was still in the negative (below zero). On that year, under “Part IX, Functional Expenses” on Line 24, they listed $228K as “Consultants.” “Consultants” are “Fees for services (Non-employees) and belongs back up on Line 11, possibly 11g, “Other.” This amount is more than 10% of Total (ALL) functional expenses for that year, which is Line 25 (I believe). When Line 11g (where this $228K should’ve gone) is more than 10%, say the instructions, an explanation must be given on “Schedule O.”

By entering the $228K amount on the wrong line, the organization involved AVOIDED telling the IRS (and any public, who is basically funding this organization) WHICH consultants. It is probable, in my opinion, that the consultants indicate some of the people running the nonprofit and who on its site take credit fro having written some of the programs they are running. But if not — it should be shown which consultants! That pattern applies also to the other organization on this post, MTCIGA.org. It looks to me like someone has “xeroxed” or photocopied most pages of the tax return and simply plugs in different numbers for different years. The number of employees claimed also varies wildly from year to year.

Further difficulty in labeling their own Officers, Directors, Trustees, and Key Employees, etc. — by checking columns labeled so is also rather odd. The only paid main employees shown — and working, it says, 60 hours a week– are notably all women. Two of these (Jennie Trotter, Gloria Elder, the ones I show below) are named “Executive Officer” (which is typically an employee) and “Project Director” but checked off as “Officers” in the columns on the same page — while three men labeled “Chair, Secretary and Treasurer” (working 1.0hrs/week as volunteers) are NOT marked as “officers.” The board seems to have, besides the employees shown, 4 men and 3 women.

Here’s that image — how can someone not understand that the Chairman of the Board IS a nonprofit Officer?, as are the Secretary and Treasurer? Look at page 7 on tax return bottom row, above; here’s that as an image (See the column with only two “xs”?? that’s “Officers”) and as link to a pdf of the same page (only). Fiscal Year 2011 (YE 2012) Form 990:

Form 990 p7only (Pt VIIA Officers) Wholistic Stress Institute (AtlantaGA) EIN#581786170 Fails to Identify Chair, Sec’y & Treasurer as %22Officers%22 by checking that column, labels Exec Dir & another Employee as only two %22Officers%22

The website lists “Community Programs” showing currently nineteen (19) classes with clever names and logos that the institute runs, and some with associated brochures. Why not name a few? For example, a 10-hour training program, per its brochure is called “PARENTWISE® Parenting Program (“PWPP”)” and the word “PARENTS” is shown as an acronym for, and designed by:

|

* |

| P |

ERSEVERING |

| A |

ADAPTING |

| R |

ROLE-MODELING |

| E |

ENERGIZING |

| N |

NEGOTIATING |

| T |

EACHING |

| S |

UPPORTING |

|

Gloria Elder Ms. Elder is the Deputy Director of Training, Co-Developer and Project Director of the Pre-School Stress Relief Project, and author of the ParentWise Parenting Program at the Wholistic Stress Control Institute, Inc. (WSCI), Atlanta, Georgia. Gloria is also a Qigong and Yoga Instructor. She is responsible for supervising staff and coordinating and conducting training throughout the world. **

Ms. Elder has extensive expertise and experience in early childhood education and administration, prevention, and health and wellness issues, with a particular focus on curriculum development and implementation and program replication. She also has experience in conference planning and implementation. Gloria has participated in conferences, seminars and symposiums as keynote speaker, workshop presenter, exhibitor and trainer for more than 25 years.

Gloria received her undergraduate degree from Spelman College where she majored in Sociology and received her Master’s Degree in Early Childhood Education from Atlanta University. Ms. Elder is a recent graduate of the Institute for Divine Wisdom’s School for Spiritual Awakening and she is Spring Forest Qigong Certified Level I Instructor. …

{{**referring to for PWPP, or for Qigong and Yoga? There apparently was an Institute for Divine Wisdom in Atlanta}} |

(from the website “http://wholistic1.com” shown on tax returns):

The Wholistic Stress Control Institute, Inc. (WSCI), founded in 1984 by Jennie C. Trotter ** and incorporated in 1987.** WSCI is a non-profit community based, award-winning, organization whose mission is to teach Wholistic stress management by promoting wellness and healthy lifestyle choices.

Our Approach

WSCI utilizes a “wholistic” approach in all its educational programs and resources. The wholistic approach advocates the harmonious development of the total person- mind, body and spirit.

**Click through to see this text and more re: Jennie Trotter, M.Ed.D.

Jennie C. Trotter, M.Ed. Executive Director and Founder

Jennie C. Trotter, M.Ed. Executive Director and Founder

Jennie C. Trotter is a child advocate, licensed professional counselor, educator and certified preventionist.## A native of Brooklyn, New York, Jennie moved to Atlanta, Georgia over 40 years ago. She has been married over 43 years to Jim Trotter, has three beautiful adult children and eight grandchildren. She obtained her Bachelor’s Degree from City College in New York. Jennie earned her Master’s Degree from Bank Street College of Education in New York, where she majored in counseling and education.

Jennie is currently the founder and executive director of the Wholistic Stress Control Institute, Inc. (WSCI), a 29-year award winning African-American non-profit community based organization which provides stress education services for children and adults. WSCI was founded as a result of a prayer Jennie had to be of services during the Atlanta Missing and Murdered Children and Youth Crisis (1980).

WSCI mission is to promote wellness and healthy lifestyles through a wholistic# approach, to increase positive coping skills for stress management and to decrease the incidence of stress related illnesses and negative behaviors. In addition to stress management services, WSCI operates 14 free community prevention programs

Certified by whom? This might be a good place to mention..

In finishing up this post, I went looking (at Georgia business entities search) for any other companies some of the leadership (Ms. Trotter or Ms. Elder) might own, searching under Registered Agent, and Officer. I found under the “Officer Search” this one — which existed 1979-2003 until it was dissolved, and showing 3 (woman) officers, the CFO at the time being Gloria S. Elder, at the same street address as the “Wholistic Stress Institute” which, below, turns out to also be a United Methodist Church formed, it says, in 1982…

#I’d thought “wholistic” might be an intentional play on words — the word “whole” and the correctly spelled “holistic.” Apparently not… The word “holistic” is all over similar websites and descriptions of multiple types of approaches to solving specific problems. It’s used frequently in the family law system. What I’m saying is, people who read this material would run across it, and sooner or later, hopefully, figure out how to spell it. Although it does come from the word meaning “whole” it is in common enough use in these circles that not “getting” the spelling would seem to indicate, someone isn’t fully literate in their own field. On-line Etymology Dictionary (page 27 under “H” currently) traces the usage back to a South African General Smuts (!!) and for medicine, since the 1960s:

holism (n.)  1926, apparently coined by South African Gen. J.C. Smuts (1870-1950) in his book “Holism and Evolution” which treats of evolution as a process of unification of separate parts; from Greek holos “whole” (see safe (adj.)) + -ism.

