Today’s post:

CBMA and CFUF in #BlackLivesMatter: What’s Up Now, 2020, with (Famous-Foundations-sponsored-) Campaigns for Black MALE Achievement and (Still U.S. Gov’t-Sponsored-) Centers for Urban Families (fka “Fathers”)? [Started June 20, 2020, Publ. July_8]. short-link ends “-cVS”

CBMA — Campaign for Black Male Achievement.

CFUF – Centers for Urban Families (fka ‘Fathers’)

In case the acronyms CBMA and CFUF, are unfamiliar, I’ve started with two images of search results for these nonprofits’ tax returns showing the full names for each, and that the latter has a second related entity (CFUF Fund) and (when live links to tax returns are provided separately) the former did not incorporate (in New York) until late 2014, first gaining speed under a major (California) community foundation which itself was created through merger, only 2006, and which I’ve blogged (red-flagged, as also has the media) several times before.

Technicalities and Hindrances looking up ANY tax returns on private databases:

Be aware, however, that the source for the images (The Foundation Center, Inc.’s Candid.org database) often gets the organization names wrong. ALWAYS check names displayed in the search results (when searching by name here) by clicking on displayed names through to the tax returns themselves. Also check for legal business name at the Secretary of State (for corporations) or, if it applies (and it does in NY), Attorney-General’s Office, or whatever department or division regulates charities and nonprofits at the state level, in the USA.

[2021 Oct. 19 comment: My Twitter Home Profile, @LetUsGetHonest (since 2012) holds a few shortlinks to search sites; its current pinned thread also links to an IRS document explaining the different parts of a tax return — these are the parts that will be seen (as many as the organization used each year) for, at least the IRS Form 990’s (Form 990-PFs, for ‘private’ (vs. ‘public’) organizations differs).

(Click on http://foundationcenter.org; you’ll be redirected to “candid.org,” but new website change doesn’t necessarily mean a business entity. It may or may not, and this time, FoundationCenter is acting as though it had, but withholding from the public paperwork proving that it did, while on its own pages, characterizing “Candid.org” as having the same EIN# as The Foundation Center.

This time, the Candid.org got both names basically right, but its own name (“Candid” is a dba) wrong. I’m going to update available information on this, separately, but I raised the issue two years ago (June, 2018). Interesting when you consider a half year later, The Foundation Center and Guidestar announced their mergers they’d been talking about (says the NPQ, NonProfitQuarterly, which I found searching this out (I’m not a subscriber) this time round) since 2013.

The Availability and Reliability of On-Line Databases (Private or Public) is a Major Obstacle to Accountability | Footnotes to “Censorship by Omission” Page [Publ. June 3, 2018]. It has a case-sensitive shortlink ending “-8ZF” and, for a change, is short.

[[TOPICS INCLUDE: the largest multi-billion-dollar Forms 990 or 990PF on the search results, including the Wellcome Trust, the Arab Fund, and several Ivy League Colleges’ endowments, several of them named (in database provider’s search results” page) completely “off,” i.e., the attached Form 990 in pdf form (when you click through) has a different name. Healthcare and insurance entities also tend to be huge. My post connects that topic to court-connected nonprofits (obviously much smaller) and highlights just how large the largest (non-government) tax-exempt entities are, not only the major failings of (the free-access version at least) of databases reporting on their assets..]]

Should I finish another post on this topic, it will be at this link under this or a similar name:

The Foundation Center, Inc.’s + Guidestar, Inc.’s Feb. 2019 Merger and Delayed Filings Obfuscate WTF is (or, is not) Candid.org aka, massive philanthropic obstruction and obfuscation — keep the public waiting,while moving private purposes forward faster. (short-link ends “-cEl”<~last character is lower-case “L.”) NB: THIS IS A DRAFT as of July 7, 2020. It refers to and builds upon my recent Twitter thread on the February, 2019 merger of The Foundation Center and Guidestar, illustrating problems with delayed publications or postings of tax returns and business language used on websites to announce and advertise the new leadership while putting actual entity status in such terms as can’t or won’t be fact-checkable til a year or more “after the fact.”

I mention it here because to look at an organization’s tax returns which refuses to post them, or even its own EIN#(s, if plural) on its website, leaves an open-ended question: Who’s most responsible for the delay, and why aren’t organizations filing timely or openly to start with? That’s a “buyer-beware” situation throughout. Meanwhile the private tax-exempt-corporation-run major databases which might provide information groups like CFUF (and the organizations some of its board of directors also run, such as the Warnock Family Foundation (posted without the word “Family” on the website and no EIN# or financials) won’t advertise openly, i.e., deliberately “forget” to post, are creating even more accountability problems: (i.e., TheFoundationCenter, rebranded as “Candid” after “transferring assets from Guidestar.org, and Guidestar.org itself) also don’t post their own timely or others’ timely (or accurately labelled), when the major source of said tax returns is supposedly the IRS, which collects revenues for the United States (federal) Government to apply as our Congress sees fit — including to promote marriage and fatherhood through diversions from welfare.

As such, while I can look at organization websites as they evolve, in analyzing, I don’t have for these two (CBMA and CFUF) (or, generally, for tax-exempt organizations involved dealing with them or their boards of directors either), any tax return for 2019, while websites are describing 2020 facts about their leadership and programming. While I’m fine-printing it, the organizations meanwhile do their “BIG-Photos-Bright-Colors” gesturing to distract from just how inbred and overlapping are the business interests of those running it. And in some cases, how crooked.

So, CBMA and CFUF in #BlackLivesMatter: What’s Up Now, 2020, with (Famous-Foundations-sponsored-) Campaigns for Black MALE Achievement and (Still U.S. Gov’t-Sponsored-) Centers for Urban Families (fka “Fathers”)? [Started June 20, 2020, Publ. July_8]. (short-link ends “-cvS”)

One is in New York (legal domicile Delaware) and the other in Baltimore, Maryland. After the two images of tax returns (the last three years for each), starting with the latest available tax returns, I have some “get-acquainted” quotes or profiles of the CFUF Chairman of the Board, CEO, and a self-descriptive quote or so from the latest available tax return. Further down, (and closer to the starting point of this post), I reference CBMA’s original fiscal sponsor (Silicon Valley Community Foundation, I’d posted on it several times– exactly where, links provided below), some of the website’s displayed current CEO’s bio blurb (Shawn Dove), some of his “bio blurb” reference involved a former Secretary of State of New Jersey (<~Wiki), and reverend, who has perfected the multi-tax-exempt entity business model sold as helping communities become debt-free and under the umbrella of community development, obviously some religious responsibility… [it] recruits and trains churches, agencies and community organizations to use [its] unique and proven strategies for recruiting families to foster and adopt children. Naturally, trademarks were involved.

A few paragraphs here — covered in more detail further down — added July 17, after publishing this post. I believe the “charitable immunity act” (from torts, i.e., responsibility), new to me, important to notice. Perhaps this may explain why privatizing government functions specifically into non-profit “charities” (very broadly defined) is so popular. This added section in fine print and a different-colored background mark its beginning and end…

Search results on this act brought up an interesting (though long) 2005 article published by Villanova University (Charles Widger School of Law). I have been reading; it puts a well-annotated timeline to the use of this immunity and the emergence (1980s) publicizing clergy abuse and subsequent lawsuits. See in pdf format here:

‘Secrecy+Settlements: Is the New Jersey Charitable Immunity Act Justified in Light of Clergy Sexual Abuse Crisis?’ by Samantha Kluxen Barbera (a second click on blank page icon may be needed to view).

//LGH

One of the entities was sued for facilitating child abuse of a minor child the entity helped (with primary funding, government grants, per its tax returns) place with a family privately. “Anal and oral penetration” of an infant, or very young boy, were involved, the case was settled (DCFS to pay) for $1.25 million dollars, not before the entity (formed by the above pastor and first tried out on his church members) pleaded “immune” under NJ Charitable Immunity Act:

…The New Jersey Charitable Immunity Act bars negligence claims against a nonprofit corporation organized exclusively for religious, charitable, educational or hospital purposes. [Link is a short explanation posted at what looks like a law firm, dated Feb., 2015, published in NJ Law Journal, © 2015 ALM Media Properties, LLC].

Straightforward explanation (and interesting examples) showing history of the law, certain exclusions, and what a nonprofit must prove (not much!) to invoke it, including that the plaintiff was a beneficiary:

…Originating in 19th century Britain, charitable immunity insulates a charitable organization from tort liability. The basis for the doctrine was the belief that charitable funds should not be diverted from the purpose for which they were donated. New Jersey followed the doctrine until 1958 when, in two cases, the New Jersey Supreme Court abolished it. Quickly after the Supreme Court decisions, the legislature restored it with temporary legislation, and then in 1959 adopted the Charitable Immunity Act, the purpose of which was to reinstate the common-law doctrine.

