The Stacked Deck, the Coups d’Etat, and the Fork in the Road.

2016 Post Cleanup Update: Posted Feb. 25, 2014, on review I see this has an entire section on CFCC and the California Judicial Council’s website describing Access Visitation Grants (and a lot more), as well as CalPERS (history), Council on Institutional Investments, and of course, the use of Business ROUNDTABLES to sequester the real decision-making in the “power elite.”

I’m quoting other sources which, unfortunately, make nearly no mention of taxation vs. tax-exemption (one of my key themes, being highly aware of the power of tax-exempt organizations to cloud money movement from the public, utilizing multiple front organizations, chameleon organizations, and “take the money and run” organizations. That’s in additino to the entire assets-acquiring-stockpiling religious-exempt sector who don’t even have to show their tax returns to the rest of us. //end 2016 update commentary:

I am so used to summarizing situations for strangers, on the phone, for people who have decided to network, and pick up this ball (and run with it — in various states), I often end up summarizing the material — in a sidebar widget. One reason I do this — I’m tired of summarizing the material one by one, and on the phone. If it’s not clear from the blog, then — well, too bad!

NOT the best idea.

However, this post supplements one of my sidebar [widget] long, narrow, narratives — one that reads Contributions Welcome — which they are. I’m incorporated as a nonprofit, so they’re not deductible, nor are there many of them. Intentionally so, given what I’ve seen of nonprofit funding — and also for more flexibility; I’m not a joiner, seek to avoid group-think; I just want this material written up to discover who else may be interested in strategizing for change.

And what we need to change is the system of taxes creating for-profit and not-for profit corporations to start with, which makes it impossible to track where ALL government funds (collectively) are going. That alone (let alone other factors) means we can’t humanly know what we have invested in through our contributions to government for those who work. It also stacks the deck away from those who pay taxes (except upper-bracket incomes, or those with other income streams) and towards the the wealthy and influential.

So, after considering how to incorporate, I decided against a 501(c)3. Smaller amounts will help pay for basics for me, the blogger — and as possible for some platform upgrades (I have two in mind, neither too pricey) and after material is in good enough shape, some PRWire press releases, etc. I’m not trying to turn this into a livelihood — just preserve the record, and to silence some of the groups which have censored this information and, in so doing, discouraged individuals from getting their comments in on time to, say House Appropriations Committee on welfare-reform issues (for starters).

Essentially, once I start talking, I am going to be talking about the context and citing examples, evidence, and lay down a challenge.

Look, across society in the USA, things are sliding downhill fast, and knocking people out of the competition along the way.

Did anyone see this competition, recently?

(link to article below). It has been compared to a demolition derby. However –notice these people have snowboards, jackets, boots, and helmets. They know when they push off, they might get taken out in a moment, maybe even injured — but they will get up and race again another day. they may not know the whole course, but they know there’s a finish line. They have sponsors, team-mates and a training regime.

Not so for our nation as a whole. We have public schools, we have education THROUGHOUT this system and we have been induced to pour billions into the “training” functions of almost every major federal agency, while the same continue to misplace trillions (this post, below), especially the Dept. of Defense and Housing and Urban Development (HUD). My category in this subject matter is moreso HHS and to a degree, DOJ.

But we are deliberately NOT being brought into the planning sector — which has been compartmentalized by profession, then centralized through affiliations and institutionalized into leadership from certain universities, which then maintain loyalty to their own (while collaborating on how to run the world). The leverage has been moved away from individuals.

DOWNHILL SLALOM SNOWBOARD CROSS, SPEEDING, JUICED UP ON LIES, “STARVATION SLOPE” — and we funded this ourselves, and facilitated it, too.

While some sectors are prospering, they are doing it at the expense of others and because of positioning in the market, or previous positioning in the market. The market is affected by the caste system enabled by the tax system, which sets up nonprofits for some and wage deductions (for taxes) for others; and wage deductions AND child support garnishments for others.

For yet others, their assets (or, if they had none, children) are being stripped out simply through the family courts, conciliation courts and/or “Unified Family Courts,” with presiding judges strapped into the “AFCC*/CRC**/NACC/*** “CFCC” etc. system.

All of those except “CFCC” refers to a nonprofit association being used to lobby for legislative changes affecting the federal (and from there, state, local, county, etc.) fundings. “CFCC” means “Center for Families and Children in the Courts” [or a version of that phrase] and “CFCC” centers can be found, well, a major one in California under the AOC (Administrative Office of the Courts); another one at a law school at UBaltimore, Maryland, and no doubt there are more, some probably at other universities. The phrase has caught on, and until any specific one is examined, we don’t know its corporation, or funding, status. BUT, that “CFCC” connection is important — because it centralizes influence in some respectable institution.

CFCC in California — the label isn’t even on the website banner but does show on the lower right side under “contact info” The website — and it’s a government website — says:

This section includes resources and program information in the areas of Family and Juvenile law. It also includes conference materials and a comprehensive list of publications produced by the Center for Families, Children and the Courts (CFCC).

but the contact information reads:

CONTACT INFO

Center for Families, Children & the Courts

Judicial and Court Operations Services Division

Judicial Council of California – Administrative Office of the Courts

Ph: 415-865-7739

Fax: 415-865-7217

E-mail: cfcc@jud.ca.gov

And at the VERY bottom of a complex (multi-link, lots of texts, and left-sidebar, center, and right-sidebar) web page:

FAMILY LAW

- Access to Visitation

- Child Support

- Family Dispute Resolution

- Unified Courts for Families/ Court Coordination

JUVENILE LAW

So, when I say, again:

For yet others, their assets (or, if they had none, children) are being stripped out simply through the family courts, conciliation courts and/or “Unified Family Courts,” with presiding judges strapped into the “AFCC*/CRC**/NACC/*** “CFCC” etc. system.

Each of those is an element in a system designed to steer and access federal money (grants, or contracts) into programs. People involved have overlapping (vertical and horizontal) relationships among the whole. In the above link: Access/Visitation: FEDERAL FUNDING (GRANTS CFDA 93.597) Social Security Law, etc.

All government operations, of course, are going to cost something — there are courts, there are courthouses, there are people who must staff the courts ,paperwork software systems (Security personnel — weapons-screening for the courthouses!), and so forth. We understand that the courts are of course part of government.

However, when I say that Government Itself has become a private corporation — and am referring specifically to the operations that deal with divorce, families and children, custody and/or child support (which is to say — for the most part — they are dealing PEOPLE). Think, for a moment, about just how many “people” may have within range of an immediate relative, or their own household, or their immediate neighbor, employee, or boss — someone who’s been run through the gauntlet on those issues, and may be paying child support.

The programs are literally targeted to the entire population of a state, just about — as a human market niche, and using multiple distribution streams for a very FEW basic philosophies, most of which have their origins in: social science, religion, or psychology. These are then connected to pharma, institutional, and big bucks economics. How big is that?

