The Giant APA and ABA Typify The People’s Problem: Distinguishing PUBLIC (Gov’t Holdings and Operations, i.e., Assets and Cash Flow) from PRIVATE (Corporate Holdings + Operations, i.e., Assets and Cash Flow) So As To Hold Gov’t Accountable to Those It Taxes: the People Employed in Public and/or Private Sectors (Moved Here Dec. 25, 2019)

Post Title:

The Giant APA and ABA Typify The People’s Problem: Distinguishing PUBLIC (Gov’t Holdings and Operations, i.e., Assets and Cash Flow) from PRIVATE (Corporate Holdings and Operations, i.e., Assets and Cash Flow) So As To Hold Gov’t Accountable to Those It Taxes: the People Employed in Public and/or Private Sectors (Moved Here Dec. 25, 2019) (case-sensitive short-link ends “-bXO,” last letter “O” as in “Ohio” not the symbol for zero (“0”) and about 9,000 words)

I off-ramped this material from the Front Page December 25, 2019 — it’d been up there quite a while but it seems I then left it in draft format. Publishing it now just over five months later (mid-May, 2020),* I supplemented it extensively at the top, as usual.

*Part of the delay was until I could replace a dysfunctional (and decade-old) laptop and adjusting to the on-set of the “COVID-19” epidemic and business and public buildings, public gatherings shutdowns restructuring daily life and short-term, probably also longer-term plans to keep on living.

Interesting to write then and now and (as always) I learned more in the process of writing. You may be interested in the section

The APA Website and its Self-Description, What’s Missing

..and watching me attempt to match up two APA entities registered in Washington, D.C., both non-profit,** with one tax return for each showing which is which. In the process of trying to do this, I found there ARE two tax returns labeled “APA” but the second one is APA Group Return for the many (about 54) divisions which, says its return, does NOT list all divisions.. and seems to have little to do with the second, more recent, nonprofit, registered only recently (relatively speaking for such an old association).

**(one is called “American Psychological Association Services, Inc.” and uses the tradename “APA Services, Inc.” [initials only] formed only in 2000, the other around since, per DC statement, 1925, although I the APA generally dates itself as far back as 1892 (corrected from “1875 as I just published it. See next inset).

https://www.apa.org/about/apa/archives/apa-history

APA was founded in July 1892 by a small group of men interested in what they called “the new psychology.” The group elected 31 individuals, including themselves, to membership, with G. Stanley Hall (1844-1924) as its first president.

APA’s first meeting was held in December 1892 at the University of Pennsylvania. The basic governance of the APA consisted of a council with an executive committee. This structure has continued to the beginning of the twenty-first century: Today, APA has a Council of Representatives with a Board of Directors. …

Realizing that the growth of applied psychology represented a potential threat to its preeminence, the leaders of APA reorganized during World War II. Under this reorganization plan APA merged with other psychological organizations resulting in a broader association organized around an increasingly diffuse conceptualization of psychology.

Now the association’s scope included professional practice and the promotion of human welfare as well as the practice of the science of psychology. This flexibility in scope has remained to the present.

Psychology boomed after the end of World War II with the greatest increase in membership coming between 1945 and 1970….

- The GI Bill, the new Veterans Administration Clinical Psychology training program, and the creation of the National Institute of Mental Health contributed to the increased interest in psychology.

- For the first time psychology was a field, in both science and practice, that was richly funded for training and research. This was, as one scholar termed it, The Golden Age of Psychology.

The rapid and incredible growth in APA’s membership reflected these trends as membership grew 630 percent from 1945 to 1970,

Emphases (except the bolds) added]

By the way, I didn’t ever solve that which entity is which, and where’s the APA Services, Inc.’s tax return, if any?” dilemma yet, but by noting it here highlight that one exists.

How devious and distracting any nonprofit entity (private trade association focused on promoting its own business interests, which are supposed to be aligned with everyone else’s, member or not) can be may be lost when noticing how gloriously and multi-faceted are their web pages and noble the organization’s purposes.

SO WHAT? Tax-exemption is a privilege, the taxpayers make up the difference and no group or corporation is “too big to have to report” on time and honestly, and make it available to the public — but it seems, some think they are.

Exactly what is [any nonprofit] entity, and where are its [for the USA], (A) IRS tax returns and (B) independently audited financial statements (for the larger ones), and ( C) how do these correspond to legally current and registered entities in which legal domicile (state, territory or “D.C.”), and if they don’t, why not? If not current, why not?

IRS Tax Returns, State (or territory, D.C.) legal domicile registrations, and independently audited financial statements. These are especially important because nonprofits are PRIVATELY controlled, not public-traded, so similar information which might be available to the public and shareholders (i.e., SEC reports) do not apply, and are not resources to know more about such organizations. How do the websites communicate where these are to the readers?

While the APA (website) is more than evasive in self-definition in business and nonprofit (IRS-responsible, that is in responsible ECONOMIC terms, (and doesn’t encouraging the public to check the other sources and find such discrepancies) rest assured the APA/APA Services, Inc. has a grand strategic plan for at least the next few years, for the benefit of all people, which means, naturally, advancing the field, called “our field”:

Our mission is to promote the advancement, communication, and application of psychological science and knowledge to benefit society and improve lives

and,

APA is positioning our field to play a leading role in addressing the grand challenges of today and the future.

I’d like to keep the extended introduction (update) to this post, with its extra hindsight in light of the recent pandemic in place here. But, being nice, I moved it and some related material I’d added to this post, to: Privatization, Functionalism, the Complete Mental Health Archipelago. It’s Here: So Why Should We Still Care? (May, 2020)(case-sensitive post short-link ends “-cmj”), where it’s waiting on me to complete it.

Post Title:The Giant APA and ABA Typify The People’s Problem: Distinguishing PUBLIC (Gov’t Holdings and Operations, i.e., Assets and Cash Flow) from PRIVATE (Corporate Holdings and Operations, i.e., Assets and Cash Flow) So As To Hold Gov’t Accountable to Those It Taxes: the People Employed in Public and/or Private Sectors (Moved Here Dec. 25, 2019) (case-sensitive short-link ends “-bXO,” last letter “O” as in “Ohio” not the symbol for zero (“0”) and about 9,000 words)

(Title clarifications: “Giant” and “Gov’t”)

“Giant” – While ABA and APA are not the largest among the nonprofits, they are still giant in influence in that almost every profession or business IN the private sector will be needing the services of lawyers, and many more, including within governments too, of licensed psychologists.

From everything I’ve been able to read about the family courts (USA and abroad), their reason for even existing is to bring on the mental and behavioral health specialists to judge and evaluate families in some sort of transition, thus diverting major business which might otherwise be handled in criminal courts into private services associated with these courts.