Thank you, Eckert Seamans, Cherin and Mellott, LLC (<~leadership page, including Executive, and (scroll down) Members in Charge for each of several offices** for at least saying “Black Lives Matter,” although the leadership profiles (with photos) say, apparently “not here”**… (also echoed in the CFUF director Henry D. Kahn‘s international firm (Hogan & Lovells), linked below, or CFUF’s mutual business interest of director David L. Warnock, Camden Partners Holdings (Meet The Team). At first glance, yes, but then pick out who are the partners (four partners, all white, one woman) or the “IR, Finances and Operations” (six staff, all look young, not much color there either). Next images are from Eckert, Seamans et. al.whose name only came up when I searched for that NJ Charitable Immunity Law.

-

-

Image #1 of 2 | Law Firm Eckert Seamans Cherin & Mellott, LLC (since 1958), explained NJ Charitable Immunity Law concisely (Feb 5 2015), for my CBMA-CFUF post update July 8, 2020. Yes, #BlackLivesMatter, not that I see any represented in your Executive Committee (tho two women) or Leadership Teams (one for each office, again women but — African-Americans? Apparently not in these leadership positions… ~~2 SShots 2020July17 Fri PST

-

-

Image #2 of 2 | Law Firm Eckert Seamans Cherin & Mellott, LLC (since 1958) [[See locations and SCG Legal network, international and DC-based) nicely explained NJ Charitable Immunity Law concisely (Feb 5 2015), for my CBMA-CFUF post update July 8, 2020 ~~2 SShots 2020July17 Fri PST

** Eckert, Seamans et. al. show offices in: Boston, Buffalo, Charlston (W. Virginia), Harrisburg, Hartford (Connecticut), Newark, Philadelphia, Pittsburgh, Princeton, Providence (Rhode Island), Richmond (Virginia), Troy (Michigan), Washington, D.C., White Plains (NY), and Wilmington (Delaware) — how do you avoid hiring individuals who represent “Black Lives” as officer (or firm) leaders in ALL those cities? Note: Not a comment on their practices, just how odd it seems to be saying Black Lives Matter, but not demonstrating it on the public face of such a law firm (I also see “family law” not mentioned, at least on first level, on any of the links. Bloomberg.com describes law firm focus as “Consumer Discretionary”).

The Wikipedia link on the Baptist pastor, above, says of the case, that an appellate three-judge panel overturned a county court granting the foster-care-family training and recruiting tax-exempt entity immunity, based on the percentage of its budget which came straight from government.

Far below, in the CBMA context, I show from the tax returns, and in a few larger, annotated images, how from near the start (as far back in time as I could access), in summarizing past years of support on its Schedules A, those Forms 990 for the “family services” entity omit, for more than one year, million-dollar government grants, instead reporting the only other contributions it received, in 2002, only about $4,000.

Boilerplate text (complete with mis-spelling on the organization purpose) was repeated year after year.

I hope, but am not confident, that the CBMA CEO was not, in his youth if that’s when he was involved in the same church’s youth ministry, in a type of mentoring relationship where he came to believe that such practices (multiplying nonprofits under the control of VERY few people, practicing on captive (church member) audiences and vulnerable populations (motherless — and fatherless — children) were “good practice,” or otherwise justifiable for the desired ends.

As always, I learned a lot doing these drill-downs, plural.

“What’s Up Now, 2020” only applies to the websites, as the latest financials or anything close to them, for either organization, just aren’t showing up. Some of the delay may be IRS filing deadlines leniency during COVID19 pandemic, but very late-filing while turnover of leadership, websites, and even entity legal business names, isn’t a new thing.

In both cases, the closest year I could find was 2017 (“FYE,” fiscal year ending, December), meaning both entities and CFUF’s related entity) are two-and-a-half years behind as of now, July, 2020.

I included tables with live links to the full tax returns (the same search results, but copied directly into the post, (rather than screen-shots later uploaded as an image, to the blog and inserted into the post) much lower on this post. Look for the similar color scheme, same organization names and EIN#s, but “clickable.” There are many such tables, once other involved personnel’s private foundations, or a larger sponsoring foundation (example: The Abell Foundation, wealth created or at least assets greatly increased when a philanthropist Henry Black sold the publisher of The Baltimore Sun).

Some chairmen and -women or directors of CFUF have been in (or run for) public office, resulting in yet other connections to foundations associated with public-interest projects, i.e., taking government money.

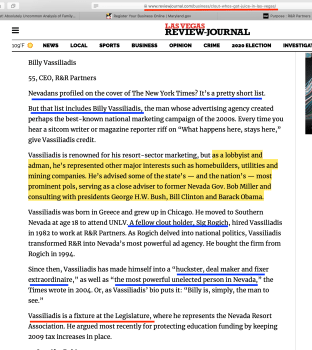

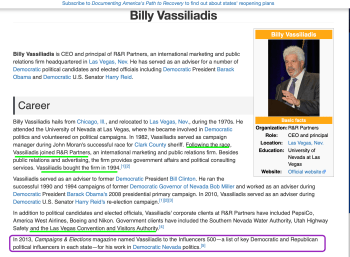

This brought up the 501©3 — 501©4 combo, “Greater Baltimore Committee” (and its Foundation) and “The Waterfront Partnership of Baltimore, Inc.”

One chairman’s background (LinkedIn) I looked at included six years volunteering at Baltimore Court Appointed Special Advocates (CASA) Programs, which relates to the National CASA (“National Court Appointed Special Advocate/Guardian ad Litem (CASA/GAL) Association”) which, oddly, chose a major media company for its latest (well, FY2018 shown) campaign based in Las Vegas, Nevada, state where illegal prostitution (far larger business than the legalized version, says Wikipedia) is high — and child-trafficking. The head of that media company (an LLC, not a tax-exempt organization) has been characterized (I’ll quote it) in 2004 (and since) as “huckster, dealmaker, and fixer extraordinaire,” “the most powerful unelected man in Nevada,” and with clear implications of mob connections.

The volunteering at a local CASA doesn’t make a person a fixer, dealmaker, or equal (per se) having mob connections, or being a crook. But, it DOES make one in that company when the National CASA is considered, it’s the company one has been keeping.

ALSO (by and large) MOST of the tax-exempt organization’s websites do not offer or provide tax returns, audited financials, or EIN#s, ALL of which are needed to understand their operations.

One CFUF board member for several years, not a household name for me so I simply looked it up (Catherine E. Pugh), was a State Legislator, then briefly Mayor of Baltimore until scandals showed that she was a crook, and how so. (See Catherine Pugh Wiki, Balletopedia, and this US DOJ announcement (next long quote) from last November, 2019.

Given the variety of people and entities involved, understand how a post on either one (let alone referencing both) entities above will be either very long, or very incomplete. The linear blog form with many links isn’t the ideal format, however, when it is read, and links followed (and read), it’s the understanding (your own comprehension) which can better process how what is being portrayed as simple, often isn’t. Without looking at the various networks, you don’t comprehend the entities or their behaviors well enough to assess how genuine is the stated purpose.

The real question is, operations. This next section on Catherine Pugh was added last (not first, where it’s showing up) as I did the drill-downs. I’ve labored on this post long enough and am about to publish.//LGH

You can now access the various documents (unsealed last Nov., posted at Maryland District Courts website Feb. 4, 2020), including indictment, plea agreement, stipulation of facts, and Government’s, then Defendant’s Sentencing Memorandum. Stipulation of Facts:= in USA v. Catherine E. Pugh:

Pugh did not maintain a personal bank account, choosing instead to comingle her personal and business finances in her business accounts. [Pugh] filed a U.S. Individual Income Tax Form 1040 for 2015 and 2016, which included Internal Revenue Service (“IRS”) Form Schedule C for Profit or Loss from a Business (Sole Proprietorship)…

Compare the dates the wire fraud (etc) took place — notice it involved public institutions (Baltimore Public City Schools, “BCPS,” a local charity (Associated Black Charities, Inc. (ABC-MD.org),** had political and self-gain (including tax-evasion) purposes, and involved — as often has to happen when fraud occurs — another civil servant / city employee) with when she was also a volunteer director (1.0 or so a week, with others: there’s only one paid officer, Joseph T. Jones, per the tax returns) with the well-known Center for Urban Families.

**(Looked up after I published this post): The ABC-MD charity’s main revenue, throughout, is federal grants under the Ryan White (HIV/AIDs) grants. Its ONLY financial posted on “Financials” page is for audit of FYE2017 and 2018 — not one Form 990, and nothing for any other years.

Yet, according to the signed (by Pugh and her attorney) Stipulation of Facts, the same charity played a major role in facilitating (knowingly or not; seems to me better fact-checking earlier was in order) Pugh & Brown’s varieties of fraud which show little regard for the poor and vulnerable — or the privilege of being in public office as a civil servant. It’s unbelievable how many other companies and types of companies were involved in donating to the above charity, resulting in the fraud: a healthcare insurance, auto insurance, Kaiser (a California, primarily, healthcare big player with a presence in Maryland), even a Chicago investment firm. But seems to have started (Count 1 of the Stipulation of Facts) describes with UMMS (University of Maryland Medical System) purchasing books intended for the Boston City Public Schools, and involving this Charity. One was played off against another, backstopping as about to be caught, lying to their accountants, use of cash, straw donors, etc. (Upcoming links and quote summarize).