And as this AND other state using government websites to market private products — you have NO IDEA until you start looking at some of this. I have an idea because I have been looking, and I have seen just how single corporate products (with a very few updates or tailoring for each new market segment). The research AND testing is done at public expense with private injections — they are field testing what works for mass behavioral change. BUT, even if it doesn’t work, the money is STILL for the most part, made up front through grants!

Because most of this post, I want to talk in the macro, larger sense (to show “Coups d’Etat and The Fork in the Road) — I’m moving the “STACKED DECK” conversation, which I again just wrote out — off post. It’s too large otherwise.

It’s also fascinating information.

The”Stacked Deck” designed to produce exactly what it has been producing — this downhill slide and eventually elimination of a “middle class” in favor of starving masses, and those who get to chose among them for laborers — in association with the bystanding professional classes still needed to run various businesses. As corporations have product, government institutions have “outcomes.” If you don’t believe this — read their language!

As technology outpaces human beings’ ability, or should I say, desire and decision-making ability, to USE their own minds intelligently, those professional classes may be fewer than before. If you’re in this position, reading my blog and think, “well that’s not ME and my family line” — don’t be too sure. You’re being used now. What is done with products (including human capital) who have outlived their usefulness, in our culture? Dumped or recycled, or sold off right? Just like divisions of corporations who are nonproducing….

So if you’re further up the hill, presently, I’d appreciate your ear, and participation in making some changes to this business model involving human capital and what looks like engineered breeding programs for domesticated labor force (with dissidence bred out of the breeding stock).

The Stacked Deck = the Racket/eering

= about the FEDERAL BUDGET = about TAXES.

Because taxes produce revenues. They are taken from some, exempted from others, enabling them to consolidate power and preserve family (private) wealth with which to influence government, and they are simply evaded by yet others — often characterized on websites as a nonprofit or charitable organization.

It takes several people operating systems elements in place to pull it off, over time. Anyone who refuses to look at these elements in combination with each other will not see the operational ‘schema,” let alone have any words (or paradigms/pictures) to describe it with.

It’s also impossible to describe unless people will get at least a few basic terms straight, and know which are basic concepts, and which are the icing on the cake, or just “a piece of the pie.”

On the other hand, if people WILL get a few terms (at least) straight, they can make more sense of the whole.

The one critical difference between AFCC and the others (and its various chapters) is that CRC and NACC, with cross-relationships among the founders (I.e., Jessica Pearson et al. — who is also currently running CPR in Denver (contracts with federal government to evaluate how well the programs of the others are running, including child support, fatherhood, mediation, access visitation etc. are getting their ends accomplished) — is that AFCC as a coherent corporation hasn’t been a continuously incorporated one over the years. This has been known for about fifteen years now (since 1999) and has been tolerated and essentially ignored — no one prosecuted, no one sat on them, no one forced compliance. MOREOVER, the federal funding has ALSO been known — but not stayed on the front burner of advocacy groups (whether court reform, child abuse prevention, or even domestic violence) groups. The public has been weighed in the balance and found — dumbed down. ONLY the public can organize itself to stop this mess.

Have you watched the Olympics, the giant slalom, or the Snowboard Cross (a.k.a. demolition derby) where six people race down the hill starting all at once, and by the end, typically, someone has taken out two or three en route; one “oops” by a speeding snowboarder can take out two others on the way down, letting perhaps less skilled but more fortunate speedsters make it to next round. BUT, this is known in advance, and trained for. They wear helmets. It’s part of the deal and for the thrill and glory:

Olympics Recap: The brilliant wipeouts of Snowboard Cross. Plus: A touch of Seacrest!

By Darren Franich on Feb 19, 2014 at 3:39AM

Image Credit: Cameron Spencer/Getty Images (= article link)

NBC’s primetime Tuesday coverage of the Olympics was filled with chilly thrilling spills, as crazy weather bedeviled crazier sports. The women competing in the Alpine Giant Slalom faced rough terrain, while the men competing in Snowboard Cross faced rough terrain and the fact that Snowboard Cross is basically a demolition derby without any safety protocols. Summer Olympians Lolo Jones and Lauryn Williams crossed over into a whole new weather pattern, competing in the Women’s Bobsled (or “Bobsleigh,” as they call it in Westeros.)

Well, many of us were thrown into this race without adequate practice drills, and we’re further down hill.

THIS BLOG is my consistently calling out “Look Ahead” to those who haven’t slidden so far into marginalized America; that there is a dumping ground at the end. Would this have been appropriate before people were herded into trains to go to labor camps half a century ago, plus some?

What if the same individuals, corporations, and practices were involved in organizing the WORKFORCE in America today? With the same agenda? Would it be, still, “OH NO! That can’t be – not here.”

Well, so much for the concept of learning from history and noticing similarities. ANYHOW, some concepts are simply basic — and wealth attracts wealth (but can be stolen) and pooled wealth has more clout than unpooled. Poor people attract others who want to use them for social science experiments, or some agenda, like (there’s no end of causes for which the poor can be used because face it — who’s defending them?? Law enforcement? Rule of law? Our Courts? Our social services network? Our religious institutions?

[Just thought I’d ask…]

THREE SOURCES ON “FINANCIAL COUPS’ D’ETAT”

REFERRING ESPECIALLY TO THE UNITED STATES:

[Above my economic literacy pay grade, other than the general trends, but articles from: March 2010 [globalresearch.ca], notice the timeframe they’re talking about:

I hope given the severity of the situation Mr. McGraw will not have a problem with me quoting so much; it also relates to the other quotes (which will affirm parts of this) on the page. Also note — for a LOT more links within the text itself (not just in para. 1 listing the other parts), see the original page. In this is style resembles Carl Herman’s, who includes many links within the text when discussing pension funds.

The idea is you scan (read!) the text, and pick up on the themes.

I – FROM “GLOBALRESEARCH.CA”

(THIS IS THE LONGEST):

The Financial Coup d’Etat: Consolidation of America’s Economic Elite

PART IV, David McGraw:This is the fourth-part of a six-part report. Part one can be viewed here, part two here, three here.

just a quick quote from Part One:

The American oligarchy spares no pains in promoting the belief that it does not exist, but the success of its disappearing act depends on equally strenuous efforts on the part of an American public anxious to believe in egalitarian fictions and unwilling to see what is hidden in plain sight.” — Michael Lind, To Have and to Have Not

I: ”Economic Terrorism”: Surveying the Damage

America is the richest nation in history, yet we now have the highest poverty rate in the industrialized world with an unprecedented amount of Americans living in dire straights and over 50 million citizens already living in poverty. The government has come up with clever ways to down play all of these numbers, but we have over 50 million people who need to use food stamps to eat . . .

The percentage of ‘underwater’ loans may rise to 48 percent, or 25 million homes.” Every day 10,000 US homes enter foreclosure. Statistics show that an increasing number of these people are not finding shelter elsewhere, there are now over 3 million homeless Americans, the fastest growing segment of the homeless population is single parents with children. . . .