No wonder the power and influence of APA combined with the ABA (most courts involve lawyers!!) as a key organization is key to understanding the family courts.

It’d be helpful to get a bird’s-eye view of their organization through understanding how they network (and looking at the financials).

“Government” in the US is not a singular. The federal government is one entity, but dispersion of its revenues throughout the system involves tens of thousands of other government entities, also typically able to tax and exercise governmental authority besides the well-known 50 states and territories. I included a brief inset below on the U.S. Census of Governments as a reminder.

Businesses resemble government in that, like government entities, they often have one main “front” entity but many related subsidiaries or companies and they are, though faster, changing hands and evolving, whether through mergers & acquisitions, spinoffs, startups, etc. Knowing public from private guides people into what kind of financials (we) have a right to expect and should seek out, and where we may have leverage as those governed, and where (if not under direct contract with such entities) we do not.

These relationships and related entities may or may not show up on their websites, but what WILL show up is whether or not the entities’ leadership — who after all are responsible for their own website design, whether in-house or contracted out — wish us to know much, or “not so much” about the companies’ financials: Do they play “late to file and hard to get”? Do they attempt to distract with ALL kinds of other detailed information about purpose, accomplishments, famous people involved or backing them, and “grand plans for good”?

Does or does not the self-description under any “About” page reveal what kind(s) of entity it is, and if so, buried how deep and mixed among how much less relevant information on the page?

Both the APA and the ABA are organized around basic nonprofit (tax-exempt) status. They do not have shareholders, are not public-traded, and not being government entities are not directly accountable to the people (of the USA. or its taxpayers) as a whole or need our consent to their operations. But being incorporated they are accountable to the federal government as to registrations and tax (exemption) filings.

Why I use the word “entity” much and why it’s so important And what IS the definition? (and according to whom?) [Section added 5-13-2020, different background color inside reddish-brown borders marks the addition; I’ll also mark the end of the section. This is for reminder and examples, because the ENTITIES I’m concerned about in this post are the PRIVATE ones participating (with Public).

‘We have overall rights (or so one might think until the recent COVID-19 pandemic!) and corresponding obligations under the public, but not necessarily under the private sector except where we have somehow contracted with them individually.

A big key to understanding the family courts is where the private sector has influenced and invaded the operations of the public, for its own profit and purposes, and justifying (continually, it seems) the deprivation and lessening of basic rights of individuals and individual families.

Basic meaning of “entity” from Cornell’s “Legal Information Institute” (“since 1992): https://www.law.cornell.edu/wex/entity (suggestion: look also at the “wex” page.. it’s a collaborative -effort encyclopedia: “Wex is a free legal dictionary and encyclopedia sponsored and hosted by the Legal Information Institute at the Cornell Law School. Wex entries are collaboratively created and edited by legal experts. More information about Wex can be found in the Wex FAQ. Here’s a list of all pages.”

A person or organization possessing separate and distinct legal rights, such as an individual, partnership, or corporation. An entity can, among other things, own property, engage in business, enter into contracts, pay taxes, sue and be sued. [emphases added]

When it comes to law and accounting, who or what is the ENTITY matters! Especially if one wants to track flow of government expenditures to (or from) that entity, or when the urge to “sue someone” or even just complain about products or services — what’s the responsible entity?

Google search of “Government Entity” (not always the best place to find conclusive definitions, BUT…) even this shows a range of definitions and how many sources cited that definition. You can gather a general sense, though, from: https://www.lawinsider.com/dictionary/government-entity. Here’s from the top paragraph, which had three examples and it says, 235 documents:

Government Entity means (a) any federal, state, provincial or similar government, and any body, board, department, commission, court, tribunal, authority, agency or other instrumentality of any such government or otherwise exercising any executive, legislative, judicial, administrative or regulatory functions of such government or (b) any other government entity having jurisdiction over any matter contemplated by the Operative Agreements or relating to the observance or performance of the obligations of any of the parties to the Operative Agreements.

This definition is not trying to restrict it to a single country, obviously, and seems broad, but notice “having jurisdiction.” References to “Operative Agreements” ~ The examples seem to be setting the definition of “government entity” for the purpose of specific contracts, which is not the same as definitions which apply to all (Americans) who are subject to taxation as a result of being citizens. In other words. The examples given are specific to the documents they were used in… not the most helpful for my purposes here in distinguishing various parts of a government entity from the entity itself. But it does point out “having jurisdiction over any matter contemplated by the Operative Agreements.

These definitions may not carry through to relationships between citizens or residents with a complaint against any government entity and wishing to sue it. Different standards and definitions are going to apply.

What about the “operative agreements” represented by various federal and state constitutions? That’s my main concern as being subjected to them, including but not limited to the experiences of dealing with their courts in the process of trying to stay alive and keep my offspring also alive and well-cared for, while exercising what I THOUGHT might be my basic liberties as a citizen, not to mention basic human rights? When these start to go haywire, routinely, consistently, it’s time to find the responsible ENTITIES, and find out where leverage exists.

Interesting how hard it is to get good, basic, definitions of what “government entity” is, who they are, and a full list at any point in time! (See “Census of Governments” section below, and note: if an entity is filing a “CAFR” report according to government standards, it’s most likely a government entity! The form differs for private entities! Those are also good places to find, for specific (geographies) what each government entity does and does not consist of — and its balance sheets; it’s “bottom line.” Look for the organization chart near the front, for Letter of Transmittal from the Independent Auditor (full of disclaimers what it did and did not audit) and as most financial statements (the “numbers” part of the lengthy reports) also have footnotes “Notes to the statements are an integral part” — and they are — I always look for Note 1 which usually gives a good, basic definition of the filing entities. (also the MD&A — Management Discussion & Analysis section. But this is reviewing material I’ve posted before, and shown.//LGH)

A broader definition from “WhatIs.Techtarget.com” matches at first, but for engineering and science, the rest of the definition (not quoted/see link) may not apply for public/private differentiation and in law and accounting. [From https://whatis.techtarget.com/definition/entity]

I used this example (after the quote), starting with a website, to separate the product or service from the entity which owns and provides the same (which, as it turns out, has several subsidiaries in other countries, but just one in the USA which started only in 1999).

In general, an entity (pronounced N-tih-tee ) is an existing or real thing. The word root is from the Latin, ens , or being, and makes a distinction between a thing’s existence and its qualities. An entity exists and that’s all it needs to do to be an entity. The fact that something exists also seems to connote separateness from other existences or entities. …

In the above quote (and url), I see that WhatIs® is a tool* (NOT an entity) and TechTarget became a public-traded company in 2007 (NASDAQ: TTGT) and so was an “entity” by at least then. Read more here (an IBM technical writer created “WhatIs” ca. 1999, TechTarget later acquired it…). (*”WhatIs® is a reference and self-education tool about information technology….”)

