Replicable Models like ~Purpose Built Communities~ Already Have Their (public/private-sponsored) positive PR, but what are the Aftershocks of “Shaking Up Your City” and What, Really, is OUR Bedrock Bottom Line? (started March 14, 2018, edited for about a month, published Sept. 8, 2018)

You are now reading Replicable Models like ~Purpose Built Communities~ Already Have Their (public/private-sponsored) positive PR, but what are the Aftershocks of “Shaking Up Your City” and What, Really, is OUR Bedrock Bottom Line? (started March 14, 2018, edited for about a month; published Sept. 8, 2018) (shortlink ends “-8OV” and the middle digit is a capital “o”, not the symbol for “zero”) About 7,200 words, some of which are in the impromptu “EndNotes” added because of the long delay in publishing.

I am coming back in April later to add a fifth (this) and possibly sixth “sticky” post alerting the public again to Place-Based Philanthropy (so-called), and the concentration of multiple federal funding streams onto projects which, ultimately, will be owned by private parties, and profit the private parties, while such parties typically have less need for acquiring more and more real estate (and profits to go with it) than for finding more tax-exempt ways to keep up appearances, retain control of projects and keep down corporate taxes.

Previously, this information was mostly introductory to several posts supplementing my original table of contents, which should be reviewed for the “Purpose-Built Communities” information and related-entity drill-downs already done.

Among the various problems of projects which blend…

- housing

- education PreK-12: charter schools, pre-schools, after-school care

- violence prevention programming (i.e., more nonprofits)

- etc.

…under common, or collectively coordinated ownership and control is that this ALSO institutes yet another means (infrastructure, technology) to control (subjugate) not just the projects, but also the people who live in them and whose children must still attend school in commonly-controlled settings.

Some of my readers may be old enough to remember the term “projects” as a (properly) disparaging term for housing projects (high-rises, apartment complexes) were those who couldn’t afford to live anywhere more safely, lived there, and were exposed to (and/or their young people pulled into) gangs, drugs, and non-white-collar criminal activity for which the young men of color, particularly, would end up in jail or dead, whether or not this situation connected at higher levels with so-called ‘white-collar’ financial or other crimes higher up.

The “Purpose-Built Community” model hails from Atlanta, Georgia area, sprang from, a certain “East Lake” housing project colloquially called “little Viet Nam.”

The “Purpose-Built Community” model hails from Atlanta, Georgia area, sprang from, a certain “East Lake” housing project colloquially called “little Viet Nam.”

Probably every major urban city in the US could name its own infamous projects that people had to continue living in and dealing with. In Chicago, on the “Near North” side not far from affluent “the Gold Coast” there was an infamous “Cabrini Green” (“the End of Cabrini-Green” photo essay in TIME).See also “Cabrini-Green” entry in Enclyclopedia of Chicago page with one photo (and some links) whose copyrights and qualifiers are almost longer than the article, or I’d show it here. Its concise history relevant to the context; I hope viewers will take a few minutes to read it. I can safely quote just a bit, however (any emphases added, but not the links):

…Formerly “Swede Town” and then “Little Hell,” the site of the Cabrini-Green public housing complex was notorious in the early twentieth century for its inhabitants’ poverty and dilapidated building…The original population of Cabrini-Green reflected the area’s prior ethnic mix; poor Italians, Irish, Puerto Ricans, and African Americans lived among the war workers and veterans. Racial segregation overtook Cabrini-Green by the early 1960s.

The large new apartments and large swaths of recreation space failed to mend the area’s poverty. The difficulty blacks had finding better, affordable housing gave Cabrini-Green a permanent population. CHA failed to budget money to repair buildings and maintain landscaping as they deteriorated. Cabrini-Green’s reputation for crime and gangs rivaled Little Hell’s. …

Increasing real-estate values in the late twentieth century led housing officials to propose replacement of the complex with mixed-income housing. Residents argued however that such a move would displace them permanently, completing the slum removal effort begun with the building of Cabrini Homes half a century earlier.

[by Amanda Seligman in Encyclopedia of Chicago]

And from the Time photo-essay link above:

Bid for Rebirth (next-to-last photo caption from the “End of Cabrini Green” photo-essay in “Time”, above).

Despite the trouble, many residents fought the Chicago Housing Authority‘s push to demolish thousands of units. The city agreed that some buildings would remain, while new units were built. A tenant group sued to prevent themselves from becoming homeless. The CHA enacted a Plan for Transformation in 2000, which included demolishing all of its public housing and replacing it with mixed income units and relocating tenants.

And here’s a much more recent, extended, and personalized article which follows one family, the last to leave Cabrini-Green, and their move to another public housing area, where they were assaulted in a home invasion. In the New Yorker Magazine, Feb. 6, 2018, by Ben Austin, “The Towers Came Down and With Them, The Promise of Public Housing (subtitle: “Former residents of Chicago’s Cabrini-Green were thrown into a system that increasingly leaves the poor to fend for themselves.”).

MY CONCERNS: The more heavily invested all government revenues (funding streams, benefits, tax-exempt bonds, etc.) are, and the more OF them there are into such programming, the LESS likely any awareness of the negative pull of tax-exempt sector upon overall tax receipts (and the increasing lack of accountability throughout, over time) will “bubble” to the consciousness of people who do not run their lives — and seek to run others’ lives — in such a manner.

Major wealth is being made, collectively, which requires a continuous stream of “low-income” families to inhabit the developments and receive services while the nonprofit sector proliferates, attracting and consolidating power and accumulating LLCs under 501©3s which then — sooner or later — also draw down from the very same public resources that the low-income wage-earners are struggling to prop up.