One place more and more Americans are finding a home is in prison. With a prison population of 2.3 million people, we now have more people incarcerated than any other nation in the world – the per capita statistics are 700 per 100,000 citizens. In comparison, China has 110 per 100,000, France has 80 per 100,000, Saudi Arabia has 45 per 100,000. The prison industry is thriving and expecting major growth over the next few years. A recent report from the Hartford Advocate titled “Incarceration Nation” revealed that “a new prison opens every week somewhere in America.”

A Crime Against Humanity

The mainstream news media will numb us to this horrifying reality by endlessly talking about the latest numbers, but they never piece them together to show you the whole devastating picture, and they rarely show you all the immense individual suffering behind them. This is how they “normalize the unthinkable” and make us become passive in the face of such a high causality count.

[[…AND from a link within there]] Molitor, the suburban Chicago therapist, says she’s noticing physically abused spouses staying in marriages because the economy has shrunk their options. “More people are living in homes that are kind of like tinderboxes now — they blow up every once in a while,” says Karen Myatt, a divorce lawyer in Fort Lauderdale whose practice is shifting to domestic violence.]]

The war against working people should be understood to be a real war…. Specifically in the U.S., which happens to have a highly class-conscious business class…. And they have long seen themselves as fighting a bitter class war, except they don’t want anybody else to know about it.” — Noam Chomsky

As a record number of US citizens are struggling to get by, many of the largest corporations are experiencing record-breaking profits, and CEOs are receiving record-breaking bonuses. How could this be happening; how did we get to this point?

The Economic Elite have escalated their attack on US workers over the past few years; however, this attack began to build intensity in the 1970s. In 1970, CEOs made $25 for every $1 the average worker made. Due to technological advancements, production and profit levels exploded from 1970 – 2000. With the lion’s share of increased profits going to the CEOs, this pay ratio dramatically rose to $90 for CEOs to $1 for the average worker.

As ridiculous as that seems, an in-depth study in 2004 on the explosion of CEO pay revealed that, including stock options and other benefits, CEO pay is more accurately $500 to $1.

Well, I would talk back (or point out the missing information) another time, not now….He’s talking like a socialist, facts about payscales, not principles, not cumulative wealth and he’s omitted, basically, the economic clout of government itself, in its pooled funds. For example, in diagram from “Part 3” — “The Axis of Greed: The Nature and Structure of the Economic Elite”Government” is not even a player — look at the diagram: it’s only referring to corporations, not governments.

What about the tax system? Not even mentioned!

although I’d probably agree with this statement, the question always comes up — where is the writer coming from? What’s the main message?

I don’t view the Economic Elite as a small group of men who meet in secrecy to control the world. They do feature elements of conspiracy and are clearly composed of secretive organizations like the Bilderberg Group – this is not a conspiracy theory, this is a conspiracy fact – but as a whole the Economic Elite are primarily united by ideology. They’re made up of thousands of individuals who subscribe to an ideology of exploitation and the belief that wealth and resources need to be concentrated into the fewest hands possible (theirs), at the expense of the many.

“Business Roundtable (BRT) is an association of chief executive officers of leading U.S. companies working to promote sound public policy and a thriving U.S. economy.“Business Roundtable was established in 1972 through the merger of three existing organizations. One was the March Group—made up of chief executive officers—which had been meeting informally to consider public policy issues. John Harper, then Chief Executive of Alcoa, and Fred Borch, then Chief Executive of General Electric, were notable leaders. Another founding group was the Construction Users Anti-Inflation Roundtable, an organization devoted to containing construction costs and headed by Roger M. Blough, then Chief Executive of U.S. Steel. The third was the Labor Law Study Committee, largely composed of labor relations executives of major companies. These groups founded Business Roundtable on the belief that in a pluralistic society, the business sector should play an active and effective role in the formation of public policy.

WELL, THIS GROUP IS MORE THAN INTERESTING — AT LEAST AS TO SHOWING CORPORATE CLOUT, AND CONNECTIONS. MAYBE NOT FOR PURPOSES OF THIS POST, THOUGH…..

| Business Roundtable | DC | 2012 | 990O | 24 | $25,500,359 | 23-7236607 |

| Business Roundtable | DC | 2011 | 990O | 25 | $20,551,812 | 23-7236607 |

| Business Roundtable | DC | 2010 | 990O | 25 | $13,654,330 | 23-7236607 |

This is interesting, as ever — I’m moving it to another post!

(MY, WHAT INFORMATION IS AVAILABLE THROUGH A FEW TAX RETURNS AND SOME BASIC LOOKUPS)

David McGraw (author, above) notes:

Shortly after Obama’s inauguration he held a meeting with Roundtable members at the St. Regis Hotel. The president of the Business Roundtable is John J. Castellani.** Throughout the first nine months of Obama’s presidency, Castellani met with him at the White House more than any other person, with the exception of Chamber of Commerce CEO Tom Donohue. If you look at the records of people who have spent the most time with Obama in the White House, other than these two, another frequent visitor is Edward Yingling, the president of the American Bankers Association.

These organizations – the Business Roundtable, Chamber of Commerce and the American Bankers Association – along with the Federal Reserve, a secretive quasi-government private institution, form the center of the Economic Elite’s power structure. Since the bailout, the Federal Reserve has been working closely with private firm BlackRock. Due to this relationship, BlackRock has emerged as the world’s largest money manager and now manages more assets than the Federal Reserve. They also “manage many of the Treasury Department’s big investments.”

“DESCRIPTION OF ORGANIZATION MISSION:

A CEO-LED ORGANIZATION THAT SEEKS TO CREATE U.S. JOBS AND MAINTAIN AMERICAN COMPETITIVENESS IN THE INTERNATIONAL ECONOMY.

- FORM 990, PART VI, SECTION A, LINE 2: DUE TO THE SIZE AND DIVERSITY OF THE MEMBERS OF THE BUSINESS ROUNDTABLE, WE ASSUME THAT DIRECTORS MAY HAVE FAMILY AND/OR BUSINESS RELATIONSHIPS WITH OTHER DIRECTORS.

- FORM 990, PART VI, SECTION A, LINE 6: BUSINESS ROUNDTABLE IS AN ASSOCIATION OF CHIEF EXECUTIVE OFFICERS. THE COMPANY IS THE MEMBER, AND ITS REPRESENTATIVE IS THE CHIEF EXECUTIVE OFFICER.

- FORM 990, PART VI, SECTION A, LINE 7A: ON AN ANNUAL BASIS, THE MEMBERS OF BUSINESS ROUNDTABLE ELECT A CHAIRMAN AND THE VICE CHAIRS OF THE ORGANIZATION.

- FORM 990, PART VI, SECTION A, LINE 7B: THE NOMINATING COMMITTEE ANNUALLY NOMINATES THE CHAIRMAN AND THE VICE CHAIRS OF THE BUSINESS ROUNDTABLE; WHICH IS SUBJECT TO APPROVAL BY THE FULL MEMBERSHIP.

- [Articles of Association not subject to disclosure to the public, it notes].