Sometimes you can find out what is its home state (but further checks needed; address may not always tell all) from its Privacy or Terms and Conditions pages (fine print, bottom of most website pages). This seems to be a Massachusetts corporation, but only going to the Massachusetts (Commonwealth) list of registered corporations would tell for sure.

TechTarget, Inc., its subsidiaries and affiliates (together, “TechTarget,” “we”, “us” or “our”) is a leading provider of purchase-intent insight for enterprise technology buyers. TechTarget owns and operates over 140 enterprise technology-specific websites and publishes or sponsors articles, blogs, newsletters, definitions, surveys, research, and other original premium content spanning over 10,000 unique IT topics (“Premium Services”). As such, TechTarget appeals to a wide range of individuals

I’ve marked my own usages of “entity” above in green, and personally make it a habit when reading casually or researching specific subjects on-line, to as much as possible, identify the responsible (owns or runs the on-line platform, or the information on it) as to its LEGAL entity, which in the USA includes a home legal domicile.

Like “domestic violence” which has so many different definitions, what may matter most is knowing what is the legal definition, and (as funds flow to-from organizations specializing in this), what business ENTITIES are sponsored with public (and, for that matter, private, and in what mix of public to private) for their advocacy.

[End, May 13, 2020-added section on “entity” / Back to the original/earlier post]:

When tax returns for nonprofits (and related audited financial statements) which by definition are the private sector and privately controlled, are required by law (the Internal Revenue Code) to be filed and the nonprofit entities make them available (ideally, filled out correctly, and filed timely), those related entities and the overall basic organizing strategies can be better seen and understood from the returns. (Related entities handling millions of dollars may not always have their own websites and may otherwise be invisible to the naked or untrained eye).

This “better understanding through viewing the audited, full financials” also goes for the public sector (but the comparable financial report being the “Comprehensive Audited Financial Report” or “CAFR” — sometimes gov’t websites called the “AFRs” but the emphasis and principle, however labeled, is the ANNUAL reports whose contents are both “Comprehensive” and “Audited”), per standards set under the GASB (Government Accounting Standards Board):

…Unless otherwise specified, pronouncements of the GASB apply to financial reports of all state and local governmental entities, including public benefit corporations and authorities, public employee retirement systems, utilities, hospitals and other healthcare providers, and colleges and universities…. [GASB.org: this specific page is “Concept Statement No.2” and only mentions CAFRs as one of other types of report in passing.]

GASB’s About Page (I’ve posted on this before): The board was established in 1984, out of Norwalk, Connecticut, and is supported by (obviously also private) the FAF (Financial Accounting Foundation) also out of Norwalk Connecticut, started (only) in 1972.

My post today calls attention to two private, giant** nonprofits influencing the public sector — i.e., government — system-wide, pervasively, including the courts. (**Qualifying my use of “giant” to describe the APA and the ABA: neither of these — I’m posting below — on its main entity filing shows assets over one-half billion (yet!); certain other tax-exempt foundations (Ford, Annie E. Casey, MacArthur, and plenty more) show assets in the billions, larger than these, typically tied with major corporations… The last time I did a random search of a 990s database for THE largest nonprofits (on that database: Candid.org), the top 50 were mostly universities, insurance companies or healthcare providers, i.e., heavily involved in public sector financing, even if private universities like Harvard, Princeton, and Yale). In other words, they were generally institutional endowments or of a type with a massive customer base or other public sector financing. But my understanding still is that the biggest “kid on the block” — and source of dependable revenues decade after decade — is government, not private sector.

Both sectors control and invest their assets with each other.

Without enough financials for public OR private sector, the strategies are less evident, particularly of blurring the boundaries between public and private overall.

By the two acronyms in this post’s title, I mean:

APA = American Psychological Association, ABA = American Bar Association, as in “lawyers.” Clarification: Several “American Psych__ Association (mental-health-professional) associations have acronyms with middle word beginning with the four letters “psych.” In this update, I name two others and take a quick look at each (website domain names, self-summaries, and I added latest tax returns) though the focus is on the APA above. Taken together they are good to be aware of and useful to see profiled side-by-side.

Besides the APA (and related organizations focused on the “psych” professions) parallel associations named after government mental health civil servant positions also exist, such as the National Association of State Mental Health Program Directors or https://www.nasmhpd.org which I’ve blogged several posts on a few years ago, and left some reminders in this next section. More on the topic of FUNCTIONALISM in SOCIAL SCIENCE / MENTAL HEALTH ARENA: As in NASMHPD to be found when I publish:

From further below on this post (my words):

The APA and the ABA represent two different models of umbrella association nonprofits exercising massive hierarchy control of their respective fields, fields in which licenses to practice are established (and can be revoked):

Specific looks at the history and primary tax returns [Forms 990] for each give an idea of scope and size, but I believe even more important, of how they organized and categorized themselves, and how they are run. I’ve probably posted specifics on these two associations also: both are so key to the family court operations.

Looking at that also helps understand how that major influence was developed and financed over time. I also say, how forthcoming any entity is about itself, and how hard do the websites make it to get to those financials (where there’s a public duty to make them available) is a Very Big Deal. On reviewing the APA website for this post again, I still say, despite the serious size and complexity of undertaking and the website itself, it flunks the categories of: forth-coming/honest/transparent.

Guess our need-to-know must not be on their social benefit agenda while benefiting “society” and improving the lives of people who live in it — through promoting the field of psychology.

I did find “financial reports” hidden under another label; but as summaries, not the most recent and not independently audited financial statements; I did NOT find tax returns or EIN#s to help anyone look them up elsewhere. Both formats are required for a better overview.

The APA Website and its Self-Description, What’s Missing:

The APA’s self-definition and motto from its website shows its belief system/basic assumption:

[This background color below only added May 10, 2021; I’m compiling a belated Table of Contents 2020 & wish to call attention to this structure on the T.o.C. listing]

First, as part of its header, the motto says “advancing psychology to benefit society (i.e., the whole) and improve people’s (i.e., individual) lives,” and so claims a public purpose.

Second, it references how many members it has: it’s a membership organization, although not filing as a “business and trade association” as one would (and the ABA does) with a Form 990-O. (Why not?)

Third (under “About/Governance”) it’s admits to being a D.C. corporation (thus, private), but strategically doesn’t utter the words “tax-exempt,” “nonprofit,” or “nonstock” and especially not the word “private” although it is, as tax-exempts = “nonprofits” are = privately owned and controlled.

Fourth (just noticed this on April 2020 revisiting the site), when I looked for its D.C. registration, I found a second organization, which is also acknowledged (in the fine print, eventually) under “Strategy.” I’ll show it below. Matching up that second (and/or first) organization with a corresponding tax return? So far, I couldn’t. Yet there’s another tax return (“Group Returns”) showing where these are found — but no corresponding entity in D.C.