It’s good to be alert to the “how” of such operations involving public institutions and private charities, because it can and no doubt does occur in plenty of places. Notice: several companies out of a home address, the types of interrelated businesses they were in, and targeting the nonprofit field and public offices (State Senator, Mayor) (using, no doubt prior involvement IN the public offices as a credibility boost) This quote is only about half (or less) of the Department of Justice press release:

Former Baltimore Mayor Catherine Pugh Pleads Guilty to Federal Conspiracy and Tax Charges

FOR IMMEDIATE RELEASE

Thursday, November 21, 2019

. . .According to her plea agreement, from approximately 2007 through 2016 Pugh served in the Maryland State Senate, where she served on various legislative committees, including the Senate Health Committee. In 2011, Pugh ran an unsuccessful campaign to be mayor of Baltimore. In September 2015, Pugh again ran for mayor of Baltimore, and won, becoming Mayor on December 6, 2016. Pugh owned Healthy Holly, LLC, a company formed in Maryland on January 14, 2011, and used to publish and sell children’s books she had written. Pugh also owned Catherine E. Pugh and Company, Inc., a marketing and public relations consulting company organized in Maryland in 1997. The principal address for both companies was Pugh’s residence in Baltimore. Pugh was also the sole signatory on the Healthy Holly and Pugh Company bank accounts. Pugh did not maintain a personal bank account, using her business bank accounts for personal and business finances.

Between June 2011 and August 2017, four Healthy Holly books were published, with each book listing “Catherine Pugh” as author. The vast majority of books published by Healthy Holly were marketed and sold directly to non-profit organizations and foundations, many of whom did business or attempted to do business with the Maryland and Baltimore City governments.

From approximately 2011 until December 2016, Gary Brown, Jr. worked as a legislative aide to Pugh.

. . .Wire Fraud

Pugh admitted that from November 2011 until March 2019, she conspired with Gary Brown to defraud purchasers of Healthy Holly books in order to enrich themselves, promote Pugh’s political career, and fund her campaign for mayor. Pugh and Brown admitted that they employed several methods to defraud, including: not delivering books after accepting payments for the books; accepting payments for books to be delivered to a third party on behalf of a purchaser, then converting some or all of the purchased books to their own use without the purchaser’s or third party’s knowledge; and by double-selling books without either purchaser’s knowledge or consent. Pugh stored quantities of fraudulently obtained Healthy Holly books at various locations, including Pugh’s residence, her state legislative offices, her mayoral office, the War Memorial building in Baltimore City, and a public storage locker used by Pugh’s mayoral campaign.

Specifically, Pugh admitted that she sold approximately 20,000 each of Healthy Holly books one, two, and three to the University of Maryland Medical System (UMMS) for $100,000 each. UMMS agreed to the purchase on the condition that it be on behalf of, and for distribution to, school children in the Baltimore City Public School system (BCPS), in part, to further the mission of UMMS’s community outreach program. As part of the agreement Pugh was to deliver the donated books to BCPS.

As detailed in her plea agreement, Pugh did not deliver the full 20,000 Healthy Holly books one, two, and three that UMMS purchased to BCPS, instead keeping some of the books for herself. In addition, Pugh sold to unwitting purchasers copies of Healthy Holly books one, two, and three that had already been sold to UMMS and donated to BCPS. Pugh used Associated Black Charities, a Baltimore-based public charity, to facilitate the resale and distribution of the books to new purchasers. Neither the charity nor the new purchasers knew that Pugh was double-selling the books. Pugh also accepted payment for books that were never delivered to the purchaser.

Conspiracy to Defraud the United States/Tax Evasion

Pugh further admitted that she used the proceeds of the sale of fraudulently obtained Healthy Holly books for her own purposes, including: to fund straw donations to Pugh’s mayoral election campaign; and to fund the purchase and renovation of a house in Baltimore City.

Specifically, Pugh issued Healthy Holly checks payable to Brown, for the purpose of funding straw donations to the Committee to Elect Catherine Pugh. …

! ! ! (From the Maryland District Courts link above, with the various pleadings, I started reading the “Stipulation of Facts” (quoted briefly above) and on page 2 see that, in approaching the BCPS (public schools) to get agreement to take her books, they first had to copyedit (Book One) for grammar and copyediting mistakes (!!) — this was a State Senator and mayoral contender in 2011!!)

You have the links and can check back through the years, when former Mayor Pugh was board of directors on CFUF…including up in 2017.

The websites (per tax returns) are BlackMaleAchievement.org for the Campaign (“CBMA”), CFUF.org for the Center, and “N/A” for the second “CFUF Fund” entity. I guess viewers of the website aren’t meant to know about the second entity and viewers of CFUFFund’s tax return who somehow manage to locate it probably did so through the other tax return.

I’ve been aware of these organizations for years (one search shows, of CBMA before it incorporated, on a post I did January 2011), and of CFUF when its business name (last initial) stood for “Fathers” not “Families.” Change of label hasn’t really become a change of focus, it becomes clear quickly.

CFUF is the earlier of the two by over a decade, but historically seems to get more government grants.

CBMA didn’t need them, with the powerful organizations which came together to start it, complete with a NY address (when incorporated) but a fiscal agent from California, at first. CFUF as you can see below has two tax-exempt related entities and some complex involvement of board members with other corporations dealing with CFUF)

Another term which I’ll be using frequently in this post is “DAF” for Donor-Advised Funds” and “FJC” which is the legal name for another indicator of the kinds of problems excessive or inappropriate use of DAFs can lead to (example given of the New York Legal Assistance Group CFO and founder (it started just after 1996 Welfare Reform too) who moved assets over to FJC, and was later indicted on several counts for breach of fiduciary duty by the New York Attorney General, under Estates and Trusts Law.

How the guy did this is a major lesson in what to watch out for in complex community or other organizations founded FROM THE START with intention to complicate or simply avoid the accountability process, within the entity and to the public.

CBMA (EIN# 47-2532282, Dec2014ff, Campaign for Black Male Achievemt, NY) Candid’org search results, Jul.1, 2020

OPINION: Perhaps the #BlackLivesMatter movement should be re-named to reflect both progressive rich people’s and (also quite well-endowed) U.S. federal government’s standard policy and practices: “Go with the flow if you’re already in power, and keep it male-dominant.”

CFUF (EIN#52-2142708) & CFUF Fund, (EIN#77-0710204) Candid Search Results | July 1, 2020.

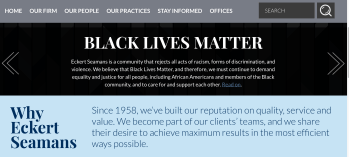

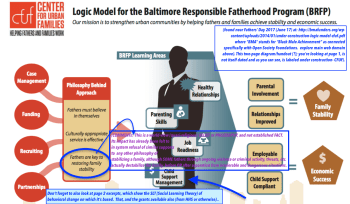

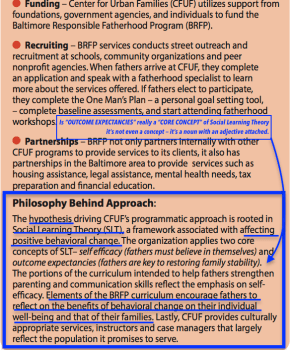

“Brief” Statement of Purpose for Fiscal Year 2017 (latest found July 1, 2020 as you can see above, their Fiscal Year is the calendar year) is hardly brief — but after stopping mid-word, isn’t continued anywhere else on the tax return. :

Since our founding in 1999, CFUF** has remained at the front-line of addressing some of our city’s most pressing issues, including poverty, unemployment, father-absence and family disintegration. We maintain an unwavering focus on addressing the key challenges of Baltimore’s urban families by working to connect fathers to their children, creating opportunities for economic and financial security through work, and providing access to other key interventions and supportive services In furtherance of our direct service work, CFUF collaborates with policy and practice change- makers to advocate policies that effectively enhance and impact low-income families. Our mission is to strengthen urban communities by helping fathers and families achieve stability and economic success.

Our unique service model, Family Stability and Economic Success (FSES), is an integrated and comprehensive approach to addressing the needs of our target population. Services offered through the FSES Model target two c__

[two What? This tax return doesn’t say, just drops off abruptly. More on it, later…but the tax return makes it clear they’re running couples’ and parent-ed classes, are government funded, have a related entity (shown in the image) and board members (volunteer and highly part-time though they may be) heavily involved in corporations or LLCs dealing with CFUF, or its Fund as “sponsors”]

Misleading Vocabulary Alert (This is common practice for nonprofits, but still important to understand, and note when you see it) : “Our” founding? The founders, staff and leadership of CFUF, taken together, may be “us” and “our,” but CFUF, that which was founded, is an “it.” So why in attempting to describe an organization, flip back and forth between “Our” (plural), “has” (singular), then most, but not all, of the rest of the description back to plural, “We, our”? Nice for the group dynamic and warm fuzzy feelings, but distracting from the “what” here: the nonprofit corporation. This entity took $1.5M government grants in 2017, is well known in the “fatherhood” field, started (as we speak here) about two decades ago, a.k.a. right after 1996 Welfare Reform, and can’t describe itself?