1926, apparently coined by South African Gen. J.C. Smuts (1870-1950) in his book “Holism and Evolution” which treats of evolution as a process of unification of separate parts; from Greek holos “whole” (see safe (adj.)) + -ism.

This character of “wholeness” meets us everywhere and points to something fundamental in the universe. Holism (from [holos] = whole) is the term here coined for this fundamental factor operative towards the creation of wholes in the universe. [Smuts, “Holism and Evolution,” p.86]

holistic (adj.)  1926, from holism (q.v.) + -istic. Holistic medicine is first attested 1960. Related: Holistically.

1926, from holism (q.v.) + -istic. Holistic medicine is first attested 1960. Related: Holistically.

Here’s a description taken from “Wikipedia” on “holistic medicine.” It’s not exactly a new concept

[I started to expand this topic post-publication, but changed my mind. Belongs in a separate post. LGH 5/13/2016]

The history of holistic health can be traced to nineteenth century alternative medicine proponents of homeopathy, hydrotherapy and naturopathy.[3]

The holistic concept in medical practice, which is distinct from the concept in the alternative medicine, upholds that all aspects of people’s needs including psychological, physical and social should be taken into account and seen as a whole. A 2007 study said the concept was alive and well in general medicine in Sweden.[4]

Some practitioners of holistic medicine use alternative medicine exclusively, though sometimes holistic treatment can mean simply that a physician takes account of all a person’s circumstances in giving treatment. Sometimes when alternative medicine is mixed with mainstream medicine the result is called “holistic” medicine, though this is more commonly termed integrative medicine.[2]

According to the American Holistic Medical Associationit is believed that the spiritual element should also be taken into account when assessing a person’s overall well-being.[5]

Ironically, the “Wholistic Stress Institute” street address — and the address on its multiple program brochures — exactly matches the Hoosier United Methodist Church which, surprisingly, says nothing about the Institute on its web page. Under “Resources” it lists a regional combination of Credit Unions. 2545 Benjamin E. Mays Dr. SW, Atlanta, GA 30311

____________[END, section on HHS grantee “Wholistic Stress Institute,”]_____________

The next posts may be more fast than “fastidious” (by my standards at least) and sections repeated from one to another. As we head into a Presidential general election SOON, this may be the year in which this entire stream of $150M/year HMRF grants in place for twenty years now (1996-2006) can be seriously questioned, and ideally, STOPPED. And there are certain Presidential Executive Orders, passed first by Bush 1/29/2001, and later versions by Obama, which have already done their fiscal damages to average Americans NOT working on the funding streams they set up.

It’s time for those to be repealed as well. The argument should not be made based on “outcomes” (anyone can pay for studies to produce favorable evaluations or, the more common response, “further studies needed!”). It should be on the basis of how grantees, collectively, have behaved on receipt of funds, and how HHS has behaved in tracking them. My posts will continue to demonstrate that if individual citizens (as opposed to favored nonprofits) engaged in the same behavior, some of us would go to jail for fraud and theft of services, or filing false and mis-leading tax returns, i.e., “Tax evasion.” I think we are looking at a racket, and possibly racketeering.

In addition, in this post, I have links to and images of what proportion of “TANF and MOE” money is actually used on basic services for residents of Georgia. The percentage in year 2014 was less than 10% on “basic assistance.” Perhaps if these funds were actually used to help people directly, some of these people would be ethically and morally upright, and concerned enough for their own household and children, that they would actually use this to better their lives, clothe their kids, and get to and from work. Why should the federal government continue to sponsor a system in which less than 10% of “Temporary Assistance for Needy Families” doesn’t include “basic services” in the form of FUNDS for those needy families? Wherever such “Assistance” goes — it should at a minimum NOT go to organizations which can’t spell and can’t fill out their own tax returns, can’t or don’t evidence understanding of the requirement to keep business entities they set up to run HMRF programming legally registered with the State of Georgia, and such basics!

NOTE: Seeing this requires showing several sources of information. It will take more than one post to do so, probably, but I have throughout this blog encouraged and told people some basic places to look and demonstrated looking there. Technically speaking, anyone curious enough by now, could make the same efforts him or herself without my coaching. Where I seem to differ is the attention span, and the desire to communicate to others the importance of looking.

A reminder what “HMRF” stands for in Department of Health and Human Services, “Office of Family Assistance” terms. We are talking about the resources appropriate by Congress under the Social Security Act, as radically revised in 1996, and reauthorized with specific changes (but not reducing or eliminating this funding stream at all) in 2005, 2009 and 2010 under different names.

Programs

The Office of Family Assistance (OFA) administers several key federal grant programs,** including the Healthy Marriage and Responsible Fatherhood Grants. These programs foster economically secure households and communities for the well-being and long-term success of children and families

…On September 30, 2015, ACF’s Office of Family Assistance announced grantee awards to 46 organizations to provide healthy marriage and relationship education programming…..

The “Welfare-Reform” (1996) theory behind pushing for this Marriage/Fatherhood funding, as part of the form primary purpose of “TANF” was that the poor people, being a burden on society, should be prevented from and assisted in, reducing their fertility rates, and getting and staying married. It was in the public benefit, allegedly, to promote marriage because it reduced the public debt burden.

This mentality is still essentially an outgrowth of the 1965 Moynihan Report “The Negro Family: The Case for National Action.” The proper arrangement of life and child-rearing was to be the two-parent, male-breadwinner family.

As you will see in this post, organizations using this type of funding are STILL targeting African-American (and Hispanic) youth for abstinence prevention marriage promotion, and so forth. On the 50th Anniversary of The Moynihan report (year 2015), which I as a woman domestic violence survivor, and college-educated mother of two, who had already proved herself capable of supporting a household in a profession AND taking care of their education adequately, and not cutting the father out of their lives in the process, found and still find personally offensive, there is still plenty of argument about it across the spectrum. Some still swear by it, including those significantly involved in Welfare Reform (Ron Haskins, Isabel Sawhill, and others) and some still say as it was said at the time, this is condescending and racist. (It’s also, FYI, sexist)..

Brief reference to that material in http://www.socialsciencespace.com/2016/03/experts-on-economic-mobility-win-2016-moynihan-prize/. Maybe more on this later (post in draft). But please DO be aware of some of the key personnel helping (re)structure 21st century lives — because, after all, “let’s leave it to the experts” (especially the social science / psychology experts).

Social Science Space was only launched in 2011 — by Sage Publications. This site also links to a timeline of “Uncle Sam and Social Science” which would be good to read, for example, referencing Ford as a major funder of the field before government got so much into it, post World War II especially.” The first statement is, essentially, a religious belief — hypothesis for the field. DOES “social science” really “play a crucial role in contributing to a better quality of life”?” What role? For whom? The statement is so open-ended it’s hard to disprove, but equally impossible to prove. One thing seems sure — it has greatly sponsored “a better quality of life” via sources of revenue for social scientists… Sage Publications…

Social science plays a crucial role in contributing to a better quality of life. It underpins many successful public policies from poverty alleviation, macroeconomics to crime prevention. Yet the contributions made by social scientists remain under-recognized in many circles. There is an urgent need for social scientists to demonstrate the value of their research and the power of their expertise for addressing the local and international challenges of our age.