REMINDER: Government revenue streams are produced, after all, by (broadly generalized!) a combination of tax receipts, especially income taxes from working, wage-earning people) AND investment proceeds, but are regurgitated back to the public (when it comes to media, or politics) typically in terms of “Budget” not in terms of “Balance Sheets” — balance sheets not just for a government’s “General Fund,” but for ALL involved funds and accompanied by other significant statements of revenues and expenses, line-item by activities, ownership and disclosing (naming!) all related businesses under the same umbrella — i.e., “Comprehensive” (Annual Financial Reports, “AFRs”)…

In general, when government could be — but choses not to be– self-funding through its own investments and instead chooses to keep the revenues from its own investments while continuing the individual income tax and, to a lesser degree, corporate taxes– then allowing continued privatization of its own services into the hands of organized tax-exempt foundations as an alternate (and non-representative) form of “government” — that’s a racket.

If/when it revitalizes some dilapidated housing in the process, it still represents a system which allowed this to happen in the first place and hasn’t restructured the caste system maintained by selective taxation / tax-exemption discrepancies.

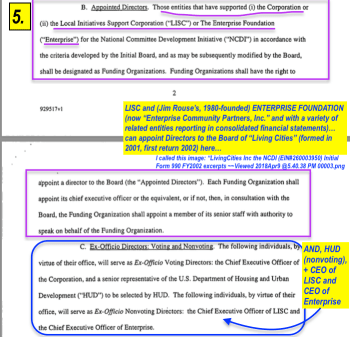

LIVING CITIES: The National Community Development Initiative (2001) ~~>LISC (Local Initiatives Support Corporation) (1979ff) + Enterprise Foundation (Also ca. 1980) + HUD….

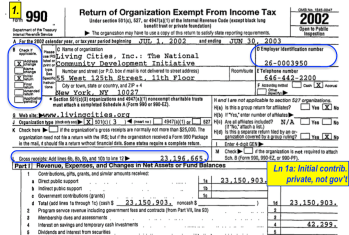

(Same image re-appears in this post below as Image #5, the others showing basic income/expenses of the initial (2002) tax return for “Living Cities…” a Delaware corporation with NY and DC offices.

Figuring out actual ownership and connecting the dots on the financing remains a maze, still, which isn’t helped much by some of the largest foundations around joining forces in the early 1990s to set up funding for what later became “Living Cities: The National Community Development Initiative” as dovetailed (from the startup ca. 2001) by design (by its by-laws) to prioritize decision-making by and funding from also the LISC (Local Initiatives Support Corporation — another giant started back ca. 1979 with help from — who else — the Ford Foundation) and the Enterprise Foundation (started 1980, see Jim Rouse**) and while I’m not showing it in this post, I’ve been looking at its presentations also — and how VERY many related entities are involved over time) — and with non-voting representation from a HUD official.

Forms 990 for “LISC”.

**one 2007 biography on Amazon:

Jim Rouse: Capitalist/Idealist is the story of a very special businessman. A successful capitalist―a real estate developer―Jim Rouse led his life as a practicing idealist. He sought to help people enrich their lives. He wanted people to live in an enjoyable environment and to experience the joy in caring for each other. But he knew that to raise the capital to accomplish those goals his companies had to be profitable.

As an enthusiast of urban renewal, he worked to rid core downtown areas of American cities of blight and despair. He created indoor malls in the new post-war suburbs that would be focal points for community life. He developed a whole new city―Columbia, Maryland―to show what an American city could be like. For one thing, it would be a city totally integrated racially, a city in which anyone could buy or rent on any street. In retirement, Rouse founded the Enterprise Foundation to produce profits that would be used to provide the poorest of Americans with a decent place to live. Rouse was one of America’s first practitioners of social enterprise

And a 1988 article on him as well. (“The Urban Legacy of Jim Rouse”) and a 12.1.2008 one in “FastCompany,” more on Enterprise than on Jim Rouse or his wife Patty. “Edward Norton’s $9,000,000,000 Housing Project (that’s $9 Billion)” (Edward Norton I see in a different article being Rouse’s grandson). (Interesting; right around the time of the real estate recession)

Enterprise may be one of the most influential organizations you’ve never heard of. A for-profit/not-for-profit hybrid, Enterprise has invested $9 billion in equity capital, predevelopment lending, mortgage financing, and development grants to house low- and moderate-income Americans. It has revitalized some of the country’s poorest neighborhoods, from Fort Apache in the Bronx to the Tenderloin in San Francisco. Perhaps its most important accomplishment was helping to create the low-income-housing tax credit that for 25 years has provided a way for the business world — developers, bankers, and boldface names like Warren Buffett — to address the pressing social need for affordable housing while still making a profit. That credit has had a bigger impact than the Department of Housing and Urban Development, accounting for some 90% of the affordable rental housing in the United States.

Jim Rouse lived 1912-1996; his wife Patty until 2012. This article is from 2004: “Rouse Charities to Continue after Parent’s Sale“, the “parent” being the real estate giant, “The Rouse Company.” With the profits from the sale, failure to pour them into a foundation would’ve resulted in some major taxation, but there were at least two charities ready to receive some of that $20M, per this article:

A quick look at the Enterprise tax-exempt entities as of 2016: (I grabbed the largest one and looked at its Schedule R from their website — not an easy task as all of Schedule I (recording $15M of grants) AND Schedule R (Related entities) were uploaded horizontally and in very faint font.