- Keep points of reference straight, even if the filing corporation, or webmaster describing it, doesn’t: an entity, singular, is NEVER an “us,” plural. Either basic writing skills and concern for the truth, stated accuratedly, are absent, or the ADHD paragraph (exhibiting identity confusion) is deliberate. For the level of government funding received, we (readers, and taxpayers) deserve better.

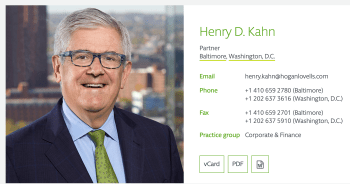

CFUF’s Chairman of the Board (Henry D. Kahn of Hogan Lovells, which provides global legal services, I see) is a high-achiever, and anything but a Black Male: also true of the large legal firm he works for.

-

-

HoganLovells.com/en/henry-kahn (see CFUF, where he was Chairman of the Board (2hrs week volunteer, gov’t grants to CFUF that year, $1.5M, private $4M+, and Revs – Expenses in the red) (three images, quote continued in body of post 7-1-2020)

-

-

CFUF’s Henry D. Kahn, as shown at Hogan Lovells (global legal services provider, since 2010 (Lovells background is UK, Hogan & Hart’s, USA) (Img#2 of 3)

Continued quote (from the image with text, above) from HoganLovells.com/en/henry-kahn, on CFUF Chairman Henry D. Kahn’s special talents:

Henry understands the delivery of institutional investment management and wealth management services and products from a trust company platform. He frequently advises limited purpose trust companies and bank trust departments, and has advised most of the limited charters formed in Maryland.

Recognized for his knowledge of Maryland corporate and real estate investment trust law, Henry has advised on the Maryland aspects of many of the largest, most complex M&A transactions involving entities formed as Maryland corporations or REITs. He helped draft (and, after the Governor’s veto, redraft) some of the most complicated provisions of Maryland’s initial anti-takeover law.

[After the list of his awards and recognitions, the Education/Membership section of bio blurb]:

Education and admissions

Education

J.D., The George Washington University Law School, 1980

B.A., Yale University, 1977

Memberships

Board Member, Center for Urban Families

Board Member, Hillel at Syracuse University

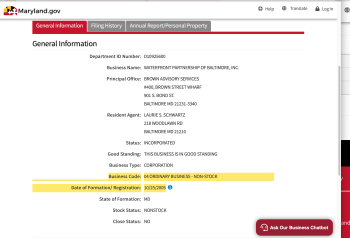

Board Member, The Waterfront Partnership##

Chair, Committee on Corporate Laws, Maryland State Bar Association, 2004-2005

Leadership Council, Open Society Institute — Baltimore

Trustee and Board Secretary, Gilman School

Bar admissions and qualifications

Maryland (and) District of Columbia

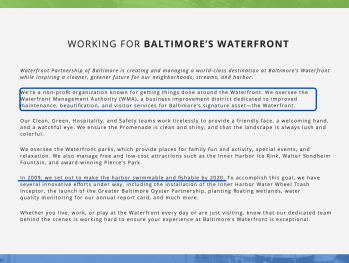

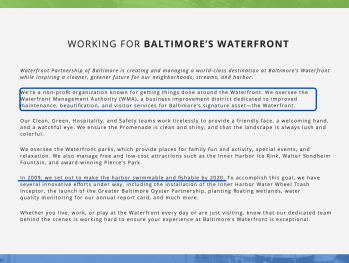

(Para: July 7, 2020). The Waterfront Partnership of Baltimore, Inc. was “Inc.” in Maryland in 2005, not mentioned on its website. What it does say in its “Mission and History, besides its worthy mission, (see nearby image) gives a clue:

…We’re a non-profit organization known for getting things done around the Waterfront. We oversee the Waterfront Management Authority (WMA), a business improvement district dedicated to improved maintenance, beautification, and visitor services for Baltimore’s signature asset—the Waterfront.

Essentially, this represents (from what it says there) a nonprofit presiding over a government entity (Authority) which has the ability to tax. (Baltimore City Codes describe how the creation of the Waterfront as a Special District, and the Authority (as an Authority) came after 2005 recommendation by the Greater Baltimore Committee; it also references the (tax-exempt) Waterfront Partnership, Inc., having been in operation 18 months earlier. (I skimmed the document and provided the link, summary “as I recall.”).

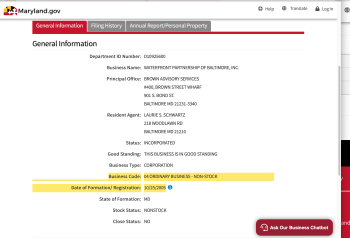

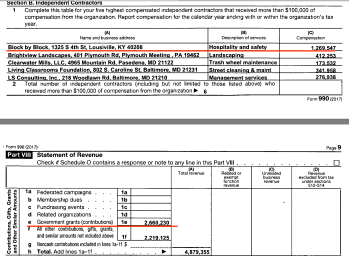

Yet the WaterfrontPartnership.org website doesn’t bother to post links to its financials, name its CEO, say WHEN it was formed, or cite its EIN# (Seems to be common practice in this crowd — see the Greater Baltimore Committee, Inc. section of my post below). I easily found its registration on the Maryland.gov business entity search page; as Nonstock entity “D10925600.” It does have an EIN# (EIN#203682821) which I went to IRS.gov to find; it has not yet, apparently, filed any FY2018 return year (fiscal year ended ONE YEAR AGO, June 2019), yet about half ($2.6M) of its contributions) are from government. See next table of returns from Candid.org to access the FY2017 return:

Total results: 3. Search Again. Waterfront Partnership of Baltimore, EIN# 20-3682821, one year behind in filing its returns, seemingly (FY Ends June 30).

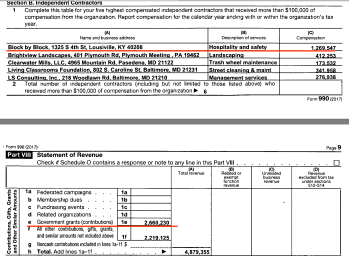

Their highest independent contractor (out of six) for 2017 (Part VIIB) was “Block by Block LLC” from a certain address in Louisville, Kentucky, and paid $1.2M for “Hospitality and Safety.” I just looked it up (in Kentucky) and found an LLC formed in 2006 which is inactive/withdrawn, after changing its name to “BLBL,LLC” in 2008, while another entity from Ohio (different set of people) took over that assumed name in 2009, i.e., took over the assumed name “Block by Block, LLC.”

-

-

Waterfront Partnership of Baltimore (website)

-

-

Waterfront Partnership of Baltimore (Maryland.gov registr’n shows Oct 2005 and NonStock (nonprofit)

-

-

Waterfront Partnership of Baltimore, Inc. (website offers zero financials, I looked it up,this is latest return showing halfway through 2020 (!)

-

-

Waterfront Partnership of Baltimore, Inc. (website offers zero financials, I looked it up,this is latest return showing halfway through 2020 (!)

Block by Block, LLC in Kentucky, Status Inactive by 2012, Name taken by an Ohio entity in 2009 | Screen Shot 2020-07-07 ..PM (One of ’em (probably the lower one) was a Waterfront Partnership of Baltimore, Inc major subcontractor in FY2017)

Nice to support LOCAL developers and entrepreneurs.

(MOVING ON…)

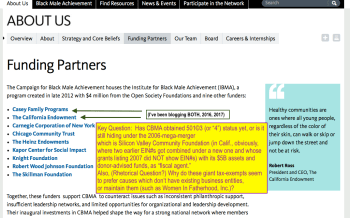

From CFUF FY2017 Tax Return, see if you can untangle THIS next statement on its Schedule O, mentioning Chairman Henry Kahn, David L. Warnock, Camden Partners Holdings, LLC /New Horizons Learning Centers (MicroSoft and Cisco affiliated, not Apple) and, having untangled that, as yourself (tell me, if you have an answer!) whether or not real estate, investment, on-line curricula and training/education, and consulting services facilitated by ongoing public grants from the United States government (and/or state of Maryland, or City and County of Baltimore) are the the real reasons for CFUF, despite its stated mission and purpose to help the poor, increase child support payments for noncustodial fathers through employment services, and (of course) strengthen families by constant coaching with special curricula and facilitators, about the strategic importance of fathers as opposed to, say, mothers (translation: men, as opposed to women, generally).

Being on Schedule O without punctuation doesn’t exactly help anyone decipher the statement… You can view directly on tax return table below, but I’m including the image the quote comes from also.