What the heck — “Who is New Models?”

http://palingates.blogspot.com/2010/05/timothy-crawford-and-new-models-shady.html

Looks like Timothy Crawford, Treasurer of SarahPAC, will be subpoenaed and deposed in Ohio regarding ‘soft money’ dirty trick campaign tactics connected to his “New Models” company in McLean, VA. That’s right. Sarah doesn’t keep him busy enough. Tim Crawford is moonlighting in Ohio.

Jennifer Brunner, the Ohio Secretary of State has sued Crawford’s corporation to determine the nature and the identity of some $1.55 million dollars transferred from “New Models” to the entity “LetOhioVote.org”, formed to thwart Democrat Governor Ted Strickland’s own plan to manage gambling in that state. Crawford and the other defendants refused to disclose the donor list. But a recent court order paved the way for depositions and subpoenas to proceed in this matter. See also this article at www.cleveland.com from April 30, 2010 with more details regarding this decision of Ohio’s Supreme Court

Jennifer Brunner, the Ohio Secretary of State has sued Crawford’s corporation to determine the nature and the identity of some $1.55 million dollars transferred from “New Models” to the entity “LetOhioVote.org”, formed to thwart Democrat Governor Ted Strickland’s own plan to manage gambling in that state. Crawford and the other defendants refused to disclose the donor list. But a recent court order paved the way for depositions and subpoenas to proceed in this matter. See also this article at www.cleveland.com from April 30, 2010 with more details regarding this decision of Ohio’s Supreme Court

(sounds like it’s a 501(c)4)…

Elsewhere it looks like it’s a (front/conduit) to pass money through to SuperPACS:

– See more at: http://www.republicreport.org/2012/new-models/ [This website had a pop-up warning, otherwise I’d make that an active link].

..

Although most of the Economic Elite live and operate inside the US, they are not concerned for our future. To them, the entire world is theirs and they work intimately with other elites throughout the world against the interests of the US public. Ever since the days of Henry Ford, the Economic Elite have needed a thriving US middle class to increase growth and profits, but now, in the global economy, they view the US middle class as obsolete. They increasingly look globally for profits and they would rather pay cheap labor in countries like China and India. On top of the millions of jobs they have already shipped overseas to increase profits at our expense, they are planning to ship an additional 25% of current US jobs overseas as well.

They now see us as the biggest obstacle to their continued consolidation of wealth and resources. This is why they have stepped up their attack on us.

If you want further proof of this, all one needs to do is study the Wall Street bailout. The entire bailout is strategically designed to eliminate the US middle class. Every time you hear the word “bailout,” you should think “coup d’état.” Here is the definition of coup d’état:

“A coup d’état or coup for short, is the sudden unconstitutional deposition of a government, usually by a small group of the existing state establishment… to replace the deposed government with another…. A coup d’état succeeds when the usurpers establish their legitimacy if the attacked government fail to thwart them, by allowing their (strategic, tactical, political) consolidation and then receiving the deposed government’s surrender; or the acquiescence of the populace and the non-participant military forces.

Typically, a coup d’état uses the extant government’s power to assume political control of the country. In Coup d’État: A Practical Handbook, military historian Edward Luttwak says: ‘A coup consists of the infiltration of a small, but critical, segment of the state apparatus, which is then used to displace the government from its control of the remainder’, thus, armed force (either military or paramilitary) is not a defining feature of a coup d’état.”

The bailout was a financial coup, an intelligence operation to seize control of the US economy and tax system. It is similar to what the Economic Elite have done through the International Monetary Fund (IMF) in many other countries throughout the world. It is clearly a case of economic imperialism. When financial coups are carried out in other countries, they call it aStructural Adjustment Program (SAP). The end result is the theft of working class wealth, the privatization of public functions and resources, rising unemployment, the elimination of the middle class and increasing taxation and debt that turns the overwhelming majority of the nation into a peasant class. This is exactly the track we are on now.

Just look at how they have already done this in many other countries, and then look at the “bailout.”

The success of the coup is clear by the control of the US Treasury by Goldman Sachs criminal masterminds Hank Paulson and Tim Geithner, and the continued control of the Federal Reserve by Ben Bernanke.

In 1970, Hank Paulson began his career in the Pentagon working for Secretary of Defense Melvin Laird. In 1972, he then moved to the White House, where he worked for the Nixon Administration. He was “the assistant to John Ehrlichman during the events of the Watergate scandal for which Ehrlichman was convicted, and sentenced to prison.” After Paulson’s disgraced exit from the political world, he joined Goldman Sachs in 1974, eventually becoming CEO in 1999 when he led an effort to force out Goldman’s previous CEO John Corzine. While leading Goldman, Paulson developed very intimate relations with members of the Chinese elite, visiting the country over 70 times.

In 2004, during his time as Chairman and CEO of Goldman Sachs, Paulson personally led a successful effort to get the SEC to remove the “ net capital rule,” which was a “requirement that their brokerages hold reserve capital that limited their leverage and risk exposure.” This was the biggest reason why the economic crisis happened. With the “net capital rule” out of the way, Goldman Sachs and other major Wall Street firms with over $5 billion in assets were free to engage in high risk/high reward behavior. This led to the housing bubble with the creation of high risk speculation, essentially rigged Ponzi-style scams like “mortgage-backed securities, credit derivatives, and credit default swaps… and other exotic structured finance instruments that only highly-trained mathematicians understand, based on models that are beyond the comprehension of most traders.”

After making over $700 million on these shady high risk activities that created a ticking time bomb in our economy, Paulson left Goldman Sachs to run the US Treasury. Shortly after that, the speculative trading scams blew up, and there was the man who played the most pivotal role in causing the economy to crash now running the US Treasury and in charge of “maneuvering” trillions of dollars in national wealth to “fix” the economy. It was time for Paulson, along with his close confidant Tim Geithner, then heading the NY Federal Reserve Bank, and Federal Reserve Chairman Ben Bernanke, to engineer the greatest theft of wealth in history with the “bailout.”

Paulson quickly brought in several former Goldman Sachs partners to help him engineer the coup. A pivotal Paulson asset was former Goldman executive Dan Jester, who Paulson quickly hired as a “contractor.” As Robert E. Prasch recently reported, “Jester was never appointed by Congress or otherwise vetted before taking up his role as the Treasury’s de facto central player in the crucial decisions that marked that fall’s bailout of Wall Street.” Paulson’s most publicized move was the $700 billion Troubled Assets Relief Program (TARP). This was a blatant no-strings attached giveaway of taxpayer money, handed directly to Wall Street’s biggest players. To oversee the TARP operation, Paulson brought in Goldman Sachs Vice PresidentNeel Kashkari.

Another egregious unilateral move by Paulson was installing Edward Liddy, one of his former board members at Goldman Sachs, as CEO of AIG. Liddy was the Chairman of Goldman’s Audit Committee, making him the most knowledgeable person regarding Goldman’s collateralized debt obligations (CDOs). Paulson knew these CDOs would go bust because they were based on fraudulent activities, essentially a massive Ponzi scheme.