EIN#521231931 — Enterprise Community Partners, getting larger (primarily through increased contributions) the last two years:

Total results: 3. Search Again.

| ORGANIZATION NAME | ST | YR | FORM | PP | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| Enterprise Community Partners | MD | 2016 | 990 | 200 | $333,035,322.00 | 52-1231931 |

| Enterprise Community Partners | MD | 2015 | 990 | 140 | $299,415,980.00 | 52-1231931 |

| Enterprise Community Partners | MD | 2014 | 990 | 304 | $264,581,345.00 | 52-1231931 |

Salaries of Trustees, Officers, Directors, Key and Highest Paid Employees latest year shown total $8.2M (plus benefits). Main officer Terri L. Ludwig pulled in $626K in the process of helping low-income people — just for that year alone…

Its Schedule R here lists many related tax-exempt entities with EIN#s (but, without any names!):

Ent Comm’ty Partners (#521231931) Sched R Pt ii Entities (from 990finder) omit entity names! (just Pt. II, the tax-exempt entities).

This slideshow requires JavaScript.

We could always print, rotate, and attempt to decipher the “Sched R” Pages scanned in at right angles to readable on the organization website to get a listing with names; would look (sample only) about like this (above), although that’s actually its Sched B “List of Contributors” (not showing the amounts, which are some distance apart on the horizontal – loaded vertical uploaded pages. (Actually, this format seems to be attachments related to a California-filing appended to the complete Form 990 above it). The Sched-R from its Form 990 as uploaded onto main website would look (at least in part) more like this (I’ll also show it rotated. See windowframe (Url listed) to see orientation.

The first non-profit listed above voluntarily posted (as if the only other nonprofit involved!) at the EnterpriseCommunityPartners website (EnterpriseCommunity.org under Results and Financials), and (after a second search) 990finders also has its returns. Compare for size:

Total results: 3. Search Again. ECLFund, EIN# 520192004, founded 1990

| ORGANIZATION NAME | ST | YR | FORM | PP | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| Enterprise Community Loan Fund | MD | 2016 | 990 | 42 | $197,097,943.00 | 52-0192004 |

| Enterprise Community Loan Fund | MD | 2015 | 990 | 37 | $176,325,087.00 | 52-0192004 |

| Enterprise Community Loan Fund | MD | 2014 | 990 | 35 | $173,857,855.00 | 52-0192004 |

Excerpt from FYE Sept.2017 and 2016 US Treasury AFR (p.57), documenting that main source of its revenues (as custodian of operating funds for the US Gov’t!) IS individual income taxes & FICA (over $2.97 trillion, that year only) and secondarily, just a fraction of this, Corporate taxes at $338B. No other segment of revenues (shown here) comes even close.BUT always read in context)

U.S. TREASURY’s (Dept. of the Treasury’s) latest CAFR, and the first in the Trump Administration contains some many revelations and admissions (especially for those who don’t normally read such documents).

I located and looked through the latest one (called “Agency Financial Report“) for Years ending Sept. 2016 and 2017. This statement showing “sources of custodial revenues” (i.e., the Treasury is custodian for operating funds of the US Government) is page 57, only one of about 7 pages of tables in an AFR of over 100 pp. It’s well-presented and described, before and after the statements. But look at the main source of “custodial revenues” and contrast it with (statements below these images) the balance sheet of what’s owed from the General Fund, and as payment on Federal Debt and Interest.

In mainstream media, politics (left or right) and often state publicity when it comes to government finances — and also in philanthropy when it comes to “place-based” philanthropy, usually the only place the word “Balance” comes up in promoting place-based philanthropy at the “for public consumption/ promotion” level is “balanced budgets..” — not “balance sheets” (listing all assets and all liabilities and supporting statements to go with them, which is closer to the bedrock reality of a situation.

Even those are still subject to how assets and liability are categorized. For example, it appears that when it comes to the famous “pension funds” and “unfunded liabilities” it seems that the total FUTURE debt is projected backwards when in fact, these are not payable all NOW, but over time. See this 2009 Q/A response to/from Walter Burien. (Example of actuarially projected /advance forward liability fund for a hypothetical dog pound used to create a wealth base. Amounts needed throughout the future + rate of return for investments needed to pay ALL of it, at (specified rate) is set up in the NOW. In case that link dissolves, here is the initial Q&A part in two images, but for the “dog pound” illustration of advance forward liability funds, click on the link.

2009 CAFR1 Q+A summary (simple summary, fr Dog Pound example) ~~Viewed 2018Apr10. Subscriber’s Question to WB. #1 of 2 images

2009 CAFR1 Q+A summary (simple summary, fr Dog Pound example) ~~Viewed 2018Apr10. WB’s answer, short form (½, see link for the rest). #2 of 2 images

Here’s another summary, this one posted in 2015 at a LinkedIn.

And I’ve been posting on CAFRs since I discovered them: here’s one on the “Dog and Pony Show” (Election Day Observations) from 2012. And in 2015, Carl Hermann, who apparently discovered the CAFRs in 2012, about the same time I somehow did (though he’s got the Harvard Education and has been a teacher of economics for many years), affirms, the title states the basics: they are buying and selling debt from each others, while trillions hid in tax-havens by the (“0.01% oligarchs”).

Meanwhile, from the intro to the above Agency Financial Report, signed by Secretary of the U.S. Treasury, Steve Mnuchin:

Globally, Treasury represents the U.S. in key economic forums and international financial institutions, including the Group of Seven (G-7) and the Group of Twenty (G-20), which hold annual summits with heads of state to discuss global foreign policy issues. Treasury plays a vital role in promoting stability and growth in the global economy via our leadership roles in the International Monetary Fund, the World Bank, the regional development banks, and other multilateral organizations, like the Financial Stability Board and the Financial Action Task Force …

(on a diff’t page, from a graphic inset, front matter):

The United States now has the highest corporate tax rate among the 35 advanced economies in the Organisation for Economic Cooperation and Development, 15.9 percentage points higher than the worldwide average. Tax reform will make the U.S. corporate tax rate competitive again[Emphases in this quote added…]

Since this department represents the US internationally as above, how about looking through this report, on your private time, and discussing it with at least five other people?