SAGE launched Social Science Space in January 2011. As the world’s leading independent social science publisher, SAGE celebrates and champions the value and impact of social science. We were founded in 1965 by philanthropist Sara Miller McCune with the firm belief that publishing engaged scholarship could change the way we look at the world. Today we publish more than 950 journals and more than 800 books each year, a majority of them drawn from across all major social science disciplines. We publish the very best authors, editors and societies in these fields, and disseminate their important research across the social science disciplines around the world.

While the summary above says “SAGE” it omits that the company is now “SAGE Publications Ltd.” which is to say – -it’s not based in the USA although its founder Sarah McCune Miller is a philanthropist here. ANY kind of science requires funding, and it’s quite fair play to ask who’s been funding the push for social sciences throughout this country, and throughout most of the last century, and so far in this one.

HMRF funding is also justified in large part on social science-based poverty theory (why people are poor). Of course, the pooling of tax-exempt wealth in some sectors that need for their prosperity and professional stability, access to endless populations of guess who — THE POOR — to perpetuate this — has nothing to do with why there are endless populations of poor people not involved in the same sectors as those reporting on them.

Nor does theft, fraud, mis-use, abuse, or simply squandering of federal resources (which the poor’s labors, through taxation and consumption of fees-based services, not to mention how many of these poor are cycling in and out of prison, and others being separated from their families and moved into the foster care system, all of which of course requires more public resources to sustain (and expand) — is apparently not a valid question. That is more a political/economic question that a social science question which, if answered (or seriously debated) might seriously disturb the status quo.

I think SAGE Publications, Inc., Ltd (i.e., in London) and its founder/s as publishers are relevant to the larger discussion — but not on this post. But, …. coming soon….

(Unfortunately, my post here does tend to prove these experts’ arrogant assumptions that Americans are gullible — in general, we don’t actually track discretionary funding such as the HMRF grants and grantees, nor do most people have a grip on just how illogical is the premise of pushing “Healthy Marriage/Responsible Fatherhood (Prisoner/Re-entry) to reduce public debt and poverty, and when indicators are that these aren’t being used primarily on the poor ANYHOW (and — see color-coded map of the US below — in many states, not for basic assistance), it’s time to quit charging full-steam ahead with the same funding decade after decade….)

Experts on Economic Mobility Win 2016 Moynihan Prize

ocial policy experts Ron Haskins and Isabel Sawhill have been named the 2016 winners of the 2016 Daniel Patrick Moynihan Prize by the American Academy of Political and Social Science. “Their commitment to creating strong public policy despite political differences and to encouraging civility and scientific partnership,” said AAPSS President Ken Prewitt, “make Belle and Ron most worthy recipients of this award. Senator Moynihan spent a great deal of his career in public service working for evidence-based policies that support child development and strong families; the careers of Sawhill and Haskins are proof of that ideal continuing in public life today.”

Haskins and Sawhill were jointly nominated, making this the first time two awardees have been chosen to receive the prize. Their collaboration began in 2001 when they worked on the effects of welfare reform legislation with a shared goal of creating opportunity for children and families. Their collaboration led to the establishment of the Center on Children and Families at the Brookings Institution.

Their lengthy partnership is especially notable given their ostensible political differences. Sawhill served in the Clinton administration in the Office of Management and Budget at the same time that Haskins worked for the Republican majority on the House Ways and Means Committee. Haskin later served as senior adviser for welfare policy in the second administration of President George W. Bush.

“What they’ve done together at the Brookings Institution is remarkable in two ways,” said Jason DeParle, a reporter at The New York Times who has covered welfare and other issues. “First, they’ve kept honest, data-rich analysis at the heart of highly ideological poverty debates, whether in books, briefs, op-eds or congressional testimony. Second, they’ve managed to bridge — even transcend — partisan divides. As other Washington institutions grew more ideologically entrenched, they modeled a partnership that defied labels other than ‘indispensable.’”

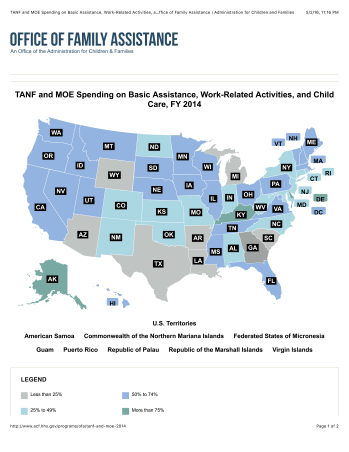

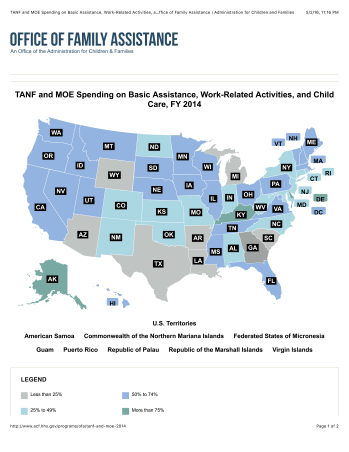

Just a few charts (from HHS) I will be showing indicate that most states receiving TANF funds any more are NOT spending most of their TANF funds on basic assistance any more. Georgia, topic of this post, in 2014 (per the chart) spent only 8.6% of their funds on “Basic Assistance” — but was that used to then reduce the tax burden, or route it back to the poor within the state?

No. Instead, 71.5% of $508.89M TANF funds SPENT or TRANSFERRED was spent on “non-basic assistance”

**yes it certainly does. From their site, here are some of the other programs OFA administers.

The Office of Family Assistance (OFA), an office of the Administration for Children and Families, administers several key federal grant programs, including the State and Tribal Temporary Assistance for Needy Families (TANF) programs,++ Native Employment Works program, and the discretionary Healthy Marriage and Responsible Fatherhood, and Health Profession Opportunity Grants programs. Our programs foster economically secure households and communities for the well-being and long-term success of children and families.

++TANF. Sometimes known as “Welfare.” Did you know? –for States to receive their TANF funds (it says), they must also spend certain amounts on MOE (“Maintenance of Effort”) funding also.

The next chart (Map of USA) shows, by color code, which states spent less than 25% (gray) 25-49% (aqua), 50-74% (sky blue) or 75-100% (green — only Alaska, Kentucky and Delaware…) of their TANF money on BASIC assistance — which I’m hazarding a guess means actual cash help to families, or actual food stamps to families, as opposed to — child care, etc. See this link

I’m frequently writing about “those funds” and might have run across this information from some other approach, but that’s how it happened this time.

Ms. Evavold first updated readers on the recent status of a criminal case (State of Minnesota v. Dede Evavold) for interfering with a family court case in which the winners and losers had clearly been already chosen, and further publicity was, well, messing up the programming (that’s MY interpretation anyhow). This was also drawing attention to just how much wealth (not just how many children) may have been at stake which I’d be willing to bet made a difference in just how aggressively the family court moved against the mother of five, even after having cut off her contact with the children.