So Paulson and Goldman Sachs covered their risk by insuring them through AIG, making it pivotal to save AIG and have one of his most trusted allies run the company. With Liddy in place, billions of taxpayer dollars were secretly funneled by the Geithner-led NY Federal Reserve through AIG to Goldman Sachs and several other Wall Street elite counterparties. Without the AIG bailout, Goldman Sachs would have collapsed as a result of their own Ponzi scheme.

The assassinations of Goldman rivals Bear Stearns and Lehman Brothers, and the forced Bank of America acquisition of Merrill Lynch were all equally scandalous actions as well. The hidden hand of the Bernanke-led Federal Reserve’s secret “black magic” tactics — which created and distributed trillions of dollars — turned Morgan Stanley and Goldman Sachs into bank holding companies overnight, which gave them access to trillions of dollars to furthermanipulate the market and create record setting profits.

Every step of the way, the economic terrorist organization led by Paulson, Geithner and Bernanke held our economy hostage by declaring that all their demands must be met or the entire economy would be destroyed, as a result of the very actions the players being rewarded had taken. (I don’t use the words “economic terrorists” as hyperbole. The threat posed by them and the amount of death, destruction and misery they have already caused the United States is much greater than that caused by Bin Laden and Al-Qaeda – it’s not even close.)

Through the crisis, the fundamental structure of the stock market has been proven to be a scam. The Ponzi scheme activities, outright market manipulation and massive worldwide fraud perpetrated by Goldman Sachs, JP Morgan, Morgan Stanley, Citigroup, AIG, the three major ratings agencies and several other Wall Street elite firms are blatant. Just in the housing an doil futures markets alone, the criminal activity and economic theft is in the multi-trillions.

By looking the other way, the SEC, Congress and Presidents Bush and Obama are complicit. An analysis of actions taken, or most often not taken, by the leaders of both the Republican and Democratic parties prove that they are now accomplices. They have not only let it happen; they continue to look the other way and have been stonewalling laws, investigations and prosecutions in what is clearly criminal activity.

If we had a nation of law, none of these things would have happened. This proves to anyone who cares to look that we now live in a Banana Republic. Our democracy has clearly become a farce.

The overwhelming majority of our politicians are now on the Economic Elite payroll. [cont’d on site].

II – FROM SOLARI.COM

Author C.A.Fitts then reports a 1997 presentation, apparently in front of PENSION FUND investors, including CALPERS (more on that, below):

” a meeting that had occurred in April 1997, more than four years before that day in London. I had given a presentation to a distinguished group of U.S. pension fund leaders on the extraordinary opportunity to reengineer the U.S. federal budget. I presented our estimate that the prior year’s federal investment in the Philadelphia, Pennsylvania area had a negative return on investment…The response from the pension fund investors to this analysis was quite positive until the President of the CalPERS pension fund — the largest in the country — said, “You don’t understand. It’s too late. They have given up on the country. They are moving all the money out in the fall [of 1997]. They are moving it to Asia.”…

Sure enough, that fall, significant amounts of moneys started leaving the US, including illegally. Over $4 trillion went missing from the US government. [HUD, DOD 1997ff] No one seemed to notice…

What Fitts points out — in talking about HUD’s missing billions is — and consider this please — the contractors (electronic, telecommunications, accounting, etc.) firms handling the information were actually DOD contractors, as I understand it.

ALSO — notice she is referring to “consolidated financial reports” but not systematically teaching it. She’s pointing out — they couldn’t produce them!

The Two Great Financial Mysteries of Our Time: Missing Money and Collateral Fraud

There are two great financial mysteries in America:

- where is all the missing money and how do we get it back?

- how big is the missing collateral black hole and how will it be resolved?

These two mysteries are essentially part of one mystery at the heart of the matter – who is in charge of – and what are – the real financial flows and assets of the central banking-warfare complex that increasingly governs the resources on our planet?

Let’s start with the first mystery, the missing money.

In fiscal 1999, the Department of Housing and Urban Development (HUD), under the leadership of Secretary Andrew Cuomo, reported $17 billion missing from its opening balance and $59 billion of undocumentable adjustments to close its books and refused to produce audited financial statements [CAFRs] as required by law. In fiscal 2000, HUD refused to disclose the amount of its undocumentable transactions. For a sense of the magnitude of even the reported discrepancies, it means that the amount of undocumentable transactions occurring at HUD in 1999 was $1.13 billion a week, $227 million each work day and $28 million an hour.

The contractors that ran HUD’s auditing and payment systems also were large contractors at the Department of Defense (DOD) which reported $2.3 trillion of undocumentable transactions in fiscal 1999 and $1.1 trillion in fiscal 2000. DOD declined to report the number for fiscal 2001 and in all years subsequent to the legal requirement to do so, declined to produce audited financial statements as required by law, ensuring that the US Treasury could also not do so.

Indeed, the federal consolidated financial statements during this period were delivered with the following admissions by each Secretary of the Treasury:

From Kelly O’Meara, “Treasury Checks and Unbalances“, Insight Magazine, April 2004.**

[[**read, and you’ll see that at lesat Kelly O’Meara was reading those financial statements!]]

The U.S. constitution says that no payments can be made which are not provided for in an appropriations bill approved by the Congress. Specifically, Article 1, Clause 7 states: “No Money shall be drawn from the Treasury but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time.”

It is quite significant that the government (and its accounting and payment contractors and bank depositories) engaged in an amount of illegal transactions in fiscal 1999 that was greater than the amount of total taxes it received in that year. It is even more significant that there has been little public discussion of this fact. This is no small violation of the Constitution in a country where millions go without health care and the infrastructure is in disrepair.

A handful of efforts to get to the bottom of what was going on met with little or no cooperation. Efforts by reporters and one brave Congresswoman, Cynthia McKinney, to identify the contractors responsible for managing the accounting and payments systems missing all this money were not successful. Investigative reporter Kelly O’Meara got David Walker, head of the General Accountability Office (GAO), the Congressional auditor, to commit during an interview that he would make this government contractor information public. However, GAO never did. One Tennessee congressman on the House Budget and Defense appropriations subcommittee confirmed to me that these billions were missing but that he was helpless to do anything about it. ( See Letter To Congressman Van Hilleary (R-Tenn.)

Things seemed to be coming to a head on September 10, 2001, when Donald Rumsfeld conceded in a press conference that DOD was missing trillions. However, that fact was not to attract much attention given 9-11 events the following day. Rather, the tragedy was used to justify the loss of financial records at the Pentagon (we are apparently to presume that the Pentagon is incapable of making or keeping back ups) and the inability of the Army to produce

Add it all up and my guess is more than $10 trillion of private and public funds has been pulled out of America by fraudulent means. That is an interesting number, given that it was an amount sufficient to pay off the direct national debt before the housing bill added Fannie‘s and Freddie’s debts to our burden.