A budget, including U.S. Government’s, is a planning document, not a financial statement!

When compared to a previous year’s expenditures, it’s still just a listing of expensed activities (i.e., “budget to actual”) with the total available assets and sources of revenue from the same entity (whether government or private corporation) a distant, cloudy presence only to be whispered about, and NOT in reference to budget battles, balanced budget, etc.

Under “Consolidated Statements” Assets & Liabilities (in same financial statements section of this “AFR”) it’s clear that the US Treasury is owed much more from “The General Fund” (meaning, the US Government’s General Fund) than the $3T+ it’s collecting from Individual Income taxes and FICA — but then declares nearly the same amount as is owed in “Federal Debt and Interest Payable” — (roughly) over six times the amount collected from Income Taxes and FICA payments… But, reading the rest of the statements (and their notes) it also mentions it holds investments in other equities — not shown on the statements, and such things as significant questions on the internal control functions of the IRS (etc.). For better understanding, read through the report:

The Treasury AFR report puts highlights (with some colorful graphs) from the statements (contained pp.50-57) in its front matter.

Next two images from pp. 26-27 better define the line items under Treasury Department Assets “Due from General Fund” and Liabilities “Federal Debt and Interest Payable.” I’d at first glance thought this might represent payments to the Federal Reserve Bank for currency, however not so. It’s referring to borrowings from the PUBLIC (in addition to taxing the public via the personal income tax, and corporate taxes, which costs, naturally, are also passed on to consumers) and other federal agencies, with interest due. This should shed more light on the links from Burien, Herman above regarding how governments project forward all debt (as an assets base) while buying and selling it (or, borrowing with interest) from each other. I’ll annotate the images to call attention to those terms and definitions. More detailed definitions of course would be contained in the corresponding Notes to the Financial Statements.

Next two images from pp. 26-27 better define the line items under Treasury Department Assets “Due from General Fund” and Liabilities “Federal Debt and Interest Payable.” I’d at first glance thought this might represent payments to the Federal Reserve Bank for currency, however not so. It’s referring to borrowings from the PUBLIC (in addition to taxing the public via the personal income tax, and corporate taxes, which costs, naturally, are also passed on to consumers) and other federal agencies, with interest due. This should shed more light on the links from Burien, Herman above regarding how governments project forward all debt (as an assets base) while buying and selling it (or, borrowing with interest) from each other. I’ll annotate the images to call attention to those terms and definitions. More detailed definitions of course would be contained in the corresponding Notes to the Financial Statements.

MOVING ON (from the topic of the U.S. Treasury’s oh-so-revealing AFR…)

I spend many days (if not most days) with my head into reading some of these, as well as tax-return after tax return, depending on what I’m researching at the time, and am speaking from experience, memory, and having written up individual my own drill-downs. I also read organization’s “About us/History” pages and often consult (despite its time limit of only up to about the year 2000) “FundingUniverse.com,” “Bloomberg.com” (does executive profiles), and though it’s not my area of expertise, sometimes prospectuses posted through SEC (U.S. Securities Exchange Commission) filings.

You have many of the results throughout this blog — and a separate one I started in 2012** specifically to feature the government entities financial statements called “CAFRs” and post many states’ for that time period.

- **Although my WordPress blog, “Cold,Hard.Fact$” wasn’t continuously active, its first development still has several accessible “pages” across the top and on the side, a list of (a) many states’ CAFRs for examples and (b) also valuable, several descriptive posts referencing origins of concepts and principles behind U.S. Welfare Reform…

- …traceable back to South African apartheid and attempted genocides a century ago in what is now Namibia but was then German Southwest Africa, in connection with a very famous and respected name — at least when it comes to scholarships (“Rhodes“) — and we’ve had Rhodes scholar presidents (Bill Clinton, who signed 1996 PRWORA), Senators, including one who instituted similar respected scholarships, “Fulbrights” (Rhodes scholarships sends students to Oxford University, as does (?) Fulbrights, while more recently Bill & Melinda Gates have set up scholarships imitated after these sending students instead to the also-famous Cambridge University.

- See posts labeled “The Long and Winding Rhodes” or “From Transvaal to TANF.” (Temporary Assistance for Needy Families, federal block grants to states, was a key (and exploited) feature of 1996 welfare reform, then and, and to current: 2018).

- Recommended reading on that blog: “From Oxford to Harvard to DC: Feeding, Fueling — and Vaccinating — the World.”

- As always as I write, I am learning too. The information presents evidence of systems and patterns of corporations commandeering a nation’s: workforce, transportation, FOOD, housing, and other infrastructures: for these multinational corporations to succeed, they must depend on MOST of their workers being retained or induced to stay local.

Over time, anyone who starts and continues looking at at least the two types of financial statements for any entity — and ideally also looks up and at the related entities, subcontractors or grantees — will see the loopholes, financial irresponsibility (in staying incorporated) and, to put it mildly, tricks that are played as money moves from one into another spun off corporation, or a corporation exists only briefly, but the websites soliciting for it remain up.

People prone to such behaviors (and tax-exempt foundations funding nonprofits ALSO prone to them) often congregate and coordinate activity.