GEORGIA’s 2014 TANF & MOE efforts — it spent less than 25% of $508.8M on “Basic Assistance.”

Look at the pie chart. 71.5% on “Non-Basic Assistance.”

ANYHOW, below all that (as other posts states) time was found to bring up the HMRF funds, not to mention my own blog. So, I stepped in, and started writing…. So, Red Herring Alert alerted us to some 2015 grants under that PRWORA-forward grants stream no one wants to really look closely at as to where it affects custody, family court ,child support, and domestic violence issues at the local level.

CFDA = “Category of Federal Domestic Assistance.”

ALL of the above will be labeled CFDA 93.086, and there’s no way you can run a report from the standard (free to the public) Database TAGGS.hhs.gov) which will SELECT on only the ReFORM type, or the Fatherhood type or the “Healthy Marriage” type after selecting on CFDA 93086. If there is any other way than actually identifying every single grant award # of running such a report, I would like to know what it is. Also, HHS doesn’t make identifying the award#s that available — just the named grantees….

As the Red Herring Alert 4/26/2016 post showed, they’re now starting to require that organizations (at least for one of the above three programs, I DNR exactly) combine ALL THREE types of services. Many have been doing that for anyhow — these groups aren’t “dumb” when it comes to GETTING the grants, but sometimes (as this post DOES show) may be “playing dumb” when telling us what they did with the money. But then again, that’s in general a risk of the 501©3 field overall, anyhow. ADD TO THIS the “faith-based” factor — you can’t sort or select on a category “faith-based” either, so on a categorical way, it’s actually meaningless..

I think it’s fair to state that the powers that be know quite a bit about the gullibility, if not vulnerability, of religious people at times to affinity fraud, and put together with the follow-the-leader (not “critique and demand to see the books of the leaders — regularly!”) mentality, that this HMRF grants program started up — well, back in 1996, and with an extra boost in 2001 from GWBush Admin for the “Faith-based” factor — they knew what they were doing…..

And this I am posting for JUST ONE example of how it may go when the “faith-based” attempt to fill out Tax Returns…. and account for where the money came from, and went to.

Here, I just picked the top of three programs, and went looking for the evidence of who got the grants. Information from GRANTS.gov tells the total amount of the funding opportunity and the bottom and top limits of individual grants, as well as when was it posted, who can apply, and other information I think the public ought to know, and think about.

It’s a Presidential Election Year. Perhaps we can get one of the (remaining) candidates to talk about this, in public?

The description of the top of those three opportunities (also on that post) is here:

- HEALTHY MARRIAGE Grants.gov View Opportunity Page (to find others, search the “funding opportunity number” which is hyphenated, shown above for each one). I couldn’t get the full page to a visual image; you’re best off clicking, but the format will look (first page of 3 from print-to-pdf, anyhow) approximately like this:

| Posted Date: |

May 08, 2015 |

| Last Updated Date: |

May 08, 2015 |

| Original Closing Date for Applications: |

Jul 07, 2015 Electronically submitted applications must be submitted no later than 11:59 p.m., ET, on the listed application due date. |

| Current Closing Date for Applications: |

Jul 07, 2015 Electronically submitted applications must be submitted no later than 11:59 p.m., ET, on the listed application due date. |

| Archive Date: |

Aug 06, 2015 |

| Estimated Total Program Funding: |

$53,846,875 |

| Award Ceiling: |

$2,000,000 |

| Award Floor: |

$350,000 |

Who is Eligible to get these? See link above, or as it says below, which is from that link:

- {{except the smart-ass bulleted comments which I added}}

| Eligible Applicants: |

Nonprofits that do not have a 501(c)(3) status with the IRS, other than institutions of higher education

- {{and nonprofits that DO have a 501©3 status, see below}}

- {{and Private institutions of higher education, see below}}

For profit organizations other than small businesses

- {{but — see below, small businesses also}}

County governments

State governments

Public and State controlled institutions of higher education

Public housing authorities/Indian housing authorities

Private institutions of higher education

Nonprofits having a 501(c)(3) status with the IRS, other than institutions of higher education

Small businesses

Native American tribal governments (Federally recognized)

Native American tribal organizations (other than Federally recognized tribal governments)

City or township governments

Independent school districts

Special district governments |

| Additional Information on Eligibility: |

Faith-based and community organizations that meet the eligibility requirements are eligible to receive awards under this funding opportunity announcement.** Faith-based organizations are encouraged to review the ACF Policy on Grants to Faith-Based Organizations at: http: //www.acf.hhs.gov/acf-policy-on-grants-to-faith-based-organizations.*** Applications from individuals (including sole proprietorships) and foreign entities are not eligible and will be disqualified from competitive review and from funding under this announcement. |

***Having said that, this site then goes about coaching faith-based organizations how to get around restrictions on their grant applications, in a variety of manner….. Another thing I believe this grant announcement makes clear is its intent that no “INDIVIDUALS” (or sole proprietorships) can get in on this. Talk about “redistribution at work….” who funds HHS to start with?

There are some new “re-Entry” programs (ReFORM), however this was my attempt to locate the actual grantees and grant awards referenced (in multiple places, including at Fatherhood.gov, at HMRF.ACF.HHS.gov, over at Grants.gov, and courtesy former Special Marriage Education asssistant (formerly HHS employee), Bill Coffin, who keeps others updated with this information that the general public, in election Year 2012, as in Election Year 2016 now, and in prior Election Years, most of them since 1996, is NOT, usually, “updated” about, if even aware of.

Unless you’re one of my local friends, networked with me or this blog, and/or over the years, have been just independent enough to recognize lone, and sometimes excommunicated bloggers and investigative journalists who chose to talk about it; and there ARE some (before me, and it is my intention — as a senior — there will also be some AFTER me….) If you hang with advocacy groups who limit your vocabulary, and world-views, chances are by the time this stuff is even mentioned, you’ve got a twenty-year history to catch up on, and do this understanding what “post-poned gratification” outside the learning curve actually represents.

I did the best I could in the past six years (with a time-out from posting Summer 2014 – January 2016, being under escalated personal attack at the time); it hasn’t been easy, but there have been SOME elements of fun, and it is more than well worth the effort. (Unless you define worth by immediate paychecks alone).

By “Funky,” I mean, among other things, the internal inconsistencies. Explained below, this is just a brief summary:

The organization in 2014 on page two reported several thousand dollars of profits (when comparing Revenues to Expenses under “Program Service Accomplishments,” which would show where “Program Service REVENUES” might exist. On the supposedly corresponding Part I (Summary), that line was blank. On the supposedly corresponding Part VIII (Statement of Revenues, Line 2) that line ALSO was blank. On the highest-revenue-producing programming ($392K of differences, Accomplishment 4d) which was not explained — at all — the “See Schedule O” (which I did) did not document any continuation of where this $392K of profit might have been run.