How many entities and people can you find in the following quote; who’s related to whom, business-wise? (Sounds like a test problem for assessing IQ, verbal comprehension. I’ve added punctuation (periods, to end a sentence, and some paragraphs) where it seems to apply):

How many entities and people can you find in the following quote; who’s related to whom, business-wise? (Sounds like a test problem for assessing IQ, verbal comprehension. I’ve added punctuation (periods, to end a sentence, and some paragraphs) where it seems to apply):

Henry Kahn provides legal services to Camden Partners Holdings LLC and the funds Camden Partners Holdings LLC sponsors. Henry Kahn is also an indirect investor in certain funds Camden Partners Holdings LLC sponsors.

David Warnock is a principal in Camden Partners Holdings and these funds.

Scott Soffen works for American Trading and Production Corporation (“Atapco”), which is an investor in a number of the funds Camden Partner Holdings LLC sponsors.

Atapco is also an investor in New Horizons Learning Centers, Towne Park, and Calvert Education Services alongside Camden Partners’ funds. Scott Soffen is a Director of Calvert Education, where David Warnock serves as Chairman of the Board.

(Calvert Education, you can explore: it’s a curriculum and more with special emphasis on Homeschooling or “Blended” learning (i.e., on-line) and in Maryland, accredited for K-12. I.e., major emphasis on on-line learning. Associated recently with Edmentum (in Richardson, TX and Bloomington, MN), and now “Calvert Learning,”

Calvert is accredited by the prestigious Middle States Association of Colleges and Schools. In addition, our Kindergarten through Grade 12 courses are approved by the Maryland State Department of Education. …

“Calvert outlines everything you need to do and say to your child. I didn’t need to plan anything at all — it was all planned for me. Thank you so much, Calvert, for your fabulous homeschool material” (testimonial, on this page)

Scott L. Soffen of CFUF mentions: Legg Mason Wood Walker, Inc (Educ Industry), Lehman Bros, Merrill Lynch etc). Viewed July 5, 2020 (url req’d subscription to view any more than this)

“Wonderful,” (not really) to be on auto-pilot as a homeschooling parent..

Though for decades targeting primarily homeschoolers and “blended education” (students who for some reason might not be in regular classrooms), Calvert Education explains how in July 2019 it became instead Calvert Learning,” through merger? with Edmentum, and that parents (such as homeschoolers) can no longer pay privately for its curricula, but must join a school offering it. (see nearby image). That this happened only a year ago, and the latest tax return available from CFUF (via Candid.org — and CFUF website doesn’t post them) is 2017 may explain why I see no mention of either Scott Soffen or David Warnock on the websites involved.

Edmentum was filed in Minnesota (search here) as a Foreign (Delaware) entity in 1992, and has changed its names three times since: original (unknown) to TRO Learning to Plato Learning, to Edmentum, Inc., to Edmentum Holdings, Inc. as of 2019, i.e., now. (For some reason, two search results, identical name, Principal (Jaimie Candee), file number (65063) address and filing dates, show up. Both still “active.” I don’t know why. May be a search results face sheet error (“Name Type” — on reads “Home Business” the other “Minnesota Business” but both are “Foreign” in the details).

What do you think and where are (now) “the funds Camden Partners Holdings LLC sponsors“??

Sounds like Henry Kahn, David Warnock, and Scott Soffen have a good thing going together, while CEO Joseph T. Jones certainly has had steady employment at very decent wages at the nonprofit CFUF for the last generation (about two decades, 1999 – 2017).

Scott Soffen (LinkedIn) shows that Atapco was a family office, and he handled all the non-real estate transactions in consultation with others” (probably Henry Kahn). “Atapaco Family Office” (described at IVAO.com, looks like Russian?-English), has it roots in family wealth of founders of AMOCO, i.e., oil:

Headquarters | Baltimore, US

Description

American Trading and Production Corporation (Atapco) was originally formed in 1931 to consolidate, expand and diversify the business activities of the Blaustein family, the founders of the American Oil Company (AMOCO). Louis Blaustein started in the oil business by delivering kerosene with his son, Jacob, from a horse-drawn tank wagon through the streets of Baltimore. In 1910, Louis and Jacob founded American Oil in a one-room office in a converted stable. The company gained national recognition for innovation, well-planned and controlled expansion and diversification. Innovations included one of the first drive-in gas stations, the first gasoline pump to show the motorist the amount of fuel received and the original antiknock gasoline that permitted the development of the high-compression engine.

Naturally, besides its innovations (in type of oil) and landmark events (it fueled Charles Lindbergh’s trans-atlantic flight), later (1954) merging with Standard Oil, and confirming its Baltimore origins (and still) and influence on the city, read the Timeline (any image can be expanded) at “Atapco Properties“. Its Executive Team, to this day (of 11 shown, just 1 woman — on Human Resources — zero color diversity).

Scott Soffen has a BA in Economics from Rutgers University (NJ, public), an MBA in Finance (1986-1988) from NYU Leonard N. Stern School of Business, and some (not all) profiles show also a masters in education from “Capella University,” which had a federal class-action lawsuit filed against it in April, 2018, as a for-profit-education provider, in exploiting on-line PhD Candidates. (Soffen’s masters’, not PhD, degree was listed however as being obtained in 2000). I’m interested in part because of the CFUF leadership’s interest in for-profit and education investments.

LinkedIn also shows he’s been with CFUF (“I chair the finance committee”) since 2012. He ran for office apparently around this time, and a “VoteSmart” profile categorized him as Libertarian and “failing the political courage test.” There’s a (Political Issues) questionnaire at the bottom of this iVotersGuide. He also describes himself as an atheist and pro-abortion (‘under all circumstances’) and “End the War On Drugs;” His position on fathers and their children, predictable given the organization he’s working for here:

(Q. #16). Briefly list three (3) political or legislative issues of most concern to you, and explain why each is important to you.

End the War on Drugs — America needs to stop incarcerating its black male population. It needs to stop gang violence. It needs to encourage youth to get an education rather than deal drugs. It needs to keep fathers with their children rather than in prison. Ending the war on drugs will allow police resources to be to used to fight violent crime. Balance the federal budget — If the federal government taxed the current population for the services it provides, taxes would rocket to a level that would be unacceptable. We should limit the size of government to the level of government we are willing to pay for, rather than offering generous benefits today and sending the bill to the next generation. Stop being the World’s Policeman — The U.S. cannot afford to be the world’s policeman, fighting wars in the Middle East and stationing troops across the globe. Imposing Western values on other countries will only continue to make the U.S. the target of others’ hatred.

17. Should abortion be allowed under extenuating circumstances? If so, what circumstances?

Abortion should be allowed under all circumstances. The morality of abortion is controversial. Rather than impose the the morality of public officials on individuals, we should allow those individuals to choose the ethics they feel most comfortable with.

(LinkedIn), before coming to CFUF, he was volunteered (on board of directors) for Baltimore CASA:

Member of the Board of Directors, Court Appointed Special Advocates of Baltimore Inc.

Dates volunteered: Dec 2003 – Dec 2009 | Cause: Children

and (bottom right of web page, CASABaltco.org):

305 W. Chesapeake Ave. Suite 117

Towson, MD 21204

P. 410-828-0515

This project is supported by a grant from the Maryland Judiciary.**

This project was supported by Subgrant No. VAWA-2019-0045 awarded by the state administering office for the Office on Violence Against Women, U.S. Department of Justice’s STOP Formula Grant Program. The opinions, findings, conclusions, and recommendations expressed in this publication/program/exhibition are those of the author(s) and do not necessarily reflect the views of the state or the U.S. Department of Justice.

**Nice to know… any particular reason no one wants to post or link to any specifics on such a grant? Like its name, date, amount, or purpose?

What kind of person would VOLUNTEER for organizations so lousy at posting their financials, and providing concrete details for accountability to the public? How does that type of “loose-end” reporting help vulnerable children, or their non-abusive, working parents who fund this?

I looked at the National CASA Association’s public-posted Forms 990 and FS, but discussing it properly would be a separate post: the parts to be compared to the whole, and the three places one can look for reports (since it’s clear the local programs aren’t about to post theirs), the IRS filings, EINs Obtained somehow from a National CASA grantee list (for more IRS filings), State level incorporations, and IRS Tax-exempt organization searches, as well as (as appropriate, depending on which state), any charitable registries where charitable registration is required.

Just know that it’s primarily a government operation (by percentage of $$ shown), and reports legal domicile Washington State, 1984ff. In FY2018, besides the over $9M gov’t grants shown as contributions, a Schedule B (Public copy, voluntarily shown, names redacted) shows only 3 major contributors. By the amount, one is obviously the Government Grants shown, the other two exceeded $300K and $400K, meaning most of the “other” (non-government) grants reported in Part VIII, “Revenues,” Line 1. Separately, from Candid.org, the latest tax return shown is for FY2017, and the table looks like this:

(Search results for: Organization Name: , State: , Zip: , EIN: 911255818 , Fiscal Year:)

Total results: 3. Search Again.