Pretty much all that’s been different recently is the many means by which the communications and habits already in place can “accelerate” the incubation and replicate the results.

There is no longer any pretense that the intent is not such acceleration and replication — the pretense, however, is on the need for THIS solution to (poverty, disenfranchisement of generations of people) as opposed to putting the spotlight on and reducing fraud within the philanthropic sector (and government, and as they work together in “revolving-door” relationships) and leaving some of the difference with the people.

“LIVING CITIES: The National Community Development Initiative, Inc.”

For further information, take a closer look at organizations such as LISC (Local Initiatives Support Corporation) or, say, the founding documents of “Living Cities: The National Initiative.”

… and its relationship to LISC and the Enterprise Foundation (now “Enterprise Community Partners” and various — many — related entities, disregarded, tax-exempt, partnerships, etc.) — and its website’s in general failure to disclose its own financials.

This is VERY large-scale, and expanding over time. The “little people” hoping for trickle-down should be getting a conceptual grasp of in which direction its going; I also recommend a survey of some of the salaries and subcontractor fees paid on some of the larger foundations. Or, just continue reading this blog, and you’ll be exposed to plenty of similar drill-downs!

Living Cities (offices in NY and DC are shown) is all eager to show its Annual Reports, but Annual Reports are more advertisement, list of accomplishments — and nothing resembling the two types of financials needed for any major philanthropy (besides its self-descriptions on any named websites):

- (1) If applicable, Forms 990 or 990PF (and realizing which one it’s using!) and

- (2) Independently AUDITED Financial Statements, typically to be produced yearly.

These types of documents (financial statements and tax returns if applicable at a minimum, plus lookups of corporate registrations in their home legal domicile for comparisons) organize information visually and by category which provide background to the “newsletter” or “newspaper” layout and approach of many organization websites, or the colorful, testimonial-filled annual reports (marketing documents) which may show up also.

“Living Cities” website viewed April 2018 offers many yrs’ worth of “Annual Reports” — readers to whom the concept of an IRS tax return or the existence of “financial statements” even occurs can go look it up themselves. (NB: I did….)

Quoting from the “About Us” image above:

…In 1990, Rockefeller Foundation President, President Peter C. Goldmark, reached out to a handful of other foundation CEOs to form what was then an unprecedented funding pool: tens of millions of grant and loan dollars, collected in a single initiative, to support community development across the United States. The result, unveiled in 1991 was a $62.5 million fund created by six foundations and a for-profit insurance company. The group called itself the National Community Development Initiative, or NCDI. The creation of the fund was the first action of the collaborative that would later become Living Cities. The purpose, at the start, was to inject enough capital into the work of community development corporations (CDCs) –both their projects and their core management—that they would be able to expand and accelerate production of affordable housing to a level that could genuinely transform the trajectory of declining neighborhoods

That’s fine, but here are the tax returns NOT uploaded to or any EIN# mentioned, from off-site. As the descriptions says, the “fund” was started in 1991, but this nonprofit (not mentioned there except in the phrase “would later become” only 10 years later (AFTER welfare reform and coinciding with the first year of a Republican President not to mention ‘9/11’ destruction of the World Trade Towers — i.e., in 2001. Just seven or eight years later, 2008, a major real estate bust/recession with global ramifications (2008) also hit “low-income” people, and other more normal-level income wage-earners where it hurt even more — in their housing… Why I mention this? At that time, certain “too-big-to-fail” banks were bailed out: with public funds. And the “Living Cities: NCDI” concept involves those who already had the capital stockpiled IN tax-exempt foundations (in combination with for-profit corporations), pooling it, and lending it out for interest.

Total results: 3. Search Again. (Source: The Foundation Center)

| ORGANIZATION NAME | ST | YR | FORM | PP | TOTAL ASSETS | EIN |

|---|---|---|---|---|---|---|

| Living Cities Inc the Natl Community Develpmt Initiative DBA Living Cities | NY | 2016 | 990 | 53 | $45,800,626.00 | 26-0003950 |

| Living Cities, Inc., The National Community Development Initiative | NY | 2015 | 990 | 45 | $51,498,276.00 | 26-0003950 |

| Living Cities: The National Community Development Initiative | NY | 2014 | 990 | 50 | $54,248,842.00 | 26-0003950 |

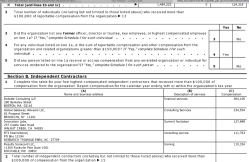

Its initial tax return (FY2002, as uploaded to this same database) happens to have its by-laws attached to the tax return: recommended reading to comprehend that this consortium from the start specified who it channels funding through, and which foundation managers would sit (in what fashion) on its board. As also shown by where its initial grants went:

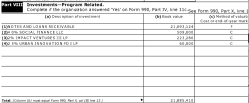

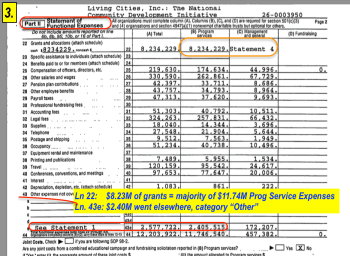

For example (see 5-image gallery, above), year one shows $23M of contributions, just over half of which was spent (in terms of pre-2008 Forms 990) on “Program Service Expenses ($11M+) and “Management” (only $457K). Of the $11M, most was in the form of $8M+ of grants to just three entities, the largest of them being — LISC (Local Initiatives Support Corporation), the others The Enterprise Foundation and a Robert Milano School which I just learned is a school within “The New School” and (this being only 2002) had been named after a Robert J. Milano “Self-made industrialist” who helped turn The New School for Social Research into The New School University — and had recently died at age 87. The street address shown on the Form 990 FY2002 shows 72 Fifth Avenue in NYC, which is that school’s street address.