Then, in reporting their key employees etc. (Part VII) who are only three people paid anything, the total is over $250K, but the corresponding part on Part IX (just the page after next) was only $50K. Compare:

Part IX, IRS Instructions for entering a number on Line 5 is “Compensation of current officers, directors, trustees, and key employees” and the number entered was $50,680.

versus what’s showing in Part VII:

Part VIIA, Total (of only three employee’s figures): $249 ,194

(7) VIOLA JANUARY 40.00 EXECUTIVE DIRECTOR

(8) PHILLIPPIA C-FAUST 40.00 PROGRAM DIRECTOR

(9) TINA-R THOMAS 40.00 PROGRAM COORDINATOR

The three employees include Just One marked as an Officer, Viola January, and the only Officer in the organization (so -checked on that section): Viola January’s salary wasn’t $50,680 (in case someone mis-understood what the words “Officers, Directors, Trustees, and Key Employees” meant after having just identifying who’s who by checkmark), but $52,262. This means that either about $200K of Key Employee expenses were mis-labeled, or omitted, in their total expenses of $1.6M.

On Part IX, Line 11g, (11g representing non-employee professionals, and “g” being the “other” category under this

On running a name-search, advanced search of this organization AFTER writing most of the text and review of their fiscal filings for this Healthy Marriage/Responsible Fatherhood and ESPECIALLY interested in Abstinence Education group near Atlanta, Georgia, I pulled it off to separate post.

Because I typically look at the top return in a row (although I’d already wondered about the four results’ normally it’s three), and being busy in looking at that, I didn’t notice the switcheroo in EIN#s. NOW get this: HHS database TAGGS.hhs.gov (to the best of my awareness) never did display EIN# in search results, “no way, no how” but until very, very recently one could at least key in an EIN# under basic recipient search and get a result. That fill-in form no longer shows on the new improved, website. It might have been handy here!

Search Again

I just searched only the EIN# 15-8211626 at the same website and came up ONLY with the top row as shown above. I then went to the IRS “Exempt Organization Select Check” and clicked the first of three buttons “ARE ELIGIBLE TO RECEIVE TAX-DEDUCTIBLE CONTRIBUTIONS,” copying in the same EIN#, and came up with a blank — this EIN# is NOT listed with the IRS as eligible to receive tax returns (and I’m checking on May 2, 2016) YET the above tax return represents a fiscal year ended 12/31/2014 and $2.1M of “Government grants” received anyhow.

I then clicked in the other EIN# on the same IRS site (above) and came up with Eligibility Status “PF” which stands for “Private Foundation” in Conyers (not “Stone Mountain”) Georgia. However, as you can see, the above filings are Form 990s, not Form 990-PF. Here are the IRS results:

| Results Per Page |

« Prev | 1-1 | Next » |

Oh my goodness, this organization (website “WWW.MTCIGA.ORG” per the 2014 return, above) is “something else…”

Under the link “Media” The PSA for “Fatherhood” are two Youtubes, bottom left and bottom right. Neither one mentions mothers; they are titled: MTCI’s PSA: Father a Generation (showing a man) and on the right (showing a young woman in a padded chair wearing a T-shirt labeled “FUN”) Positive Parenting Month Testimonial.” If you start the video, it then displays “MTCI’s Mature Plus Program Presents…”

The PSA Fatherhood” has a brief (under 2-minute) close-up video of a man talking to his adolescent son, headshots only. At the end, it zooms out and shows the father in prison stripes, his visiting session over and this, voiceover, “A father’s presence should be felt regardless of where he is. Instead of a fatherless generation, let’s father a generation.“

Organization has been around since 1989, and it took me less than 5 minutes to find major reporting oversight (error) in, so far, TWO categories — no program service revenues were reported, but ALL program service accomplishments (page 2) show operating at a profit, which represents program service revenues! (second quote below) And, the Part VIIA paid people (only three) totaled about $250K in salaries (plus benefits) — yet in the corresponding section of Part IX, Expenses (line 5), only “$50K” (roughly) shows. Good grief! And they are almost exclusively dependent on government grants, too.

MORE THAN CONQUERORS , INC MISSION IS TO PROVIDE COMPREHENSIVE AND CONSISTANT* YOUTH SERVICES THROUGHOUT ITS COMMUNITY. MTCI HAS DEVELOPED , IMPLEMENTED , ADMINISTERED AND EVALUATED SUCCESSFUL YOUTH DEVELOPMENT PROGRAMS THAT HAVE SERVED MORE THAN 12,000 STUDENTS.

*(sic — “Consistent”)

Part III (on second page), “Program Service Accomplishments” shows three activities, for all activities Revenues exceeded Expenses — but this isn’t shown on Part I, Line IX, or in Part VIII, Line 2, where this type of information belongs. Copied from the year 2014 tax return, Part III (Page 2):

4a (Code ) (Expenses $ 673,067 including grants of $ ) (Revenue $798,798*

MATURE PLUS IS A YOUTH DEVELOPMENT PROGRAM FOCUSED ON THE DEVELOPMENT OF HEALTHY MARRIAGES AND RELATIONSHIPS. THIS IS ACCOMPLISHED BY OFFERING AN EXPANDED EXPERIENCE TO PREGNANT OR PARENTING TEENS IN SETTING THAT INDICATE POOR FAMILY RELATIONSHIS. THESE SERVICES INCLUDE A COMPREHENSIVE ASSESSMENT OF JOB TRAINING AND SKILL DEVELOPMENT THAT WILL PREPARE THEM FOR THE WORKFORCE.

*$798,798 (odd #) – $673,067 = $125,731 Revenues (profit)

*On further lookups this EXACT number ($798,798) of Revenues occurs in the 2013 Tax Return also, on this return, it showed as Program Service Accomplishment 4b (“Collegiate Health Awareness,” below was 4a) I’ll omit the blue borders & font change to indicate, different IRS form:

4b (Code )(Expenses$ 736,298 includinggrantsof$ )(Revenue$ 798,798 MATURE PLUS IS A YOUTH DEVELOPMENT PROGRAM FOCUSED ON THE DEVELOPMENT OF HEALTHY MARRIAGES AND RELATIONSHIPS. THIS IS ACCOMPLISHED BY OFFERING AN EXPANDED EXPERIENCE TO PREGNANT OR PARENTING TEENS IN SETTING THAT INDICATE POOR FAMILY RELATIONSHIPS. THESE SERVICES INCLUDE A COMPREHENSIVE ASSESSMENT OF JOB TRAINING AND SKILL DEVELOPMENT THAT WILL PREPARE THEM FOR THE WORKFORCE. IN 2012, THE MATURE PLUS PROGRAM SERVED OVER 200 PARTICIPANTS.

Boilerplate phrase remains the same. Note that the 2012 statistics were reported on the Fiscal Year 2013 return… Makes no sense, right?