Again, you can see that Candid.org search results labeling don’t display actual entity name in two out of three results. Any name-search will, at first (until it’s repeated with an EIN# search) be ineffective.

~ ~ ~END of “SCOTT SOFFEN” / Baltimore CASA program section of this post ~ ~ ~

June 2020, Campden Partners Closes Fund VI with $100M in Commitments from Investors

June 24, 2020, (Baltimore,MD) – Camden Partners (“Camden”) announced that it has held a final close on its sixth private equity fund. Strategic Partners Fund VI (“Fund VI”), the latest fund in Camden’s Strategic Partners fund series, wrapped up its fundraising efforts this month with $100 million in commitments from limited partners which include Pension Funds, Endowments & Foundations, Family Offices, and Fund of Funds (private equity funds that invest their assets into other private equity funds).

Founded in 1995 by David Warnock after leaving T. Rowe Price, Camden has become one of the oldest and longest-tenured private equity firms in the Baltimore area, having invested in more than 80 private businesses since inception. …

For 25 years Camden has consistently focused on investing in smaller, often founder-led, growth-stage companies, leveraging domain expertise in tech-enabled services and software, business services, and education.

Like running responsible fatherhood and parenting classes?

Bloomberg.com, straightforward summary: It’s a Private Equity Firm that focuses on education, healthcare and business services sectors in the US.

Its street address, 500 East Pratt Street #1200, Baltimore, MD 21202, which also happens to be the street address of The Warnock Foundation, which loves Baltimore, “social innovation, education, social justice and “workforce development” but does not take any unsolicited proposals.

-

-

Warnock Foundation (David L Warnock), Contact is 500 East Pratt Street #1200, Baltimore, MD 21202 ~~Viewed 2020July03

-

-

Camden Partners HQ, contact is 500 East Pratt Street #1200, Baltimore, MD 21202 ~Viewed 2020July03 Fri

Currently (Warnock Foundation’s) text-deprived website, motto, Challenging a Culture of Low Expectations is full of VERY large photos and a lot of white space, specifically with Mr. Warnock’s (white, middle-aged male) face near the top, and below it, many others displaying its color and gender diversity. I had higher expectations of such a fine, civic-minded foundation, noting on my own desktop files that some years ago I actually tried to puzzle out (and, to a degree, did, through tax returns which reported grants and grantees) its financial relationships to CFUF, the Green Academy (charter school at the site of a former public school), etc.

(Did I mention yet that its financials (and its EIN#) aren’t exactly advertised on its website now and probably weren’t then?)

In 2015 (Nov. 11, Baltimore Sun) Warnock announced a plan to run for Mayor of Baltimore, citing his working hiring ex-cons and (some of the above projects), as a Democrat and an outsider, hoping they wouldn’t hold his wealth against him:

David L. Warnock, the Baltimore venture capitalist and philanthropist, is entering the mayor’s race — arguing that his business background and political inexperience are positives for a city in desperate need of job growth and a fresh start. …

Other announced candidates include former Mayor Sheila Dixon, state Sen. Catherine Pugh,** and City Councilmen Nick J. Mosby and Carl Stokes, all Democrats. …

The Democratic primary, which has decided who becomes Baltimore’s mayor in recent elections because of the party’s 10-to-1 advantage over Republicans in the number of registered voters, is scheduled for April 26.

That’s about one year after the unrest that gripped Baltimore following the death of Freddie Gray, who suffered a severe spinal cord injury in police custody.

Warnock said his experience in the city has given him insight into the city’s social ills; he is the founder of a West Baltimore charter school, Green Street Academy, and the Warnock Foundation, which funds efforts to improve education, create jobs and other initiatives.

(**I noticed also on 2.0 hrs/week volunteer, Board of CFUF)

Warnock, who has three children, lived in Baltimore in the 1980s and 1990s before moving to Baltimore County. He returned to downtown in December, buying a $1.7 million condominium at the Ritz-Carlton Residences. // While the median income in Baltimore is far below the national average, Warnock said he does not believe city voters will hold his personal wealth against him. …

“I think Baltimore likes winners,” Warnock said. “I’ve made a lot of money. It’s time for me to make a lot of change.”

Since 1999, Warnock has been a trustee and board chairman for the Center for Urban Families, which has helped thousands of ex-offenders find jobs. He also is chairman of the board of the pro-business Greater Baltimore Committee. Warnock said he is stepping down from those positions to run for mayor.

Greater Baltimore Committee (1955, think “urban renewal” and regional development planning (“action committee”). Baltimore, remember, has a harbor. Major real estate development projects. Several enthusiastic paragraphs and a web page (on the GBC website) reference a “GBC Foundation” and the opportunity people have (since it was formed in 1978) to contribute to these public projects, it’s after all a 501©3.

The Greater Baltimore Committee Foundation, Inc. is the charitable arm of the Greater Baltimore Committee, providing an outlet for which businesses, foundations, civic leaders and members of the public can make charitable contributions to affect the mission of the GBC.

The GBC has historically been the voice for the community and advocated for projects and initiatives to improve the Baltimore region and to help it succeed and thrive.

The GBC Foundation, Inc. is a 501(c)(3), nonprofit, civic interest corporation that was founded in 1978 …

While mentioning that GBC Foundation is a 501©3, why not also mention that GBC is a 501©4? Does everyone in Baltimore already know this, somehow? Others who might read the website?

Does the website show the financials? Of course not! See GBC.org/donate: feel free to check).

Not finding it there, I went to the IRS and found a “GBC Foundation” in Chicago (obviously not the same one), then “Greater Baltimore Committee Foundation,” which has 3 officers, no employees, is taking in very little but spending twice that, holds only $68K as of 2018,* and from which tax return I learn that the “Greater Boston Committee” is in fact an “Inc.,” a related 501©4, i.e., also a business entity, and obviously doing better financially (Part VIIA on the 501©3 shows this) it is paying Donald C. Fry (FY2018) $342K + benefits. The corresponding year at the 501©4 reports about $51K more bonus compensation (Sched J explains why the $393K). *(Somehow it must have taken in more, earlier in its history).

Donald C. Fry was also a former state legislator who sat on most of the budget, appropriations, Ways & Means committees.

Earlier history of the GBC Fndtn shows larger grants, and building some assets. Most recent shown (2018) shows only $11K rec’d and twice that spent, i.e., maintaining a negative in the “Revenues – Expenses” category. I also learned in the process of looking around that its street address matches the Abell Foundation, which also helped (I read) start up the CFUF originally. (111 S. Calvert Street, Baltimore).

Total results: 3. Search Again. Greater Baltimore Committee Foundation, EIN# 52-1131843, a 501©3

Formed 1978. Address, 111 So. Calvert Street #1700, Baltimore, MD

Summary: currently “barely there,” but earlier had some assets. (Earlier years visible by tweaking the date section of urls; for 2008, however, add an “EZ” after the characters “990” near end of the url — it filed a short-form). Its related organization is a membership entity (Files Form 990O), with the members being major business owners.

And the related entity, formed about 25 years earlier, in 1955,

Total results: 3. Search Again. Greater Baltimore Committee, Inc. is EIN# 52-0645650, a 501©4

Address, 111 So. Calvert Street #1700, Baltimore, MD

Here’s the Abell Foundation’s tax returns (not posted at their website, either), whose assets increased nicely when The Baltimore Sun (which it published) was sold:

Total results: 3. Search Again. The Abell Foundation, Inc. is EIN# 52-6036106 and a files as a private foundation, not a public charity (Forms 990PF)

Address, 111 S. Calvert Street #2300, Baltimore, MD.

“Just a few minor issues with transparency:” Since 2016 its tax returns uploaded here are MISSING many pages, including its statement of contributions made (typically in the millions of dollars, and mostly to Baltimore. From 2001-2015 tax returns (I checked) it also consistently did not provide — as IRS Form 990PF instructs, the name AND address of each grantee, which is a point of verification; 2015 list was shrunken and did not cite any city or state, just an entity name (which can obviously change with time). Being a Form 990PF filer, corresponding EIN#s for each grantee was not even requested.

One of Abell Foundation’s two (only) listed major contractors was Hogan & Lovells, LLP. The other was a firm in Boston.And while I’m here, the Warnock Family Foundation (at same address — see above — as both Warnock Foundation and Camden Partners, LLC, i.e. 500 E. Pratt Street #1200, Baltimore, MD). Basic name search didn’t locate any specifically named Warnock Foundation (without “Family”), although there are other Warnock Foundations in different states, true also of Abell Foundations.

more moderate in size, but the second-largest contribution ($50K) going to CFUF, with $400K promised in future years:

Total results: 3. Search Again. Warnock Family Foundation, EIN# 46-0971823, filing Form 990PFs with gradually declining total assets as you can see. In 2018, David Warnock made the only contributions ($333K) and it’s said to owe him $96K as a loan from one of the officers.