In short, our problem is not that our national debt is out of control. Our problem is a financial coup d’ etat. The reason we have debt is that the federal accounts have a private back door that is feeding an insatiable parasite. The money we need to address our financial, social and retirement obligations has disappeared and we need to get it back. The housing bill does not do this. Quite the contrary: it represents a step in the opposite direction. Instead of getting the money back, the housing bill ensures that our contingent liabilities increase astronomically and puts in place additional mechanisms for engineering more missing money and draining small business and communities as a result of further centralization of mortgage credit into Washington and Wall Street.

Kelly O’Meara 2004 also noticed.

She’d also earlier noticed missing money around some L.A. Judges, relating to “AFCC.”. (In fact that’s how I eventually found C.A.Fitts’ Solari.com work; through this investigative reporter’s 1999 articles), more pieces in the puzzle. (IRE.org’s listing of O’Meara Story).

I say:

More missing money is possible through privatization of court functions — which 1996 welfare reform setup, and facilitated. The privatization is the problem. “Nice to know” in hindsight! (!!)

The solution — and about the only solid one I can think of at this time — is that we have got to stop putting IN the taxes, and put ourselves (as per Burien, below, or on his other sites) as the BENEFICIARIES of our own government operations, and start claiming it back again. If we are citizens, then we own the infrastructures we have funded. IF, as Citizens, we have simply been treated like colonized slaves, or as working “the plantation” as formerly British Style, or as in colonial times, or any other regimes were “Slaves” applies — then forget it. No deal. The tax system is the caste system; and the “equality” or “justice” or “freedom” are sound-bytes were allowed to play with meanwhile.

I don’t know if people can be woken up to understand they must at least TRY to read their own government’s operations, and to at least TRY to get, perhaps, a diagram of how many gov’t entities are in operation around here — understanding that through their pension funds they WILL be pooling investments, and affecting the business climate. I HOPE so.

I do know that I sought help from the various institutions, in some life-and-death situations, year after year, and it’s been treated like a joke; and I’ve been treated (as have others), like, well, someone on the auction block — the various possible buyers sizing up the potential clients, in re: their private fiefdoms of government-funded programs (or nonprofit agencies), with the

‘WHAT’S IN IT FOR OUR OPERATIONS?” SKEPTICAL LOOK.

And when your usefulness to someone else’s professional resume-building, nonprofit entity client-seeking machine, that’s about it. “See ya’ later, not this time…. Shut up and go away.”

Aug. 29, 2011 article — this, on fiscal issues around 9/11 however earlier discussions, also basic finances, that one talks about 9/11, and it’s my understanding the author was working there before it went down.

Before joining the WTC staff, Rodriguez had worked for ten years as an aide to New York Governor Mario Cuomo, helping organize press conferences for high-level policy-making events. He knows the games that are played of Truth vs. Fiction.

He has been on a ten year mission to make sure truth wins out over the fiction we have all been spoon fed to cover up the crime of the century. A crime that was nestled intentionally within a contrived and vile political agenda allowing for massive wealth and power transfer to take place from the planed [“Planned” unless that was a bad pun?] event.

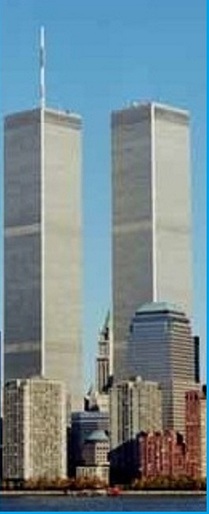

The following is my personal knowledge from being a tenant of WTC1 back in 1978 – 80 and my own look at what I would consider to be the “connect the dots” as to the underling motive for the event. Please share with all 911 researchers that you may know. The following points I bring forward NEED to be the focus of “connecting the dots“:

1. When the NY/NJ Port Authority presented plans back in the 60’s to build the WTC complex they were hit with multiple law suits from surrounding building owners to stop the project. The reason being was that they did not want the tallest building in the world at that time being built that could in the event of collapsing (falling over) take out twenty or thirty other near-by buildings.

SOLUTION PRESENTED by the NY/NJ Port Authority that got the law suits dropped and the WTC complex project underway was to build a center steel core that all floors would be suspended upon and in the event of a collapse the center steel core would act as a guide post where the collapsing floors would pancake down in their own “foot print”…..

2. After the WTC complex was built NY/NJ Port Authority found out they had a big problem. That problem was: Asbestos was banned in the US. The WTC towers were built with potential fires in mind and the inside walls and steel columns were sprayed with a thick coating (millions of pounds) of asbestos foam fibers. This was a big mistake on Port Authority’s part.

SOLUTION PRESENTED: by the NY/NJ Port Authority in 1978/79 was to instal a special micro fiber filtration system in the air filtration system of the towers to filter out the asbestos fibers as they broke down and then circulated within the building. If my memory serves me correctly they spent about 131 million dollars on this special and unique filtration system.

Additionally being that the asbestos problem was not going to go away, the NY/NJ Port Authority commissioned a study around the years of 1980/81 to see what the cost would be to demolish the towers. The findings of that study were disconcerting to say the least. The cost for demolition and clean up was about nine-billion dollars and that was not accounting for the thousands of law suits from people who claimed to be exposed to the asbestos fibers from the demolition that could amount to billions of dollars extra.

NY/NJ Port Authority though from 1978 forward did try to pass the buck and “lease” the WTC complex to another but no takers for obvious reasons…

(My Dec. 2012 EconomicBrain [“Cold,Hard.Fact$”] post combines several articles — I think pretty well — but see “Are You Ready for Real Change,” Jan./2012 therein, and towards the bottom):

Government has built their internal empires by and through selective presentation and utilizing taxpayer revenue systematically separated from the general purpose operating budgets to build power-bases of standing wealth outside of the “general purpose” operating funds. /// A large local government can be crying “Budget Shortfall’ under their selectively presented general purpose operating budget but upon review of the financial wealth power based funds held and “other” income, the same local government upon total and comprehensive review can be clearly in the black by millions if not billions of dollars.

There is nothing complicated here. If an individual or a government has established significant fund balances developed over decades, those funds balances are power-bases by investment that makes or breaks many individual fortunes by where those funds are invested.

If an individual or a local government thinks they can tag someone else to pay for shortfalls in other areas without tapping into their power-bases of funds under domestic and international investment management they will do so.

As others have pointed out already– governments tend to pool their investments, for example, “CALPERS” (essentially created ca. 1931) is the largest “public pension” investing platform around, or at least in the country. Getting started earlier sure helped, then adding players (subscribers) over time ALSO did. That summary is from “Allgov.com” and goes (at least about half of it) like this; notice the progressive growth and expansion of what was included under this FUND, and the various names it went under (CalPERS was not the original one).

Overview:

The California Public Employees’ Retirement System (CalPERS) administers the largest pension fund in the country. It manages a portfolio exceeding $200 billion in assets that provides retirement benefits for more than 1.1 million active and inactive public employees and around half a million retirees and beneficiaries. The 1.6 million members of CalPERS are current and retired employees of the state, schools and public agencies. In addition to retirement, CalPERS manages health benefits for more than 1.3 million members and their families.