Robert J. Milano, 87, Self-made Industrialist (NYT obituary Feb 3, 2000, by Wolfgang Saxon)

Robert John Milano, a self-made millionaire industrialist who briefly served Mayor Edward I. Koch as deputy mayor for economic development, died Saturday at a hospital in Palm Springs, Fla., where he lived. A former New York resident, he was 87.

In January 1978, a newly minted Mayor Koch introduced him as a Horatio Alger he had recruited to head the office that the mayor said would produce the city’s salvation. Ten weeks later, the two men announced their parting at separate news conferences….||[paras. inbetween|| …Gov. Nelson A. Rockefeller appointed him in 1971 to the Scott Commission, which the governor created to investigate the city’s fiscal policies.

Serving on that panel and on a State Charter Study Commission for New York City gave him enough experience with the workings of the municipal government to enable Mr. Koch to draw on his talent.

He helped expand the New School for Social Research into the present New School University. He joined the New School’s board in 1976, served as vice chairman and remained a trustee at his death. In 1995, the university named its Graduate School of Management and Urban Policy for Mr. Milano.

I could image these — or you could click on the Form 990 (Living Cities) link/s above and fact-check my summary here. Comments are from the top row’s tax return(FY2015 is Year-End Jun30 2016 and so displays at Yr “2016” on this particular search results table).

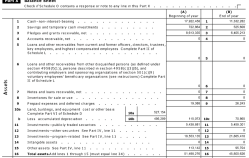

The IRS return says formed “2001” (legal domicile Delaware), although the website’s “About Us” claims 1991, that’s a decade’s unexplained discrepancy. Perhaps it refers to an earlier fund, (whose name isn’t shown here). Almost half its assets (top row tax return), (Balance Sheet is Part X, Assets on Top, Liabilities on the Bottom) “Program Investments” $21M are in the form of loans. It’s primarily a lender, with (Schedule R) “Disregarded Entities” LLC showing $28M of assets held in a certain fund, and $23M of liabilities as “unsecured notes and loans.” Its only “program service revenues” were in the category: “Loans and fees” — and at $506K, that effectively funded their CEO Ben Hecht’s $405K salary (not including $20K benefits).

-

- LC EIN#260003950, FY2015 Balance Sheet (PtX, top). Notice Line 13’s $21M (Year-End column) which comes up again in this gallery.

-

- LC EIN#260003950, FY2015 Indep Contractors pd over $100K (only 5 of 15 are shown, **Calif. one looked up, next images)

-

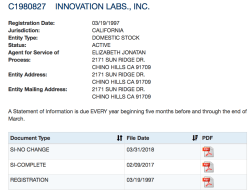

- Cal. SOS Bus Lookup shows diff’t street address (I checked all 3 pdf’d images, 1997 image shows same city as 2017, which doesn’t match LC Form 990 FY2015 location. Why?

-

- LC FY2015 Excerpt from “Revs” (Pt. VIII) shows an unusually low profit margin ($1.00) for sale of $1.1M. How so?

-

- LC EIN#260003950, FY2015 Sched D gives details of $21M Assets (see prior image of “Balance Sheet” Pt. X (top half, Assets) image, Year-End column: Ln.13)

Meanwhile, on the same page, $1.1M of “securities” were sold for a profit of only $1.00 (i.e., HIGH cost). Who DOES that, and to whom?

That year, it employed 15 subcontractors paid over $100K, of which the IRS form only requires 5 be listed. One is in California, the rest (of the 5 shown; 10 obviously are not shown…), all East Coast.

From what I can tell comparing the California recipient “Innovation Labs” on the tax return to an entity by the same name formed in only 1997, the wrong city was entered on its address (Correct: Chino Hills, vs. Walnut Creek as shown, the amount was $127K paid for “Summit Facilitation.”

Within that 85-page link, on pg.56, look for this cover sheet to start off the remaining pages which are the Consolidated (Audited) Financial Statements, giving a better overview than just a tax return — or its own glamorous and colorful self-promotions– of these three entities. “LIVING CITIES” easily could, but is not legally required to, and chose NOT to, post this (or its tax returns) voluntarily on “LivingCities.org” websites to the public might better understand what it’s doing, and in what other funds its two Disregarded LLCs (shown in the title) are investing — in tables showing also the straightforward spreadsheet- style (itemized in rows and columns) numbers, and with notes describing the activities, in ONE document representing TWO years’ worth. LC claims interest in housing AND education, but not in this type of education for the general public. Perhaps readers so acquainted with those formats might start prodding deeper into some of the investments which may produce their own FS, which is apparently just not wanted, and wasn’t incorporated in to their website.

“Notes Receivable” would be assets. The FYE2016 amount of $21.0M is very close to Form 990 Tax Return’s Pt. X Balance Sheets (Assets, Line 13, Year-End Column) and corresponding Sched D detailing those $21M. Though listed differently (fewer details) than here both were receivables considered as assets.

CONSOLIDATED FS FYE2016, 2015 for ~Living Cities~ starts (after the Tax Return) on p 56 of 85 B007330DOC201700000089 <==Link to an audited financial statement was obtained from CharitiesNYS.com lookup (after entity is found using its EIN#, see image orange heading, click in org. name then under the latest (or, here, 2016) “Annual Report” pdf). My post here isn’t about “Living Cities,” but a quick through at the Financial Statement shows that beneath the three named entities (two disregarded funds and the nonprofit — ALL of which are tax-exempt) are many more investments and agreements, etc.