(Current and an older photo, with description, of David L. Warnock I found on my desktop files its foundation lookups. I may not have previously posted it, but found it likely looking up some of the entangled relationships (but not listed as “related entities” of Kahn, Warnock and Stoffen, and who they were):

CFUF Bd David Warnock~W’nock Fndtn ~ Green Academy+Fndtn~Balt Charter School~ Look at GSA Related Contribs FY2014 cf Elijah Cummings + Dan Schochor***MustReName Later! ~~Shot 2017Nov30 (posted in July 2020)

And, after reading (above) about the complex relationships of CFUF’s board (again, FY2017) with certain other entities one name caught my attention on the “Representative Experience” part of Henry D. Kahn’s page at Hogan Lovells:

Sale of Bentall Kennedy to Sun Life of Canada.

Bentall Kennedy purchase of New Tower Trust Company.

Towne Park sale to investor group led by TA Associates.

Henderson Global plc purchase of Geneva Capital Management.

Sale of New Horizons Worldwide to investor group led by Camden Partners and American Public Education.

Purchase of Ned Davis Research Group by Euromoney Insitiutional Investor PLC.

Purchase of FS Advisory Asia by FTI Consulting Inc.

Sale of Securities Finance Trust Company (dba eSecLending) to Parthenon Capital Partners.

I just looked at American Public Education (I “get it”) and New Horizons Worldwide, but it’s time to get this post out! Think on-line technology, distance learning, franchising, etc.

New Horizons Worldwide is in Florida and seems to have a close relationship with Microsoft.

“American Public Education” (APEI.com) is public-traded (NASDAQ) since 2006, and the parent company of American Military University (founded by “retired Marine Corps officer (what rank, not shown there, but see his LinkedIn now) James P. Etter, as a private company in Virginia).

The website has a timeline…APEI was formed in 2002 (W. Virginia is mentioned), Distance Learning accreditation (2006) opened it up form Federal loans (Title IV), and one year later (Nov. 2007) it went public at $20/share. By 2010 it was the “top provider of higher education to active duty service members.” …. Then gradually expanded its focus beyond military to others. In 2013 it acquired “Hondros College of Nursing” *** with campuses in Ohio (and on-line), educating healthcare professionals. APUS then launched “Momentum™” (‘faculty-guided degree program). In 2018, “APUS” (American Public University System) begins offering its classes in Global Security and Strategic Intelligence.

**Actual name appears to be “National Education Seminars, Inc.”per its March, 2020 10-K SEC Annual Report (which I got from their website).

Although APUS’s focus has broadened, it continues to have an emphasis on its relationship with the military community. Approximately 57% of APUS’s students as of December 31, 2019 self-reported that they served in the military on active duty at the time of initial enrollment. The remainder of APUS’s students are military-affiliated professionals (such as veterans, reservists or National Guard members), public service professionals (such as law enforcement personnel or other first responders), and other civilians (such as military spouses and working adult students).

I understood it even better on reading who was added as “Two Strategic Hires,” announced June 9, 2020: One of them had a background in Kaplan and Rosetta Stone, the other in Cisco Systems.

…Somers has extensive professional experience in the education and training industries, as well as in the e-commerce and wireless industries.

Prior to joining APEI, Somers served for more than five years as VP of Corporate Development at Kaplan, Inc. where he led acquisitions and divestitures across all business units. Prior to Kaplan, Somers served as VP of Corporate Development, Investor Relations and Treasury at Rosetta Stone, where he helped the company expand its core business and enter a new business segment with the acquisition of Lexia Learning. Prior to his experience in the education space, Somers led the M&A activities of GSI Commerce, an e-commerce business acquired by eBay, and SunCom Wireless, a telecom company acquired by T-Mobile. Somers graduated from Lehigh University with a BS in Business and Economics and an MBA from Villanova University. Somers is also a CFA Charterholder.

Maybe it should instead read #BlackMALELivesMatter, to call attention to how organizations addressing racism as if sexism weren’t part of it makes no sense.

Why should anyone have to choose between those options — racism or sexism?

And regardless of the merit of any cause, it’s simply wise to look up and look for the financials (translation, if in the USA and a tax-exempt that has to file tax returns). You need both forms:

- IRS Forms 990 (which means, you need an actual business entity name to look it up and get the related EIN#, which is a more reliable identifier –search filter — databases posting those tax returns. Helpful links on my Twitter profile description and (currently) pinned post.

- AUDITED Financial Statements to correspond with the same year’s tax forms.

These are great sources of information on the entity; compare these to whatever any website does or does not say about it. Yes, it takes some time and follow-through, but do you or do you not want to make decisions based on rhetoric, second-hand information (hearsay) or “Go With The Flow” peer pressure — without understanding just how rich and altruistic are the sponsors? Or how honest?

Steps 1 & 2 naturally lead to more steps, as supporting organizations, related organizations, independent subcontractors making over $100K (that year), each with their own steps 1 & 2 (minimum) , not to mention grantees. Do enough of them, and getting a sense of the patterns emerges faster with each round. Others with enough income-producing assets (or the ability to persuade others they have it) to distribute among tax-exempt entities so as to avoid timely recognition of “improprieties” are fast learners. They know how to publicize (in subscription-only form, or by-invitation-only conferences, in person, or working together on other projects) and replicate such practices. Examples in this post.

A legitimate cause should not be confused with legitimate entities, tax-exempt or otherwise. Excessive use of fiscal agents or “dba’s” is, first, unnecessary, and second, devious. “Trust me!” ….

Today’s post:

CBMA and CFUF in #BlackLivesMatter: What’s Up Now, 2020, with (Famous-Foundations-sponsored-) Campaigns for Black MALE Achievement and (Still U.S. Gov’t-Sponsored-) Centers for Urban Families (fka “Fathers”)? [Started June 20, 2020, Publ. July 8]. (short-link ends “-cvS”)

When “Do The Drill-Down” on US-based 501©3s (and ©4s, ©6s, etc.) tax-exempt entities talking big about closing achievement, inequity, wealth or other gaps for a more just and sustainable world becomes the norm, you’ll start to understand, as I have by now, that the label and the cause makes far less difference than the involved entities’ (whether government, private, or both) operating practices.

Among such operating practices, hiding the financials to avoid exposing (potential or real) “shell corporations” or other fraud, is an art form, if not “standard practice.”

Pretending to be open and transparent, but not filing timely, or sometimes at all, or when caught in one form of fraud, quickly moving the assets or altering the company name is commonplace. So are using dbas (doing business as) needlessly on websites (complicating lookups of the financials for viewers), mislabeling which year’s “financials” are actually posted (i.e., when a fiscal year doesn’t match the calendar year ending December 31, they may look more current than they are), and failing to nail down absolute, verifible business entity names and legal domiciles (within the USA, there is no “Federal” registration making a company automatically good in all states; if Washington, D.C. is the home legal domicile, other states are not.

At the moment, I’m annoyed at the CBMA entity’s leadership (which came out of Harlem Children’s Zone + Open Society Foundations; and I note that CEO Shawn Dove’s background as a director of youth ministries for the “First Baptist Church of Lincoln Gardens” in Somerset, New Jersey.

More on the significance of that, further below. Short version: Like many successful churches with charismatic leaders, this one’s leader was good at forming many nonprofits and getting on the boards of them also, to deal with government and help lift up the community. Only problem, and one reason why I have a separate post, not just an insert into another one, is when the “family services” nonprofit was sued by a child survivor of being raped and molested as an infant by foster carers (sic) the private agency helped the government entity place (him/her) with. Talk about the contrast of a name on the outside with the contents on the inside!

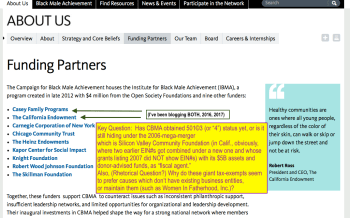

My next section deals with a certain 2006 billion-dollar-assets (at its start) foundation which, says an earlier version of the CBMA website (and I posted it years ago), was acting as fiscal agent for the campaign in its earlier years. Wikipedia now displays it as having $13 billion (USD) assets. HOW does that happen when organizations are also making substantial grants year after year?

Let’s take a look:

Fat Cat Foundations, Merged, means Bigger Fat Cat Foundations. Sometimes one is the “survivor” but in this example, both gave their assets to a third entity with its own, new EIN#.

I’m reminded again that the CBMA (Campaign for Black Male Achievement) with its many (fat cat) tax-exempt foundation sponsors (progressive), whom I also knew generally to be promoting “fatherhood.gov””fatherhood.[state].gov” and/or “fatherhood.org” type organizations, started using the Silicon Valley Community Foundation (for short on this blog, “SVCF”) shortly before the 2008 financial meltdown /recession /crisis by a MERGER of two previously-existing fat-cat (if one-half billion dollars in assets, that is, over $500M each — in your book qualifies as “well-to-do” for a state known for its homelessness and urban poverty centers — into a new foundation with a different EIN called the Silicon Valley Foundation. As a formula, that’d be

“Fat Cat Community Found’n #1 (EIN#nn-nnnnnnn) + Fat Cat Community Found’n #2 (EIN# 00-0000000) = BIGGER Fat Cat Community Found’n #3 (EIN# pp-ppppppp, starting assets $1B USD)

From the bottom (more recent events) on Wikipedia on the merged foundation (for what it’s worth). The years 2006-2011 are considered its “early history“on Wiki (nearby image). On that image, article’s right sidebar, please note as of that date, its assets were $13 billion, and revenues $1.3 billion. That’s 10%. Such charities only have to distribute (as I recall) 5%, but that’s still not much in exchange for lower taxation on income from such assets. Imagine how much is saved by the reduced tax on “non-program-related, income-producing assets!”