CalPERS is transitioning from the State and Consumer Services Agency to the new Government Operations Agency by July 1, 2013, as part of a larger government reorganization. href=”http://www.allgov.com/usa/ca/departments/state-and-consumer-services-agency/california_public_employees_retirement_system?agencyid=174#”>less

History:

California’s state employees began discussing a retirement system as early as 1921, and learned that an amendment to the state constitution would be required. Eleven years later that amendment created the State Employees Retirement System (SERS), allowing the retirement fund to invest in bonds, and only bonds. It was seen as a way to retire state employees with income, clearing the way for younger workers. The state contributed $1.4 million over the first 18 months, to shore up assets during the early years of the Depression.

Public agency and classified school employees began to participate in 1939.

Legislation in 1953 allowed SERS to invest in real estate as well as bonds.

More laws passed in 1967, allowing investment in stocks—but only up to 25% of SERS’ portfolio.

Not until 1984 did Proposition 21allow SERS to exceed the 25% limit and send its board members and staff to explore international markets as investment opportunities.

The Public Employees’ Medical Hospital Care Act of 1962 authorized CalPERS to provide health benefits to state employees, and was expanded five years later to cover local employees on a contract basis.

The Long-Term Care Act of 1990 meant that long term care insurance could be offered to everyone covered by SERS, STRS (the State Teachers’ Retirement System), and those brought into SERS by the County Employees’ Retirement Law of 1937.

Starting in 1995, a not-for-profit Long-Term Care Program was offered to all the state’s public employees and retirees.

Thanks to the efforts of Jesse Unruh, who served as the State Treasurer from 1975-1987 and was a board member, SERS started its corporate governance reform program. Unruh helped create the Council of Institutional Investors, an organization of pension and benefit funds, endowments, and institutions that formulates policy about shareowner rights and other issues.

In 1996, SERS—now called CalPERS—began its International Corporate Governance Program. Allying with other large non-profits who are active share-owner organizations created clout and power, impacting the way many top firms did business—sometimes called “the CalPERS effect.”

As the state has gone through budget difficulties, legislators and governors have tried to use the CalPERS fund to solve problems. Governor Pete Wilson was facing a $14 billion deficit in 1991 and suggested using SERS money to help balance his budget. In response, Proposition 162—the California Pension Protection Act of 1992—was put on the ballot and passed by voters, giving the SERS board absolute authority to administer and invest the pension fund and changing the name, officially, to CalPERS.

Just a few years later, in 1996, the fund hit $100 billion.

Governor Schwarzenegger tried to partially privatize the retirement system in 2005, with a plan that would have forced public employees to join a defined contribution plan. That idea was abandoned in the face of strong opposition by unions and studies showing that CalPERS and CalSTRS, the state teachers’ retirement fund, generated over $20 billion in economic activity for the state.

In 2007, the fund’s 75th year, CalPERS was managing $241.7 billion in assets when it established the California Employee’s Retirement Benefit Trust Fund for the state’s public agencies. This $1.8 billion investment fund “prefunds” health benefits and other retirement obligations to employees of over 300 agencies, similar to the pension fund.

The fund hit its peak of $260.6 billion on October 31 of that year before the worldwide financial collapse sent it plummeting 31.2% to $179.2 billion in about five weeks. The Dow Jones Industrial Average was off 39.8%. CalPERS’ real estate holdings were hit especially hard as the housing market nationwide collapsed.

CalPERS CEO Federico Buenrostro Jr. left under a cloud in 2008, after six years at the helm, to take a lucrative job with a consultant to whom he allegedly steered millions of dollars of business. A subsequent investigation by an independent firm hired by CalPERS alleged that Buenrostro and two board members strong-armed a benefits firm to pay more than $4 million in fees to the consultant, Alfred J.R. Villalobos. The report said Villalobos earned $50 million as a placement agent, hooking up CalPERS with private clients in need of investment funds.

The scandal led to new calls by Republicans for conversion of CalPERS’ traditional pensions with guaranteed payouts to a 401k-type plan.

In 2010, the Los Angeles Times published an expose of scandal in the poor Los Angeles County city of Bell, where its chief executive, Robert Rizzo, was making $800,000 a year and other city employees pulled down high six-figure salaries. CalPERS had become aware of the situation in 2006 when Rizzo was granted a 47% pay increase but approved the deal because at least two other officials received similar boosts. Rizzo and a number of city officials were indicted on multiple charges, including fraud, and removed from office.

CalPERS got a makeover by the Legislature in September 2011 with passage of legislation creating a chief financial officer and impeded the revolving door that led to lucrative placement agent positions for its employees in the private sector.

Get the general idea? There’s more, below, at the same site.

As they said, ca. 1985, add “Cii” Council on Institutional Investors (members: in 31states and D.C.); this idea having come from the then-California State Treasurer, Jesse UnRuh.

LINKEDIN FOR THIS SAYS IT CONTROLS ABOUT $3 TRILLION COLLECTIVELY — AND COLLECTIVE CLOUT AND CORPORATE REFORM WAS THE IDEA BEHIND THIS COUNCIL TO START WITH!.

Types of Members: Notice Corporate Funds, Union Funds, and 61 PUBLIC EMPLOYEE FUNDS (49%). WOW! See link for what each type does.

WIKI definition (just the very basic):

Council of Institutional Investors is a nonprofit “association of pension funds and other employee benefit funds,foundations and endowments” that “promotes the interests of institutional investors in the United States“.[1] It describes its mission as to “educate its members, policymakers and the public about corporate governance, shareowner rights and related investment issues, and to advocate on members’ behalf.”[2]

The CII was founded in 1985 by 21 public pension fund officials and has grown to include 125 institutional investors (public, union and corporate employee benefit plans and foundations and endowments) whose combined assets “exceed $3 trillion“[3]

It maintains its headquarters in Washington, D.C.”,[1] and as of mid-2012 its chair was Anne Sheehan (California State Teachers’ Retirement System), and co-chairs were Lydia Beebe, Jay Chaudhuri, and Patrick O’Neill.[4]

- $3 million: $3,000,000

- $3 billion: $3,000,000,000

- $3 trillion: $3,000,000,000,000

| ORGANIZATION NAME | STATE | YEAR | FORM | PAGES | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| Council of Institutional Investors | DC | 2012 | 990O | 40 | $7,848,453 | 52-1380217 |

| Council of Institutional Investors | DC | 2011 | 990O | 36 | $7,768,819 | 52-1380217 |

| Council of Institutional Investors | DC | 2010 | 990O | 43 | $8,541,990 | 52-1380217 |

PURPOSE:

TO EDUCATE OUR MEMBERS AND THE PUBLIC ABOUT GOOD CORPORATE GOVERNANCE, SHAREOWNER RIGHTS, AND RELATED INVESTMENT ISSUES AND TO ADVOCATE ON OUR MEMBERS’ BEHALF.