In other words, “Huh?”

I’ve read thousands (probably over 100,000) tax returns over the ten-plus years writing this blog, but how “Group Returns” really work is not my long suit. Perhaps it should be “next up…”

American Psychological Association (www.APA.org), motto “Advancing psychology to benefit society and improve people’s lives” is displayed openly; but “Governance,” few clicks further away.

At any rate, one of the most important things about ANY organization is its basic identity as a corporation (or unincorporated association), and whether or not it’s for-profit or tax-exempt, implying “not-for-profit.” APA doesn’t exactly divulge this voluntarily…

Who We Are (https://www.apa.org/about/)

APA is the leading scientific and professional organization representing psychology in the United States, with more than 121,000 researchers, educators, clinicians, consultants and students as its members.

OK, it’s a (“scientific and professional”) MEMBERSHIP organization and begins self-identification by emphasizing on its large membership and prominence for representing psychology in the United States. This should not be confused with representing people in the United States.

How does this membership size compare with the size and population of America? Considering the grand purposes of the organization and its repeated reference to how nicely representative is its self-governance — within the organization, a membership organization, I think it’s worth mentioning (and keeping in mind).

Population of the United States in 2019, just a quick look-up, at “worldpopulationreview.com, from, it says,UN World Population Prospects (2019 Revision): 330,647,241 people.

By this standard, 121,000 members of the APA is merely about a tenth of a speck of 1/330th (ie., one-plus million) of the population. In the nearby chart, it’s “not even on the radar.” See graph; where would 121,000 members show?

Yet how central to public policy and public institutions is the APA? How aggressively (and at whose cost) does it desire to be evaluating and improving society as a whole? How desperate is it to prove that psychology is indeed a science, or a scientific profession?

More to the point, how does it organize to promote and achieve those purposes, which includes (see next quotes) this strategic purpose:

“APA is positioning our field to play a leading role in addressing the grand challenges of today and the future…”

Our Work

Our mission is to promote the advancement, communication, and application of psychological science and knowledge to benefit society and improve lives. We do this by: (see link above for bulleted points)…

“psychological science and knowledge…”

If the word “science” has to be qualified adding the word “psychological,” is psychology really a science? It may not matter if its embedding in public policy is firm enough. What is psychological “knowledge,” as opposed to “science”?

APA has a Strategic Plan

APA is positioning our field to play a leading role in addressing the grand challenges of today and the future. In February 2019, APA’s Council of Representatives adopted a new strategic plan that provides a roadmap to guide and prioritize the work of the organization for the next three to five years. The implementation process will be transformative and comprehensive, with the association realigning itself and refocusing its work in concert with the new APA/APA Services, Inc. strategic priorities.

From (https://www.apa.org/about/apa/strategic-plan)

…The plan was built on a strong belief that a new vision for the association should be co-created. Our more than 121,000 members were invited to provide input into a transformative path forward that addresses the needs and interests of the different segments that make up the field. This three- to five-year strategic plan — adopted in February 2019 by APA’s Council of Representatives — enables us to focus the association’s efforts toward maximizing the impact we can have on complex issues facing the field of psychology and broader society.

About “APA Services, Inc.” which is a separate entity from the APA, as indicated above, but which, if it’s a nonprofit required to file tax returns, doesn’t seem to be filing any under that name….

I checked “DCRA.DC.Gov”** corporate on-line business search (free to register; I did long ago) and discovered TWO organizations containing the name “American Psychological Association” — one founded in 1925, the other, (written out in full) APA Services, Inc., incorporated in D.C. only in June, 2000. Being “nonprofit” I figured it ought to be filing some form of tax return.

**DCRA stands for Department of Consumer and Regulatory Affairs.” In some of the 50 United States, incorporations are tracked and reported under the Secretary of State (California does this), but as the District of Columbia is not a “State” such registry would have a different-name.

Then I checked Candid.org (search it here) for any tax return for the second one (named as shown above: “APA Services, Inc” (that’s a trade name; the full name is APA written out, followed by the word “Services, Inc.”), but so far found nothing. However, you can see from the cover sheet that BOTH are (right-column) described as “Non-Profit” and both “Domestic” (D.C. is their home legal domicile). One formed 1925, the other in 2000.

So, hoping to quickly connect one set of data (local) to the other (federal, as represented by the privately-run Candid.org (which recently absorbed the better-known “Guidestar”): the DCRA website doesn’t provide uploaded images, or identify any EIN# to accommodate any potential recent name changes. (Some states’ corporate registries do: Florida, Massachusetts, do. California’s does not, but its “Registry of Charitable Trusts,” if an entity can be found, does (under “details” provide a number corresponding to the Secretary of State data).

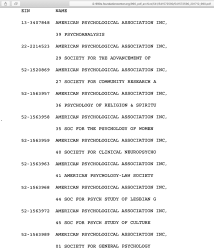

DCRA.dc.gov search results, showing two different business entities with the name “American Psychological Association,” the more recent one founded only in the year 2000 and has a trade name (details/Trade Name tab would show) of “APA Services, Inc.” I have not yet found which EIN# corresponds to it./LGH April, 2020.

EIN#541572590 for “APA Group Return” (click “other options” to search again w/ EIN#~> HERE)

Showing all this is beyond the scope and purpose of this post, however it’s odd that a separate EIN# (541572590) for “APA Group Return” did show up at the IRS level and on Candid.org, but not as a registered entity at DCRA.DC.Gov (see above).

That EIN# seems to represent services for the various divisions; I have more about it on the section of this post displaying tables of tax returns, below. This entity seems to service the APA’s DIVISIONS, whose EIN#s and titles are listed in Schedules O of the tax returns.

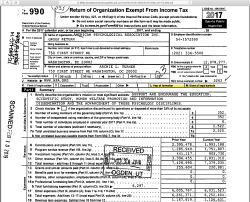

The Tax return for “APA, Inc. Group Return” for 2018 found at an IRS website shows by its date and time stamp it was only delivered one month before the end of the year (its fiscal year ends Dec. 31 — is the same as a calendar year — yet tax return for 2018 was only delivered Nov. 2019).

And, you can see from the Header info, Date of Incorporation and Legal Domicile are left blank.

To explain much more than this would need another post. //LGH April 25, 2020.

Referring back to the APA.org website proper (previous quotes), these all deal with its purposes, but under “Governance” of this organization it self-identifies a BIT more specifically as a corporation (and where) — just not what TYPE of corporation…. And type matters: a lot!