And wonder, also, of the donations granted, how many are to charities also controlled by some of the same individuals? (Why: See “New York Legal Assistance Group” example later on this post…does it facilitate criminal activities?). The tail end of the Wiki then talks about problems with sexual harrassment with its high-paid CEO PhD, as well as abusive treatment of staff by the head of its Human Resources. Just the kind of personality you want helping the needy and disenfranchised…

2018[edit]

A senior staff member resigned. The Foundation hired a law firm to investigate the associated claims of sexual harassment from Mari Ellen Loijens over the course of many years.[27] A few days later, the CEO, Emmett Carson, was placed on paid leave.[28][29] Two months later, the CEO’s employment “ended” and the resignation of the head of H.R. was accepted, as an investigation “found that many allegations from current and former employees were substantiated.”[30][31]

In November, the board of directors of the foundation named Nicole Taylor as President and CEO.[32]

Criticism[edit]

As a donor-advised fund,[??] the Foundation allows donors to claim a tax benefit immediately but indefinitely defer when they transfer the assets.[33] The fund also isn’t legally required to distribute any assets, like family foundations are, so there is little pressure to move money.[34]

The timing of prominent donations to the foundation has led to accusations of the Foundation being used as a tax loophole. Both Mark Zuckerberg and Nick Woodman donated near the same time as their companies’ IPOs, and the founders of WhatsApp donated shortly after their company’s acquisition.[35]

See also[edit]

[??] Wrong. SVCF manages donor-advised funds. It’s not one itself. SVCF is a tax-exempt foundation and 501©3. Many tax-exempt foundations and 501©3s feature DAFs (Donor Advised Funds), and every Form 990 has a section in its Schedules which reports how many DAFs versus other types of funds, and how much in each of them. A key feature of Donor-ADVISED-Funds is that once donated, they are no longer under the direct ownership (and as a consequence, control) of their donors (assuming those donors aren’t “coincidentally” also on the board of the foundation holding them). In other words,I think the wording in the Wikipedia may be a bit off.

This can get tricky and it can cleverly conceal whose money is whose, avoiding statement of those assets in other charities audited financials, such that people are encouraged to give thinking it has less than in fact it does. Key word here: “Advised” funds. Not donor-controlled funds. The relationship is different.

CLASSIC and STILL-RECENT EXAMPLE: NYLAG.

More recently, a lawsuit (criminal) against New York Legal Assistance Group (“NYLAG”) illustrated, in extensive detail how DAFs could be used and in this case were, to defraud the corporation.** NOT the topic of this blog, but with diligent follow-through (as possible) on some organizations utilizing DAFs, or with many related entities, you can start to see how it might easily happen. (**Searchable term “Yisroel Schulman,” whom I noticed made it onto my blog, in an earlier post on the group, if not before the prosecution, at least before I knew about it).

Courthouse News, Dec. 1, 2017, ‘New York Settles with Founder of Legal Aid Group‘.

Reading about this (especially the complaint, with its specifics on DAFs, naming specific charity Schulman used, “FJC: A Foundation of Philanthropic Funds” (founded in 1995, it too specializes in: Fiscal Agency, Donor-Advised Funds and other ways to grow FAST, such as “Agency Loan Fund” (loans to charities, but then the charities help secure their own loan fund by donating assets as collateral — get the picture?) helped me see better how the fraud could and did happen. I believe I may have profiled the FJC separately a year or so back; do not remember caught my attention somehow. Also the full name is itself a dba (the business entity name is just “FJC,” changed in 1999 from “The Jewish Community Foundation” (paperwork found at CharitiesNYS.com under its EIN#). This also becomes somewhat obvious from a look at the largest grantees and from the board members.

While organizations have to file “Schedule B” with their Forms 990 for “excess contributions” (the level is low — over $5,000), somehow FJC’s filings either skip the most important page of Schedule B (Section II,actually listing the amounts and whether cash or non-cash or both. The entity may choose to disclose or not disclose actual donor names (the IRS must be told, however), but simply leaving pages “MIA” is a new tactic on me, also making it unclear whether the organization did this, or someone handling the data as uploaded to the state charities (or, Candid.org’s) website. FJC’s contributions from its start have been HIGH (very large!), so absentee declarations are unusual.

It seems significant that the same person defrauding NYLAG (in part, through investments in FJC) is also called the founder of the entity. A quote from that Courthouse News article:

“In addition to reaping personal financial benefits, Schulman also made the transfers to enhance his reputation and standing in his community – i.e., so that he could appear to be a much greater benefactor of the organizations with which he was affiliated than he could be by using his own personal funds,” the complaint states.

Attorney General Eric Schneiderman said in the complaint that Schulman funneled improper transfers through NYLAG’s Interest on Lawyer Account “because he knew that NYLAG’s accountants did not audit those accounts and that the Board would not be monitoring those accounts when it reviewed the financial statements prepared by the accountants.”

From the Office of Attorney-General of New York, similar, press release November 29, 2017, more on how and what he did (the press release is about the settlement):

NEW YORK – Attorney General Eric T. Schneiderman announced today that his office has reached a settlement with Yisroel Schulman, the former President and Attorney-in-Charge of the New York Legal Assistance Group, Inc. (NYLAG), in which he admits to breaching his fiduciary duties to NYLAG and other charities with which he was affiliated.

The settlement was reached after an extensive investigation by the Attorney General’s Charities Bureau, which led to the filing of a complaint against Schulman in New York State Supreme Court. As detailed in the complaint, the Attorney General’s investigation found that that beginning no later than 1998 and continuing through at least 2013, Schulman diverted millions of dollars from NYLAG, a charity that provides free legal services to low-income New Yorkers, to other charities that he controlled.

I wonder who tipped them off.

Nov. 30, 2017, from “The Forward” (“Jewish. Fearless. Since 1897”), “Mystery Solved: Ex-Head of Jewish Legal Services Agency Sent Funds to Other Charities” by Josh Nathan-Kazis:

[Opening paragraphs] Schulman’s resignation from NYLAG two years ago has been a lingering mystery in Jewish communal circles, and was one of a number of financial scandals that shook New York’s Jewish not-for-profit community that year. Schulman, who co-founded NYLAG in 1990, is a member of a Lubavitch synagogue in Monsey, New York, and was a well-known figure in Jewish organizational life. At the time, media outlets reported that federal prosecutors were looking into accounting irregularities, but no details were provided.

The federal prosecutors have not brought any charges against Schulman. But an investigation by the Attorney General’s office** has uncovered a story of financial misconduct that stretches back over a decade. The settlement came after the Attorney General’s office filed a civil complaint against Schulman in New York State Supreme court alleging that Schulman diverted NYLAG assets for his personal benefit.

(Then Attorney-General Eric Schneiderman, also former NY State Senator, who also ? prosecuted the Madoff Ponzi Scheme (E.J. Merkin funds) fraud, but resigned in 2018 amid charges of sexual abuse, per Balletopedia):

….The complex scheme involved millions of dollars moving through more than a dozen accounts. While much of the money made it back to NYLAG, some of it was granted to unrelated charities tied to Schulman without the approval of NYLAG’s board. Meanwhile, the shifting funds meant that NYLAG understated its assets to regulators and donors, making itself look more in need of funds than it actually was. …[**LGH comment]

Beginning in 1998, Schulman began transferring millions of dollars in NYLAG reserves to donor advised fund accounts held by the FJC, a Jewish organization that manages philanthropic funds.

“[LGH comment]” I read nonprofit tax returns (Forms 990, 990PF) and where available if studying an organization, its audited financial statements — BOTH forms of filings are to be compared and lead to better insight — just by writing for this blog and sometimes in response to Twitter posts. I have been doing this almost every day for years, out of a desire to understand (not as a job or for paying clients).

Based on that, I see that “understating assets to look more in need of funds than actually” is common, which makes me to wonder why wouldn’t others familiar with nonprofit regulations (which the Attorney General’s Office regulates in various states), or major philanthropists who set up philanthropies for specific causes (and for tax-exemption) also know this.– Was the “failure to notice” either NYLAG’s or the FJC’s failures (of internal controls and to reduce/protect from their own types of misdeeds) more political than righteously indignant at the wrongdoing? I notice here, it settled; no jail time was involved for the perpetrator, although the fraud seems to have been in the millions of dollars, and for two organizations supposed to be helping the poor.