4b (Code. ) (Expenses $ 552,542 including grants of $ ) (Revenue $ 652,045

THE COLLEGIATE HEALTH AWARENESS MESSAGE PROTECTING STUDENTS PROJECT (CHAMPS) IS A YOUTH DEVELOPMENT PROGRAM FOCUSED ON INTEGRATING STRATEGIES THAT WILL REDUCE TEEN PREGNANCY. CHAMPS UTILIZES AN EVIDENCE BASED MODEL THAT INCORPORATES MULTILPE COMPONENTS SUCH AS PERSONAL DEVELOPMENT, ACADEMIC SUPPORT AND COMMUNITY ENGAGEMENT.

*$652,045 – 552,242 = $99,803 Revenues (profit)

4c (Code: ) (Expenses $ 184,711 including grants of $ ) (Revenue $ 249,555*

THE HOPE PROJECT TARGETS AT RISK YOUTH (AGES 14-19) IN THE MOST IN-NEED HIGH SCHOOLS AND COMMUNITY SITES. THE HOPE ABSTINENCE PROJECT STRIVES TO SERVE 1200 PRIMARILY IMPOVERISHED AFRICAN -AMERICAN AND LATINO STUDENTS OVER TWO YEARS. THE PROJECT INTENDS TO REDUCE TEEN PREGNANCY, BIRTH AND STD RATES IN THE AREA BY PROVIDING IN-SCHOOL, AFTER SCHOOL AND SUMMER INSTRUCTION AND ACTIVITIES USING THE WAIT TRAINING CURRICULUM

*$249,555 – $184,722 = $64,833 Revenues (profit)

From the organization’s website, there is no mention of “The Hope Project” but there is a “PEER PROJECT” using the WAIT Training Curriculum (“WAIT Training comes out of Colorado — see yellow-highlit row above (The Center for Relationship Education) and I have blogged it herein. (Joneen Krauth? MacKenzie).

Before I quote that, note that for the year 2013, it would appear that the HOPE project was the big revenue-producer. Perhaps also was the big revenue-producer for 2014, only categorized as “Other” and not reported on Schedule O, as it was supposed to have been….). Here’s the paragraph from Year 2013 (EIN# being a different one, #582116261 and not the same as for 2014….)

4c (Code )(Expenses $ 33 ,266 Including grants of$ )(Revenue $ 241,696 THE HOPE PROJECT TARGETS AT-RISK YOUTH (AGES 14 – 19) IN THE MOST IN-NEED HIGH SCHOOLS AND COMMUNITY SITES. THE HOPE ABSTINENCE PROJECT STRIVES TO SERVE 1,200 PRIMARILY IMPOVISHED AFRICAN-AMERICAN AND LATINO STUDENTS OVER TWO YEARS. THE PROJECT INTENDS TO REDUCE TEEN PREGNACY, BIRTH AND STD RATES IN THE AREA BY PROVIDING IN-SCHOOL, AFTER SCHOOL AND SUMMER INSTRUCTION AND ACTIVITIES USING THE WAIT TRAINING CIRRICULUM.(sic)

I assume my readers can “eyeball” Expense of approximately $33K and Revenues of Approx $241K, remember their multiplication tables and that, if you are basically looking at 3 X 8 = 24, or that 24-3= 21, 21/3 = 7. You are basically looking at a seven-fold increase of REVENUES over PROFITS. ERGO, this is a tax-exempt running (for profit), the WAIT TRAINING CURRICULUM — in Atlanta, Georgia area, doing this through an HHS-dependent nonprofit, and HHS and the HHS/OIG (Office of Inspector General) is allowing this through benign non-monitoring. As HHS is also heavily funding the nonprofit in Denver which PRODUCED the “WAIT Training,” til further reason to believe otherwise, I am assuming (also from so many parallel situations across the HMRF grantee sectors), that HHS (that is to say, “our leaders”) is in on it.

Or then again, perhaps “HOPE” just got re-named….

Description of the PEER project reads like this on the MTCIGA.org web page:

This project serves a minimum of 200 Rockdale County high school students and community youth, both male and female, aged 14-19 over the live of the grant (200 participants annually). The PEER project targets those students that are most at risk for involvement in risky behavior, including those from the most impoverished communities such as students with histories of academic failure, skipping school, disciplinary issues and students residing in group homes and foster care systems. __________

The foundational services will be the implementation of WAIT Training, a promising program, as identified by the HHS Abstinence Evaluation Conference. This curriculum has also been reviewed and approved by the local sexual education committee and parents for use within the Rockdale County public school system and will provide the basis for the lessons taught as part of the PEER project. WAIT training is a dynamic, interactive curriculum that provides essential information for students to make healthy choices in their relationships. This practical and affirming program addresses sexual pressures currently confronting young people and is the ideal complement to the Georgia Department of Education performance standards ._______

This is where the form itself looks odd, compared to most I’ve been reading. Usually, there are some blank lines (as I recall, not 100% sure) under item “4d” but this form has multiple blank lines under 4a,b & c and almost no space under 4d. In other words, the normal look for this page would be space to fill in 4a,b,c,d and THEN “Other.” Perhaps they didn’t wish to call attention to the profit being earned under “See Schedule O” “Other” — which was proportionately the highest revenue-producer of all, close to Page 1 of the return which indicates 0 profit made under Program Service Revenues….

4d Other program services (Describe in Schedule O )##

(Expenses $ 71,221 including grants of $ ) (Revenue $463,937*

Total program service expenses ► $ 1,481,541

*$463,937 – 71,221 = $392,716 Revenues (profits) for Services “4d/Other”

(Too bad the form doesn’t prompt for “Total Program Revenues” on the same page. Perhaps the IRS doesn’t wish attention to be called to this, either. If there were such a blank to fill in, based on the sum of 4a,b,c & do on this page, totaling $125,731 + $99,803 + $64,833 + $392,716, it would look like this:

Total program service revenues ► $ 683,803

$683,803 / 1,481,541 = 46.1% That’s a lot to omit on Part I Summary and Part VIII Revenues!

Other Tax Return OMISSIONS — how they earned There IS a “Schedule O” attached to this tax return (last page, a single page), but it says nothing about the “other program service activities,” which leaves nearly $400K or revenue unexplained under 4d: Check yourself (this is same link as in the table, top line): Bolded “201412” is the Year and Fiscal Year-end Month (“12”). Maybe some other database has a more complete year 2014 return, but at this point, I’m not hunting for it. http://990s.foundationcenter.org/990_pdf_archive/158/158211626/158211626_201412_990.pdf?_ga=1.233193819.498400656.1461724132

Activity 4d, “Other”…..$71,221/$463,937 = only 15.3% This means that for that activity that year, a 15.3% investment yielded an 84.7% profit. NOT BAD for an HHS-supported tax-exempt in operation since 1989!

The business model of running HMRF curricula is, FYI, a HIGH-PROFIT revenue. The brilliance of incorporating this theme into the welfare budget itself, nationwide, is to be able to make such profits with THE PUBLIC funding the operating budgets, and at times (for some organizations) capital (“i.e., “Capital Compassion Grants” is another CFDA# seen at times), and then apparently SOMEONE is being charged SOMETHING to produce $463,937 for undescribed services (See below re: “See Schedule O” (in 2014), so others can be billed for what’s already been covered by HHS, in the State of Georgia.