Governance (https://www.apa.org/about/governance/)

APA is a corporation chartered in the District of Columbia. This, together with the fact that APA is given favorable tax treatment as a result of its unerring focus on serving the public interest, determines and limits the kind of organization we can be and what we can do. APA’s bylaws establish our major structural units and put in place a complex system of checks and balances that ensure smooth and democratic operations.

See the annual reports of APA and reports from various boards, committees and task forces.

My comments, especially on: “APA is a corporation…APA is given favorable tax treatment…”

The opening statement could easily have and should have read “tax-exempt” or “nonstock” or “nonprofit corporation,” but doesn’t. Why: anytime someone incorporates, a choice is forced whether or not to incorporate as a nonprofit. Different forms for different types of corporations exist, so far as I know, in every state and in D.C. Anyone who has incorporated a business and submitted the filings to do so (in the US) reasonably knows this.

Yet here’s THE American Psychological Association avoiding admission that its originators opted for non-profit status. At least it admits to being a “corporation!”

The choice of how to incorporate reflects organizer’s purposes in incorporating. In general, choosing to incorporate tax-exempt is for one major purpose — tax-exemption. Which represents retaining greater control of accounts and records in private hands — as opposed to a corporation set to issue stock and potentially going to be public-traded, with shareholder accountability — while paying no taxes on “tax-exempt purpose” related profits — and reduced taxes on revenues from non-program-related charitable assets. A low level of charitable distributions (5%?) to get the deduction exists.

“…[F]avorable tax treatment” by whom? What’s the point of reference?

Tax exemption, generally but not exclusively, refers to under the Internal Revenue Code: U.S. federal government, and what types of reports (and whether any reports) must be filed with the administrator, the IRS, Internal Revenue Service.

So, APA’s self-description avoids mentioning the most obvious likely explanation for its mysterious statement, thus implying special-service basis for such treatment might exist. The paragraph doesn’t specify what type of “favorable tax treatment” — whether above-average favorable or simply having been organized tax-exempt, which in this country: isn’t and for decades, hasn’t been that big of a deal. It has a very low entrance standard, and an equally low maintenance standard.**

**Failing to follow the IRS or local requirements for tax-exemption consistently doesn’t automatically produce consequences except when a once-registered entity fails to file ANYTHING three years in a row. Then, it is auto-revoked by the IRS (and that standard, as I understand it, only after the global economic crisis of 2008). The entity then can and often does correct IRS status retroactively by filing without a significant hitch.

Beyond this, some organizations seem too tiny to bother with and some may, it seems, be judged “too big to fail” or be forced to operate up to standard (as to IRS, local and charitable registries) by IRS or state-level prosecution with associated penalties.

This may not stop any entity from (illegally) continuing to collect donations, operate, or maintaining a state (or here, “D.C.”) local business entity, and (for places it’s applicable) also a charitable registry status.

Neither the APA nor the ABA are posting their latest tax returns (by a long shot) on the websites (or, potentially filing them timely); I suspect they are closer to “too big to fail” — but there doesn’t seem to be any law that these must be posted on an acknowledged website.

I’ve seen websites without tax returns, and tax returns with the header blank “Website” on page 1 marked “N/A” when a known website exists; the idea being, I guess, “never the twain shall meet.” If we want serious change to “business as usual,” that’d be a good one to pass, and enforce! IF the entity indeed has a website, its returns should reference it. And that website should produce the EIN# and, in my opinion, MOST current tax returns provided the IRS. The basis for this would be that tax-exemption is a privilege, and tax-payers deserve accountability for enterprises exercising that privilege; as they make up the difference in government revenues.

My basis for saying this: What I’ve learned over time through reading and basic observation, including but not limited to extensive searches of individual organizations (often looking for an EIN# or to get my hands on a tax return which shows legal domicile where the website may not) here: apps.IRS.gov/app/eos (That link repeated below, with other helpful state databases links. These sometimes change, but current as of April, 2020. I am also on Twitter and keep some of these links on my home profile). I am NOT a tax specialist, CPA, or attorney.

That the APA has an unspecified “favorable tax treatment” attributed to its “unerring focus on serving the public interest” is probably just a lie, but at worst, and unsupported and because so poorly defined, probably hard to DISprove, statement. It is, in other words, salesmanship.

The organizers choose how to incorporate, not vice-versa, so what I’m saying here is: within the second statement at the very top of of “Who We Are” the APA has posted some possibly true, but also possibly false (misleading, irrelevant) information about itself. It’s also unclear how being in D.C. limits what it can do as a corporation.

CLARIFICATION: Other “APA” entities with different names and websites:

There’s also an American Psychiatric Association (www.psychiatry.org), which I’m not talking about in the above title, and an APsaA (American Psychoanalytic Association, (www.apsa.org) although all of these are nonprofits.

This being a new decade, I decided to look for and simply post the last three tax returns of the the APA, and APsaA and the American Psychiatric Association — and the ABA — all next to each other, to compare for size, and form. This adds new material to an existing (though in draft) post.

Posting just those basics wouldn’t show all the subsidiary entities nationwide, all the related entities (where there are some identified), or ALL the assets, but they would provide some basis for comparison to keep in mind, generally.

Since psychologists [William James], psychoanalysts [Freud, imported], and psychiatrists are so prevalent in and around the family court system (see blog url), remember that among these three (sample) private tax-exempt organizations set up to in America (USA) promote the interests of particular brands of “psych-” belief systems, as science, some are older, larger, and more pervasive than others. Some can, others cannot proscribe drugs, as in, antipsychotics, anti-depressants, etc. ( A short piece on the history of psychiatry, posted Oct. 2014 in Psychology Today gives some timelines and definitions, by a psychiatrist) :

Psychiatry got its name as a medical specialty in the early 1800s. For the first century of its existence, the field concerned itself with severely disordered individuals confined to asylums or hospitals….

Around the turn of the 20th century, {{early 1900s}} the neurologist Sigmund Freud published theories on the unconscious roots of some of these less severe disorders, which he termed psycho-neuroses. …Psychoanalysis thus became the first treatment for psychiatric outpatients. Psychoanalysis was the dominant paradigm in outpatient psychiatry for the first half of the 20th century. In retrospect it overreached, as dominant paradigms often do, and was employed even for conditions where it appeared to do little good. …

By the late 1950s and early 1960s, new medications began to change the face of psychiatry. Thorazine and other first generation anti-psychotics profoundly improved institutionalized psychotic patients, as did newly developed antidepressants for the severely depressed. (The introduction of lithium for mania is more complicated; it was only available in the U.S. starting in 1970.) State mental hospitals rapidly emptied as medicated patients returned to the community (the “deinstitutionalization movement“).