As I recall from my “7 posts from Dec. 2017” write-ups or research (it may have not been actually posted), LISC was involved in the Purpose-Built Communities collaborations also.

This section with its olive background-color here re-emphasizes this post’s connection with my “7 Posts from December 2017” which has substantial detail on Purpose-Built Communities (a model pulled from Georgia and as applied to Oakland, California, ended in a situation requiring a civil grand jury to be convened asking where the money went. I emphasized that this result was predictable, and that Purpose Built Communities model involved some substantially larger players (such as Warren Buffett) and multiple business entities, intentionally complicating any fiscal accountability for the public, while retaining major control (but controlled liability) for project sponsors. For example, the need for a new “quarterback” nonprofit to promote the model should be a warning to those watching such nonprofits get set up in the first place.The earlier “7 Posts from December 2017” post has enough documentation (images, narratives, annotations) on said “Replicable Model” BEFORE it even got to the listing of those posts, I’d call it required reading — unless you already are familiar with the model as an originator. People employed by it perhaps not aware of the scope, might want to still look at this presentation. //LGH April 8, 2018.

Replicable Models like ~Purpose Built Communities~ Already Have Their (public/private-sponsored) positive PR, but what are the Aftershocks of “Shaking Up Your City” and What, Really, is OUR Bedrock Bottom Line? (started March 14, 2018) (shortlink ends “-8OV” and the middle digit is a capital “o”, not the symbol for “zero”).

I recognized this as the Harvard/Bain/Bridgespan model (searchable phrase on this blog; taking the highly profitable consulting practice nonprofit, with help from Harvard Business School) where the assistance comes with control of project implementation, so was not really surprised to find some of the “purpose built” leadership had been involved with the Boston Consulting Group (where Bain came from) and a reference to “Bridgspan” on one of the graphics describing the great idea for fixing neighborhoods:

It Takes a Neighborhood: Purpose Built Communities and Neighborhood Transformation (undated, on website called “Investing in What Works for America’s Communities” — (per its footer), a sponsored joint project of “Federal Reserve Bank of San Francisco” and “Low Income Investment Fund,”) by Shirley Williams and David Edwards (both bios available on the website).

The truly negative outcomes of poverty flow directly from its concentration in a small number of isolated city neighborhoods. To successfully address the issue of poverty in American cities, governments must organize around this geographic dimension of the problem. Poverty, and its many negative outcomes, can only be solved on a neighborhood basis. Transforming these neighborhoods should be our highest priority.

The challenge is that the public mechanisms and resources available to transform neighborhoods are not organized around this goal. Large local, state, and federal bureaucracies and funding streams are focused on “silos” such as housing, education, public safety, and nutrition. None are focused on neighborhood health. As a result, government agencies attack poverty by applying solutions within these functional silos rather than using solutions tailored to neighborhood-specific needs. If the problem of concentrated poverty is to be effectively addressed, government— local, state and federal—needs to develop approaches that are geographic, holistic, and specific to the unique set of assets and deficits that exist within neighborhoods.

Purpose Built Communities offers one such model. The Purpose Built model can serve as one component among a family of solutions for transforming distressed neighborhoods and eradicating concentrated poverty in our urban centers.

Endnotes, Sept. 8, 2018:THIS BLOG published just about as DRAFTED, except addition of some tags (labels)). As a blogger I have been busy personally, on Twitter, and researching other topics meanwhile. When some time opened up recently, I started pulling nearly-complete posts left in draft (and in my opinion, research worth posting even if the topic wasn’t current-events timely, or a bit out asynchronous (? not coordinated with) my current focus.

For example, having just noticed on Twitter that two UK charities, one of which (“RELATE” — featured extensively on my new static front page (not the “Current Posts” one), I already knew had done some “hookup” and had some overlapping membership with “AFCC” at St. George’s (Windsor Castle) in 2018, has since October 2016 partnered with “BACP” that is, the British Association for Counsellors and Psychotherapists.” I looked at BACP’s two (now down to just one) subsidiary entities, both accounts and filing histories, at “CompaniesHouse.Gov.UK” website.

On Twitter (@RELATE_Charity + @BACP) they also have a Change.org petition urging more government funding for more counselling for all (who want it, that is). “RELATE” operates as a kind of federation.

The original subsidiary entity (now called “BACP Enterprises Ltd.”) was formerly BACP Advertising, before which it was BAC (no “Psychotherapist”) Advertising, before which (again, as I remember off-hand) Yiull Kennedy-Browne Associates. Its focus was on business and industrial personnel human resources; it started 1972, before BACP (the charity) which began, I think, 1982. Meanwhile, the BACP Research Foundation only lasted 2008-2018, and was formed to do some ‘RCT” (Randomized Clinical Trials) on which kind of therapy was better for, for an example, treating depression. …

I also looked again at some of the filing history of “RELATE” and realized that it only changed its name to “RELATE” in 1999, before which it was (if I recall the name correctly just now) The National Marriage Guidance Council, and that it goes as far back as 1945.

I’d love to post or discuss (cross-Atlantic on Twitter, and over some of the same topics as plagues the USA — attempting to turn EVERY human activity into something for which the federal, or state, or other, governments should provide “therapy” and treatments… without corresponding discussion of some of the ongoing pressure upon most people being financially supporting such a bureaucracy in the first place. However, whether posted or not, I did the look-ups for about a day and a half recently, which led to deeper understanding on how the pushing of psychotherapy into people’s lives as a public good is promoted, at least in the UK.