Still on one little HMRF Grantee in Georgia….

Street address from TAGGS (2015 grants) doesn’t match the Return’s Street address (top row)

More Than Conquerors, Inc. street address (per HHS TAGGS == and Redfin) is estimated worth just under $100K, it’s a 3-bedroom, just under 2000sf single-family home built in 1969. Think a few million $$ over 5 years of HHS grants — less operating expenses of running HMRF curricula or programs plus any salaries (assuming that the homeowners might be also on the Board and taking part of the salaries) might help make the mortgage payments? Another source calls it an investment property with estimated return of 6.9%. While it doesn’t have sale history PRICE, it does show that the property was sold in 2007, and again in 2014. A chart of neighborhood property prices, shows the graphs plumetting to around $100K in 2010 (not surprising — see “recession of 2008”) and rising steeply to $150K in 2014. That’s significant increase — and the HHS grants to this organizations started in 2010 (through so far, 2015)….

“MTCIGA.org” “HISTORY” Page (light-gray font, but long) shows historic collaboration with Rockdale Medical Center (receiving the grants), Schools, Coalition of Churches in the area, and while other services were provide, throughout the focus has been HEAVILY on Abstinence Education. This is just a part:

HISTORY OF MTCI

More Than Conquerors, Inc. (MTCI) is a 501(c) 3 non-profit, faith-based ministry formed in 1989 as a community outreach for the people residing in DeKalb County, Georgia. We were charged to serve those who were asking for help with life-controlling problems. Initially, MTCI provided ongoing counseling and weekly support groups. In 1996, a community Social Service Director was appointed. Under his leadership, a community food bank and clothes closet was set-up in the Lithonia community. Additionally, financial assistance for rent, utilities and transportation to social assistance appointments was implemented. Collaboration was established with the South DeKalb Church Coalition of Churches to develop and implement a continuum of social assistance services.

More Than Conquerors, Inc is governed by a six-member Board of Directors. The mission is to improve the capacity of young people in Metropolitan Atlanta to form safe and stable families sustained through a network of support. View our Board Page Here

Interesting, because in 2014 tax return, only three women were paid, and one was paid only about half of the other two. Then, where these totals (in more than one column) were supposed to have been transferred over to Part IX, Statement of Expenses, they were understated by about 80%. This despite the “History” page stating they’d been independent (from having another entity as their “fiscal agent”) and had gotten a CPA. What kind of CPA can’t fill out a tax return showing they understand the relationship between the various parts, and that it should be internally consistent?

This next, UNBELIEVABLE description of their dealings with DeKalb County agency and Rockdale Medical Center (as a fiscal agent for abstinence grants) in a symbiotic relationship: MTCI stood for the “community concerns” of the larger funders, and the larger funders, obviously gave the funds to MTCI –they describe “obtaining a bank account” as preparing themselves for independence — and it appears to be somewhere around 2006. The time frame is then clearly 10 years after welfare reform (1996-2006)… the focus is on continuing to encourage teens from refraining in having sex…

In 1998, MTCI began its adolescent program in response to the numbers of first time and repeat pregnancies among the community’s teens who were presenting themselves and asking for help. The abstinence program directed teens toward understanding their physical, emotional and academic development, while enhancing their resistance skills in regard to participating in unhealthy risk behaviors such as sex, alcohol and drugs.

We began to participate in community functions that had a youth focus. We joined DeKalb County Teen Pregnancy Prevention Task force. This facilitated the collaboration with DeKalb Health Department’s Youth Development program.This partnership allowed access to conferences and programs sponsored by Adolescent Health and Youth Development. Service opportunities expanded to provide education and support to the Drug Court parents on strategies for parental involvement encouraging teens to choose abstinence. The teens were exposed to comprehensive risk avoidance strategies designed to impact character-based decision making. Selection of three high schools (Redan, Cedar Grove and Lithonia) and two middle schools (Redan and Lithonia) to provide abstinence until marriage education that directed teens toward goal setting, decision making and refusal skills was implemented. Between 1998 and 1999, MTCI managed and delivered programs for local governments and agencies. These included awards from The Status of Health, DeKalb’s Neighborhood prevention project that addressed nutrition in pregnant adolescent with an emphasis on abstinence. Each goal and objective outlined in the prevention project was successfully meet. The financial management and accountability for fund disbursements met the standard established by the funding agency. Periodic reviews were conducted to address regulatory and liability concerns.

{{Keep reading. How was this done without, apparently, a banking account under their own corporate name, I wonder…}}

In 1999, we formed a partnership with Rockdale Medical Center in an effort to secure federal funding for abstinence education. The Adolescent Health & Leadership Project (A-HELP) @ Rockdale was initiated as an abstinence until and in preparation for marriage education strategy promoting marriage as the best and only legitimate place in which to have and rear children.

This is a self-described faith-based group. In DeKalb County, Georgia. Is this entirely surprising? But, ti does sound more than a little obsessive — the year is only 1999….

In 2016, Rockdale Medical Center in Conyers Georgia is part of “Lifepoint Health Company” (add “.org” to the name, with no spaces, and that’s the link). I went looking under its “Community Benefit Reports” posted since year 2009, and elsewhere for anything relating to abstinence education, or which references MTCI, but so far have come up empty. The related company name (bottom, fine print) is “LifePoint Hospitals, Inc.”

Rockdale Medical Center

1412 Milstead Avenue

Conyers, GA 30012

770-918-3000

Copyright ©2016. All Rights Reserved.

Here’s (some of) the fine print at the bottom of a Community Report 2011: LifePoint(r) Hospitals, Inc. (out of TN) has hospitals in 18 states….

Rockdale Medical Center is part of LifePoint Hospitals®, a leading hospital company focused on providing quality healthcare services close to home. Through its subsidiar- ies, LifePoint operates more than 50 hospital campuses in 18 states. With a mission of “Making Communities Healthier,” LifePoint is the sole community hospital provider in a majority of the communities it serves. More information about the Company, which is headquartered in Brentwood, Tennessee, can be found on its website LifePointHospitals.com.

Where are the corresponding HHS grants records? Incidentally, “Community-Based Abstinence Education” over at HHS (and “Grants.gov” etc.) is not “CFDA 93086, but another CFDA which can be looked up. I DNR offhand whether the SOURCE of these funds, however, might not still be TANF (i.e., the same source used for food stamps, cash aid and other “Assistance to Needy Families”

LifePointHospitals.com apparently became “LifePointHealth” at some point in time, and is an “investor-owned” hospital (??).