In 1980, the Diagnostic and Statistical Manual (DSM) of Mental Disorders, published by the American Psychiatric Association, was radically revised. Unlike the prior two editions which included psychoanalytic language, DSM-III was symptom-based and “atheoretical,” i.e., it described mental disorders without reference to a theory of etiology (cause). This was intended to provide a common language so that biological and psychoanalytic psychiatrists could talk to each other, and to improve the statistical reliability of psychiatric diagnosis. Patients were thereafter diagnosed by “meeting criteria” for one or more defined disorders. One result of this shift was that psychoanalysis and psychodynamic therapies were increasingly seen as nonspecific and unscientific, whereas pharmaceutical research took off in search of drugs that could improve discrete symptoms to the point that patients would no longer meet criteria for a DSM-III disorder.

[Describing new, improved drugs with SSRIs, like Prozac (1987), Risperdal, Zyprexa] …Heavily promoted and with apparent advantages over their predecessors, these medications were widely prescribed by psychiatrists, and later by primary care physicians and other generalists. Psychiatry was increasingly seen as a mainstream medical specialty (to the relief of APA [American Psychiatric Association) leadership), and public research money strongly shifted toward neuroscience and pharmaceutical research. The National Institute of Mental Health (NIMH) declared the 1990s the Decade of the Brain“to enhance public awareness of the benefits to be derived from brain research.” DSM-IV was published in 1994, further elaborating criterion-based psychiatric diagnosis. Biological psychiatry appeared to have triumphed.

Meanwhile, clinical psychologists championed the use of cognitive and cognitive-behavioral psychotherapies. Coming from an experimentalist tradition (the “rats in mazes” stereotype of academic psychology), clinical psychologists empirically validated the use of cognitive-behavioral therapy(CBT) for depression, anxiety, and other named disorders. Standardized therapy could be conducted by following a treatment manual; targeted symptom improvement documented success or failure. This empiricism meshed well with the “evidence based medicine” movement starting in the 1990s, to the further detriment of analytic and dynamic therapies. Whether treated by a psychiatrist with a prescription pad or a psychologist with a CBT manual (or both), emotional complaints were first categorized and diagnosed, and then treated by sharply focusing on the specific defining symptoms of the diagnosis.

[all emphases above, mine. The original has internal links//LGH].

??”biological and psychoanalytical psychiatrists.” (psychoanalytical by juxtaposition seems to emphasize non-biological, but the same summary calls Freud, the father of psychoanalysis, a neurologist, which seems plenty “biological…”…)

I found this interesting: The New Yorker, a book review by Jerome Groopman, May 20, 2019: The Troubled History of Psychiatry. “Challenges to the legitimacy of the profession have forced it to examine itself, including the fundamental question of what constitutes a mental disorder,” historic overview talks about the pendulum swings and paradigms over time...

Some among those three professional types probably have more college or university-based or independent graduate educational institutions promoting their specialty (TIMELINE: professional schools of psychology independent from major universities do not seem to date earlier than the mid-1900s; one activist I’ve blogged on claims the earliest ones in California were Governor Ronald Reagan-era: 1969).

From images in this “About APA” website, the “P” obviously refers to “Psychiatric.”

The American Psychiatric Association, while I’m here, in its “About” page starts with “Mission and Vision” like this:

Vision

The American Psychiatric Association is an organization of psychiatrists working together to ensure humane care and effective treatment for all persons with mental illness, including substance use disorders. It is the voice and conscience of modern psychiatry. Its vision is a society that has available, accessible quality psychiatric diagnosis and treatment.

Mission

The mission of the American Psychiatric Association is to

- promote the highest quality care for individuals with mental illness, including substance use disorders, and their families

- promote psychiatric education and research

- advance and represent the profession of psychiatry

- serve the professional needs of its membership

It does post ONE consolidated and audited financial statement, and SOME Forms 990 — but nothing since 2015 (wow!) … and no annual report beyond 2013. !! See: https://www.psychiatry.org/about-apa/read-apa-organization-documents-and-policies/annual-and-financial-reports (EIN# 52216849, can be seen by looking at one of the Forms 990)…Its tax return acknowledges it was only formed in 2000 and is a 501©6 (not 501©3)…It also has what looks like (probably) a 501©4 (political action group), EIN# 020548679 and (see its Schedule R Part II) a foundation (501©3), EIN# 130433740, and a Delaware-based (Disregarded) LLC to hold real estate (Sched R Pt. I), and a (Sched. R Part IV) taxable trust, with activity “Grantor Activity), EIN# 526173713 (but wouldn’t show, obviously, on a tax-exempt database).

I’m reading off the FY2015 return, so things may have changed since. Now, most recent tax return is FY2017…

Total results: 3. Search Again. American Psychiatric Association, EIN# as shown: 52-2168499; latest year here, FY2017 (YE December) and I checked in April, 2020.

Notice it is filing 990-O’s.

| ORGANIZATION NAME | ST | YR | FORM | PP | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| AMERICAN PSYCHIATRIC ASSOCIATION | DC | 2017 | 990O | 68 | $132,837,958.00 | 52-2168499 |

| AMERICAN PSYCHIATRIC ASSOCIATION | VA | 2016 | 990O | 61 | $113,900,993.00 | 52-2168499 |

| AMERICAN PSYCHIATRIC ASSOCIATION | VA | 2015 | 990O | 44 | $108,087,651.00 | 52-2168499 |

For the APA, while I’m here, just a single EIN# looked up for now, although there is more than one as I mentioned and showed an image for, above. (The image is just the non-interactive version of the tables I’m showing here, despite color differences.) See my comments just below the table.

Total results: 3: Search Again. The American Psychological Association, EIN# 53-0205890; latest year shown here: FY2016 (YE December and I checked in April, 2020.

Notice it is filing a plain “990” not a Form 990-O, although its state purpose is “advancing psychology” which by definition includes advancing the interests of psychologists…

| ORGANIZATION NAME | ST | YR | FORM | PP | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| American Psychological Association | DC | 2016 | 990 | 106 | $231,306,083.00 | 53-0205890 |

| American Psychological Association | DC | 2015 | 990 | 89 | $230,421,517.00 | 53-0205890 |

| American Psychological Association, Inc. | DC | 2017 | 990 | 95 | $265,119,671.00 | 53-0205890 |

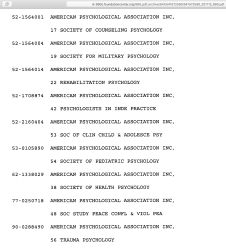

NOTE: There are (currently listed on its website) 54 divisions.

EIN#541572590 for “APA Group Return” (click “other options” to search again w/ EIN#~> HERE)

A number of them (?) submit a group return, which is a different EIN# (541572590) which indicates on its header (Part “H”) that the return does NOT incorporate (financial information for) all subordinates. The instructions on the Form 990 say, attach a list for those not included.