From a personal perspective, at least that type of study is not just repeating the same mantra about the HHS grants, fatherhood promotion, court-connected nonprofits, and how those so upset about “junk psychological theory” (meaning “parental alienation”) should then be bright enough to observe who and what private professional non-profit associations has been spreading it, and how, where and through whom. In other words, either “put up or shut up”** in that category.

**I believe one reason many just won’t, I’m seeing (particularly in recent exchanges) is that honest reporting tramples on sacred territory – -including religion, and alignment with conservative causes. Meanwhile honest reporting on FAILURE to report on the (“healthy marriage/responsible fatherhood” etc.) funding and erosion of jurisdiction between USA federal and states among “progressive” feminist and/or “domestic violence” grants-receiving tramples on sacred progressive turf. I.e., that not everything called “feminist” makes the world a better place for women, particularly for child-bearing women. MUCH of it throws MANY of us “under the bus” through silence.

Kind of like abuse itself. Prolonged through silence, assent, and passivity, and while unmitigated, only grows and expands over time….

Anyhow I’m not in academia associated with the courts (or any university) or paid to publish. or consult. FamilyCourtMatters has a “DONATE” button, generally inactive (not in use) on the sidebar here, — feel free to use it, no amount, I suppose too small! — but I am still vitally interested to communicate these essentials. I’ll continue while I can to give example after example of look-ups (or, “Drill-Downs” a term explained in a recent post for its geological (in my intended meaning) points of reference. The LIVING CITIES, ENTERPRISE COMMUNITY (etc.) entities reported above have no doubt changed, may have expanded or (some of the smaller affiliated ones) evaporated over time.

Put this together with other recent posts on other billion-dollar “community” or other foundations (like “Silicon Valley Community Foundation” or the various Tides Entities (both in Northern California) and their related non-profits shuffling funds around while providing neat investment platforms for the wealthy — the ones mentioned here have had major influence in the American (USA) urban and suburban landscapes, and I see intend to continue having the same.

(If this applies, consider it; if not, so what? I know it does for many:)

Don’t be daunted by a lot of black & white forms with words and numbers on them (often called tax returns or financial statements). They symbolize how things operate in the 21st century; familiarity with their terms, parts, and categories is a good investment of anyone’s personal time.

Remember, many basic accounting terms and what’s even more important — concepts behind them — are transferable, though the context differs, to both private business, nonprofits, and government. Eventually, the relationship between taxed, tax-exempt, and the “taxors” (governments, obviously) should start becoming clearer, and what role the constant of “low-income families” or “noncustodial parents” or “fathers” plays in the mix.

The same mix of public/private jurisdiction-altering, in my opinion, “stealth” change agents (in the sense of how little local individuals are aware of how pervasive the practice is) as helped set up those family courts decriminalizing/diverting handling of crimes against women and children, while playing also the extortion card to continue inciting men (over child support), works in other theaters too — not just the family courts.

It should be understood as part of basic citizenship and, really, adulthood. If the competence isn’t innate, acquire some! At least make an attempt!

ALSO (recent exchanges on-line, both personal and public), polarized politics is also “theater.”

Pay better attention to what’s behind the curtain, and use better language to describe and discuss it. Splitting issues “ABC | XYZ” and regurgitating arguments about them down the middle between Conservatives (so called) and Progressives (so-called) is a lose/lose scenario. Taking time out to look at financials of giant (and handling of smaller) nonprofits on both sides, is win|win.

As a formerly battered wife, mother, (obviously then also) and woman inside a so-called “Christian” home and allegedly because of that, I’ve seen both conservative and “liberal” responses to my decision to separate (and file for protection) from both sides for now, nearly two decades. Definitely made an activist out of me, except that this blog and exhortations to “change the conversation” — while attempting to maintain SOME sort of continuing attention to the various elements particularly around the main theme (i.e., the family courts + their handling of violence and abuse issues, etc.) is my primary activism. The rest remains, continuing survival issues.

~ | ~ | ~ | ~

Related

Written by Let's Get Honest|She Looks It Up

September 8, 2018 at 2:35 PM

Posted in 1996 TANF PRWORA (cat. added 11/2011)

Tagged with "A Budget =/= a Balance Sheet!", "Audited Financial Statemts (entity detailed financials) vs Annual Reports (basically = entity advertising)", "Dog Pound Example" 2009 CAFR1 Q+A for "David" (simple summary:Who OWNS the Assets?), Cabrini-Green (Chicago) + Chicago Housing Authority, ECLF - Enterprise Community Loan Fund (EIN#52-0192004), ECP - Enterprise Community Partners (EIN#52-1231931 1980ff in Columbia MD - $333M Assets (FYE 2016Dec) + its SO MANY Sched-R related entities - poorly presented), Harvard/Bain/Bridgespan model, Jim and Patty Rouse, LGH Endnotes Sep 8 2018 (Exhortatn | Relate + BACP entities ℅ CompaniesHouse.gov.UK | Relate + AFCC (see my Home Page) etc), Living Cities (dba for The Nat'l Community Developmt Initiative) EIN# 26-0003950, LIVING CITIES: The National Community Developmt Initiative (2001) ~~>LISC (Local Initiatives Support Corporation) (1979ff) + Enterprise Foundation (Also ca. 1980) + HUD, Philanthropic Obfuscation (on websites &/or Forms 990 presentation), Purpose-Built Communities in Georgia, Replicable Models for Purpose-Built Communities, Robert Milano School at New School University (Robt J Milano d 2003 - self-made industrialist under then NY Mayor Koch), US Treasury AFR (Audited Financial Report) FYE Sep 2017 + 2016

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Leave a comment