William F. Carpenter III is Chairman and CEO of LifePoint Health. He has served as CEO since 2006 and assumed the additional position of Chairman of the Board in 2010. He is a founding employee of the Company, which was established in 1999, having previously served in various roles, including Executive Vice President and General Counsel. Mr. Carpenter has served in leadership positions for many influential industry organizations. He is secretary and past chairman of the board of directors for the Federation of American Hospitals, the national public policy organization for investor-owned hospitals. He is a member and past chairman of the Nashville Health Care Council Board of Directors and also serves on the boards of directors of the Nashville Area Chamber of Commerce, the Tennessee Governor’s Foundation for Health and Wellness, and the Center for Medical Interoperability. A recognized leader in the healthcare industry, he has appeared on Modern Healthcare magazine’s annual “100 Most Influential People in Healthcare” list numerous times.ospitals (in 2011) appears to now be LifePointHealth (URL redirected to this site), “Making Communities Healthier®.” Interesting Executive Board — their CMO (only joined in 2013) hails from Minnesota. Wm. F. Carpenter is also on the regular Board and a Founding member. One member has a background that includes “Psychiatric Solutions, Inc.” which as I recall may relate to someone currently on the board of Providence Services Corporation (See my 2016 Post “NCJJ: About that Find” or similar title).

About this time I’m starting to remember Georgia’s “Phoebe Factoids” scandal, involving a for-profit hospital, a chiropractor and CPA who took on the over-charging, and found themselves quickly needing a bodyguard. A District Attorney and plenty of others were involved, and I do recall it being posted here. (Use Archives, Search, or there may even be a tag to find where). The relating issue being not just the state, but for-profits hospitals.

HHS/HRSA/MCH (Maternal Child & Health) has a Project LEAH of similar name, but not target grantees; it is aimed at training professionals as Leaders in Education in Adolescent Health. The site references universities involved.

Click to access factsheet-LEAH.pdf

LEAH projects ($8+M so far per TAGGS) are CFDA 93110, are aimed at professional education, and I don’t see that any institution in Georgia is involved. TAGGS saved search. Abstinence education comes under Operating Division “HHS/ACF” not “HHS/HRSA…”

Unfortunately I do not have time to finish looking for these grants at HHS, or communicating what else I have seen on the tax return of MTCIGA.org, which another person who paid some close attention to the tax return alone, would understand, I believe, raised several red flags about this HHS-dependent nonprofit. Another place to look might be the incorporation history.

HHS shows NO grants (Only Select = State of Georgia) to “Rockdale Medical Center.” I’m not up for a nationwide search given HHS’ record in not getting grantee names straight, or award names spelled straight EITHER, for what is referred to here. What’s more, I just now scrolled, twice, through all the displayed “CFDA Program Numbers” at TAGGS.hhs.gov, looking for “Community Based Abstinence” (while only “GEORGIA” was selected otherwise) — which scrolling isn’t exactly obvious or easy to do on their new database — and didn’t even see it!

In the first year, A-HELP was invited to give classroom presentations on teen pregnancy and STDs. In 2000, Teen Centering, which targeted pregnant/parenting teens, began in an OB practices in DeKalb, expanding to Newton County in 2001. In 2003, under the fiscal leadership of Rockdale Medical Center, we receive a one-half million dollars three-year federal grant which afforded expansion into the classrooms for entire semesters system- wide in Rockdale County, and added group homes. During that thee-year period, A-HELP reached greater than 5,500 (unduplicated count) students providing them more than 25,000 exposures to abstinence. Additionally, greater than 3,000 subset populations in the community were encountered through mock weddings, abstinence training’s and community events.

In 2004, MTCI received a federal capacity grant which afforded the organization the opportunity to build infrastructure such as organizational development and financial skills. After the completion of that grant, MTCI continued to build the necessary capacity to meet all of the responsibilities inherent in being a fiscal agent.

In 2006, under the fiscal management of Rockdale Medical Center, we again received a federal grant. The Healthy Marriage Grant awarded over two million dollars for five years for the purpose of sharing the value and advantages of marriage and healthy relationships with high school students through the MATURE Project. The project served in 9 venues, which translated to over 50 classes per week and 2,000 students per year. We also we trained and mentored students as peer educators and hosted several community events each year.

MTCI and Rockdale Medical Center enjoyed several years of a mutually beneficial relationship, as MTCI provided the management of community-based projects that provided Rockdale with an excellent opportunity to demonstrate their commitment to meeting a wide range of needs that go beyond medical treatment for the local population. During the course of this relationship, Rockdale acted as the banker for the projects, accepting all grant finds and dispersing them in accordance with the requests made by MTCI. MTCI provided all of the other supervision, management and direct services for the federally funded grant projects that were offered as a result of this partnership. To prepare for additional grant management responsibilities, the organization forged a relationship with a CPA, established a banking account, as well as accounting and funds management procedures

Unbelievable — they finally got a bank account ca. 2010? (Read next quotation of this color background) What was happening in all the prior years, then?

I went on a final look for the CFDA for Abstinence Education (which I’d seen before, but had forgotten). Why? That HHS TAGGS had dropped it from their listings covers up the public’s ability to do any historic search on such funding to specific organizations, or even to all organizations. A google search reveals that the number (one of TWO CFDAS aimed at Abstinence Education) was 93.0110. I found a “Single Audit” site (can’t speak for what it is, just found it), which notes the program was dropped in 2010:

https://singleaudit.org/program/?id=93.010

CFDA Historical Index

- 2005: Community-Based Abstinence Education (CBAE)

- 2015: Archived

The local organizations below have received funding through this program. This list is not comprehensive.

Fiscal Year End 2013 2014 2015

None found for this program.

Reported Expenditures

Fiscal Year End 2013 2014 2015

Expenditure Metrics

Fiscal Year End 2013 2014 2015 {(= Column headings). So 2013, 11 recipients, 2014 6, 2015, 3, etc.) }

Number of award recipients 11 6 3

Number of awards audited 5 3 2

Number of awards with findings 1 0 0

Percent of audited programs with findings 20% 0% 0%

Percent of awards reported as R&D 36% 50% 67%

Note: This information has been compiled from data collection form submissions to the Federal Audit Clearinghouse, Harvester.census.gov.

Note 2: This information is updated periodically and may not include recent data collection form submissions

Program Objective

To promote abstinence education, as defined by Section 510(b)(2) in Title V of the Social Security Act, for adolescents aged 12 through 18. The entire focus of these programs is to educate young people and create an environment within communities that supports teen decisions to postpone sexual activity until marriage. The CBAE program was discontinued in FY10. No new funds will be available and no new awards will be made.

Under TAGGS “ADVANCED” Search site, there is no visible way to key in a CFDA # which HHS has decided to remove from their list. The only blanks near the top, you must know Award #, Award Title#, Abstract Text (if there is any Abstract; many awards have none) or Principal Investigator name). For CFDA, you can only click on the one’s shown, not manually type in one NOT shown. On “Basic Search” there is a generic “Keyword or Award” blank (or similar title), but not under Advanced. Talk about making it HARD TO FIND!

I typed in “93010” as “Keyword, selecting Georgia, and got these grantees for CBAE. Sorting by Recipient Name, I don’t see this one — or Rockdale Medical Center. Obviously this is a minor look-up project to locate, which I’m not up for (not a high priority) just now. Hope I made my point, though!

To be continued

Jennie C. Trotter, M.Ed. Executive Director and Founder

Jennie C. Trotter, M.Ed. Executive Director and Founder

Leave a comment