-

- EIN#541572590 for “APA Group Return” (click “other options” to search again w/ EIN#~> HERE). Page 1 FY2017, others are from the Candid.org search results, sample listing of divisions’ EIN#s NOT included on this return, it seems. Img. 1 of 3

I saw this list on the tax return (which includes ALL the separate EIN#s represented by those divisions), however, a shortcut to a numerical list of APA divisions and their names, from there website, is here:

https://www.apa.org/about/division/officers/services/profiles Notice that this link doesn’t provide any handy EIN#s associated with each division, or mention whether they file their own ta returns (apparently not).

The smallest of these (mental-health-focused associations) is the APsaA, although it says it dates to 1911 (JUST before the passage of a Constitutional Amendment regarding the income tax!)

Total results: 3. Search Again. American Psychoanalytical Association (latest year here, FY2016: it reads “2017” because Fiscal year ends Aug. 30, 2017) and I checked in April, 2020. That means, for FY2017 (ending Aug. 2018) nothing is up yet; for FY2018 (ending Aug. 2019), you might expect a filing by the following April, but none up yet.

Notice it is filing a Form 990, not a Form 990-O.

| ORGANIZATION NAME | ST | YR | FORM | PP | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| American Psychoanalytical Association | NY | 2017 | 990 | 67 | $6,566,661.00 | 13-1685533 |

| American Psychoanalytic Association | NY | 2016 | 990 | 63 | $6,428,852.00 | 13-1685533 |

| American Psychoanalytic Association | NY | 2015 | 990 | 40 | $6,225,273.00 | 13-1685533 |

And while I’m here, the ABA: which also has related tax-exempt entities (and two other) I’m not showing here. It is larger than any of the above: EIN# 36-0723150

Total results: 3. Search Again. American Bar Association, latest year shown is FY2017 (because fiscal year ends Aug. 30, i.e., the “2018” below represents FYE Aug. 30, 2018, hence FY2017). The total assets as of August, 2018 were $311M million or nearly ⅓ billion dollars.

The ABA is at least honest in filing a form 990-O, indicating a business purpose of promoting the interests of the involved membership as a business sector.

| ORGANIZATION NAME | ST | YR | FORM | PP | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| American Bar Association | IL | 2018 | 990O | 72 | $311,233,827.00 | 36-0723150 |

| American Bar Association | IL | 2017 | 990O | 82 | $319,040,810.00 | 36-0723150 |

| American Bar Association | IL | 2016 | 990O | 70 | $318,580,024.00 | 36-0723150 |

[Originally, post probably started here…//LGH Apr 2020]

About 1,600 words with brief intro and as moved off the Front Page Christmas Day, 2019. A few months later (April, 2020), and now having a functional input device (for the first time in a month or so), I’m going to publish. In other words, among my now about 1,000 posts* in draft, from the beginning of the blog, this one was waiting nearly four months to see daylight. [*blog dashboard automatically counts them]

This post should be read along with another short page which I’ve just been reviewing and sprucing up, although it’d been published already. (Link and excerpt were already at the bottom of this post):

How Local (Truly Representative) is ANY Government Entity with All These Kinds of Nonprofits? (THE Power & Class Divide: The Taxed vs. Those Living off/Managing The Taxed).(Page started|published Dec. 11, 2018, from Front Page).(Case-sensitive shortlink for this Page ends “PsBXH-9l0” <~~middle character is a small “L” not a number “1.” I.e., those last three characters do not represent the number “nine hundred and ten” (910) Page slightly updated (including wording in the title) in a few places April 2020, when I re-read this page being about to publish a draft post referring to it//LGH April 15, 2020. With updates, about 3,000 words only; several update sentences or paragraphs I marked with light-blue-background).This is an extemporaneous informal expression diverted from the Front Page of the blog for smoother reading of that page, but about a reality that should not be ignored.

Why this post?

This new (newly located) post reduces the size of my front page. I am also reducing its size by simply a major “haircut” (creating a subsidiary page). That subsidiary page may duplicate this post — until I start elaborating whatsoever here on its key points in order to justify posting it separately.

Context. Holiday (2019) Blog Housekeeping:

I don’t “do” holidays anymore. Period. Most people, and stores and businesses do, and as I live in a multi-unit property featuring privacy and security now, so, it seems, do most of its residents. The walls are great (basically soundproof), but I do pass people daily in the halls or doorways just going about our mutually private lives. There are also shared common areas which aren’t usually so quiet…

While I have no problem using any holiday for some practical purposes or tasks, the extraordinary quiet where I live (which I haven’t chosen to “fix” by turning on media: TV, internet music, etc.) is different. I tend to write in public and out and among people for general social purposes (fresh air, not being stuck in a small space (where I live over the years has typically been smaller and smaller spaces until very recently). At these times effecting some major change in some project is psychologically helpful. I chose to handle a single task with many steps after realizing a VERY short Front Page would open up access to the sidebar contents for, probably, all cell-phone users. While this blog isn’t exactly designed for small-screen viewing, the narrower side bar with its summaries and recent posts (and Archives function) is helpful.

This post’s particular topic is its own giant topic and SO basic to the nature of (a) the country, presently (USA); and (b) the family courts within it (lawyers and psychologists — get it?) I’ve been thinking about posting it separately for a long time now.

The ABA and APA as nonprofit associations with related entities are also fine opportunities to practice the “990s” and “corporate-filing” (state-level) skills we need in order to cut through some propaganda and start translating legalese and the even more specialized jargon (sic) of the psych-fields (here, “psychology”) into a practical overview in economic [accounting] and business terms that any other nonprofit might have to show:

- date of incorporation or association; IRS status, EIN# (exactly!) if any, home legal domicile,

- and activities as shown by its tax returns in dollars and cents terms, annually, and incrementally since the start;

- types of assets (investments, real estate, hedge funds, etc.) held and how big.

Basically getting one’s (your) face, eyeball-to-page (hard copy if you print it, or electronic) with tax returns familiarizes people with their sections, line items, and vocabulary. I rarely read every single word on every tax return: I scan for certain things and take notes (usually, screenprints).

I look for the basic numbers (most filings has a Summary on Page 1), the bigger numbers, whether the supporting details match the summary (they often don’t) and specific parts of them which help profile the organization and how it interacts with, especially, its revenues and expenses streams. That data represents what the organization told the IRS about itself, which often doesn’t correspond to or is less than clear on their “About Us” web page. It’s KEY information about any organization!

How well (careless or detailed) is it filled out. I ALWAYS look near the top for “Gross Receipts” and if this is much larger than “Revenues” section (Forms 990 Part I, Summary, years 2008ff; before then the form differed), I know someone has been selling some assets for very little profit; to be checked out on “Statement of Revenues” page. (Forms 990PF read differently, have basically corresponding parts, though, with some things 990s include that they don’t (EIN# of grantees) and some things they DO include or should, that plain Form 990s (for public charities) don’t: like specific names of investments bought, sold, and held.