…(Program service accomplishments pt. III):

ADVOCACY & ENGAGEMENT – IN 2012, CII MEMBERSHIP APPROVED THE FOLLOWING AMENDMENTS OR NEW POLICIES TO THE CII CORPORATE GOVERNANCE POLICIES *STATEMENT OF PRINCIPLES ON CREDIT RATING AGENCIES, *COUNCIL POLICY TO OPPOSE FORCED ARBITRATION CLAUSES, *VARIOUS TECHNICAL AMENDMENTS TO COUNCIL POLICY ON CLAWBACKSCII ADVOCATED MEMBERSHIP -APPROVED POLICIES IN COMMENT LETTERS TO GOVERNMENT AGENCIES AND IN MEETINGS WITH GOVERNMENT AGENCIES AND MEETINGS WITH GOVERNMENT OFFICIALS AND OTHER POLICY MAKERS CII ALSO ENGAGED WITH MANY PUBLIC COMPANIES ON MATTERS RELATED TO MEMBERSHIP – APPROVED POLICIES, INCLUDING VIA WRITTEN REQUESTS THAT COMPANIES NOT HOLD VIRTUAL-ONLY SHAREOWNER MEETINGS, AND THAT COMPANIES TAKE ACTION IN RESPONSE TO SHAREHOLDER PROPOSALS THAT GARNERED MAJORITY SHAREOWNER SUPPORT, AND ELECTIONS OF UNCONTESTED DIRECTORS THAT FAILED TO RECEIVE MAJORITY SHAREOWNER SUPPORT

(Code ) (Expenses $ including grants of $ ) (Revenue $

EDUCATION AND RESEARCH – IN 2012, CII ENGAGED IN A VARIETY OF INITIATIVES DESIGNED TO EDUCATE MEMBERS AND KEEP THEM UP TO DATE ON THE LATEST DEVELOPMENTS AND ISSUES ON CORPORATE GOVERNANCE AND SHAREOWNER RIGHTS IN 2012 CII SPONSORED SPRING AND FALL CONFERENCES FOR MEMBERS WHICH INCLUDED HIGH QUALITY SPEAKERS, OCCASIONS FOR NETWORKING AND EDUCATIONAL OPPORTUNITIES CII PURCHASED NEW CUSTOMER MANAGEMENT SOFTWARE TO OFFER INCREASED SUPPORT AND SERVICE TO MEMBERS AND BEGAN WORK ON A NEW WEB SITE WITH ADDED CAPABILITY TO OFFER PUBLICATIONS, RESEARCH AND TOOLS TO MEMBERS CII PUBLISHED A WHITE PAPER ON THE MORRISON V NATIONAL AUSTRALIA BANK CASE AND PUBLISHED FIVE PLAIN-ENGLISH ISSUE BRIEFS ON THE JOBS ACT LEGISLATION AND THE POTENTIAL IMPACTS FOR INVESTORS CII ALSO PUBLISHED UPDATES TO THE LIBRARY OF CORPORATE GOVERNANCE BASICS, WHICH IS A SERIES OF PLAIN-ENGLISH PRIMERS DESIGNED TO ASSIST MEMBERS AND THEIR CONSTITUENTS UNDERSTAND THE MORE COMPLEX TOPICS IN CORPORATE GOVERNANCE

As this goes with nonprofits — are ALL the members public employees? No. The Nonprofit is the vehicle that allows clout to be exercised cross-jurisdiction and public/private. See member list, again. The expense are reasonable considering the size of assets controlled — Membership dues, 4 officers working full-time, paid pretty well, and several other officers, 3 hours/week, unpaid. The granted out some funds to related organizations, and there’s $70K of investment income — NO contributions. Who needs ’em?

(LA Times 1985 article on Calif. Politician (state treasurer, assembly speaker) Unruh whose idea it was for the Council so institutional funds could “flex their muscle”; and push for corporate governance reform. Cii members now control $3 trillion of assets). Point being, government holdings are invested, and when pooled like this, are major clout, and the average person never reads even a single government entity’s annual financial reports. (I wasn’t aware of them til 2012!)

Governments not only invest their funds in business, they also by legislation, patenting, and protections, set them up to win, or lose. So, “know thy government” is a great place to start. (See blog/see links in the blog).

Find the named funds; who set them up to start with? I found the DV funds in California, how they were split off in 1999 between the DA’s office and the DV industry, and guess what? My Congressman and I are going to have a talk REAL soon about case-dumping of dangerous cases into the family law system, where the marriage/fatherhood/access visitation funding sector can have their way with the kids, and the nonabusive parents, and further expand (rather then reduce) welfare loads, for profits to the state. Your legislators votes on budget. Budgets appropriate. Get it?

By the way, every Congressperson (US level ,no doubt state levels also) and I’m told major media gets copies of the relative CAFRs. They just don’t really to have that conversation about BUDGET vs. ASSETS which leads to, now WHY are we being taxed, still? It gets down to ownership of the income-producing assets.

Connect the dots between funds and funders, grants, and grantees. (Blog links show how). Do this for a while, and the lights will start to go on; illuminating another serious problem: the fundamental truth is, a Very Big Lie is Standard Operating Procedure throughout government, especially social services sector. Now what?

A real fork in the road… Now what? Is your Congressperson in on it?Now what?.

Two roads diverged in a yellow wood

And sorry I could not travel both

and be one traveler long I stood

and looked down one as far as I could….

[The Road Not Taken, Robert Frost, 1874-1963, from “The Poetry Foundation”

Once at this point, you cannot travel down both paths and be one traveler. It’s either retain that humanity, sensitivity to truth, or lose it.

Either look down that less-traveled road, Or, do nothing much, and just sign over the decision-making process to others. AFTER ALL, it’s not as though cloud-based software, combined with social service programming through welfare and child support systems to continue dumbing down people and smartening up robots! (I kid you not — see “Neurala, Inc. and Brains for Bots(tm)” And corporate connections between the two! (stay tuned for the post)….

Know how I found that? Looking at a tax return, looking up the Chief Operating Officer. AND his Board Relationships. Including this one (talk about putting together a team with international connections!!). The company is a federal contractor, too. Did my doing that take artificial intelligence, was it “rocket science?” (Not hardly!) This NONPROFIT is an HHS grantee and contractor founded in 1974, Ford Foundation capital + Federal agencies, and is the “evaluation and testing” arm of many Responsible Fatherhood projects (“Fragile Families” and the whole 9 yards), to justify the social policies that PRWORA (1996 Budget Act, “Welfare Reform”) further enabled by dedicating millions, and enabling “Block Grants to the States” via “TANF.” We are granting millionaire nonprofits more millions, WHY, again??? (while cutting funds for FOOD?). For more info, read my blog!

It’s simpler than it sounds IF you look. Most, just won’t. How about you?

[“Stopping by Snowy Woods on a Snowy Evening.” Observe from a distance, not in the thick of it, consider (I have). And there are miles to go before I sleep, too. If you have stopped and seen, remember to stop back on the way out, and feed the blogger. See “strung out and stripped down” phrase, above. Thanks!

Leave a comment