It’s all about proportion and comparing one to another, and getting a broader context.

The point isn’t to micro-manage and micro-track these (someone should, but I don’t expect most people to have the time or tools to do so) but to raise awareness that these organizations exist in the private, non-profit/tax-exempt field and are to be subject to government (of, by, for the people) no matter how much they are contracted with, granted, to, give grants to, themselves “contract with” or involve people employed by any government — U.S. federal, any state, any (more local than state; Counties, for example) and so forth.

It’s also interesting how the APA organized itself quite differently than the ABA, which you can also see by looking. Taken as a whole (individually and in combination) (and being aware of how many state, county and other specialized bar associations there just might be nationwide), it’s good to be aware of.

So there you have it.

This title version resembles more closely its wording as a section on my Front Page. I tweaked it, above for clarity.

THE GIANT “APA” and “ABA” TYPIFY THE PROBLEM WITH ACCOUNTABILITY The Problem Distinguishing PUBLIC from PRIVATE GOVERNMENT (Activism to Direct Policy) so as to hold Government Itself Accountable to the People. (Front Page Off-ramped Dec. 25, 2019) (short-link ends “–bXO” last letter “O” as in “Ohio” not the symbol for zero (“0”).

As section title looked on the home page:

THE GIANT “APA” and “ABA” TYPIFY THE PROBLEM WITH ACCOUNTABILITY

The Problem Distinguishing PUBLIC from PRIVATE GOVERNMENT (Activism to Direct Policy)

so as to hold Government Itself Accountable to the People.***

**I’ve had this section on the front page for months. I added the title because it’s come up repeatedly (connection of the APA and the ABA both with private organizations steering family court policies, which I often blog: i.e., AFCC, NCJFCJ, and others).

However as I review (some quick edits only) this Front Page in Dec., 2019, the nation is watching Impeachment Proceedings against the current President of the United States Donald S. Trump, with focus on the partisan nature, and another election looming in (Fall) 2020. People seem cognizant there is a challenge to the literal integrity of the United States itself and its Constitution, including the degree of interference in elections by foreign governments (invited or uninvited).

Yet this has been going on in a more subterranean manner for DECADES in system after system NOT under direct jurisdiction of the U.S. federal government and through the family courts and associated supportive/administrative networks of private nonprofit and for-profits businesses and/or individuals. Privatization is already WELL in place for almost every function of government and most levels of civil servants, it seems, which might have authority to direct — or re-direct — available funds. (This two-para. & headings update, Dec. 7, 2019//LGH)

Government (tax-supported) entities have a duty of accountability to the public. By and large, except indirectly or unless regulated by government at some level, private businesses do not. When the operations and policymaking are so well blended it’s impossible to follow the money, the entire SYSTEM is un-accountable.

The APA and the ABA represent (two different models) of umbrella association nonprofits exercising massive hierarchy control of their respective fields, fields in which licenses to practice are established (and can be revoked).

Specific looks at the history and primary tax returns [Forms 990] for each give an idea of scope and size, but I believe more important, of how they organized and categorized themselves, and how they are run. I’ve probably posted specifics on these two associations also: both are so key to the family court operations.

If you think about it, “large umbrella nonprofit and dozens (or more) state and local-jurisdiction related (but fiscally independent) members” is a good description of two big ones: speaking of USA, The American Bar Association (“ABA”) and The American Psychological Association (“APA”).

For that concept, just look at them! (Name search “bar Association” or “Psychological Association” and nothing else at FoundationCenter.org** or apps.IRS.gov/app/eos** or your local/ state business entity search — often at Secretary of State website, or Corporations Division — or state*** charitable registration database (here’s California’s Business Entity Search (use to look, also to obtain an Entity#, where applicable, which can be used at California’s (Charitable) Registry Verification Search to get a federal EIN# (and if uploaded there, view tax returns over time) here’s New York’s Charity Search website; Florida’s Business Entity search (“Sunbiz.org” — easy to remember!).

**For the IRS website, use quotes for “bar association” and set results to 250 a page and start scrolling. I found 1,086 today [<~either Jan. 2018 or Dec. 2018], some were “foundation of ” or Project of” but scroll and browse to see some of the scope and naming categories *** States vary in requiring charitable registration; not all states do.

However, the same organizational concept (with or without the state-level bar or board licensure as a pre-requisite) is replicated within almost any social cause nationwide; popularizing phrases and names, but preventing full accountability, really, for who’s spreading them. Popular causes are picked up and dropped and local jurisdiction entities promoting them come and go, or are shut down for failures to file. But when they start, often a curriculum or procedure gains favor, is branded, funded, facilitators trained or certified, and disseminated. I’ve featured several in this blog over the years.

The overall result? So much of what we may think to be local, isn’t. Check this out:

How Local (Truly Representative) is ANY Government Entity with All These Kinds of Nonprofits? (THE Power & Class Divide: Taxed vs. Living off/Managing The Taxed).(…).(Under 2000 words; case-sensitive shortlink for this Page ends “-9l0”). My impromptu expression based on years of acquaintance/observation.

Next image is from the end of that short page (my writing):

(closing excerpt from LGH subsidiary page to Home Page; commentary..Click to enlarge or click HERE to read that short page).

Related

Written by Let's Get Honest|She Looks It Up

May 13, 2020 at 9:30 PM

Posted in 1996 TANF PRWORA (cat. added 11/2011)

Tagged with "A brief history of psychiatry | Biology & Psychology wrestle..." Steven Reidbord M.D., "The Troubled History of Psychiatry" (Book Review by Jerome Groopman | 20May2019 | NYT), "Want accountability? FIRST-- Find the Entity (Its Financials Will Help)" (tag added May2020), 'Entity' - basic definitions, (Off-ramped from my Front Page Dec. 2019 re-published May 2020), ABA American Bar Association EIN# 360723150, ABA Tax Returns Financial Statements and Related Entities, APA Group Return EIN#541572590 (for the Divisions), APA Services Inc, APA Tax Returns Financial Statements and Related Entities, APsaA EIN# 131685533 American Psychoanalytical Association, DCRA.dc.gov business entities search, Elaborate but still Evasive 'About Us' pages (What type of Entity? Show Us The Money!), FAF Financial Accounting Foundation (estab. by AICPA ca.1971 Norwalk CT set up GASB+FASB who set the guidelines=acctg rules)(see also “CAFRs”), GASB, Psychiatry.org | American Psychiatric Association EIN# 52216849, Public/Private Partnerships (as the Food Chain), Where are the most recent financials? to so many organizations?

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Leave a comment